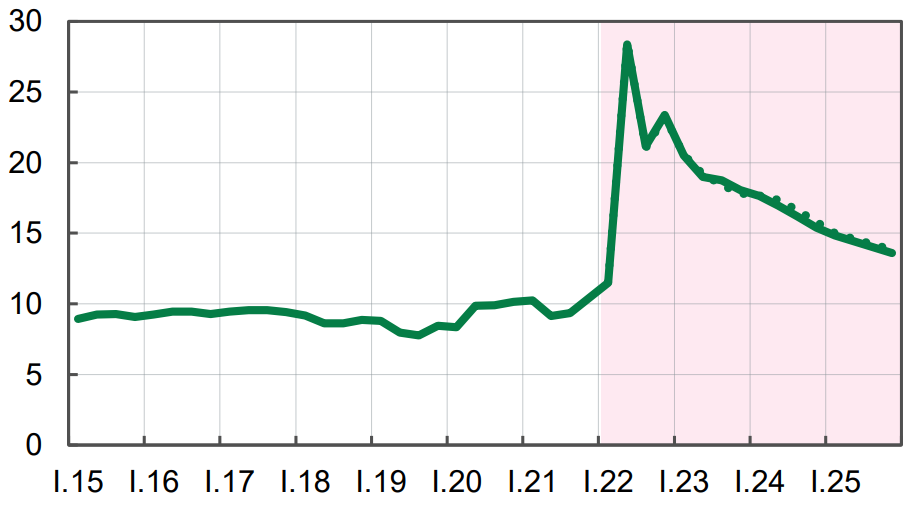

Forecast of unemployment rate in Ukraine according to methodology of international labor organization until 2025

Source: Open4Business.com.ua

The National Bank of Ukraine (NBU) fined Elit Finance FC LLC (Kyiv) UAH 76,500 for violating ethical conduct requirements, according to the regulator’s website.

The decision was made based on the results of non-field supervision of compliance with the requirements of Ukrainian legislation on the protection of the rights of consumers of financial services, during which facts of non-compliance by the company with the requirements established by law regarding interaction with consumers and other persons during the settlement of overdue debts (requirements regarding ethical conduct) were revealed.

The relevant decision was adopted by the Committee for Supervision and Regulation of Non-Bank Financial Services Markets on October 6, 2025.

Elit Finance FC LLC was registered in March 2016 with a charter capital of UAH 20 million.

According to the Prosecutor General’s Office, 168 raiding cases were recorded in Ukraine in the first eight months of 2025. This is 36% less than in the same period last year. 80% of cases involve document forgery. At the same time, 830 complaints of raiding were considered during the same period, according to the Office for Combating Raiding.

168 criminal proceedings for raiding were opened this year. This is 36% less than during the same period last year. While in 2024, an average of 33 cases were opened each month, this year there were only 21. Overall, the number of raiding cases has decreased 3.4 times in four years.

The vast majority of proceedings involve document forgery (Article 205-1 of the Criminal Code). This year, 134 such cases were opened, or 80% of the total number. Suspicions were handed down in less than half of the cases (62), and only 40% (53) were sent to court.

There were 23 proceedings registered for obstruction of economic activity (Article 206 of the Criminal Code), which is 42% less than last year. However, no charges were brought and no cases were brought to court.

Even fewer cases were opened for unlawful seizure of enterprise property (Article 206-2) — only 11, which is more than half the number last year. Charges were brought in only one case, and no cases were brought to court.

At the same time, the Office for Combating Raiding, where victims file their complaints, reviewed 830 appeals during the same period. However, this is also 40% less than last year.

Most complaints concerned real estate — 676 (81%), while another 154 cases were related to business. It is worth noting that there were 43% fewer complaints about illegal seizure of real estate this year. As for business, complaints decreased by 15%.

While in 2024 most complaints were filed by businesses, this year the situation has changed. In 2025, half of the complaints were filed by individuals (411). Companies filed 232 complaints (28%), local authorities filed 162 (20%). The rest of the complaints were filed by state authorities and registration entities.

The vast majority of complaints (818 out of 830) were considered collegially. Of these, 247 were upheld (30%), 243 were rejected (30%), and 328 were left without consideration (40%). Ten complaints regarding businesses and two regarding real estate were upheld by individual decisions this year.

https://opendatabot.ua/analytics/raiders-2025

The Kovalska Group is establishing its own architectural and engineering studio and moving to a full design cycle using its own resources, according to the company’s press service.

“Previously, our team supervised and coordinated the work of external architects and designers, but now we will be developing projects from start to finish — from the initial sketch to the interior design. It is important for us that the architectural solution for each project reflects the high standards and style of Kovalskaya,” said Olga Pylypenko, executive director of the group.

The new architectural and engineering structure of the Kovalskaya Group brings together architects, engineers, designers, and constructors. The new division will provide a full design cycle: from concept to working documentation. Kovalskaya’s architecture and engineering services are now also available to external clients.

