The first nuclear power plant (NPP) in Kazakhstan will be named “Balkhash”, the press service of the republic’s atomic energy agency reported.

“According to the results of the final meeting of the Competition Commission, the name ”Balkash” nuclear power plant was recognized as the winner, which received the largest number of proposals from citizens. The chosen name also corresponds to the international practice of naming nuclear power plants by geographical feature,” the report on the results of the nationwide contest for the best name of the nuclear power plant reads.

The contest committee also determined the name in Russian and English: “Balkhash Nuclear Power Plant” and Balkhash Nuclear Power Plant.

The first NPP, which will be located near Lake Balkhash, will be built by Rosatom. The Russian company has signed a roadmap with Kazakhstan for the construction of two VVER-1200 nuclear power units. The construction of the plant will take approximately 11 years and may be completed in 2035-2036. The issue of attracting state export financing at the expense of the Russian Federation is being studied for the construction of the plant.

Research work near the village of Ulken on Balkhash started on August 8. Here, as part of preliminary surveys, Rosatom’s specialists will explore at least three sites in Zhambyl district, for which they will drill 50 wells with depths ranging from 30 to 120 meters. Based on the hydrogeological features of the site, seismic stability parameters and others, a decision will be made on the exact location of the NPP.

The government said that the second and third nuclear power plants in Kazakhstan could be built by China National Nuclear Corporation (CNNC).

Ukrnafta, Ukraine’s largest network of filling stations, has started selling winter diesel fuel, which will ensure reliable engine operation at low temperatures, Ukrnafta said in a press release on Monday.

“Ukrnafta winter diesel has stable performance properties and remains effective even at temperatures as low as -21°C,” the company noted.

It recalled that the use of winter diesel allows drivers to start the engine smoothly in freezing weather and maintain optimal parameters of the car’s operation throughout the cold period.

“Preparing for the winter season is traditionally one of the priorities for our company. We strive to provide our customers with confidence in their vehicles in any weather“, – noted in ”Ukrnafta”.

JSC “Ukrnafta” – the largest oil company in Ukraine, is the operator of the largest national network of filling stations – Ukrnafta. In 2024, the company entered into the management of Glusco assets. In 2025 finalized a deal with Shell Overseas Investments BV to purchase the Shell network in Ukraine. The company operates a total of 663 filling stations.

The company is implementing a comprehensive program to restore operations and update the format of its network of filling stations. Since February 2023, the company has been issuing its own fuel coupons and NAFTACard, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

Ukrnafta’s largest shareholder is Naftogaz of Ukraine with a 50%+1 share stake. In November 2022, the Supreme Commander-in-Chief of the AFU decided to transfer to the state a share of the corporate rights of the company owned by private owners, which is now managed by the Ministry of Defense.

The EU Council announced on Saturday that it has agreed with the European Parliament on a €192.8 billion EU budget for 2026.

“Today’s agreement demonstrates that Europe is able to act even in challenging times. The EU budget for 2026 will allow us to realize our common priorities: security, competitiveness and border management – while ensuring that we can respond quickly and effectively to unforeseen needs and crises,” said Nicolai Wammen, Minister of Finance of the Danish Presidency of the Council of the EU and the Council’s chief negotiator on the 2026 budget.

The total EU budget commitment for 2026 is €192.8 billion and total disbursements €190.1 billion. “Commitments are legally enforceable promises to spend money on activities whose implementation is spread over several financial years. Payments cover expenditure arising from commitments made under the EU budget in the current and previous financial years,” the council explains in a published communiqué.

This is the sixth annual budget of the EU’s long-term budget for 2021-2027. The 2026 budget is complemented by measures to support post COVID-19 recovery under the special NextGenerationEU program, the document notes.

Disbursements for EU defense and security in 2026 are planned at €2.25 billion. For migration and border management – 3.88 billion euros. For neighborhood policy and foreign policy – 16.56 billion euros. For the common market, innovation and digitalization – 23.33 billion euros.

