Ukrainians mostly do not have a clearly defined attitude towards Tajikistan. These are the results of a nationwide survey conducted by Active Group in cooperation with the Experts Club think tank in April 2025.

According to the data, 66.4% of respondents rated their attitude towards Tajikistan as neutral. Another 15.5% expressed a positive attitude (10.1% — mostly positive, 5.4% — completely positive).

A negative attitude was recorded among 12.3% of Ukrainians (9.9% mostly negative, 2.4% completely negative). 5.8% of respondents were unable to decide on an answer.

The data obtained indicate limited public information about Tajikistan, as well as the absence of strong emotional or political triggers in relations between the countries.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Most Ukrainians currently do not have a clearly defined attitude towards Kyrgyzstan. This is evidenced by the results of a nationwide sociological survey conducted by Active Group and the Experts Club analytical center in April 2025.

According to the survey, 64.3% of respondents said their attitude toward Kyrgyzstan was neutral. Only 21.3% of Ukrainians said they had a positive attitude (15.0% — mostly positive, 6.4% — completely positive).

A negative opinion was expressed by 9.5% of respondents: in particular, 7.9% said they were mostly negative, and 1.7% said they were completely negative. Another 4.9% of respondents abstained from answering.

Experts note that the high level of neutrality indicates low public awareness of this country and the absence of an active information field.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Most Ukrainians have a positive attitude towards Kazakhstan, but a significant proportion of respondents remain neutral. This is evidenced by the results of a sociological survey conducted by Active Group in cooperation with the Experts Club analytical center in April 2025.

According to the survey, 45.8% of respondents have a positive attitude toward Kazakhstan: 34.2% are mostly positive, and 11.6% are completely positive. At the same time, 47.3% of respondents took a neutral position.

Only 3.9% expressed a negative attitude (in particular, 3.0% mostly negative and 0.9% completely negative). Another 3.0% of respondents abstained from answering.

Analysts explain the results by Kazakhstan’s stable image as a partner country with which Ukrainians do not associate conflict narratives. At the same time, the high level of neutrality indicates limited communication at the cultural and informational levels.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

