CRH Group, the largest building materials manufacturer in North America and Europe, has invested $80 million in Ukraine over the course of the full-scale invasion. Guillaume Cavalier, President of CRH in Central and Eastern Europe, told Forbes Ukraine that the group’s total investments in Ukraine over 25 years of work amount to more than $500 million. According to him, in the context of rebuilding infrastructure in Ukraine, it is important to use cement produced locally, which will provide jobs and higher revenues to the state budget.

Cavalier emphasized that for the potential growth of the Ukrainian cement market after accession to the EU, it is important to invest in the expansion of production facilities now. He reminded that the Antimonopoly Committee of Ukraine (AMCU) is currently considering CRH’s application to acquire assets of Italian Buzzi in Ukraine – cement plants Volyn-cement (Zdolbunov, Rivne region) and YuGcement (Olshanskoe, Mykolayiv region).

As reported, on January 23, AMCU reported about the beginning of consideration of the case on concerted actions in the form of fulfillment of provisions on refraining from competition, enshrined in the concentration agreement between the Irish group CRH and Dyckerhoff GmbH, which own assets in Ukraine.

In June 2023, Italian cement producer Buzzi, listed by the National Agency for the Prevention of Corruption as an international sponsor of war, through its subsidiary Dyckerhoff GmbH, reached an agreement to sell part of its business in Eastern Europe to Irish group CRH, including Ukrainian assets in the form of two cement plants. The transaction is expected to close in 2024.

Later, in September 2023, the AMCU returned CRH’s application for concentration without consideration due to non-compliance with the requirements, and also noted that the group occupies about one-third of the Ukrainian cement market. In October of the same year, the agency reopened the case.

CRH has been operating in Ukraine since 1999. Since November 2021, its cement enterprises in Ukraine have been operating under the Cemark brand: Podolsk Cement JSC (Khmelnytskyi oblast), Cement LLC (Odessa) and Mykolaivcement PJSC (Lviv oblast).

A separate business area of CRH in Ukraine is production concrete and reinforced concrete products. PoliBeton Energo’s Bila Tserkva Reinforced Concrete Plant is a specialized enterprise that produces supports for power transmission lines. PoliBeton’s concrete unit in the north of Odessa joined CRH in 2020.

CRH is a leading manufacturer of construction materials in the world. The company employs about 71,000 people at its 3,200 plants in 28 countries. It is the largest producer of building materials in North America and Europe. The company is also present in Asia. American depositary shares of CRH are listed on the New York Stock Exchange.

State-owned PrivatBank (Kyiv) will increase to UAH 360 million the financing of the Viliya group of agrarian enterprises to expand production, increase exports, increase the fleet of agricultural machinery and equipment, PrivatBank’s press service said on Thursday.

“The bank has decided to increase the volume of lending to the largest agribusiness in Volyn – the group of companies “Vilia”, which according to Forbes rating this year entered the TOP-20 of the most effective agro-companies in the country. The increase in the volume of financing by the bank up to UAH 360 million will allow the company in 2024 to ensure the acquisition of fixed assets to expand production and export capacity of agricultural products in the region, increase the fleet of agricultural machinery and equipment”, – said a member of the Board of Directors Yevgeniy Zagraev.

According to his information, PrivatBank since the beginning of the war has identified the financing of agro-production as a top priority and has become one of the leaders in terms of lending to agrarians.

“We continue to support agribusiness and today we expand investments in leading modern agribusinesses, such as the enterprises of SC “Vilia”, striking the dynamics of development and modernization of business,” – said Zagraev.

According to PrivatBank, since the beginning of the war SC “Vilia” has increased investments in the construction of a grain terminal, increased the volume of products processing due to the launch of a flour milling complex. During 2024, the company plans to invest more than UAH 1.5 billion in modernization of production and export capacities.

In addition, during the two years of the war “Vilia” increased the fleet of grain trucks by 25%, and the volume of grain storage in elevators – by 20%. In 2025, the agroholding plans to resume the construction of a dairy farm and is considering a project to create the latest pig farms.

The group of companies “Vilia” unites a number of enterprises of Volyn and Rivne regions, which cultivate 42 thousand hectares of land, specialize in crop production, storage of grain, oilseed and legume crops, grain trading, flour and granulated flour production, animal husbandry. Its parent company Volyn-Zerno-Product LLC began operations in 2001. Vilia Group of Companies includes seven elevators in Volyn and Rivne regions, Lutsk Feed Mill LLC, Mlynivsky Feed Mill LLC, a seed factory, a number of warehouses, and its own railroad line. The beneficiary of the company is Yevhen Dudka.

According to the National Bank of Ukraine, as of September 1, 2023, PrivatBank ranked first in terms of assets (UAH 782.31 billion) among 64 banks operating in the country and second in terms of the number of branches in the country (1131).

Shareholders of Alliance Bank have made a regular decision to increase the authorized capital by 51.3%, or UAH 234.356 million – up to UAH 691.636 million, according to the information disclosure system of the National Commission for Securities and Stock Market.

It is specified that such decision was made at the remote general meeting of shareholders of the financial institution on April 29.

Additional capitalization is planned to be carried out at the expense of the issue of 8.2 million common registered shares, which will be held without attracting an underwriter.

This is not the first attempt of the bank to increase its authorized capital. As reported, the shareholders made such a decision at the meeting on December 21 last year, but then abandoned it at the end of March 2024.

Before that, Alliance Bank made a similar decision to increase the authorized capital to UAH 689.367 mln at the end of June 2023, which was then canceled in October.

Alliance Bank was founded in 1992. In terms of total assets as of March 1, 2024 (UAH 12.87 billion), it ranked 24th among 63 Ukrainian banks. Its net profit for last year amounted to UAH 0.09 billion.

The shares of the financial institution at the beginning of this year were owned by Alexander Sosis – 89.289006%, Pavlo Scherban – 3.994938%, Marina Getmantseva – 1.706025%, as well as indirectly through the venture capital CIF “Avanpost” Dmitry Melnyk – 3.793525% and Vladimir Bychnik – 1.364910%.

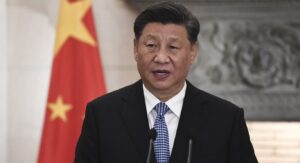

The Chinese president will visit France, Serbia and Hungary this week. His trip comes at a time of strained relations with many European countries over trade and allegations of Chinese espionage.

Chinese President Xi Jinping will visit Europe this week for the first time in five years, with stops in France, Serbia and Hungary.

Mr. Xi’s trip comes at a time of tension with many European countries over China’s support for Russia amid the war in Ukraine, its trade practices and apparent spying activities. The trip will also test Europe’s delicate balancing act between China and the United States.

Xi hopes to avert a trade war with the European Union as friction grows over Chinese electric car exports and reduced access for European companies to the Chinese market. Xi will also encourage French President Emmanuel Macron to seek greater autonomy from the United States in an effort to weaken Washington’s global dominance.

Here’s what we know about Mr. Xi’s trip, which began on Sunday.

What is the significance of Mr. Xi’s itinerary?

Experts say the three countries Mr. Xi will visit support, to varying degrees, China’s drive to overhaul the global order. All of them to varying degrees question America’s post-war world order and seek to strengthen ties with Beijing.

Hungary has close ties with China and is seeking to attract Chinese investment in areas such as electric cars and batteries as Chinese manufacturers expand beyond Asia. Serbia also has warm relations with Beijing and has attracted billions of dollars in Chinese investment.

Mr. Xi’s first stop will be France, where Mr. Macron recently declared that Europe “should never be a vassal of the United States” and turned France into a bridge between the Global South and Western powers.

Despite Beijing’s advances, Mr. Macron said he remains closer to his ally, the United States, than to China.

“I prefer to choose my relationship with the United States, with China, rather than have it imposed on me by one of the two parties that either pushes me one way or pulls me the other way,” he said in an interview with The Economist. However, he added. “It is quite clear that we are not equidistant. We are allies of the Americans.”

Before Mr. Xi’s visit, Chinese diplomats expressed hope that ties between France and China would take a leading role in China’s relations with the West.

Ursula von der Leyen, the president of the European Commission, the EU’s executive arm, will attend talks with Mr. Xi and Mr. Macron in Paris on Monday.

This year is also symbolic for China and the three countries.

It is the 60th anniversary of diplomatic relations between China and France and the 75th anniversary of diplomatic relations with Hungary.

This year also marks the 25th anniversary of the NATO bombing of the Chinese embassy in Belgrade, Serbia, during the Kosovo war, which killed three Chinese journalists and sparked angry protests outside the U.S. Embassy in Beijing. Chinese officials continue to point to the bombing as a sign of NATO aggression and an example of why Russia was right to feel threatened before deciding to invade Ukraine.

When was the last time Mr. Xi visited Europe?

Mr. Xi last visited Europe in 2019, before the coronavirus pandemic, after which he spent time in China, leaving the country’s borders for the first time in the fall of 2022.

The 2019 trip included a colorful ceremony in Rome to celebrate Italy’s participation in China’s Belt and Road global infrastructure project, which aims to expand China’s influence abroad. France rolled out the red carpet for Mr. Xi in Paris and signed more than a dozen commercial and government contracts worth billions of euros, though Mr. Macron warned that “China is playing on our differences” and that “the period of European naivete is over.”

Mr. Xi also visited Greece, where he pledged support for that country in its fight with Britain to obtain the Parthenon sculptures, known as the Elgin Marbles.

How are relations between Europe and China faring?

Since Mr. Xi’s last visit, there has been a growing rift in relations between China and much of Europe. The coronavirus pandemic, Beijing’s embrace of Russia and crackdown on ethnic minorities, and the surge in Chinese exports have sparked a backlash against China in many European countries.

China has quintupled its shipments of automobiles to foreign markets in recent years, and the European Union has recently taken a more confrontational stance toward China’s trade practices. EU authorities have launched an investigation that could lead to restrictions on Chinese solar panel exports and have taken preliminary steps to limit trade in Chinese goods including electric cars, wind turbines and medical devices.

Italy has also told China that it will no longer participate in its Belt and Road Initiative, and last month within a week, six people in Europe were charged with spying for China, indicating that European countries are stepping up measures to combat Chinese espionage.

At the same time, European countries have different views on how to engage with Beijing and capitalize on economic opportunities, and some fear the imposition of European tariffs.

Mr. Macron and German Chancellor Olaf Scholz also believe China’s influence will be crucial to ending the war in Ukraine.

Insurance group “TAS” (Kiev) for January-March 2024 paid out under the concluded insurance contracts indemnities in the amount of UAH 465,89 mln, which is 50,8% more than in the same period of the previous year.

According to the insurer’s website, more than a quarter of its payments (27,54% or UAH 128,31 mln) following the results of the first quarter fell on CASCO, which is 33% higher than the corresponding indicator for the same period of the last year, 35,46% or UAH 165,21 mln – on MTPL insurance (+ 40,1%), 18,91% or UAH 88,12 mln – on voluntary medical insurance (+62,6%)

At the same time, the company has paid UAH 2,8 mln of indemnities under property insurance contracts during the reporting period – by 38,3% more than in the first three months of the last year.

The volume of payments under other insurance contracts amounted to UAH 10.92 mln, which is 30.9% higher than in the same period of 2023.

SG “TAS” was registered in 1998. It is a universal company offering its clients more than 80 types of insurance products on various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.

According to the Unified State Register (USR), there are 1,286 addresses for mass registration of companies in Ukraine. Most of them are located in Kyiv, Kharkiv and Odesa regions. The largest number of businesses at one address is recorded in the capital – more than 2 thousand companies.

More than 140 thousand companies are registered at mass registration addresses in Ukraine. These addresses are used by Opendatabot to identify locations where more than 50 different businesses are registered. Checking the address for mass registration will help to avoid fraud and potentially unreliable businessmen.

Follow the information on the page of the Register of places of mass registration of legal entities

The largest number of companies registered at such addresses was recorded in Kyiv – more than 101 thousand, or 71.8% of the total. Kharkiv and Odesa regions are also in the top three, with more than 8 thousand (6.3%) and 5 thousand (4.1%) respectively.

The same regions are also leading in terms of the number of addresses. In Kyiv, companies are massively registered at 815 addresses (63.4%), in Kharkiv and Odesa regions – 105 (8.2%) and 65 (5.1%) respectively.

Most companies are registered at one location in the capital: 12 Melnykova Street. This is the legal address of 2,363 companies, including 1,978 active and 385 inactive.

The registration of a company’s location at the addresses of mass registration can be attributed to its negative characteristics when planning cooperation with such a company, says insolvency receiver Denys Lykhopiok.

“In my practice, I have encountered a frequent phenomenon that the location of a bankrupt company is the place of mass registration.

In particular, such re-registration is most often initiated by managers and business owners who are trying to avoid financial liability on the eve of bankruptcy proceedings. Sometimes, such developments can be planned even from the very beginning of the company’s activities,” comments Denys Lykhopiok, attorney at law, insolvency receiver, member of the Qualification Commission of Insolvency Receivers, bankruptcy specialist.