As noted in the release, in order to further strengthen its internal expertise and integrate best international practices into its projects, Kovalskaya will continue to collaborate with leading architectural studios around the world — no longer just as a customer, but as an equal partner in joint project development. Current partnership projects include the revitalization of the historic building of the former Kyiv Distillery in collaboration with David Chipperfield Studio and the NUVO business park, which is being created together with the Dutch firm MVRDV.

Among Kovalskaya’s own projects is the design of the group’s new plant in Rozvadov. According to Serhiy Grabars, chief architect of the Kovalskaya Group, the team focuses on leading global examples of architecture and implements the principles of sustainable development, taking into account both modern technologies and local characteristics.

The Kovalskaya Industrial and Construction Group has been operating in the Ukrainian construction market since 1956. It unites more than 20 enterprises in the field of raw material extraction, production, and construction. Its products are represented by the brands “Beton vid Kovalskoi,” “Avenue,” and Siltek. Kovalskaya’s enterprises operate in the Kyiv, Zhytomyr, Lviv, and Chernihiv regions. The aerated concrete plant in the Kherson region has not been operating since the beginning of the occupation.

Ukrainian Foreign Minister Andriy Sybiga said that the Foreign Ministry will play a role in relation to potential partners in the controlled export of Ukrainian weapons.

“Support for our defense industry is an absolute priority for our diplomacy. It includes three priorities. The first is more investment. The second is support for the president’s initiative on the possibility of exporting surplus products from our defense industry,“ Sybiga said during his opening remarks at the third International Defense Industry Forum (DFNC3) on Monday.

According to Sybiga, the Foreign Ministry ”will play its role here with regard to potential partners.”

“Those countries that today take a passive position on supporting Ukraine, that provide covert or overt support for Russian aggression, will certainly not be included in the list of partners who will be able to cooperate with Ukraine and Ukrainian companies in this area,” the head of the ministry said.

The third priority of the Foreign Ministry in supporting the Ukrainian defense industry, Sibiga added, is “to create a real multiplier effect from our weapons.” In particular, this refers to the creation of jobs for Ukrainian citizens in Ukraine.

“This, by the way, is also our integration into the European Union. The latest Eurobarometer says that it is precisely because of our contribution to security that we are most eagerly awaited as a future member of the EU,” the minister added.

https://interfax.com.ua/news/diplomats/1110142.html

The National Bank of Ukraine (NBU) reduced its sales of dollars on the interbank market by $227.2 million, or 40.6%, to $332.6 million last week, the lowest level since mid-April, according to statistics on the regulator’s website.

According to the NBU, it even managed to purchase $1.5 million, which is also the best result since mid-April this year.

According to the National Bank, during the first four days of last week, the average daily negative balance of currency purchases and sales by legal entities fell to $11.8 million from $49.6 million during the same period a week earlier, totaling only $47.3 million. Moreover, on September 29, for the first time in a long time, a positive balance of $49.8 million was recorded.

At the same time, on the cash market, on the contrary, there was a significant increase in currency purchases by the population, as a result of which the negative balance grew to $132.28 million from $34.6 million on Saturday-Thursday. This result is also due to the fact that, after a break of almost a month, purchases of non-cash currency exceeded sales on Tuesday-Thursday.

The official hryvnia-to-dollar exchange rate, which started last week at 41.3811 UAH/$1, strengthened to 41.1420 UAH/$1 in two days, but fell to 41.2286 UAH/$1 by the end of the week.

On the cash market, the dollar exchange rate over the past week followed the official rate, so overall it remained virtually unchanged for the week: buying was around 41.22 UAH/$1, and selling was around 41.30 UAH/$1.

“In the short term (1-2 weeks): the base corridor is 41.20-41.70 UAH/$1 with possible fluctuations and a tendency towards the upper limit. Medium term (2-3 months): 41.30-42.00 UAH/$1,” according to the forecast for the cash market exchange rate provided by experts from KYT Group, a major player in the cash currency exchange market.

They noted that spreads on the cash market remain stable (0.40-0.50 UAH/$), which reflects the controllability of the market and the absence of sharp imbalances that could radically change the market situation.

“The NBU’s reserves remain high, which guarantees the regulator has the resources to smooth out fluctuations. Demand for the dollar from the population is restrained, and import payments, like the behavior of the population, do not create a critical burden,” KYT Group believes.

As for the international context, experts believe that after the Fed’s actual rate cut in September, markets have already priced in a “cheaper” dollar, and now the focus is on the Fed and ECB’s further actions until the end of the year, which will be triggered by macro data (inflation, labor market, etc.).

“Long term (6+ months): the baseline scenario of a gradual devaluation of the hryvnia remains. The benchmark is 43.00-44.50 UAH/USD until mid-2026,” KYT Group said in a comment.

https://interfax.com.ua/news/projects/1108372.html