In the first half of 2024, clients of PrivatBank (Kyiv) made payments using a bank card or its mobile application totaling UAH 451 billion, which is 27.3% more than in the first half of 2025.

According to the state bank’s statistics released on Thursday, the number of purchases during this time increased to 1.6 million from 1.3 million, thus the average cost of one purchase increased from UAH 269 to UAH 282, or 4.7%.

It is noted that the most popular item of expenditure during this time was the purchase of food: the share of payments in grocery stores and supermarkets in the total volume of non-cash payments was 44%, which is 1.5% percentage points less than in the first half of 2023.

The second place in terms of the share of card spending is occupied by the purchase of medicines and health products – 6.6%, and the third place is occupied by payments in public catering establishments – 6.4%.

The top five is rounded out by spending on clothing and footwear, as well as fuel – 4.5% and 4.2% of the volume of non-cash payments by Ukrainians, respectively.

In addition to the aforementioned goods, Ukrainians often paid for household goods (4%) and electronics and household appliances (3.8%). Expenditures on transportation and recreation amounted to 1.5% and 1.4%, respectively.

According to the National Bank of Ukraine (NBU), as of June 1, 2024, PrivatBank was the leader in total assets (UAH 872.40 billion) among 63 banks operating in Ukraine. Net profit for the previous year amounted to UAH 37.76 billion.

According to the NBU, as of June 1 this year, Privat had 28.5 million active cards, while the total number of cards in the market is about 53 million.

Scooter riders guilty of an accident are fined from 340 UAH to 17 thousand UAH and deprived of their driver’s license

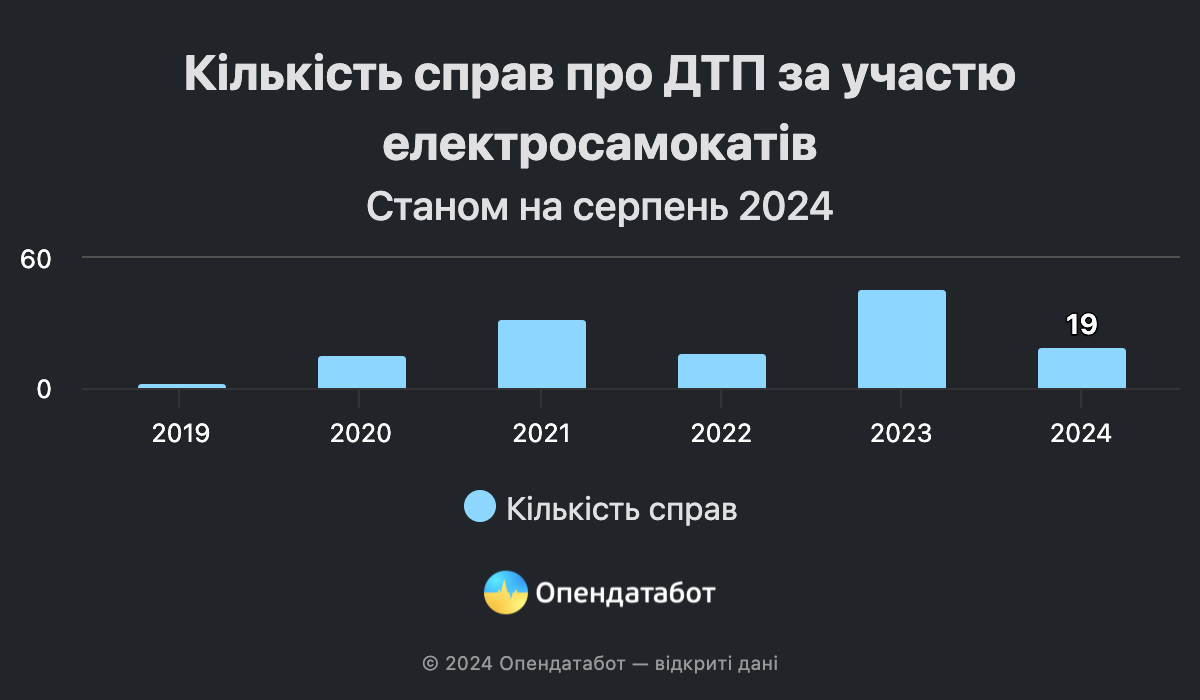

At least 130 cases of accidents involving electric scooters have been considered in courts over the past 5 years, according to the court register search engine Babusya. 34% of them were considered in 2023. Scooter drivers can be fined from UAH 340 to UAH 17,000 for violations and lose their driver’s license for a year.

111 administrative and 22 criminal cases related to accidents with electric scooters were found in the court register as of July 2024.

The largest number of accidents involving scooters was recorded last year: 36 administrative and 10 criminal cases. However, the number of such proceedings is only increasing from year to year: more criminal cases have already been opened this year than in the entire year of 2021. Since the beginning of this year, the courts have already heard at least 16 administrative and 3 criminal cases involving scooters.

The most common types of accidents where scooter drivers are to blame are pedestrian collisions or property damage. In such cases, drivers mostly get off with a fine of UAH 340 to 850.

At the same time, the number of cases when scooter drivers are caught driving while intoxicated is increasing. For example, last year, a driver of a rented scooter hit a woman on the sidewalk. During the test, he was found to have 0.9 ppm of alcohol, which is about the same as after drinking 250 ml of vodka. The offender was fined UAH 17 thousand and deprived of his driver’s license for a year.

However, violators cannot always be fully prosecuted: drivers may not have a driver’s license and simply do not know the traffic rules. For example, a courier on an electric scooter rushing to deliver an order with 0.33 ppm in his bloodstream argued in court that he was sober and that the scooter was not a vehicle. However, these arguments did not help him avoid a fine of UAH 17 thousand. The driver’s license could not be confiscated, as required by law, because the offender never had one.

Our editorial team asked how the scooter rental business reacts to such statistics. Bolt and Jet companies said that the law does not require scooter riders to have a driver’s license, but according to the rules of their services, the driver must be an adult. It is worth noting that the services do not require documentary proof of age: users must enter their date of birth during registration.

Both companies noted that all trips are insured against damage to life or property of third parties. At the same time, if a minor is involved in an accident and pretends to be older when registering (as in the case of a teenager who rammed a car in Kyiv), the consequences of the accident are either not covered by insurance at all (Jet) or, depending on the circumstances, the service reserves the right to make a final decision (Bolt).

“At themoment, it is very important to develop clear and understandable traffic rules for electric scooters and liability for their violation at the legislative level. We don’t track all incidents with electric scooters, but we do monitor insurance claims – this year it is less than 0.001% of all trips,” comments Anton Milka, Head of Sharing Services Development at Bolt in Ukraine.

Context

As a reminder, in 2023, scooter drivers were legally recognized as full-fledged road users – but special rules for them have not yet been approved. Drivers of electric scooters, monowheels, etc. must move as far to the right of the roadway as possible, use reflective elements and helmets. At the same time, such vehicles are prohibited from driving on sidewalks and pedestrian paths.

https://opendatabot.ua/analytics/scooters-dtp-2024

Ukrainian companies increased imports of tin and tin products by 7.8% in January-July – up to $1.536 mln (in July – $185 thousand),

According to customs statistics released by the State Customs Service of Ukraine, exports of tin and products amounted to $331 thousand (in July – $150 thousand) against $53 thousand in the same period a year earlier.

In 2023, exports of tin and products totaled $159 thousand vs. $424 thousand for 2022.

Tin is used primarily as a safe, non-toxic, corrosion-resistant coating in pure form or in alloys with other metals. The main industrial uses of tin are in white tinplate for food containers, in solder for electronics, in house piping, in bearing alloys, and in coatings made from tin and its alloys. The most important tin alloy is bronze (with copper). Another well-known alloy – pewter – is used for the manufacture of tableware.

More than 65% of all housing sales in the primary market are made through installment programs, about 30% are purchased at full price and 5% or more through mortgages – the state program “eOselya” and joint mortgage programs of banks and developers.

This was stated by Marianna Bigunets, Sales Director of GAZDA Construction Company.

According to the expert, before the full-scale invasion, the ratio of housing purchases by various financial mechanisms was as follows: installment programs accounted for up to 35-40% of total sales, more than 50% of sales were recorded for the full cost of the house, and the share of mortgages was 10-15%.

She believes that the growth in the share of housing purchases under installment programs is directly related to several factors.

“Amid economic uncertainty and inflationary processes that also affect the primary housing market, as housing prices may rise by 30% in 2024 compared to 2023, a citizen can, first, buy a home with a minimum down payment (from 10% to 30% of the cost of an apartment or, for example, a townhouse) and with a fixed price, which will protect his or her savings from depreciation. And secondly, their monthly expenses for servicing the installment plan, depending on the cost of housing and the amount of the down payment, will not exceed UAH 36-55 thousand,” the expert argues.

She said that as of August, the most common installment programs are 3-year installment programs with a down payment of 10% to 30% with a fixed price. Most often, 1.2-room apartments with an area of 40 m2 to 60 m2 and smart apartments with an area of up to 30 m2 are purchased with the help of installment programs. At the same time, the tendency to invest in the early stages of construction is slowly returning, when the price for the buyer is on average 35% less than at the stage of putting the house into operation.

Marianna Bihunets gave an example of an interest-free installment program with a down payment of 30% of the cost of the apartment and a term of up to 3 years. Thus, for a 2-room apartment of 60 m2 with an average cost of UAH 2 million to UAH 3 million, the buyer will pay a down payment of UAH 700 thousand to UAH 1 million, and monthly payments can range from UAH 36 thousand to UAH 55 thousand.

According to the expert, currently the most expensive cities in terms of prices in the primary market are Kyiv, Lviv, Uzhhorod and Odesa. In these cities, the average cost per m2, depending on the stage of construction, class of the object, and the area of the apartment, varies from UAH 42 thousand to UAH 47 thousand. She is convinced that it is the price level that requires the developer to look for and implement mechanisms that would, on the one hand, allow citizens to become owners of new housing, and on the other hand, not to stop construction.

“Given the rising cost of housing, installment programs and prices should be proportionate and affordable for the buyer. That is why we note the slow return of the “pre-war” trend of citizens investing in the early stages of construction, as the price is the lowest at such stages. Of course, so far this applies mainly to safe and most comfortable regions, such as Lviv, Chernivtsi, Uzhhorod, Kyiv, etc. It is important that this trend is possible only in the objects of the most reliable companies that not only do not stop construction, but also whose objects are accredited by the state mortgage program “eOselya” and have special loan programs with commercial banks,” she said.

GAZDA Construction Company was established in 2007. During this time, the company’s portfolio includes 13 residential construction projects: more than 1500 apartments have been commissioned. The total area of commissioned real estate is more than 150 thousand m². Currently, 3 projects are under construction in Uzhhorod: ParkLand RC, Grand Hills RC and the new phase of Sherwood Cottage Town. GAZDA does not have a single object under construction.

The company specializes in the construction of mid-rise apartment buildings (5-9 floors), comfort-class townhouses, comfort- and premium-class cottage communities. Apartments range in size from 25 m² to 160 m². Townhouses range in size from 122 m² to 238 m².

In 2023, GAZDA commissioned 22 thousand m². Of these: ParkLand residential complex – 12 thousand m²; Dzherelna townhouses – 1 thousand m², Sherwood townhouses – 9.8 thousand m².

GAZDA offers a variety of options for apartments in its complexes: with a rough finish and individual wiring, or with a ready-made renovation from the developer. In addition, the company has its own design studio, MG Design Studio, which performs repairs from the developer and saves you time and money. About 5% of apartments are offered with a ready-made design renovation, including household appliances, furniture and textiles.

The company is a participant of the state preferential mortgage program “eOselya” (ParkLand and Sherwood residential complexes are accredited to participate in the program (there is a queue).

Ukrainian enterprises in January-July decreased imports of lead and lead products by 14.4% to $610 thousand ($50 thousand in July).

According to customs statistics released by the State Customs Service of Ukraine, exports of lead and lead products decreased by 27.8% to $6.492 million (in July – $1.089 million).

Ukraine’s imports of lead and lead products decreased by 65.2% to $989 thousand in 2023.

Lead is currently mainly used in the production of lead-acid batteries for the automotive industry. In addition, lead is used to make bullets and some alloys.

The Cabinet of Ministers has adopted a draft law “On Amendments to the Law of Ukraine ‘On Sanctions’ on the Prohibition of the Use of Software Products and Access to Electronic Information Resources,” which, in particular, proposes to ban electronic websites in Ukraine developed by foreign persons subject to sanctions, according to Taras Melnychuk, a representative of the Cabinet of Ministers in the Verkhovna Rada.

According to his message on the telegram channel, “the draft law proposes to amend the Law of Ukraine ‘On Sanctions’ by defining new types of sectoral sanctions, in particular, a ban on the distribution and use of software products on the territory of Ukraine by legal entities whose components originate in a foreign country, which has been sanctioned under the Law of Ukraine “On Sanctions”, or whose developer or copyright holder is a legal entity (individual) resident of such a foreign state or a legal entity whose share in the charter document is foreign, as well as a ban on the use of electronic websites.

In addition, it is proposed to prohibit the use of software products from entities engaged in terrorist activities, or whose developers or copyright holders are foreign legal entities or individuals subject to sanctions.

Sanctions may also be imposed on software products created using the source or object code of software products or their components subject to sanctions; access to electronic information resources on the Internet (web pages, websites, other web resources), electronic communication networks, electronic communication systems, information systems, information and communication systems may be prohibited.