Prime Minister Denys Shmygal asks Denmark to consider the possibility of supplying Ukraine with raw materials needed for farmers and oil products.

“I thanked for the decision to take part in the restoration of the city of Nikolaev together with other international partners. Also, in the coming days, as Prime Minister Matte Frederiksen promised, Ukraine will receive equipment and machinery that will help in the restoration of the liberated cities,” Shmyhal wrote on the Telegram channel following a meeting with Danish Foreign Minister Jeppe Kofodom.

According to him, the parties discussed the supply of military equipment, the tightening of sanctions against Russia and the rejection of Russian energy resources.

“I touched upon the issue of diversifying gas supply sources. I made a proposal to consider the possibility of supplying Ukraine with raw materials needed for farmers and oil products, since the enemy is purposefully trying to disrupt the sowing season and cause a shortage of fuel,” the prime minister wrote.

Among other things, Shmygal thanked Denmark for its strong political and financial support.

“We also count on Ukraine’s support in acquiring the status of a candidate for EU membership and on the approval decision of the European Commission to suspend import duties on all Ukrainian exports for a year,” he added.

The second tranche of the European Union’s macro-financial assistance to Ukraine in the amount of 600 million euros will be paid “very soon” in May.

This was reported to Interfax-Ukraine on Monday by a high-ranking official of the European Commission.

“The European Union has allocated 1.2 billion euros of macro-financial assistance, of which 600 million euros have already been paid, and the remaining 600 million will be paid very soon this month,” he informed.

The official also reminded that on May 5, a donors’ conference organized by Poland and Sweden will take place. “It will be a fundraiser for humanitarian aid,” he added.

Speaking generally about the reconstruction of Ukraine after the war, the representative of the European Commission stated the need to restore the country in accordance with “European standards, in accordance with the European Green Deal, the digitalization agenda, with the best principles of public administration, the rule of law – in every sense – in accordance with European standards.” “This is exactly how we think it can be done, that we can do it together. Of course, on our part, this will require very deep cooperation with Ukraine,” he added.

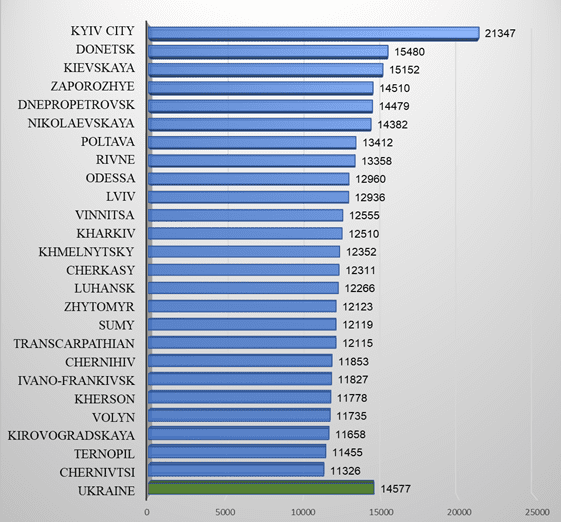

Average monthly wage by region in Jan 2022, UAH

SSC of Ukraine

Agroholding KSG Agro in 2021 increased its net profit by 16 times compared to 2020 – up to $20.27 million, EBITDA doubled – up to $12.28 million.

According to the holding’s report on the Warsaw Stock Exchange website on Monday, its revenue for the specified period increased by 44% to $30.75 million.

KSG Agro for the reporting period doubled its gross profit – up to $12.95 million, operating profit – one and a half times, up to $10.63 million.

“The past year, thanks to our efficient work and a number of circumstances, was successful for us. Thanks to the right selection of technologies and favorable weather conditions, our crop yields set a record for the last 10 years. In the pig segment, we received good intermediate results from our long-term project for the renewal of the pig population sows of Canadian genetics Genesus”, – commented on the results of the holding’s work, the head of its board of directors Sergey Kasyanov.

According to the report, the working capital of the agricultural producer by December 31, 2021 increased by 9.5 times compared to December 31, 2020 – from $1.1 million to $10.6 million.

Last year, the agricultural holding increased profits in the crop segment by 2.2 times compared to 2020, to $18.3 million, while in the livestock sector it increased by 9%, to $11.2 million.

According to the report, the agricultural holding collected 31.02 thousand tons of wheat in 2021 (+ 72% by 2020); 18.21 thousand tons of sunflower (+55%); 8.56 thousand tons of barley (+76%); 9.33 thousand tons of corn (an increase of 3.4 times) and 0.76 thousand tons of rapeseed (a decrease of 3.6 times).

The number of sows at KSG Agro last year increased by 3% – up to 5.56 thousand. At the same time, the total number of animals (pigs and piglets) for the specified period increased by 5.5% – up to 43.7 thousand heads.

“Currently, management assesses the risk that any fighting will reach the group’s pig farm as low. The group also temporarily moved its headquarters from the city of Dnipro to Chernivtsi, close to the western border of Ukraine and away from Russian aggression,” the group said. in a group message.

As of December 31, 2021, the agricultural holding’s assets increased by 13.5% compared to the same date in 2020, to $71.44 million, while its current debt obligations decreased by 20.4%, to $25.74 million, and long-term liabilities – by 11%, up to $22.36 million.

The vertically integrated holding KSG Agro is engaged in pig breeding, as well as the production, storage, processing and sale of grains and oilseeds. Its land bank is about 21 thousand hectares.

According to the agricultural holding itself, it is among the top 5 pork producers in Ukraine.

KSG Agro in 2020 reduced net profit by 3.2 times compared to 2019 – to $1.27 million, revenue – by 11%, to $21.34 million, while increasing EBITDA by 2.9 times – to $6, 02 million

The owner and chairman of the board of directors of KSG Agro is Sergey Kasyanov.

The Cabinet of Ministers of Ukraine has approved the powers of notaries in certifying real estate transactions during martial law, the press service of the Ministry of Justice reported.

According to the relevant resolution of the Cabinet of Ministers, notarial certification of contracts on real estate transactions is allowed only to those notaries who were included in the relevant list of persons who are allowed to carry out notarial acts in relation to valuable property during martial law.

In addition, such actions are prohibited for notaries whose workplace is located in territories where access to unified and state registers has been terminated, in particular, in the temporarily occupied territories of Ukraine.

It is also prohibited to sell real estate within one month from the date of state registration of ownership, as well as real estate transactions by proxy.

Certification of contracts for the sale of real estate, mortgages, trusts is allowed only at the location of the property. At the same time, in Kyiv and the Kyiv region, notarial actions with real estate are allowed only for local notaries, if the property or legal entity is located in this territory, or at the registered place of residence of an individual – one of the parties to the agreement.

Such conditions will be in effect during martial law for one month after, the Ministry of Justice notes.

The Embassy of the Republic of Korea in Ukraine will resume work in Kyiv on May 5, the Ministry of Foreign Affairs of the Republic of Korea has reported.

“Our embassy is preparing to resume its activities on May 5 and plans to carry out diplomatic affairs and protect foreign citizens in Kyiv in close cooperation with the government of Ukraine,” the Korean Foreign Ministry said in a statement on Sunday.

As noted, Ambassador Kim Hyung Tae and some employees who have been working in a temporary office in Chernivtsi have already returned to Kyiv. The remaining staff in temporary offices in Chernivtsi and Romania are considering a plan for a phased return to Kyiv, while monitoring the local situation going forward.