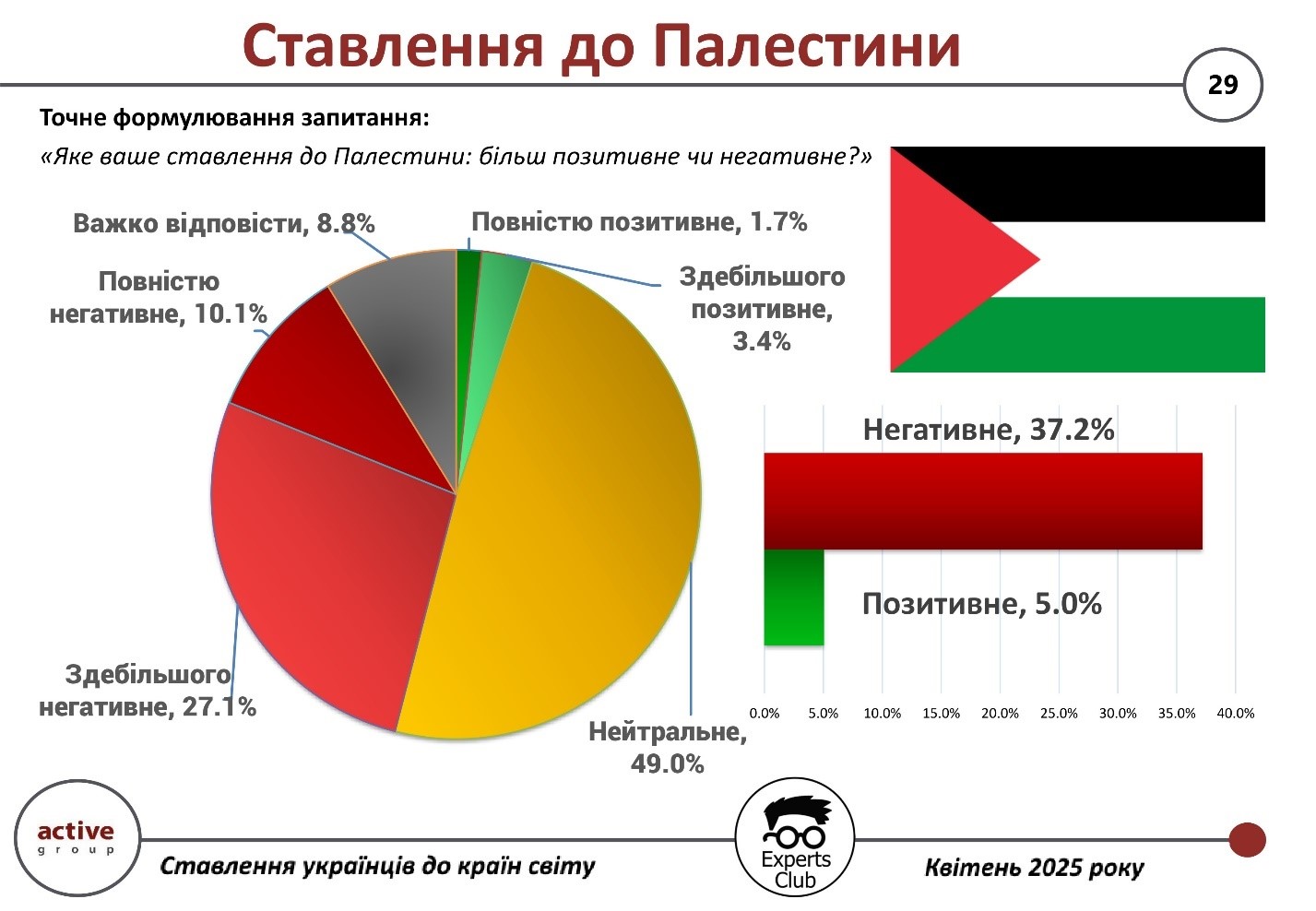

According to the results of a sociological survey conducted by Active Group and the Experts Club information and analytical center in April 2025, Ukrainians’ attitude towards Palestine is predominantly neutral or negative.

Thus, 49.0% of respondents expressed a neutral attitude towards Palestine. On the other hand, 37.2% of respondents expressed a negative opinion (27.1% — mostly negative, 10.1% — completely negative). Only 5.0% of Ukrainians have a positive perception of Palestine, of which 3.4% indicated a mostly positive attitude and 1.7% — completely positive. Another 8.8% were undecided.

“The neutrality and negativity of Ukrainians’ attitudes toward Palestine indicate a lack of clear emotional connection with this country and a prevailing sympathy for Israel in the context of the ongoing regional conflict,” said Maksim Urakin, founder of Experts Club.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

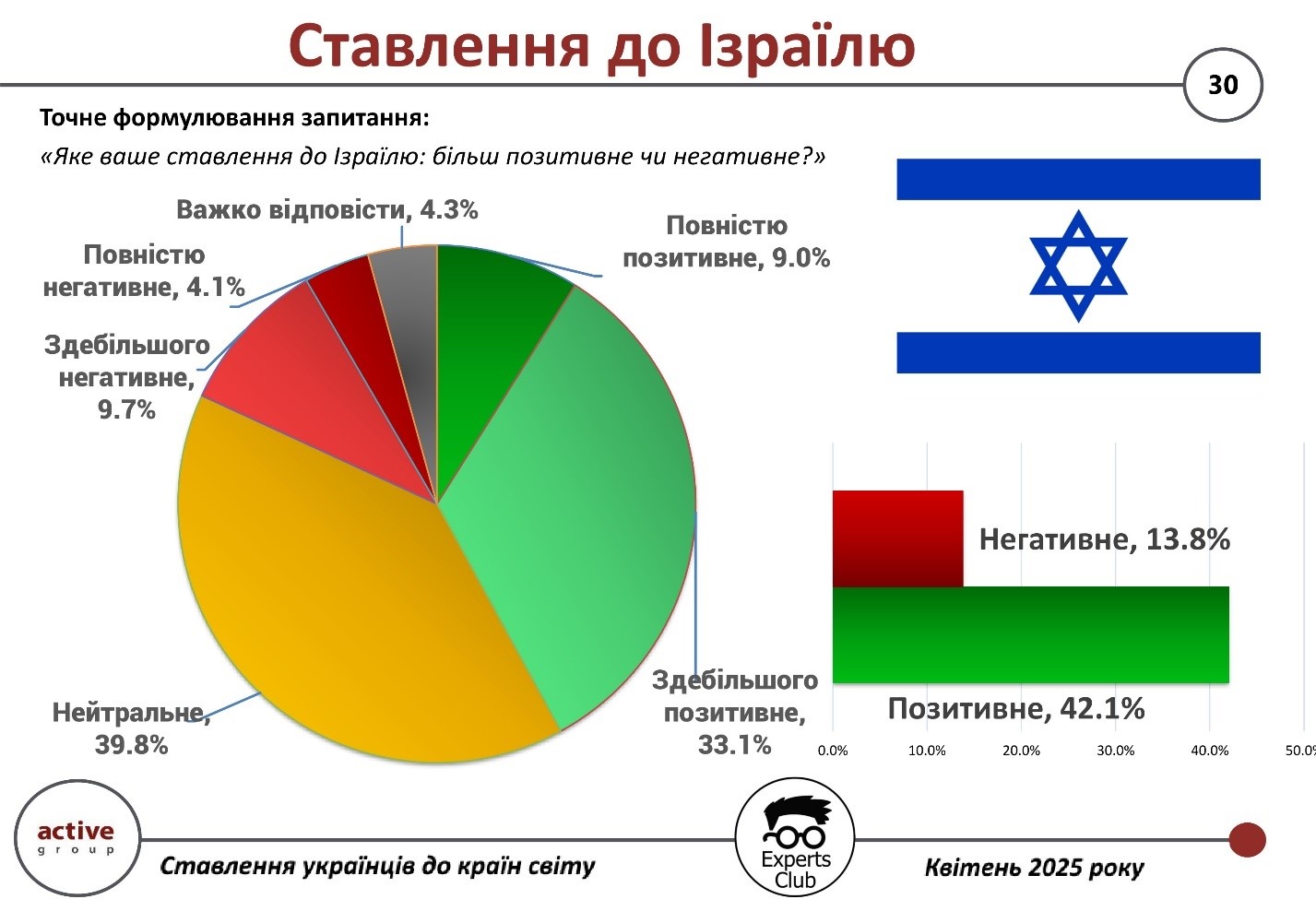

According to the results of a sociological survey conducted by Active Group in collaboration with Experts Club in April 2025, the attitude of Ukrainians towards Israel is mostly positive.

Thus, 42.1% of respondents expressed a positive attitude toward Israel (33.1% — mostly positive, 9.0% — completely positive). A neutral position was taken by 39.8% of respondents. Negative attitudes toward Israel were expressed by 13.8% of Ukrainians (9.7% — mostly negative, 4.1% — completely negative). Another 4.3% were unable to answer.

“According to Ukrainian citizens, Israel is perceived very positively, both because of historical ties and because of the image of the country as a high-tech state with competent healthcare and a high standard of living,” said Maksim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Experts note that the positive perception of Israel among Ukrainians may be linked to diplomatic relations, humanitarian aid, and the country’s technological development.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

The mayor of Niš, Dragoslav Pavlović, has announced the prospects of Chinese e-commerce giant Alibaba coming to southern Serbia. This became possible after the signing of a memorandum of cooperation with the Chinese city of Hangzhou, the birthplace of Alibaba. The document confirms the partnership within the framework of the Digital Silk Road initiative and provides for the intensification of Chinese investment in the region.

According to Pavlovic, the possibility of building an Alibaba logistics center in Nis is being discussed, as well as the implementation of projects in the fields of science and education. However, at this point, there has been no official confirmation from Alibaba or Chinese authorities regarding these plans.

Earlier it was reported that AliExpress, a subsidiary of Alibaba, is considering the possibility of setting up warehouses in Serbia to speed up the delivery of goods to countries in Southeast Europe. According to Serbia Business, such plans were discussed after the Chinese president’s visit to Serbia in 2024.

In addition, as part of the expansion of transport infrastructure in Niš, the Chinese company Shandong Hi-Speed Group has signed a contract to modernize the Constantine the Great Airport. The project, worth more than $153 million, includes the reconstruction of the runway, the expansion of the apron, and the construction of new taxiways.

Thus, Niš is becoming an important center for Chinese-Serbian cooperation, bringing together initiatives in logistics, infrastructure, and digital trade.

Source: https://t.me/relocationrs/949