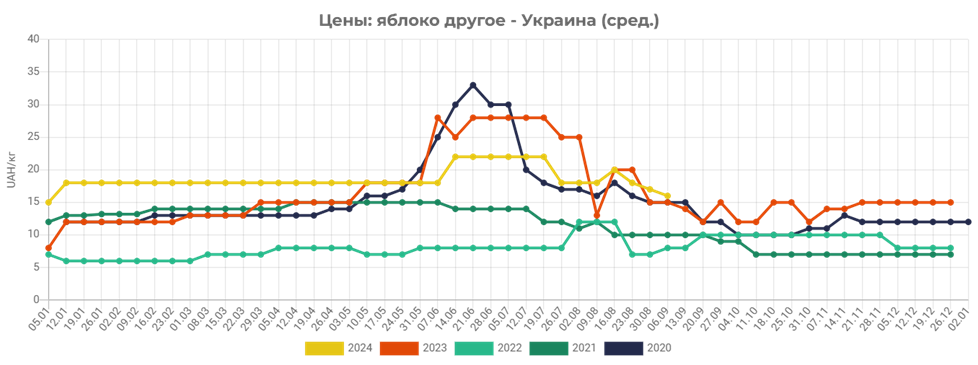

Low demand for apples and increased supply of these fruits of autumn varieties are forcing Ukrainian gardeners to reduce selling prices in this segment, according to analysts of the EastFruit project. It should be noted that this trend has been observed on the Ukrainian market for the third week in a row.

Thus, currently, high-quality varietal apples go on sale at a price of 12-18 UAH/kg ($0.29-0.44/kg), which is on average 15% cheaper than at the end of the last working week.

As of today, apples of autumn varieties that are not suitable for storage are mostly on sale, so growers are trying to sell them as a matter of priority and reduce the cut-off prices for these products.

It should be noted that as of today, the price of apples in Ukraine has actually dropped to the level of prices in the same period last year. For more information on the development of the apple market and other fruit and vegetable products in Ukraine, please subscribe to the operational analytical weekly– EastFruit Ukraine Weekly Pro. More information about the product is available here.

Source: https://east-fruit.com/novosti/tseny-na-yabloki-v-ukraine-prodolzhayut-snizhatsya/

After the launch of the online order delivery service Varus.ua via Nova Poshta in August, the average check increased by 55.14% and turnover by 50.57%, the retailer’s press service reports.

It is specified that the delivery service from Varus.ua is available to any city in Ukraine, and it is actively used in areas where there are no physical stores of the Varus chain.

In August, the top new regions where online orders were made were: Rivne, Lviv, Kirovohrad, Kharkiv and Donetsk regions. In the regions where the chain is present, the highest number of orders was made in Kyiv, Odesa, Dnipro and Zaporizhzhia regions.

The new service from Varus.ua can be used when ordering long-term storage products and non-food products, with a maximum order weight of 50 kg. Among the most popular products ordered by Varus.ua customers with delivery via Nova Poshta in August were snacks, pet products, beverages, tea, and coffee.

The cost of delivery is calculated according to Nova Poshta’s tariffs, and the estimated time for order picking and delivery is one day for most Ukrainian cities.

Varus is a national supermarket chain represented on the Ukrainian grocery retail market by Omega. The authorized capital of Omega is UAH 111 million 129 thousand, the owner is Weigant Enterprises Limited (Cyprus), the ultimate beneficiaries are Valeriy Kiptyk and Ruslan Shostak. In 2023, Omega’s revenue amounted to UAH 17.51 billion, which is 20% higher than in 2022, and net profit amounted to UAH 200 million, which is 69.5% higher than in 2022.

The first store of the chain was opened in 2003 in Dnipro, and the total number of its stores is 109 in different cities of Ukraine and a DarkStore in Kyiv. The chain operates in several formats: classic supermarkets, To Go stores, and the varus.ua conscious shopping service.

“Nova Poshta is the largest logistics operator in Ukraine. From the beginning of 2024 to the end of July, the company expanded its network in the country from 26.6 thousand to 30.1 thousand points: up to 12.1 thousand branches and 18 thousand post offices. As reported, in Ukraine, Nova Poshta LLC increased its unconsolidated net income in the first half of 2024 by 20.1% to UAH 20.12 billion, while the company’s net profit decreased by 38.1% to UAH 1.49 billion.

In January-August 2024, Ukrzaliznytsia JSC (UZ) increased its cargo transportation by 24.3% compared to the same period last year, to 118.04 million tons, according to an analytical note prepared for a meeting of the Exporters’ Office on Wednesday.