Now the EU Council and the European Parliament must formally approve the agreement reached. The EU Council is expected to approve it on November 24. A qualified majority vote is required to pass the budget, according to the communiqué.

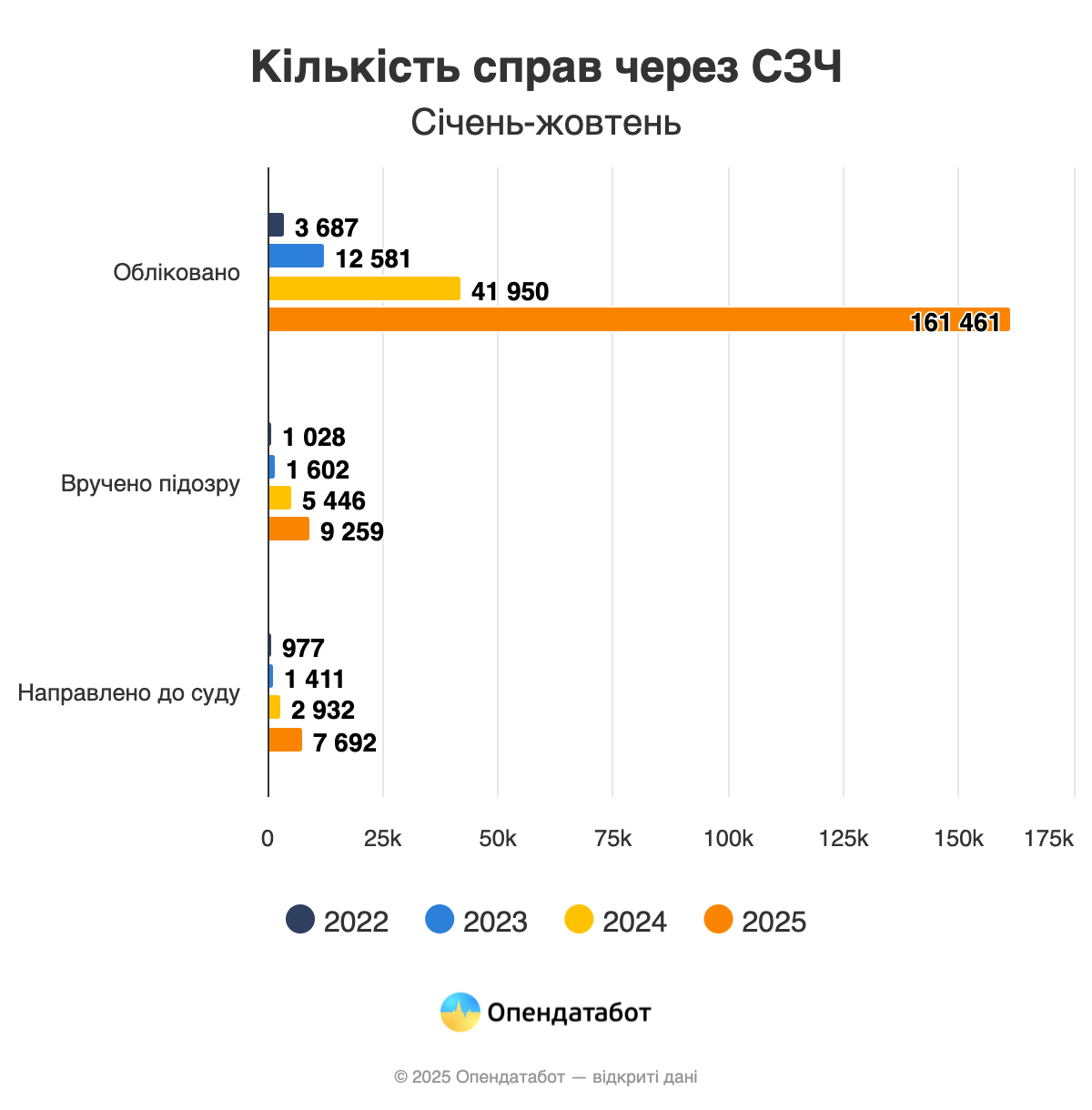

More than 161,000 criminal proceedings on unauthorized abandonment of a military unit (UAW) were opened in the first 10 months of 2025, according to the Prosecutor General’s Office of Ukraine. This is 4 times more than in the same period last year. Every month, law enforcement officers register almost 16,000 new cases of AWOL. So far, only 5% of cases have gone to court.

