According to the results of a joint survey conducted by Active Group and the Experts Club analytical center, most Ukrainians have a neutral or positive attitude towards Thailand.

Thus, 54.8% of respondents rated their attitude as neutral, while 36.4% responded positively (of which 28.4% said “mostly positive” and 8.0% said “completely positive”). Only 3.2% of respondents expressed a negative attitude, while 5.6% were unable to answer the question.

“Thailand has long been one of the favorite destinations for Ukrainian tourists, especially in winter. Tourism shapes a positive image of the country in the Ukrainian public consciousness,” comments Maxim Urakin, PhD in Economics and founder of the Experts Club information and analytical center.

Overall, more than a third of Ukrainians have a favorable attitude toward Thailand, and more than half are neutral. These data indicate a positive tourist image of the country among Ukrainians, which creates potential for further development of cultural and economic ties.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

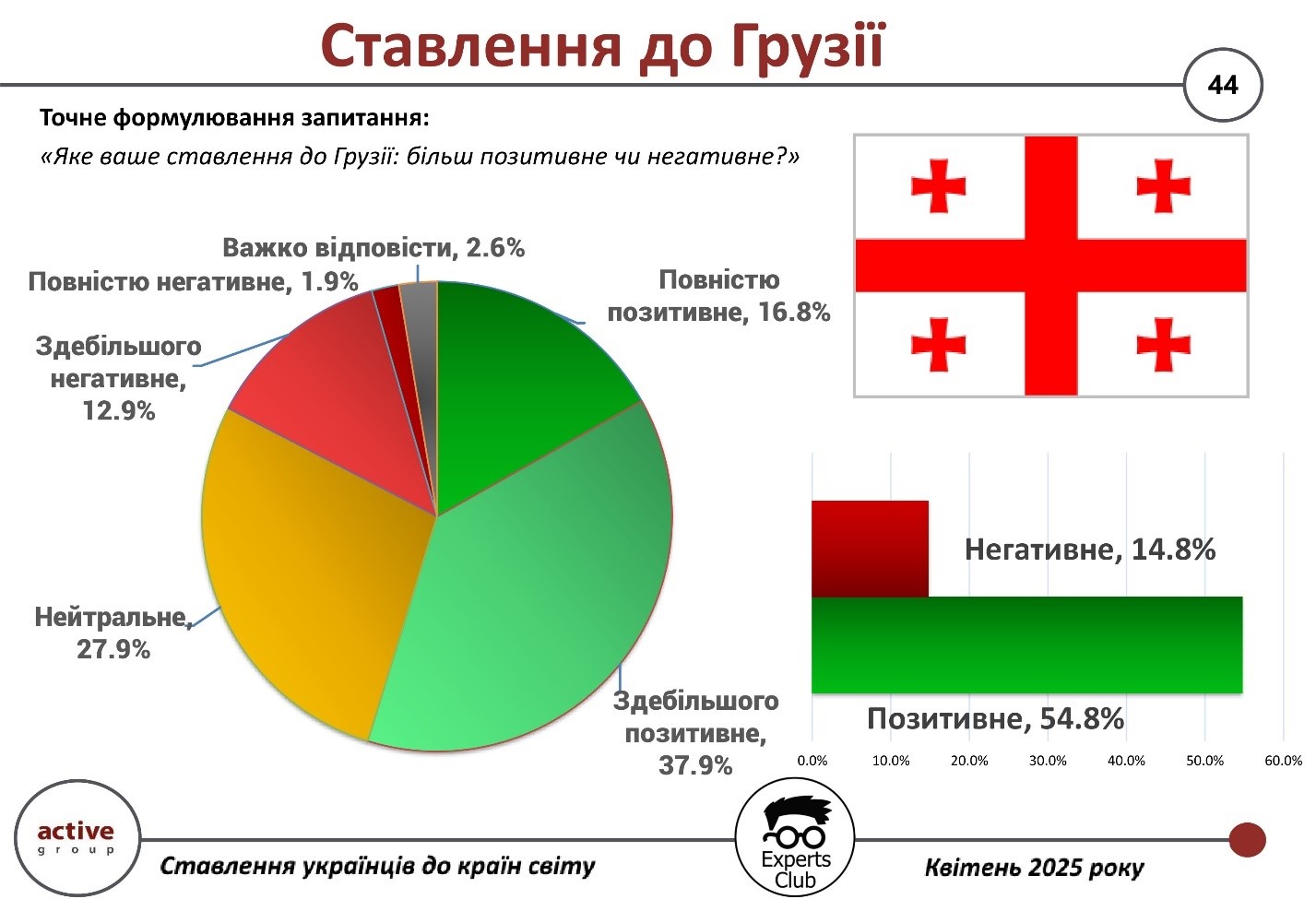

In April 2025, the sociological company Active Group, in collaboration with the analytical center Experts Club, conducted a study to find out how Ukrainians perceive Georgia in the context of modern geopolitical realities. The results show a consistently high positive attitude with a certain critical background.

According to the survey, 54.8% of Ukrainians expressed a positive attitude toward Georgia, with 37.9% expressing a mostly positive attitude and 16.8% expressing a completely positive attitude. At the same time, 27.9% of respondents held a neutral position. 14.8% of citizens have a negative attitude, of which 12.9% are mostly negative and only 1.9% are completely negative. Another 2.6% of respondents were undecided.

“Georgia remains one of the closest countries to Ukrainians in the post-Soviet space, but the political inconsistency of some of its leaders in recent years has partially undermined this trust,” said Maksim Urakin, PhD in Economics and founder of the Experts Club information and analytical center.

The majority of Ukrainians maintain a positive attitude toward Georgia, despite the growing share of neutral and critical assessments.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

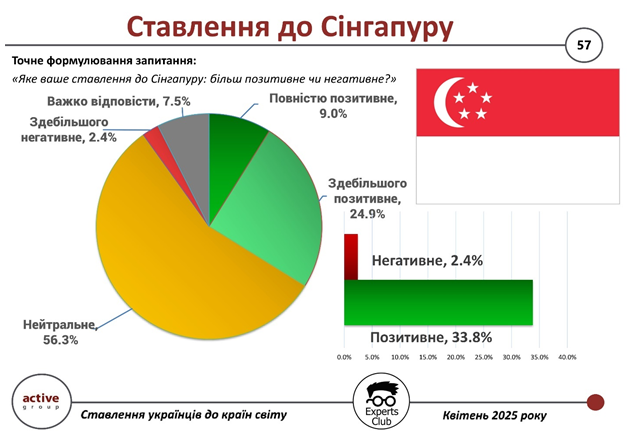

According to a survey by Active Group and Experts Club, 33.8% of Ukrainians have a positive attitude toward Singapore (24.9% — mostly positive, 9.0% — completely positive). A neutral position dominates, expressed by 56.3% of respondents, while only 2.4% of those surveyed have a negative attitude.

Another 7.5% of respondents were unable to give a definite answer, which may also indicate the limited amount of public information about the country in the Ukrainian media.

“Singapore is considered a symbol of effective governance, economic miracle, and high quality of life. It embodies modernization and development without unnecessary political noise. That is why the attitude towards it is mostly positive, without significant emotional overtones,” notes Oleksandr Pozniy, co-founder of Active Group.

For Ukrainians, Singapore is a model of stability, dynamic development, and economic efficiency, which shapes a mostly favorable attitude against a backdrop of low levels of criticism.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

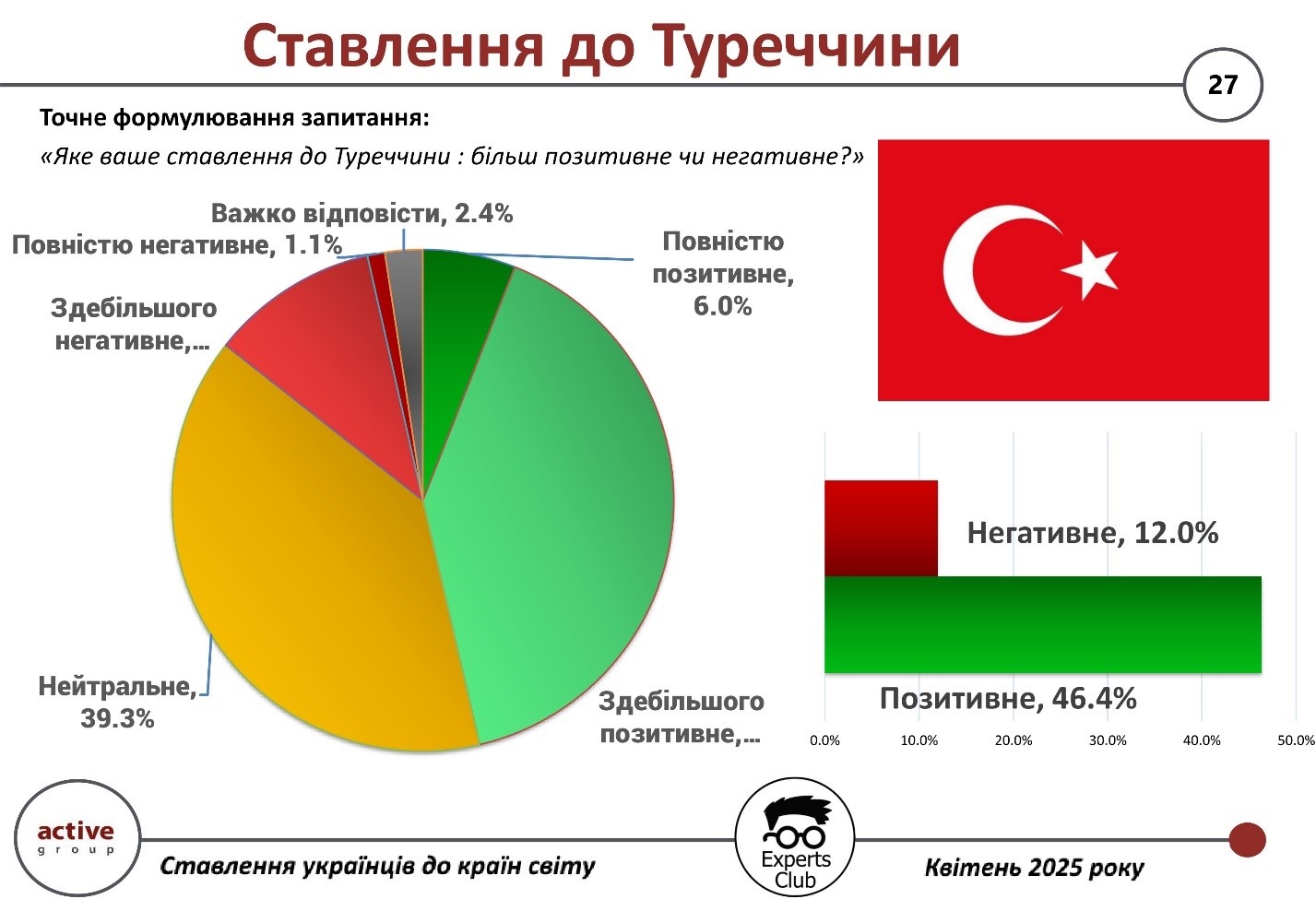

Turkey remains one of the countries towards which Ukrainians have predominantly positive feelings. This is evidenced by the results of a sociological survey conducted in April 2025 by Active Group in collaboration with the Experts Club analytical center.

The data show that 46.4% of Ukrainians have a positive attitude toward Turkey (40.4% — mostly positive, 6.0% — completely positive), while 12.0% express a negative opinion (10.9% — mostly negative, 1.1% — completely negative). At the same time, 39.3% of respondents remain neutral, and 2.4% abstained from answering.

“Ukrainian society perceives Turkey as an important regional partner, in particular thanks to its role in humanitarian and defense initiatives, as well as its developed tourism industry,” said Oleksandr Pozniy, co-founder of Active Group.

These results indicate stable relations between the two nations and room for further intensification of cooperation at the intergovernmental level.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

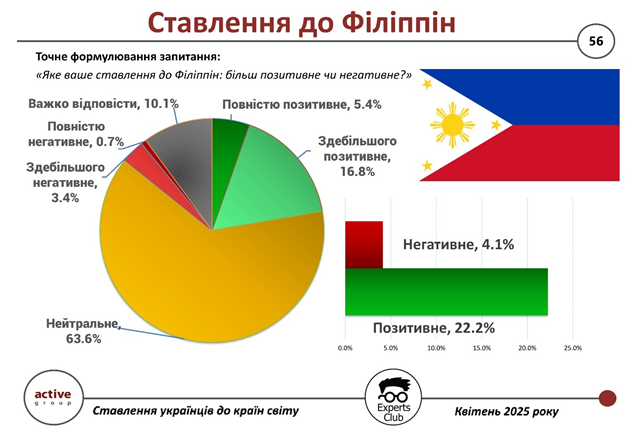

The results of a sociological survey conducted by Active Group and the Experts Club analytical center show that 63.6% of Ukrainians expressed a neutral attitude towards the Philippines.

A positive assessment was given by 22.2% of respondents, of whom 16.8% chose the option “mostly positive” and 5.4% “completely positive.” Only 4.1% of respondents expressed a negative attitude, of whom 3.4% said “mostly negative” and 0.7% “completely negative.” Another 10.1% of Ukrainians were unable to determine their position.

“This level of neutrality and relatively high positivity indicate a generally friendly, albeit not very informed, attitude of Ukrainians towards the Philippines. It can be assumed that the country is associated more with tourism and nature than with politics,” explains Maksim Urakin, PhD in Economics and founder of the Experts Club information and analytical center.

Ukrainians are mostly neutral towards the Philippines, but a fifth of respondents have a favorable opinion of the country. This opens up opportunities for the development of bilateral dialogue, particularly in the humanitarian and tourism sectors.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

DTEK Energy, Ukraine’s largest private energy holding company, has approached the holders of its Eurobonds maturing in 2027 with a proposal to review the existing limited payment arrangements and commit to repurchasing up to $100 million of bonds each year.

“The Group intends to continue its debt reduction strategy and proposes to include additional commitments by the Issuer to reduce its debt,” the company said in a request to the Irish Stock Exchange on Monday, for which it is willing to pay 1% of the nominal value of the bonds.

DTEK Energy clarified that bonds with a nominal value of $930.91 million out of a total issue of $1 billion 466.87 million are currently outstanding.

It is noted that despite the challenges and disruptions caused by the war in Ukraine, the group has proactively reduced its nominal debt by approximately 47%, or $750 million, since the start of the war by combining semi-annual amortization of $8 million to $10 million every six months, bond repurchases in November 2022 under the issuance agreement, as well as voluntary repurchase offers in a Dutch auction in December 2022, March and October 2023, respectively, and other market bond repurchases.

“As of the date of signing the Request for Consent, the Group’s outstanding debt is approximately $931 million,” the document says.

According to the document, the ability to continue the declared debt reduction strategy depends on the current restrictions of the NBU, i.e., the ability of the holding’s Ukrainian subsidiaries to provide the issuer, DTEK Energy B.V., with foreign currency in the required amounts.

As part of the proposal to Eurobond holders, the company will be required to reserve the amounts not used to reduce the debt by the declared $100 million in a separate account in Ukraine, with limited ability to use such funds for short-term investments.

In addition, DTEK Energy is offering to amend its covenant package to enhance the company’s investment attractiveness and improve its financial and operational flexibility to make strategic investments, such as removing restrictions on future business lines and increasing the thresholds for requiring independent valuations and bondholder consent.

“DTEK Energy’s operational and strategic vision is to continue supporting Ukraine’s energy system by generating as much electricity as necessary to meet national demand, as well as providing balancing and other services. In line with this vision, the holding company is continuing its repair campaign to repair or replace damaged or obsolete equipment, which requires significant capital investment,” the document says.

According to the document, the bonds may be repurchased through tender offers or private buybacks, in one or more transactions, and any remaining amount up to the NBU limit will be used to repurchase bonds at par value together with semi-annual amortization of $10 million.

Applications from bondholders will be accepted until May 26 of this year inclusive.