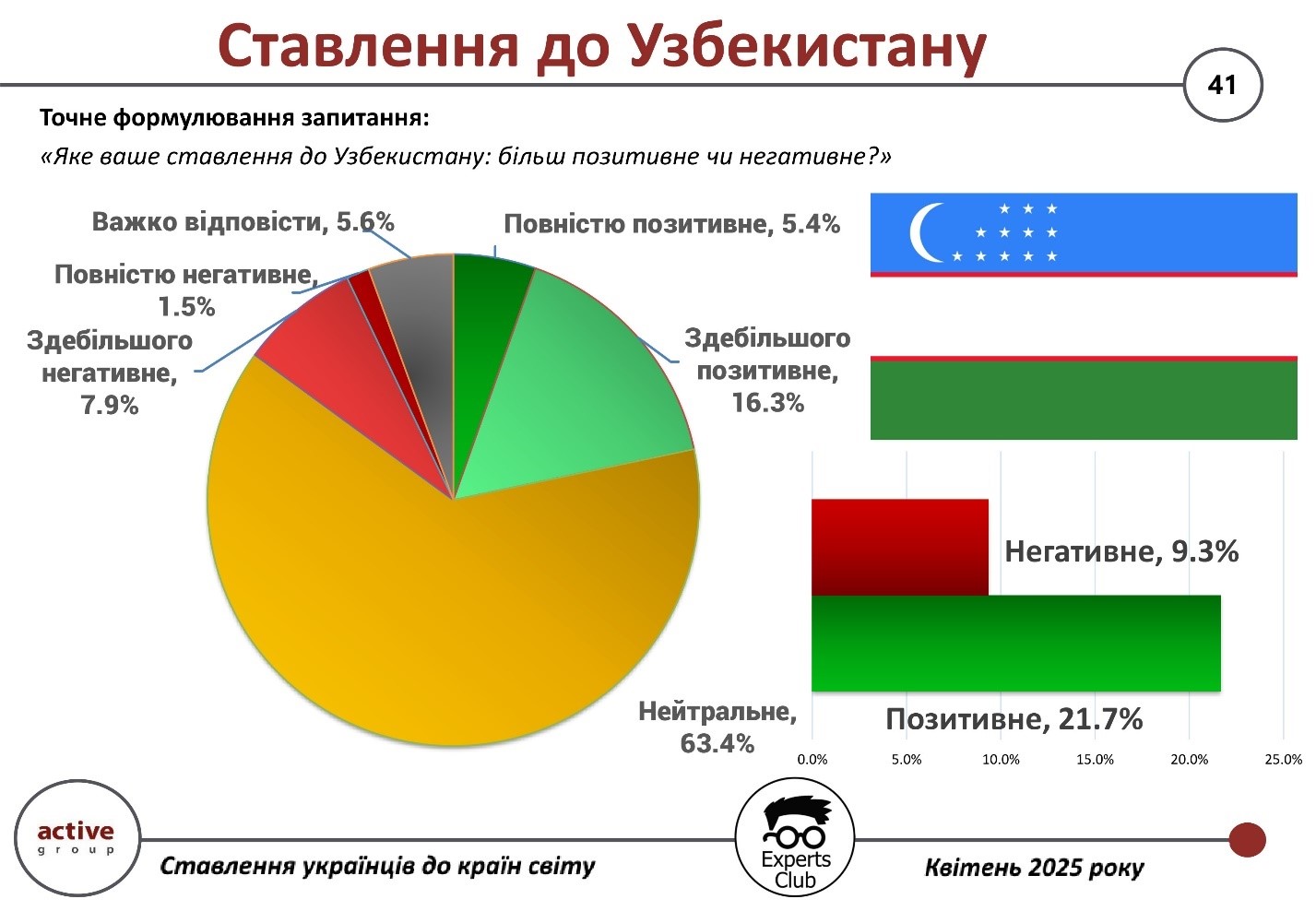

Most Ukrainians do not have a strong opinion about Uzbekistan, according to the results of a nationwide sociological survey conducted by Active Group in collaboration with the Experts Club analytical center in April 2025.

According to the survey, 63.4% of respondents chose a neutral position towards this country. 21.7% of Ukrainians are positively disposed, including 16.3% who are mostly positive and 5.4% who are completely positive. At the same time, 9.3% of respondents have a negative attitude: 7.9% are mostly negative, and 1.5% are completely negative. Another 5.6% of Ukrainians were unable to decide on an answer.

“Ukrainians mostly perceive Uzbekistan without strong emotions, which is typical for countries with which there are no close political or informational ties. At the same time, part of the population sees positive aspects in interaction with this country,” notes Maksim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

In January-April 2025, Naftogaz Group companies paid ₴30.3 billion in taxes, which is more than in the same period of 2024, when ₴28.4 billion was paid.

“In April 2025, ₴7.1 billion was paid. Of this amount, the group transferred ₴6.4 billion to the state budget and ₴692 million to local budgets,” the company said on Monday.

As emphasized by Naftogaz CEO Roman Chumak, the group’s enterprises demonstrate stable tax payment dynamics, contributing to the country’s financial stability.

“Since the beginning of the year, the group has provided 7.6% of all tax revenues to the budget,” he said.

As reported, the net profit of the Naftogaz group for 2024 amounted to almost UAH 38 billion. According to last year’s results, the group’s enterprises paid UAH 88.6 billion in taxes to the general budget, of which UAH 81.8 billion went to the state budget and UAH 6.8 billion to local budgets.

In addition, Naftogaz of Ukraine paid UAH 15.7 billion in dividends to the state in 2024.

Ukrainians demonstrate a restrained and divided attitude towards Turkmenistan. This is evidenced by the results of a nationwide sociological survey conducted by Active Group in cooperation with the Experts Club analytical center in April 2025.

According to the survey, 61.3% of Ukrainians said they had a neutral attitude toward this Central Asian country. Those with a positive attitude (16.3%) and a negative attitude (16.4%) were almost equally divided. In particular, 10.8% of respondents consider it mostly positive, and 5.4% consider it completely positive. On the other hand, 13.3% of respondents expressed a mostly negative attitude, and 3.2% — completely negative.

Another 6% were unable to give a definite answer.

“Attitudes toward Turkmenistan in Ukraine are in a ‘gray zone’ — citizens generally do not have deep knowledge about this country. That is why we are seeing such a high level of neutrality and very limited emotional polarization,” commented Maksim Urakin, founder of the Experts Club analytical center.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

The Spanish authorities are tightening control over the short-term rental market in popular resorts such as Mallorca, Menorca, and Ibiza.

The essence of the new rules

The maximum fine for illegal rentals will increase to €500,000, which is 25% more than the previous limit. At the same time, fines will be differentiated: minor violations, such as lack of registration, may result in a warning or a fine of €5,000, while systematic violations, including rentals in protected natural areas or repeat offenses, will be punishable by fines of up to €50,000–500,000.

At the same time, a freeze on new tourist rental licenses is being introduced to stop the uncontrolled growth of supply. The authorities are also offering violators an alternative: if the owner agrees to transfer the apartment or house to the state for five years for use as social housing, the fine can be reduced by 80%.

Why these measures are necessary

The Balearic Islands have been dealing with the effects of mass tourism for a few years now. Because of illegal rentals, housing prices have skyrocketed, and locals are finding it harder and harder to rent apartments in their own towns. In places such as Palma de Mallorca, Ibiza Town, and Ciutadella, residential areas are gradually being transformed into tourist zones, causing protests among the population.

In addition, the uncontrolled flow of vacationers puts a strain on transportation, utilities, and the environment. In response to these problems, the Balearic Islands government is not only tightening penalties but also expanding the powers of inspection authorities. Now, not only municipal services but also the national police, the Guardia Civil, will be involved in enforcement.