The volume of cargo transportation in August 2024 increased by 15.5% compared to the same period in 2023 (1.9 million tons), amounting to 14.18 million tons, which is 4.2% more than in July 2024.

“Massive missile attacks have significantly affected the state of the energy sector, certain industries, and transport infrastructure, which affects the dynamics of cargo transportation,” the analytical note says.

The volume of export transportation in January-August increased by 65.8% to 57.74 million tons. According to the results of eight months of 2024, the share of cargo exports in the total volume of transportation amounted to 49% compared to 37% in the same period of 2023.

In August 2024, the volume of cargo transportation for export amounted to 6.58 million tons, which is 2.8% more than in July 2024. At the same time, compared to August 2023, when 3.3 million tons were exported, the volume of cargo transportation for export doubled.

The volume of exports through land crossings in January-August decreased by 6.9% year-on-year to 21.31 million tons. As of August 2024, the volume of cargo exports via land crossings amounted to 2.5 million tons, which is 2.4% less compared to July 2024.

In January-August, the volume of cargo exports via ports increased 3.1 times to 36.42 million tons. As of August 2024, the volume of cargo exports to ports amounted to 3.9 million tons, which is 6.5% more than in July 2024.

In January-August, 92.3% of all rail transportation to ports was accounted for by the ports of Greater Odesa, and 7.7% by the Danube ports.

Grain remains the leader in exported cargo, with a volume of 2.63 million tons in August, accounting for 40.1% of the total. Iron and manganese ore came in second place at 2.32 million tons (35.3%), followed by ferrous metals at 0.57 million tons (8.6%). Construction materials accounted for 0.48 million tons (7.2%), ranking fourth in total cargo exports in August, the company said.

“The metallurgical and agricultural sectors retain the status of the basis of Ukrainian exports in the current environment. Sea routes remain the main channel for supplying Ukrainian goods to foreign markets,” the note says.

Earlier, Yevhen Lyashchenko, Chairman of the Board of Ukrzaliznytsia JSC, said that the company suffered losses of UAH 600-700 million in July-August and expects a small loss by the end of 2024, despite profitable operations in the first half of the year. According to him, this was due to the lack of profitable cargoes that provide a safety margin.

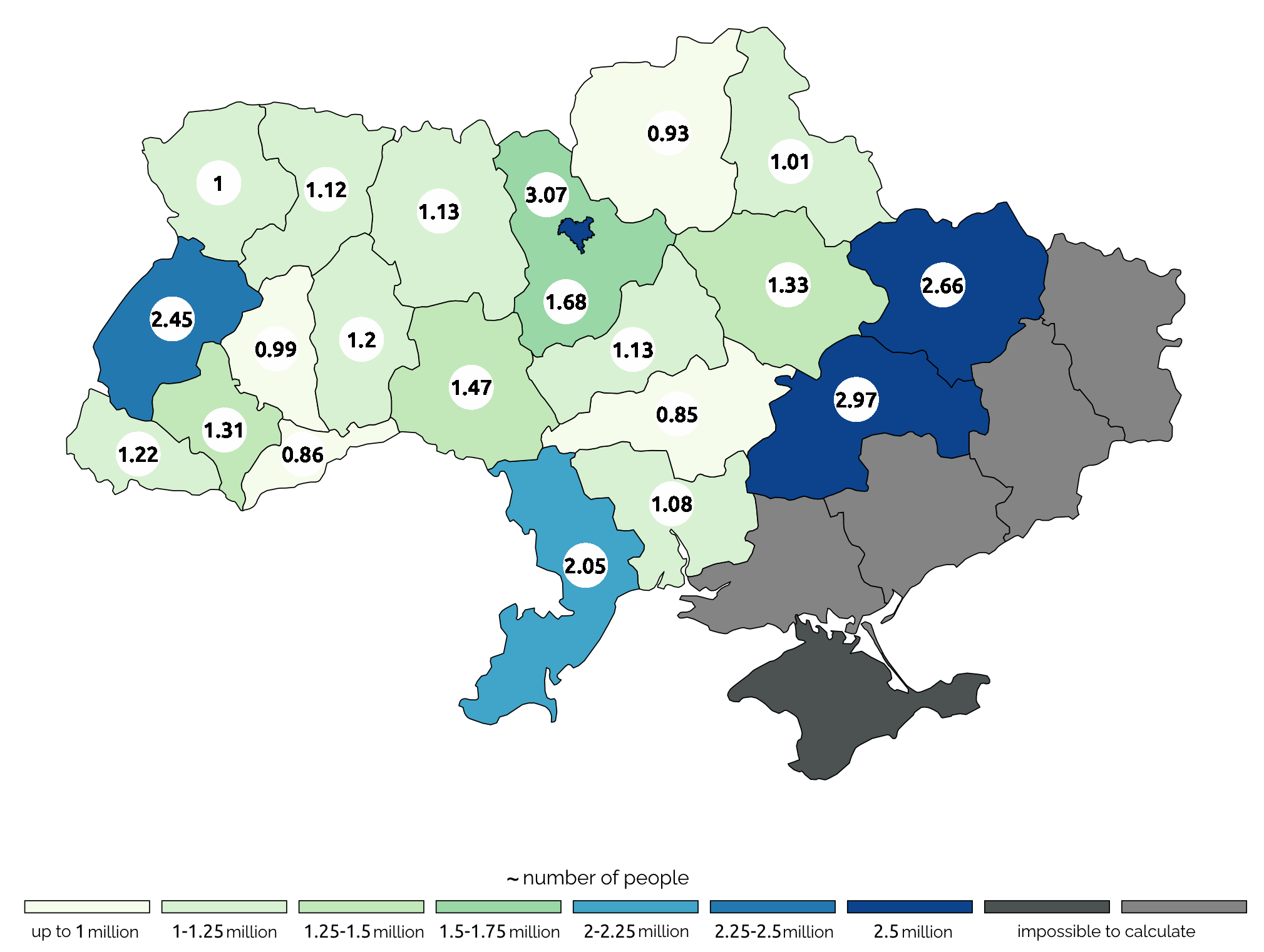

Estimated number of population in regions of Ukraine based on number of active mobile sim cards (mln)

Open4Business.com.ua

The Textile-Contact trading and production group of companies (TC-Group) plans to achieve a gross turnover in 2024 at approximately the level of 2023, but a slight decrease in this figure is possible, said the group’s owner, Alexander Sokolovsky.

“I don’t think there will be any growth, I don’t see any big jumps yet. But our production capacities are fully utilized, just like last year and in 2022,” he said at the Forbes Ukraine Business Breakfast on Wednesday.

Sokolovsky did not name the gross turnover figure for 2023, but noted that it is easy to calculate based on the fact that the UAH 443 million in taxes paid in 2023 is 14% of gross turnover (i.e., a turnover of about UAH 3.2 billion – IF-U).

At the same time, he reminded that in 2022 the group paid about UAH 285 million in taxes, which means that in 2023 this amount increased by 55%.

According to the owner of TK Group, the peak demand for light industry products was in 2022, when, after Russia’s full-scale invasion of Ukraine and the initial “chaos,” a lot of orders appeared, in particular from Europe, which wanted to support Ukraine.

“Even if it was possible to buy more conveniently and cheaper, they ordered from Ukraine. Unfortunately, this trend disappeared later, and many European customers are no longer interested in our offers because they are afraid to place orders in Ukraine, especially near the front line or near the border with Russia,” Sokolovsky explained.

According to him, the group’s main strategy, which allows it to compete in international markets, is to develop production in Ukraine rather than move it abroad.

“When many people were moving production to China or Southeast Asia, we, on the contrary, were developing here, even though we were told that it was wrong. But over the past five years, the number of our factories has grown from seven to 12, in particular, last year we added the production of bags, this year – shoes, and we are expanding the production of clothing,” Sokolovsky said.

At the same time, he said that a partner from Poland may appear in the shoe production project at the Chyhyryn factory, but he has not yet announced any details.

Answering the question about the share of exports in total turnover, he suggested that over the past two years it has increased to about 15%, but mostly these are the products of TK-Home Textile, which participates in tenders of international organizations, in particular in Germany, Poland, and the UK, competing with companies from Turkey, China, and other countries.

“But we are planning to enter Europe, and while we are developing a production base in Ukraine, we offer finished products to Europeans. Our first representative office in the EU, in Lithuania, is still developing a client base – we have not yet achieved much there because there are many bureaucratic procedures in Europe, but we plan to come up with a proposal to develop social clothing and sew it in Ukraine,” Sokolovsky said.

At the same time, the owner of the group said that the biggest problem for the group is human resources (the majority of employees are women).

“We see that no matter what conditions you create and what salaries you promise, many women leave because they are uncomfortable in terms of blackouts, safety, many are nervous and leave because they are scared,” Sokolovsky said.

Speaking about the group’s plans for the heating season, he said that the companies mostly use generators, and the group does not have the funds to purchase, for example, gas-piston stations.

“To buy such a station, you need about EUR 850 thousand. We don’t have that kind of money, so we are currently using generators,” said the owner of the group of companies.

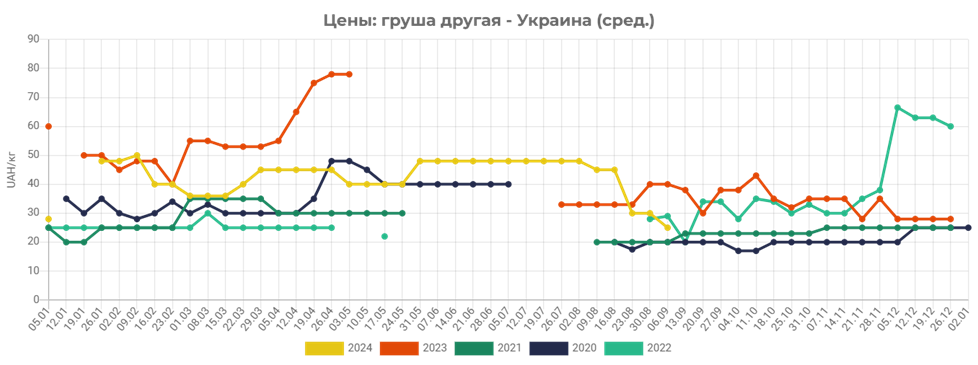

At wholesale markets of Ukraine this week there was recorded a decrease in selling prices for pears from local farms, analysts of the EastFruit project report. The reason for this price situation, according to market participants, is the seasonal increase in the supply of these products on the market, while the demand of wholesale companies for these fruits remains inactive.

Thus, today pears from local farms on the Ukrainian market are offered for sale in large wholesale at UAH 15-30/kg ($0.36-0.73/kg), which is on average 25% cheaper than a week earlier. According to the results of regular monitoring, prices for pears in the current season continue to gradually decline, starting from the middle of August this year, which is a consequence of constantly increasing supply of products on the market.

It should be reminded that in the current season due to milder weather conditions in winter-spring period in Ukraine, the average yield in the pear segment has significantly increased. As a result, a significant increase in production had a negative impact on the price situation on the market. As an exception here we can single out Vinnitsa region of Ukraine, where in spring of the current year producers lost 30% and more of future fruit crop due to frost and hail. But in general, this had little effect on the overall market condition in this segment.

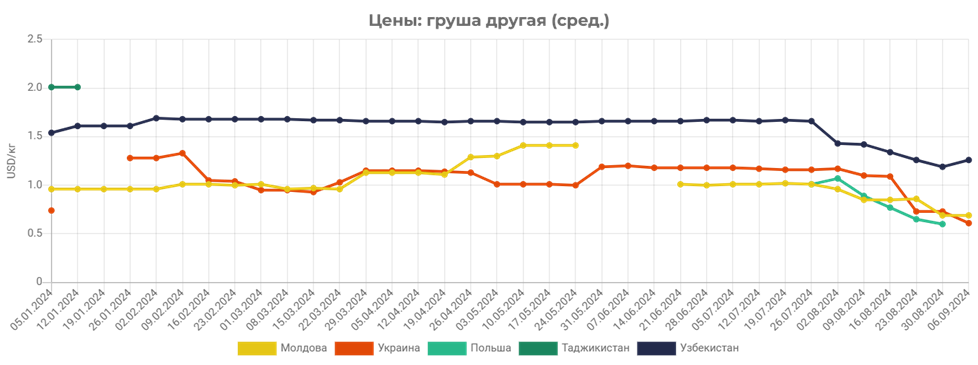

If we compare the situation on the pear market in Ukraine with other countries of the project monitoring region, it is in this country that the most affordable pears are currently on sale. This fact once again shows the growing interest of Ukrainian gardeners in growing these fruits in the last few seasons.

It should be noted that today the selling prices for pears in Ukraine are already on average 32% cheaper than in the same period last year. You can get more detailed information about the development of pears and other fruit and vegetable products market in Ukraine by subscribing to the operative analytical weekly – EastFruit Ukraine Weekly Pro. Detailed information about the product can be found here.

Source: https://east-fruit.com/novosti/tseny-na-ukrainskie-grushi-na-32-nizhe-proshlogodnikh/