161,461 cases of unauthorized leaving of a military unit (Article 407 of the Criminal Code) were recorded in 10 months of 2025. This is 4 times more than in the same period last year.

The number of cases that took 12 months to accumulate three years ago is now recorded in less than two weeks. Every month, law enforcement officers register almost 16,000 new cases of “unauthorized absence,” while in 2024 there were about 5,000 per month, in 2023 – only 1,500, and in 2022 – only 6,000 for the entire year.

Despite the record number of proceedings, only 9,300 servicemen were served with suspicion notices, which is about 6% of all registered cases, and only 5% went to trial. For comparison, back in 2022, every fifth case went to trial.

It should be reminded that until August 30, 2025, a simplified mechanism for returning servicemen after the Joint Forces Operation without criminal liability was in place. Thus, soldiers who wished to continue their service could apply and return to the army in a reserve unit within 72 hours.

However, this option was available to soldiers who had completed their service before May 10. Those who did so after that date could return only to the unit they left, and reinstatement could take months.

It should be noted that unauthorized leaving of a military unit under martial law is punishable by imprisonment for a term of 5 to 10 years.

https://opendatabot.ua/analytics/awol-2025

Former head of the European Union delegation to Ukraine José Manuel Pinto Teixeira said that Ukraine is currently more ready to join the EU than a number of Western Balkan countries. He said this in an interview with Deutsche Welle. According to the diplomat, fears about the new stage of EU enlargement are exaggerated.

Teixeira noted that Ukraine has significant potential for the EU: it is a large country with natural resources, developed agriculture, and an educated and hard-working population that has demonstrated resilience and courage in the face of war. He stressed that Ukraine’s accession would be an “important acquisition” for the European Union in terms of territory, resources, and human capital.

The former ambassador recalled that Ukraine has made significant progress in the fight against “physical corruption” since the Revolution of Dignity, but such reforms always take a long time. He stressed that Ukraine remains a unique case in modern history: a country in the midst of a full-scale war is simultaneously carrying out reforms and moving towards European integration.

Teixeira pointed out that Ukraine continues to reform its public administration system amid constant Russian missile and drone attacks on civilian infrastructure. At the same time, Moscow, despite its status as a permanent member of the UN Security Council, is effectively avoiding international responsibility for its actions.

Assessing the prospects for EU enlargement, Teixeira said that the long preparation period for the Western Balkan countries does not in itself mean that they are more ready for accession than Ukraine. In his view, Kyiv is already ahead of a number of Balkan states in terms of its fulfillment of most of the key criteria, but must continue with reforms even after receiving candidate status.

He recalled that Ukraine is moving forward in the same “enlargement package” as Moldova and the Western Balkan states of Albania, Montenegro, Serbia, North Macedonia, Kosovo, and Bosnia and Herzegovina, which have been negotiating for many years but face chronic problems of the rule of law, corruption, and territorial disputes.

José Manuel Pinto Teixeira headed the EU Delegation to Ukraine from 2008 to 2012 and is now vice president of the European Center for Electoral Support (ECES) in Brussels.

Ukraine’s positive foreign trade balance in services in January-September 2025 decreased by 47.3% compared to the same period in 2024, to $856.8 million (in January-September 2024, it was $1,652.8 million), the State Statistics Service reported on Friday.

According to its data, exports of services for the nine months of 2025 decreased by 15.7% to $6,338.7 million, while imports decreased by 7% to $5,481.9 million.

The export-to-import coverage ratio was 1.16 (1.28 for the first nine months of 2024).

Foreign trade operations were conducted with partners from 211 countries around the world.

The structure of foreign trade in services for the first nine months of 2025 can be found at: