Insurance companies Arsenal Insurance and VUSO (both based in Kyiv) paid UAH 19.9 million (UAH 9.95 million each) in insurance compensation under a co-insurance agreement for buildings against military risks.

According to the Arsenal Insurance website, two business centers belonging to the same chain were damaged after two powerful air strikes on Kyiv in June and July 2025.

On June 23, the blast wave and debris damaged the facade, window structures, glass elements, finishes, and engineering systems of one business center. And on July 10, during another massive attack on Kyiv, an explosion damaged a second business center of the same chain — the entrance, office premises, and double-glazed windows on several floors of the building were destroyed.

Arsenal Insurance is a non-life insurance company with 100% Ukrainian capital. It has been operating since 2005. At the end of 2024, it was among the top six non-life insurers in Ukraine in terms of gross premiums.

VUSO is a Ukrainian insurance company that is among the top five market leaders. It was founded in 2001.

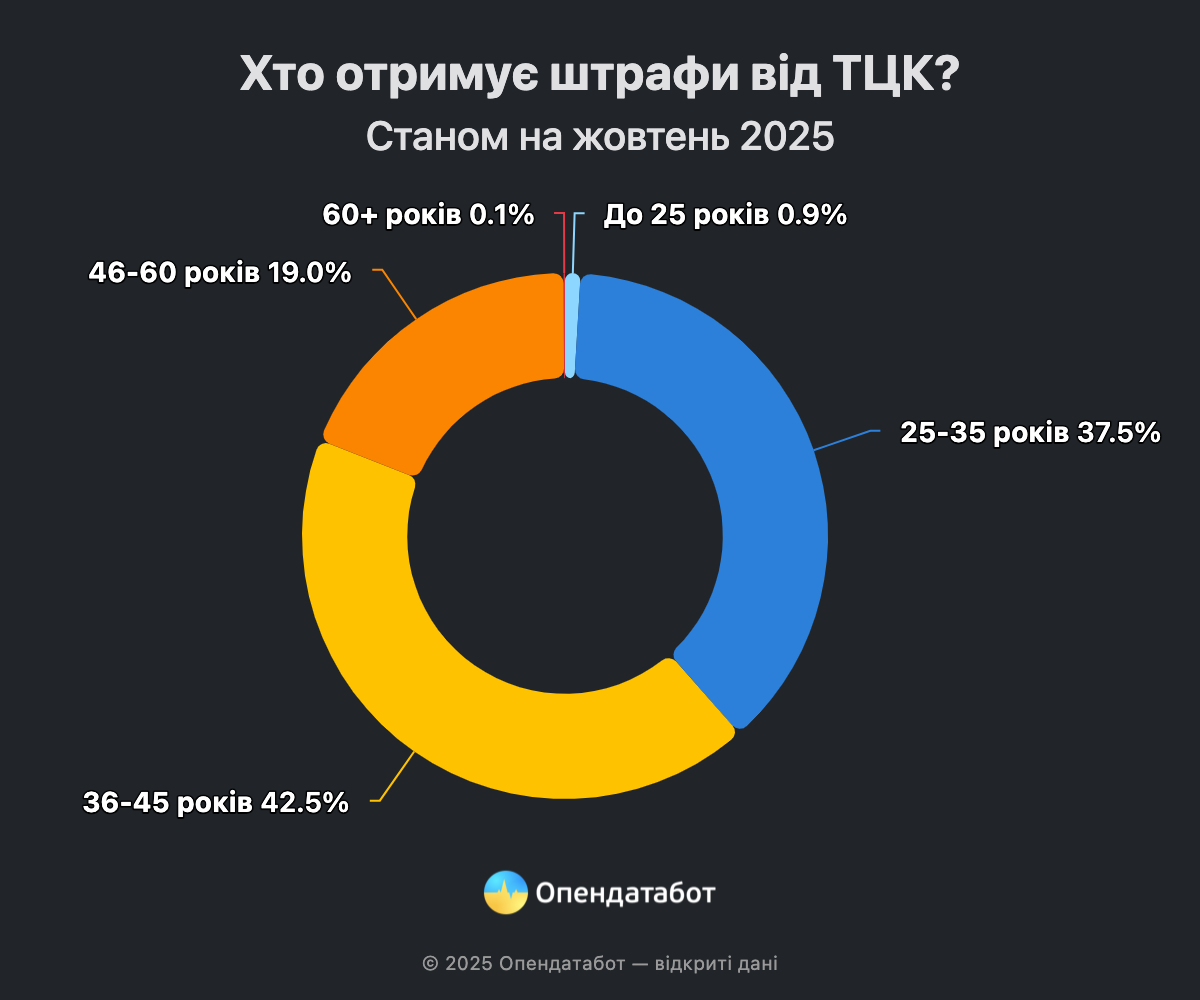

More than 47 thousand proceedings for violation of military registration rules have been opened since the beginning of 2025. A third of them have already been completed. About 4.5 thousand proceedings per month are opened by the MCC this year. Of these, 98 fines were imposed on women. A record 9 proceedings per person were opened against two men in Sumy region.

47,046 fines for violating the rules of military registration were recorded as of the beginning of October 2025. 14,454 proceedings – about a third – have already been completed.

It is worth reminding that you can check for overdue fines of the UCC in the Opendatabot.

On average, the TCC opens 4.5 thousand new proceedings every month. However, July was a record-breaking month with 7,595 openings. The lion’s share of July fines fell on the capital: 26% or 1,999 proceedings.

In total, 18 regions of Ukraine already have more than a thousand open proceedings in 2025. Kyiv is the absolute leader with 7,163 proceedings (15%). It was followed by Sumy (4,251 or 9%), Odesa (3,995 or 9%), Dnipro (3,846 or 8%), and Kharkiv (3,349 or 7%) regions.

The lowest rates are recorded in the west and in the area of active hostilities: Lviv region – 626, Rivne region – 464, Ivano-Frankivsk region – 315, Kherson region – 137, and in Luhansk region – 11 cases.

The vast majority of those fined were men aged 25 to 45 (80% of cases), while women accounted for 98 cases, which is only 0.2% of the total. It is worth noting that since July 31, 2025, a new mechanism for registering women with medical or pharmaceutical education has been in place – since then, 26 proceedings have been opened against women under the new rules.

The record holder in terms of activity was the Sumy City MCC, which opened 9 proceedings against two men this year, as well as 8 proceedings against another man. This is currently the largest number of fines per person in the country.

https://opendatabot.ua/analytics/tck-fines-2025-10

The network of bank branches in Ukraine shrank by 21 locations in the third quarter and stood at 4,913 branches at the beginning of October, according to information on the website of the National Bank of Ukraine.

According to its statistics, the reduction amounted to 98 branches over the first nine months of the year.

PrivatBank reduced the most branches in the third quarter—six—which reduced its network to 1,096, but the bank retained second place in terms of their number.

Oschadbank, despite closing five branches, remains the leader in Ukraine with 1,142 locations.

Pivdenny Bank and Radabank reduced their networks by three and two branches, respectively, in July-September, to 37 and 30 locations.

In the third quarter, Ukrgasbank (210 branches), MTB Bank (43), BIZbank (29), Industrialbank (24), MetaBank (21), RVS Bank (13), First Investment Bank (10), and Motor Bank (7) closed one branch each.

Among the banks that expanded their networks in the third quarter, PUMB, Akordbank, TAScombank, Bank Lviv, and Bank Ukrainian Capital opened one branch each—their networks grew to 220, 163, 92, 21, and 12 branches, respectively.

According to the National Bank, as of early October this year, the largest branch networks in Ukraine are traditionally held by the largest state-owned banks—Oschadbank with 1,142 branches and PrivatBank with 1,096. Raiffeisen Bank (321), PUMB (220), and Ukrsibbank (218) followed them at a considerable distance.

The second five in terms of network size were formed by the state-owned Ukrgasbank (210), A-Bank (198), Akordbank (163), the state-owned Sens Bank (137), and Credit Agricole Bank (125).

As of early October, seven banks with state ownership held a network of 2,639 branches, accounting for 53.7% of the total number of branches at the end of the third quarter.

Omnichannel tech retailer Foxtrot has purchased and installed backup power supply equipment worth a total of UAH 5.565 million to ensure uninterrupted operation during 2022-2025. As of October, all stores in the chain are energy independent, the company’s press service told Interfax-Ukraine.

