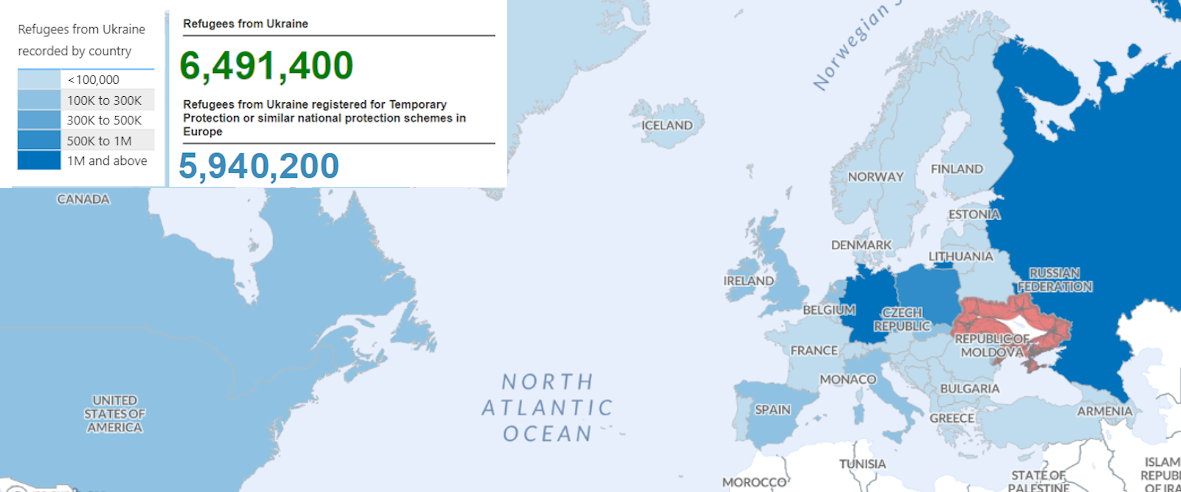

Number of refugees from Ukraine in selected countries as of 31.03.2024

Source: Open4Business.com.ua and experts.news

The flow of grain ships through the ports of Odessa Region is bringing long-awaited support to Ukraine’s economy. However, analysts warn that this may be a temporary phenomenon.

“In early March in Odessa, a 700-foot Liberian-flagged vessel slowly sailed out of the port, passing rows of yellow cranes and plunging into the calm waters of the Black Sea. Its hull was almost completely submerged as the ship was loaded with corn bound for Bangladesh. Meanwhile, other ships laden with grain have already left port, bypassing those that were just arriving,” the New York Times reported.

What seemed impossible last summer, when the Russian naval blockade paralyzed all commercial activity, is now a reality. The port was back on track thanks to a military campaign that drove Russian warships out of Ukrainian waters and provided a trade route for supplies to foreign markets.

Ukrainian grain and oilseed exports across the sea, which are vital to the Ukrainian economy, have almost returned to prewar levels, according to data provided to the New York Times. Over the past six months, Ukraine exported 27.6 million tons of grain and oilseeds across the Black Sea, only 0.2 million tons less than the average volume for the same period from 2018 to 2021 before Russia’s invasion in February 2022.

In the first quarter of this year, Black Sea exports even exceeded pre-war figures, according to Ukrainian data.

Grain and oilseed export estimates from Dragon Capital, a Kiev-based investment firm, and data from Lloyd’s List Intelligence, a shipping analytics firm, confirm this trend.

Sal Gilberti, head of Teucrium Trading, a U.S. company that trades agricultural commodities on the New York Stock Exchange, said claims by Ukrainian officials that grain exports across the sea are close to prewar levels are “accurate.”

Ukraine still faces challenges that could prevent grain exports from stabilizing at previous levels, including continued Russian attacks on port infrastructure and a reduced harvest this year. The U.S. Department of Agriculture predicts a decline in grain exports in the near future.

However, analysts say the overall environment is improving and freight companies are willing to transport Ukrainian grain despite the war. “The data shows there is no shortage of shipowners willing to take the risk and go for it,” said Greg Miller, senior maritime journalist at Lloyd’s List.

Maintaining high levels of grain exports is a strategic necessity for Ukraine. Grain and oilseeds accounted for a third of Ukrainian exports last year, said Natalia Spygotska, senior analyst at Dragon Capital. It has become critical to sustaining Ukraine’s economy and ultimately its war effort.

Tariel Khajishvili, head of Novik LLC, a Ukrainian ship agent operating in Odessa, said: “It is obvious that without grain exports, the country’s economy will collapse.”

After the invasion, Russia seized control of the Black Sea, blocking trade for months, jeopardizing global food security. In July 2022, a deal brokered by the UN and Turkey allowed Ukraine to resume exports through an agreed corridor in the Black Sea.

But a year later, Russia pulled out of the agreement and threatened all commercial ships traveling to or from Ukraine, leading to a complete halt to maritime grain exports last August.

To resume exports, the Ukrainian army launched a campaign to drive the Russian navy out of part of the Black Sea, destroying many warships and attacking their headquarters in Russia-occupied Crimea. The successful operation allowed Ukraine to create a new trade corridor along the coast that allows ships to enter the territorial waters of NATO countries.

Dmytro Barinov, deputy head of the Ukrainian Sea Ports Administration, recalls how nervous they were when the first grain ship passed through the corridor in mid-September: “We prayed that everything would go well.

Eventually, the ship successfully sailed into the open sea, and soon the “familiar pleasant sounds” of the ship’s sirens were again heard in Odessa.

The number of grain ships arriving at the three ports of the Odessa region – Odessa, Pivdennyi and Chernomorsk – increased to 231 in March from just 5 in September, according to Lloyd’s List.

Ukraine’s ship insurance arrangements with global insurers also contributed to the increase. Mr. Gilberti of Teucrium Trading added that Moscow is also interested in keeping the fighting out of the Black Sea, as it is also used to export Russian goods.

Today, Ukraine can only use ports in the Odessa region for grain exports, as other seaports are either too close to Russian positions or occupied by Russian troops. Despite this, with 4.1 million tons of grain and oilseeds shipped monthly, these three ports are close to pre-war export volumes.

The opening of the Odessa ports brought welcome financial relief to Ukraine. Having lost key economic assets during the war, such as steel mills in the east seized or destroyed by Russia, Ukraine is now more dependent on grain exports to support the economy. Dragon Capital predicted in the fall that a return to full operation of Odessa ports could add several percentage points to Ukraine’s GDP growth this year, which was forecast at 4 percent.

However, analysts warn that the initial success of Ukraine’s new trade route may be short-lived.

Russia continues to strike port infrastructure in Odessa, and with Ukraine’s air defenses in short supply, more missiles are reaching their target. In mid-April, Russia successfully struck two terminals in Pivdenne, destroying several containers.

Dragon Capital’s Ms. Spygotska also noted that high volumes of recent grain exports partly reflect shipments delayed by the Russian blockade, which could make it difficult to achieve those volumes in the future, especially with grain production projected to decline.

“Producers and exporters are now well positioned to export all available crops,” she said. “But it all depends on the harvest.”

In January-March 2024, IMC Agro Holding posted a net loss of $3.81 million compared to $4.10 million in the same period of 2023, while its EBITDA increased 3.2 times to $4.43 million, according to the company’s report on the Warsaw Stock Exchange.

“The increase in normalized EBITDA in the first quarter of 2024, as well as the decrease in net loss for the period, was due to an increase in sales,” the company said.

According to the report, the holding’s revenue increased by 41% to $59.20 mln, while the share of exports decreased to 71.7% from 83.5% a year earlier.

The share of corn in the revenue decreased to 42.8% from 83.3%, while the share of wheat increased to 34.4% from 15.9%, and sunflower seeds to 22.3% from 0.3%.

IMC’s gross profit increased by 48% to $12.75 mln, and its operating loss decreased to $0.17 mln from $2.85 mln in the first quarter of 2023.

At the same time, due to the devaluation of the hryvnia in the first quarter of this year compared to its fixed exchange rate for the year, the company incurred a foreign exchange loss of $4.10 million, which resulted in the total loss of IMC for the reporting year increasing to $7.86 million from $4.08 million a year earlier.

Overall, the agroholding’s assets increased by 0.6% to $314.14 mln in the first quarter of 2024.

At the same time, the company increased its investments in the reporting period to $4.9 mln, while in the first quarter of last year there were practically none ($0.02 mln), while the outflow from financing activities decreased to $0.9 mln from $6.4 mln, and the inflow from operating activities amounted to $16.4 mln against an outflow of $1.9 mln in the same period last year.

As a result, free cash flows at the end of March increased to $26.0 million from $16.20 million at the beginning of the year, while bank debt remained virtually unchanged at $45.9 million.

“IMC is an integrated group of companies operating in Sumy, Poltava and Chernihiv regions (north and center of Ukraine) in the crop production, elevators and warehouses segments. The land bank is about 120 thousand hectares, storage capacity is 554 thousand tons with a harvest of 1.002 million tons in 2023.

In 2023, IMC posted a net loss of $21.03 million compared to $1.12 million a year earlier, and its EBITDA decreased 11.3 times to $3.22 million. The holding’s revenue increased by 22.3% to $139.45 million, while the share of exports decreased to 68% from 73% a year earlier.

Population structure of ukraine (data from ukrainian institute of future)

Source: Open4Business.com.ua and experts.news

Belgium will allocate an additional 9 million euros in aid to Ukraine to repair its damaged energy infrastructure, Belgian Minister of Development Cooperation Caroline Genne said on Friday.

“Ukraine’s energy infrastructure is old and too centralized, which makes it very vulnerable,” the minister said, as quoted by RTBF.

The 9 million euros will be channelled through the United Nations Development Program (UNDP), which has organized a system that allows for the rapid procurement of spare parts and the supply of new equipment to repair damaged or destroyed infrastructure. In doing so, UNDP “emphasizes sustainable and decentralized energy sources,” Genne explained.

According to her, “Together with military assistance, this support will help strengthen Ukraine’s resilience.”

State-owned Ukreximbank has provided $4.5 million to replenish working capital and purchase equipment for Dnipro-based agricultural producer Agro Oven LLC, according to a press release from the financial institution.

It is specified that $2.3 million of the total amount was provided for three years to refinance the cost of purchasing equipment for poultry farming, and the remaining $2.2 million was provided for 1.5 years to replenish working capital to ensure uninterrupted operations.

According to the press service of the financial institution, the financing rates are classified as confidential information.

According to the release, Agro Oven LLC is part of the Agro Oven Group of Companies, which is a leader in the production of livestock products in the Dnipro region and is among the top 10 poultry producers in Ukraine and at the same time among the top 3 largest exporters of poultry products in Ukraine. According to the website, the company started its operations in February 1998 with 4,000 employees in agriculture, livestock, poultry, and its own processing plants. It is stated that production is provided by four agricultural farms of the corporation in Magdalynivka, Solonyansky, Novomoskovsky, and Dnipropetrovsky districts of Dnipropetrovska oblast.

“Agro Owen supplies products under its own brands Dlia Svoi, Zolotko, Svoi Potato, Dniprovskyi Myasokombinat, and also sells them through its own retail network, Dim Myasu.

The ultimate beneficiary is Viktor Zavorotnyi (65%). According to OpendataBot, the company increased its revenue in 2023 by 14.4% to UAH 4.04 billion, while the net profit of the agricultural producer jumped 2.4 times to UAH 166.1 million. The number of employees decreased by 121 to 1389 over the year, according to the platform.