Consequences for tourists and property owners

For tourists, the new rules may mean fewer rental options, especially on platforms such as Airbnb and Booking.com, where unlicensed listings are actively removed. It is now extremely important for property owners to check the legal status of their rentals to avoid huge fines.

Will similar measures be introduced in other regions

The experience of the Balearic Islands could set a precedent for other European tourist destinations such as Barcelona, Amsterdam, and Venice, which are also experiencing tourist oversaturation and an affordable housing crisis. If strict rental controls prove effective, other countries and cities may adopt this regulatory model.

Over 2,500 visitors and more than 60 programs: an overview of the Svoe.IT 2025 showroom in Kyiv

On Friday, May 9, the Mystetskyi Arsenal in Kyiv became a gathering place for everyone who creates, develops, and implements Ukrainian technological solutions. The third national showroom of Ukrainian software, Svoe.IT 2025, brought together over 55 Ukrainian developers and more than 2,500 participants from all over the country.

This is not just an exhibition, but a platform for testing solutions in action: CRM and ERP systems, document management software, accounting software, call center software, website and application development, payment services, POS systems, software for the public sector, EDTech solutions, and more.

Event format

Traditionally, the event was held in a showroom format to simplify the process of finding the necessary software for visitors. Guests could “try on” and test programs on site, conduct a full test drive, and get advice on their implementation. Most importantly, they could understand whether a particular software would meet their business needs.

Participants of Svoe.IT 2025 in categories

Payment services, POS systems, software cash registers

IT services

Accounting/management accounting

Reporting and Document Management

AI solutions

Telecom, telephony, and software for call centers

ERP

CRM

Risk monitoring and cyber security solutions

Other

Svoe.IT and Ukraine’s digital sovereignty

This year’s event was dedicated to the topic of Ukraine’s digital sovereignty — the state’s ability to independently control, protect, and develop its own IT infrastructure without critical dependence on foreign technologies.

“Digital sovereignty is not an abstract concept, but a real necessity for Ukraine in the context of war. Svoe.IT demonstrates that we already have our own powerful solutions that can replace foreign or Russian software. When we choose our own, we protect the state, support the economy, and build an independent technological future,” said Nazar Kurochko, CEO of GigaCloud, in his speech.

Nazariy emphasized that high-quality software is not only created in the capital. Khmelnytskyi, Chernivtsi, Kryvyi Rih, Poltava, Dnipro, Uzhhorod, and Ivano-Frankivsk are regions that are full-fledged players in the market. With this in mind, GigaCloud plans to expand the geography of Svoe.IT by organizing regional events to support local developers and strengthen the presence of Ukrainian IT solutions in every corner of the country.

The event also featured panel discussions with business and government representatives. Experts discussed issues related to countering hostile software, integrating AI into domestic developments, what is needed for the development of the technology industry, and practical case studies of solutions for small and medium-sized businesses.

Throughout the event, funds were raised for the needs of soldiers from the 46th separate brigade. Cloud provider GigaCloud launched the fundraiser together with the Tycho Charitable Foundation, and anyone could contribute with a donation. The fundraiser is still ongoing, and anyone who wishes to contribute can do so via this link.

The general partners of the event were IT Ukraine Association and UKRSIBBANK BNP Paribas Group. Diia.City Union and EIT, the Ukrainian hub of the European Institute of Innovation and Technology, organized the Tech Ecosystem Stage. Diia.City United organized a chamber event, Diia.City Square, during the event.

The Svoe.IT 2025 showroom demonstrated the existence of competitive Ukrainian developments in various market segments. GigaCloud announced further steps in the development of the project, including regional events, and therefore Svoe.IT remains a platform for the dissemination of domestic technological solutions and discussion of key issues of the country’s digital development.

https://interfax.com.ua/news/press-release/1071171.html

GigaCloud, Payment services, POS systems, software cash registers, Svoe.IT 2025, Назар Курочко