“For Foxtrot, investing in energy independence is a necessary step for the company’s operation and development in the context of full-scale war. This makes it possible to organize the full operation of all services and also fulfills the company’s social mission: to be a local ”point of resilience“ for Ukrainians in difficult times,” the press service noted.

During September-October 2025, Foxtrot conducted an audit of its existing resources in case of repeated blackouts: 36 stores in the chain are equipped with generators; 48 were equipped with various types of uninterruptible power supplies; 44 stores were connected to the backup power supply equipment of landlords in shopping centers/malls. All stores are equipped with powerful charging stations, UPS equipment, additional lighting powered by power banks, etc. This allows cash registers and security systems to be activated and provides sufficient lighting for service.

In September and October, one additional backup generator and six charging stations were purchased.

Thanks to innovations in IT infrastructure implemented in 2023-2024, all of Foxtrot’s core business processes — from placing an order on the website to delivering goods in stores — run on reliable digital platforms and remain stable even in the event of a power outage.

A key element in ensuring the operation of stores is the internal ecosystem and the FoxyHUB mobile application, which allows salespeople to advise customers, process purchases, and accept card payments anywhere in the store or even outside it. For convenience, various digital payment methods are available that do not depend on stationary cash registers or POS terminals: via the seller’s mobile app, LiqPay, QR code, or chatbot in Viber/Telegram. The buyer receives a fiscal receipt immediately in electronic form. In October, Foxtrot is launching tap to phone, which will allow sellers to accept card payments via the customer’s smartphone through the app.

In addition, during power outages, stores offer gadget charging stations and free Wi-Fi.

Foxtrot is one of Ukraine’s largest omnichannel retail chains in terms of the number of stores and sales of electronics and household appliances. As of early October 2025, the company operates 127 stores in 68 cities, the Foxtrot.ua online platform, and the mobile app of the same name.

According to YouControl, the revenue of FTD-Retail LLC (Kyiv), which develops the chain, amounted to UAH 14 billion 882.632 million in 2024, which is 17.6% more than in 2023, and its net profit was UAH 6 million 721 thousand against UAH 314 million 436 thousand, respectively.

The founders of the omnichannel retailer Foxtrot are Ukrainian businessmen Gennady Vykhodtsev and Valery Makovetsky.

Norway plans to allocate NOK 2 billion in 2026 to finance a new package of military equipment from the US for Ukraine as part of the PURL initiative, according to the Norwegian government’s press service.

“Ukraine depends on continued military and civilian support in its struggle to defend itself against Russia. It is of great importance that several countries are coming together to provide funding to help meet Ukraine’s military needs. Norway is now joining forces with a number of other European countries to finance a military support package that will provide high-priority defense equipment for Ukraine. We are committed to providing NOK 2 billion for the package, which is being coordinated by NATO,” said Prime Minister Jonas Gahr Støre.

The contact group meeting will take place ahead of the NATO defense ministers’ meeting on October 15. Several European countries are expected to coordinate their planned contributions to Ukraine, including support provided under the new Ukraine Requirements List (PURL) initiative. Norway has also contributed 1.5 billion Norwegian kroner to finance the previous support package under the PURL initiative.

“It is important that European countries stand together and continue to provide support so that together we can finance the delivery of military equipment needed by Ukraine, such as drones, artillery, and advanced air defense systems. Under the PURL mechanism, the US provides NATO with lists of available weapons and military equipment. Allies, including Norway, then contribute to financing the purchase of this equipment for Ukraine,” said Defense Minister Tor Sandvik.

NATO coordinates shipments to ensure that weapons arrive in Ukraine as quickly as possible. For security reasons, the specific contents of each package are not disclosed.

“Norway has now contributed to the financing of two such support packages, and the government will work to ensure that as many allied countries as possible participate in this important initiative to support Ukraine. The equipment arrives quickly and helps

Ukrainians defend the front line and protect critical infrastructure more effectively. Supporting Ukraine’s fight for freedom is not only important for Ukraine’s defense; it is also crucial for the defense of Norwegian and European security,” Sandvik emphasized.

The draft law “On the Use of Assisted Reproductive Technologies” (No. 13638) could radically change the provision of medical services in the field of reproductive technologies and lead to Ukraine losing its status as the “reproductive hub of Europe.” It requires significant revision with the involvement of the professional expert community, according to experts surveyed by Interfax-Ukraine.

“According to various estimates, up to 40-60% of patients in large reproductive medicine clinics are foreigners (especially from the EU, the UK, the US, Canada, Israel, and China). If the law does not provide for transparent mechanisms for foreign patients, such as official medical visas or agreements between countries, Ukraine may lose its status as the “reproductive hub of Europe,” said Dmytro Biletsky, head of the assisted reproductive technology department at the Adonis Medical Gynecological Center (MGK) Adonis Medical Gynecological Center (MGK).

According to him, Ukraine is currently among the top 10 global destinations for reproductive technologies, thanks in particular to “affordable prices: an IVF cycle in Ukraine costs three to five times less than in most EU countries or the US,” the high level of specialists and technologies, the certification of many clinics according to international standards, and the fact that “Ukrainian legislation allows virtually all ART methods — donor eggs, sperm, embryos, IVF programs for married couples and single women.”

“In Ukraine, anonymous donation and the creation of embryos for storage are permitted, which is not acceptable everywhere,” he said.

Predicting the impact of the bill if it is passed, Biletsky expects that in the short term (one to two years), Ukraine may lose some of its patients for reproductive technology (ART) programs, although overall demand will remain high because IVF, donation, and embryo banking procedures will remain permitted, and Ukrainian clinics have an internationally recognized reputation and competitive prices.

However, he predicts that in the medium term (three to five years), “if the rules for foreigners remain strict (especially regarding embryo transportation, donation, and surrogacy), demand will decrease by 20-40%.”

At the same time, commenting on the impact of the bill’s proposed ban on embryo donation on the development of reproductive prospects in general, Biletsky noted that “the ban on embryo donation will result in some patients simply losing the opportunity to treat infertility, as well as an increase in the number of ‘unused’ embryos in clinics.”

“Currently, some couples voluntarily give their frozen embryos to others. If this is banned, embryos will either have to be stored (which is expensive) or destroyed. This raises the ethical question: ‘What to do with embryos that could give life?’” he said.

According to his estimates, donor embryo programs may account for up to 10-15% of all IVF procedures, so clinics specializing in “full cycles” (creation, donation, surrogacy) will lose a significant share of their clients.

“Many foreign patients came specifically for donor embryo programs — this was a unique Ukrainian advantage, because in many countries (for example, Germany and Italy) this is prohibited. The ban will mean the loss of one of the key areas of reproductive medicine. Ukraine is effectively losing one of the most humane mechanisms for helping infertile couples,“ he said.

For her part, Svitlana Shiyanova, head of assisted reproductive technologies at the Dobrobut medical network, also predicts that ”the adoption of this bill will lead to a sharp decline in international demand, as it contains two critical restrictive provisions: a ban on surrogacy services if one of the spouses is a citizen of a country where this method is prohibited, and a requirement that one of the spouses be a citizen of Ukraine (for surrogacy).”

“These provisions effectively close the international surrogacy market, which has brought significant investment to the medical sector. A sharp drop in international demand is expected,” she said.

In addition, Shiyanova noted that the ban on embryo donation provided for in the bill “is one of the most restrictive and controversial provisions of the bill,” which, also contradicts the principles of evidence-based medicine (European Society of Human Reproduction and Embryology, ESHRE) and takes away the last chance for the most vulnerable category of patients, forcing them to seek this service abroad.

“For clinics, this means excluding an important service from the list, which limits the ability to provide a full range of ART and comprehensive patient care,” she said.

According to Shiyanova, the following aspects of reproductive medicine currently require regulatory regulation: the definition of infertility, the determination of who is eligible for ART, the need to ensure the anonymity of donations, the regulation of compensation, as well as the lack of a clear mechanism for creating a single national ART registry and standardized performance monitoring.

As reported, representatives of the Ukrainian Association of Reproductive Medicine (UARM) believe that government bill No. 13683 “On the Use of Assisted Reproductive Technologies” will limit Ukrainians’ access to such technologies.

Tags: Government bill on reproductive technologies may lead to Ukraine losing its status as “Europe’s reproductive hub” – experts

The draft law “On the Use of Assisted Reproductive Technologies” (No. 13638) could radically change the provision of medical services in reproductive technologies and lead to Ukraine losing its status as the “reproductive hub of Europe,” It requires significant revision with the involvement of the professional expert community, according to experts surveyed by Interfax-Ukraine.

“According to various estimates, up to 40-60% of patients in large reproductive medicine clinics are foreigners (especially from the EU, the UK, the US, Canada, Israel, and China). If the law does not provide for transparent mechanisms for foreign patients, such as official medical visas or agreements between countries, Ukraine may lose its status as the “reproductive hub of Europe,” said Dmytro Biletsky, head of the assisted reproductive technology department at the Adonis Medical Gynecological Center (MGK) Adonis Medical Gynecological Center (MGK).

According to him, Ukraine is currently among the top 10 global destinations for reproductive technologies, thanks in particular to “affordable prices: an IVF cycle in Ukraine costs three to five times less than in most EU countries or the US,” the high level of specialists and technologies, the certification of many clinics according to international standards, and the fact that “Ukrainian legislation allows virtually all ART methods — donor eggs, sperm, embryos, IVF programs for married couples and single women.”

“In Ukraine, anonymous donation and the creation of embryos for storage are permitted, which is not acceptable everywhere,” he said.

Predicting the impact of the bill if it is passed, Biletsky expects that in the short term (one to two years), Ukraine may lose some of its patients for reproductive technology (ART) programs, although overall demand will remain high because IVF, donation, and embryo banking procedures will remain permitted, and Ukrainian clinics have an internationally recognized reputation and competitive prices.

However, he predicts that in the medium term (three to five years), “if the rules for foreigners remain strict (especially regarding embryo transport, donation, and surrogacy), demand will decrease by 20-40%.”

At the same time, commenting on the impact of the bill’s proposed ban on embryo donation on the development of reproductive prospects in general, Biletsky noted that “the ban on embryo donation will result in some patients simply losing the opportunity to treat infertility, as well as an increase in the number of ‘unused’ embryos in clinics.”

“Currently, some couples voluntarily give their frozen embryos to others. If this is banned, embryos will have to be either stored (which is expensive) or destroyed. This raises the ethical question: ‘What to do with embryos that could give life?’” he said.

According to his estimates, donor embryo programs may account for up to 10-15% of all IVF procedures, so clinics specializing in “full cycles” (creation, donation, surrogacy) will lose a significant share of their clients.

“Many foreign patients came specifically for donor embryo programs — this was a unique Ukrainian advantage, because in many countries (for example, Germany and Italy) this is prohibited. The ban will mean the loss of one of the key areas of reproductive medicine. Ukraine is effectively losing one of the most humane mechanisms for helping infertile couples,“ he said.

For her part, Svitlana Shiyanova, head of assisted reproductive technologies at the Dobrobut medical network, also predicts that ”the adoption of this bill will lead to a sharp decline in international demand, as it contains two critical restrictive provisions: a ban on surrogacy services if one of the spouses is a citizen of a country where this method is prohibited, and a requirement that one of the spouses be a citizen of Ukraine (for surrogacy).”

“These provisions effectively close the international surrogacy market, which has brought significant investment to the medical sector. A sharp drop in international demand is expected,” she said.

In addition, Shiyanova noted that the ban on embryo donation provided for in the draft law “is one of the most restrictive and controversial provisions of the draft law,” which, also contradicts the principles of evidence-based medicine (European Society of Human Reproduction and Embryology, ESHRE) and takes away the last chance for the most vulnerable category of patients, forcing them to seek this service abroad.

“For clinics, this means excluding an important service from the list, which limits the ability to provide a full range of ART and comprehensive patient care,” she said.

According to Shiyanova, the following aspects of reproductive medicine currently require regulatory regulation: the definition of infertility, the determination of who is eligible for ART, the need to ensure the anonymity of donations, the regulation of compensation, as well as the lack of a clear mechanism for creating a single national ART registry and standardized performance monitoring.

As reported, representatives of the Ukrainian Association of Reproductive Medicine (UARM) believe that government bill No. 13683 “On the Use of Assisted Reproductive Technologies” will limit Ukrainians’ access to such technologies.

ADONIS, Biletsky, BILL, reproductive, Shiyanov, TECHNOLOGIES