According to an analytical report by Relocation, the average price of secondary housing in Spain reached a historic high of €2,555 per square meter in October 2025, which is 15.7% more in annual terms and 1.5% more than in September. In some markets, the growth was even higher: in the province of Malaga, the average price of secondary housing rose to €3,842 per square meter in August, +13.8% year-on-year. The INE’s nationwide housing price index for the second quarter recorded +12.7% year-on-year, with secondary housing rising by 12.8%.

Prices in Spain are being driven by a shortage of supply, high demand in coastal provinces and on the islands, and sustained activity from foreign buyers. According to Relocation, up to 80% of potential buyers face the problem of affordability and a lack of suitable properties, which further pushes prices up.

The leaders in terms of regional dynamics are the Costa del Sol, the Balearic and Canary Islands, and the provinces of Alicante and Valencia. In the large agglomerations of Madrid and Barcelona, demand is sustained by the rental market and limited construction.

Spanish business publications forecast further growth of 4-6% for 2025-2026, with a shortage of new supply on the market.

Romanian law enforcement agencies have detained former senator Marius Ovidiu Isele on suspicion of attempting to bribe Defense Minister Ionut Mosatan with €1 million to facilitate an ammunition deal. According to investigators, the scheme involved purchasing Soviet-style shells in Kazakhstan, importing them, and “rebranding” them in Romania, then selling them through an intermediary in Bulgaria for delivery to Ukraine. This was reported by Radio Liberty, citing investigation materials and participants in the events.

The head of the state-owned company Romtehnica, Razvan Minku, said that he had been approached with a proposal to use his contacts in Kazakhstan to resell ammunition, but he considered the proposal suspicious and refused. The intermediary was politician Octavian Bercian, who contacted law enforcement agencies and made 17 hidden recordings of meetings with Isele. The court imposed a preventive measure on the former senator in the form of 30 days of pre-trial detention.

There are also reports about Bulgarian businessman Roman Ivanov Angelov, the sole owner of Sofia Arm Tech, which received a license for international arms trade in 2024. His whereabouts are unknown, and he has not responded to journalists’ inquiries. The defense minister stated on social media that he had refused any meetings and that the attempt to “buy his influence” had been rejected.

The publication notes that the initiators hoped to attract funds from the European Rearm Europe program to support the defense industry of EU countries in the future, but the scheme remained at the trial stage and was not implemented.

Rearm Europe was launched by the European Commission in March 2025 to stimulate arms production in EU countries. Romtehnica is the authorized intermediary of the Romanian Ministry of Defense for international procurement and sales of arms and military equipment.

The area affected by forest fires in Ukraine has decreased fourfold this year. The area affected by fires in the forests of the State Enterprise “Forests of Ukraine” (excluding the Izyum Forestry) amounted to only 1.5 thousand hectares, compared to 6 thousand hectares in 2024. This was reported by the head of the enterprise, Yuriy Bolokhovets.

According to him, since the beginning of the year, forest fires in the European Union have destroyed more than a million hectares of forest, which is a record for the last twenty years. For example, in Ukraine’s neighbor Romania, 126,000 hectares of forest land have burned down. In Ukraine, military factors are added to the negative climatic factors – a significant proportion of fires are associated with rocket and drone strikes. However, the percentage of forest loss due to fires is an order of magnitude lower than in the EU.

The most problematic remains the Izyum Forestry, which this year included three de-occupied forestries in the Kharkiv region. Last year, almost 13,000 hectares of forest burned down here. After joining the State Enterprise “Forests of Ukraine,” the company notes that new firefighting equipment and tools were transferred to the forestry enterprises, and the salaries of forest protection workers were increased. As a result, the area affected by fires in the Izyum Forestry was reduced by almost 8 times to 1,800 hectares.

The State Enterprise “Forests of Ukraine” explains that the reduction in the area affected by fires was achieved thanks to the purchase of new firefighting equipment. This year, dozens of new forest firefighting modules were sent to most of the company’s branches, which are capable of reaching places that large fire trucks cannot access. Recently, new tenders were announced for the purchase of 50 modules to be installed in pickup truck beds and 20 trailer platforms with pre-installed forest firefighting modules.

The salaries of forest protection workers have also been increased by an average of 20%.

Over the past two years, the State Enterprise “Forests of Ukraine” has set up more than 100 new modern recreation centers, the presence of which significantly reduces the risk of fires caused by human factors. Another 50 have been opened this year. According to the company, these are full-fledged complexes for safe leisure in the forest with all the necessary infrastructure (children’s and sports grounds, water, electricity, changing rooms, barbecues, etc.).

In addition, foresters continue to make large-scale investments in firefighting infrastructure. This year, 38,800 km of mineralized strips were installed and 183,400 km of existing ones were maintained. The State Enterprise “Forests of Ukraine” maintains 3,500 fire reservoirs, equips them with piers, and installs water storage tanks so that even in hot weather, each reservoir has the necessary water supply.

Work is continuing on the purchase and installation of 30 new television surveillance systems and the construction of 24 new observation towers. The goal is to completely cover forest areas with a high risk of fire with a video surveillance system. In total, the company operates almost 500 such towers.

To prevent large-scale fires in the future, Lisy Ukrainy has refused to plant pure coniferous stands, creating exclusively mixed forests of coniferous and deciduous species, which are more resistant to climate change and less vulnerable to fires.

In October 2025, Ukraine imported 353.9 thousand MWh of electricity, which is 2.5 times more than in September, according to the DIXI Group analytical center, citing data from Energy Map.

“This is the highest monthly import figure since the beginning of the year. At the same time, exports fell sevenfold to 90.8 thousand MWh, which was the first decline in the last five months,” the center reported.

According to DIXI Group, the sharp increase in imports is due to the deterioration of the situation in the energy system caused by massive shelling of energy infrastructure. In particular, during October, Russian attacks damaged, among other things, thermal and hydroelectric power facilities, which led to a power shortage. As a result, emergency and scheduled hourly power cuts for the population were resumed, as well as restrictions on consumption for industry and business.

The situation was exacerbated by a drop in temperature. Low output from residential solar power plants due to cloudy weather, as well as the active use of electric heaters before the start of the heating season, placed an additional burden on the power system.

Electricity imports in October were wave-like in nature, due to enemy shelling. In particular, after a massive strike on October 10, external supplies rose sharply – on October 11, imports reached 19.0 thousand MWh, which is 141.5% more than the previous day.

A similar situation repeated itself after the attack on October 22: on October 23-24, there was a sharp increase in imports to 19.8 thousand MWh and 23.4 thousand MWh, respectively, or +64.8% and +94.4% compared to October 22. At the end of the month, after another large-scale attack on October 30, Ukraine was again forced to increase external purchases: on October 31, imports amounted to 22.4 thousand MWh (+76.9% compared to the previous day).

In the structure of imports by direction of electricity supply, Hungary accounts for more than 50% – 180.0 thousand MWh (50.9%). This is followed by Poland with 80.2 thousand MWh (22.7%) and Romania with 76.9 thousand MWh (21.7%).

The maximum agreed commercial capacity for imports from the EU from December 2024 is 2.1 GW. On average, in October 2025, capacity utilization was 22.6%, with a maximum on October 18 between 20:00 and 21:00 (84.4%) and the only hour of the month when no electricity was imported (October 3 between 22:00 and 23:00). At the same time, during peak morning and evening consumption hours, capacity utilization increases significantly.

In addition to the commercial capacity of 2.1 GW for Ukraine, an additional 0.25 GW of emergency assistance is available from neighboring ENTSO-E operators as “insurance” at critical moments. Thus, emergency assistance was provided during October from Poland, both in the form of additional electricity with a total volume of 28.8 thousand MWh and in the form of supplies of surplus electricity to Poland (5.25 thousand MWh). There is no public information available on other neighbouring power systems.

In turn, the main volumes of electricity exports in October were carried out during hours of minimum domestic consumption – mainly at night and early in the morning – from 0:00 to 6:00.

In terms of export structure by destination, Hungary prevails with 39.3 thousand MWh (43.2%), Moldova with 31.1 thousand MWh (34.3%), and Romania with 14.9 thousand MWh (16.4%).

“As a result, imports in October exceeded exports by almost four times – the negative balance in October amounted to 263.0 thousand MWh,” DIXI Group concluded.

Overall, based on the results of the first 10 months of 2025, Ukraine is a net importer of electricity, with a negative balance of 168.7 thousand MWh for this period.

More than 13.3 thousand new food service businesses have opened in Ukraine this year, according to the Unified State Register. At the same time, more than 10.6 thousand food outlets have ceased operations. This year, the growth of new cafes and restaurants has more than halved. Half of the cafes and restaurants that closed this year had been in operation for less than a year and a half.

13,373 new food service outlets were opened in Ukraine this year. This is 5% less than in the same period last year. September was the most active month, with 1,699 new establishments opening.

At the same time, 10,645 cafes and restaurants ceased operations over the same period. Overall, this year’s growth of new entrepreneurs amounted to +2,728 establishments. For comparison, last year’s increase amounted to 6,004 new businesses.

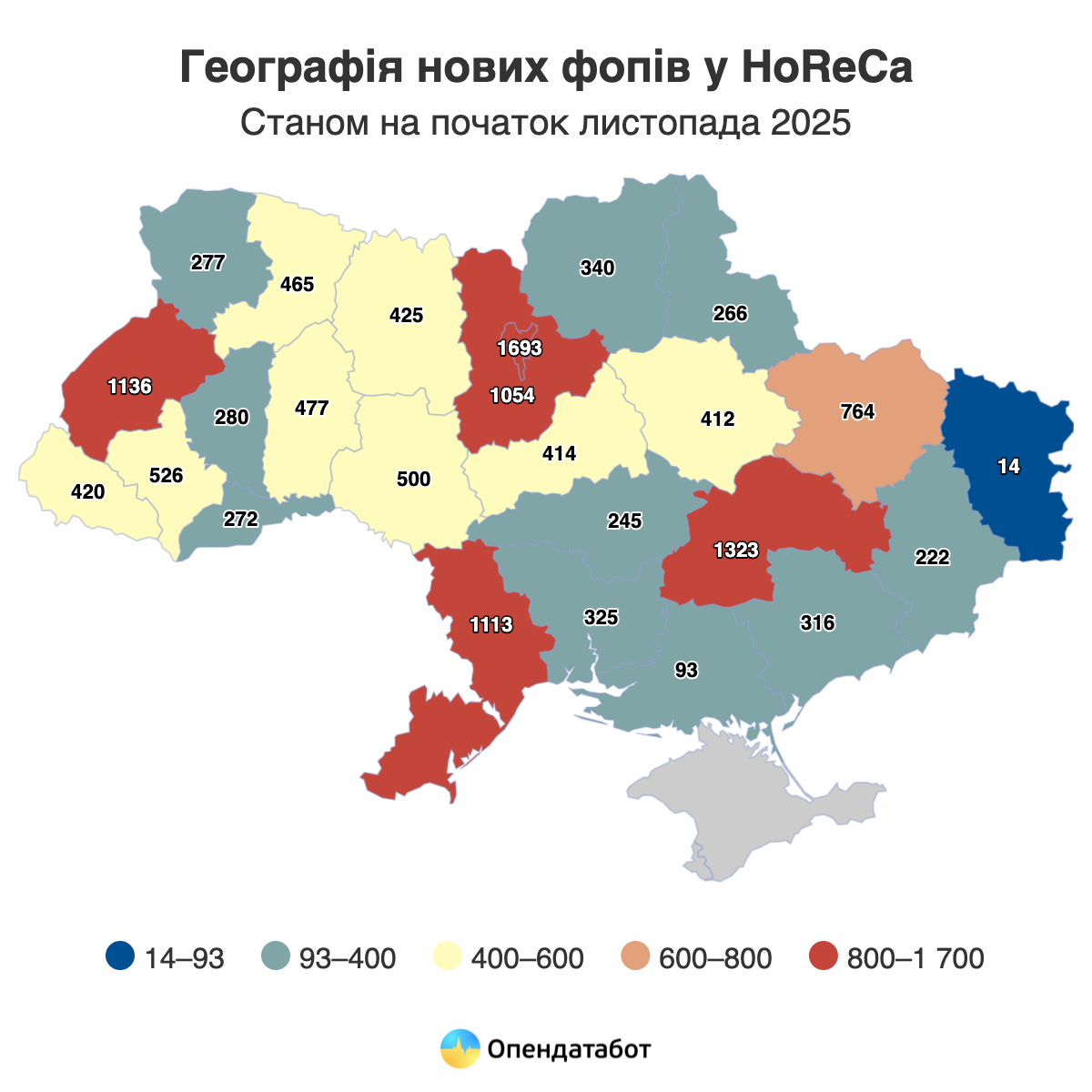

The largest number of new HoReCa fops were opened this year in Kyiv (1,693), Dnipropetrovs’k (1,323), Lviv (1,136), Odesa (1,113), and Kyiv (1,054).

The restaurant business in Ukraine is currently predominantly a women’s business: 66% of new business owners are women. In some regions, this figure exceeds 70% – in particular, in Khmelnytskyi, Kirovohrad, Zakarpattia, Cherkasy, and Rivne. In no region do men prevail in terms of the number of new openings.

A quarter of the fops closed this year had been in operation for less than six months. In general, the median life of small and medium-sized businesses in HoReCa is 17 months. The oldest restaurant fop that closed this year had been operating since 1992.

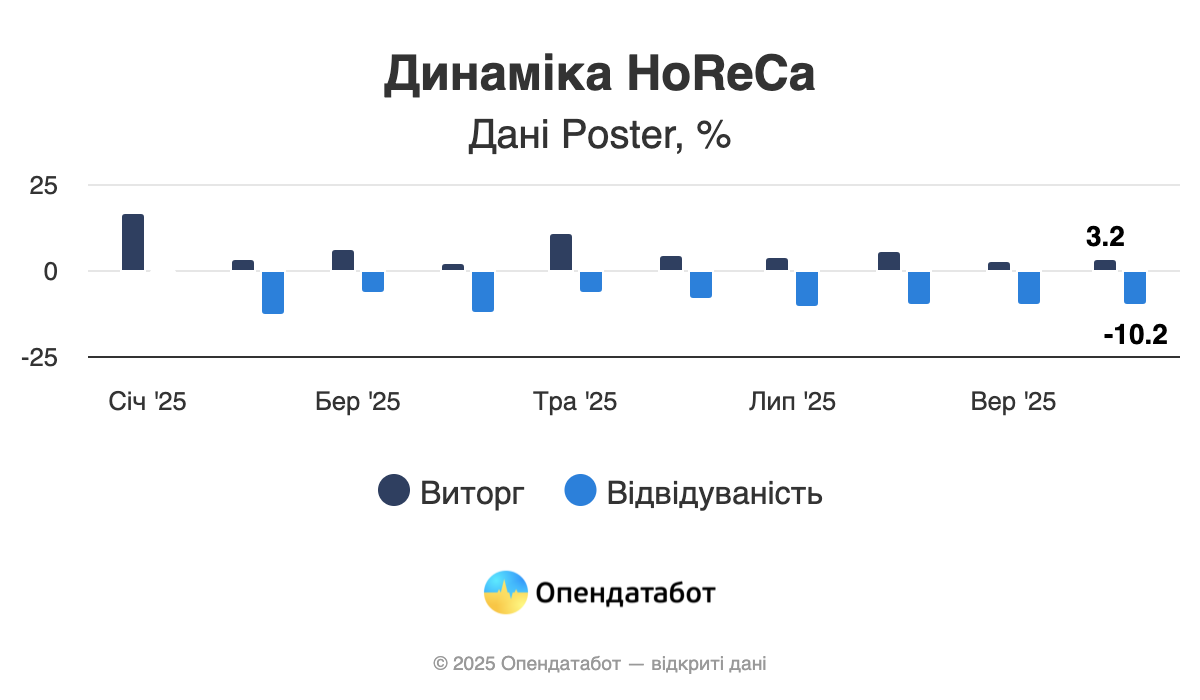

Despite the decline in the number of new establishments, according to the Ukrainian service Poster, the revenue of public catering establishments increased by 6%, but this cannot be called a significant success. Attendance decreased by 9%, so the growth is due to higher prices rather than an increase in customers. The average check in restaurants has grown by 11% since the beginning of the year.

“Revenue growth of 6% is not real earnings, but catching up with inflation. The average check grew due to higher food prices and operating expenses for rent and payroll. The industry’s problems are exacerbated by the outflow of employees after legislative changes to the age of 18-22 and a decrease in the purchasing power of the population.

Despite the challenges, we do not currently see a massive outflow of customers at Poster – the number of existing establishments and those preparing to open remains within the average. The winter months are always a stressful test for the industry – not everyone passes it successfully, but in the spring new establishments open and the market is renewed,” comments Rodion Yeroshek, CEO and co-founder of the Ukrainian restaurant automation company Poster.

According to Poster, attendance has dropped across Ukraine this year. Looking at the top 5 big cities, it looks like this:

Lviv – -8%.

Odesa – -6%.

Kyiv – -13%.

Dnipro – -11%.

Kharkiv – -7%.

The number of insurance companies in Ukraine in October 2025 decreased by one. At the end of the month, 49 risk insurers and 10 life insurance companies, as well as the Export Credit Agency with special status were operating in the market, according to the website of the National Bank of Ukraine.

According to the NBU, the number of insurance and/or reinsurance brokers has not changed – 45. In October, the regulator received 55 inquiries regarding registration and licensing actions of insurers.

In general, the number of non-banking financial market participants for the month decreased to 787 from 791. In the non-banking market, there were 417 financial companies (there were 418), 102 pawnshops (there were 104), 88 credit unions, one lessor and 74 collection companies. The number of non-banking financial groups increased by one – to 42, banking groups unchanged – 16.