NJSC Naftogaz Ukrainy, through the issuer of its Eurobonds, Kondor Finance plc, has approached the holders of these securities in the amount of almost $1.5 billion with a proposal to defer coupon payments on them for two years, including postponing the repayment of Eurobonds for the same period – 2022 for $335 million.

“In light of the protracted circumstances affecting Ukraine as a result of the ongoing full-scale Russian military intervention and its impact on Ukraine’s energy security, the Issuer, at the request of the Borrower, has initiated this Consent Request in order to obtain the approval of the Noteholders to facilitate the Borrower’s retention of available cash to support strategic priorities. Ukraine,” the stock exchange said.

As reported, there are currently three issues of Naftogaz Eurobonds circulating on the market, all of which were placed in 2019: in July – three-year for $335 million at 7.375% and five-year for EUR600 million at 7.125% (one fifth of the euro bonds were bought by the EBRD ), and in November – 7-year for $500 million with a yield of 7.625%. The maturity date for the $335 million issue is July 18, 2022.

Naftogaz proposes to pay all coupons on 2022 and 2024 Eurobonds on July 19, 2024 and redeem 2022 Eurobonds on the same day. And NAC would like to pay coupons for Eurobonds-2026 on November 8, 2024.

The offer also includes a waiver of any default that occurs as a result of such a deferred payment and compliance with certain covenants for a two-year period (from July 19, 2022 to July 19, 2024 for Eurobonds 2022 and 2024 and until November 8, 2024 for Eurobonds-2026)

Naftogaz, in the argumentation of its request, indicates that the government, by Decree No. 691 of June 17 of this year, obliged the group to ensure the availability of natural gas in storage facilities as of October 1 in an amount sufficient for the stable passage of the autumn-winter period, including to meet the needs household consumers and heat supply organizations.

“Thus, the borrower needs to purchase and import natural gas in the amount of up to 5.6 billion cubic meters of natural gas for a total amount of more than UAH 230 billion (about $7.8 billion). Naftogaz is also obliged to provide natural gas to the most vulnerable consumers ( primarily the population of Ukraine) at fixed prices, which in many cases are many times lower than market prices for natural gas in Ukraine and Europe,” the stock exchange said.

The NAC adds that the Russian invasion of Ukraine has led to a significant economic and business downturn in the country, the inability of many Naftogaz customers to pay for the consumed gas has increased debt on the company’s balance sheet and negatively affected its liquidity, and any continuation of aggression will put additional pressure on NAC balance.

“It is possible that the borrower may not be able to comply with the current provisions of the relevant loan agreements (…) while the invasion continues. Therefore, the borrower considers it necessary and prudent to remove restrictions that may jeopardize its priorities and objectives, in addition to removing the administrative burden on the borrower in these exceptional circumstances,” the company argues for the need to lift covenants.

According to the report, Naftogaz does not plan to pay any premium to holders of its bonds for deferring payments.

In accordance with the document, the deadline for voting on proposals expires in the afternoon on July 21, and the meeting and announcement of the results are scheduled for July 26.

Naftogaz attracted Citigroup Global Markets Limited as an agent for this proposal.

This announcement led to a drop in quotations of NAK Eurobonds maturing in 2024 on the Frankfurt Stock Exchange, according to information on its website, from 29% to 10% of face value, and Eurobonds-2026 – from 24.44% to 20% of face value.

For the first time in 20 years, the euro exchange rate fell to parity against the US dollar on fears that the crisis in the European economy may be more significant than in the United States.

The euro/dollar is trading at $1.0017 at 8:55 am KST, compared to $1.0043 at the market close on Tuesday, with the euro shedding about 0.3%. During overnight trading, the euro traded against the dollar at a parity rate.

The ICE-calculated index, which shows the dynamics of the dollar against six currencies (the euro, the Swiss franc, the yen, the Canadian dollar, the pound sterling and the Swedish krona), rises by 0.4% to 108.43 points. Over the past five sessions, the index has gained 1.8%. The broader WSJ Dollar Index added 0.2%.

The dollar has been gaining in price lately as traders consider the US currency a defensive asset that will help save capital in the event of a recession in the global economy, writes Trading Economics.

In addition, the dollar is supported by expectations that the Federal Reserve System (Fed) will again raise the key interest rate by 75 basis points in July in order to curb inflation, which has been a record for 40 years.

June US consumer price data will be released on Wednesday. Experts expect inflation in the country to accelerate to 8.8% from 8.6% a month earlier.

The value of the pound fell during trading on Tuesday by 0.3% to $1.1861 against $1.1892 at the close of the previous session.

The exchange rate of the American currency paired with the yen is stable and is around 137.44 yen.

In the first 10 days after the abolition of benefits, Ukrainians cleared 4,600 cars through customs and paid UAH 464 million to the budget, the State Customs Service reported.

“For 10 days of customs clearance of vehicles, almost UAH 464 million was paid to the state budget. From July 1 to July 10, the State Customs Service issued 4,662 units of vehicles purchased abroad with customs payments,” the agency said on the Telegram channel on Tuesday.

As the customs reminded, benefits for the import of goods, including cars, have been canceled since July 1. Thus, at present, imported vehicles are again subject to import duties, and individual entrepreneurs of groups 1-3, who are not VAT payers, must again import goods with VAT.

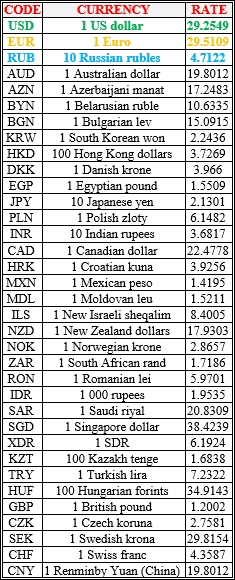

National bank of Ukraine’s official rates as of 12/07/22

Source: National Bank of Ukraine

JSC “Lvov confectionery factory “Svitoch” (Lviv), controlled by Nestle and one of the largest manufacturers of confectionery products in Ukraine, will change its legal form of business from a joint-stock company (JSC) to a limited liability company (LLC).

The corresponding decision at the meeting on July 8 was made by the sole beneficiary owner of the enterprise – the company “Societte De Produit Nestle S.A.” (Societe Des Produits Nestle S.A.), according to the NCKBFR website on Tuesday.

“First of all, we want to assure you of the continuity and continuity of our business activities. We have no plans to stop such activities. On the contrary, the simplification of the company’s management system will lead to an improvement in the efficiency of such management,” the company said in a statement.

“Svitoch” clarified that all obligations assumed by it in accordance with the law and agreements with partners remain in force and will be fulfilled in full and within a certain period – either JSC “Lviv Confectionery Factory “Svitoch”, or its successor LLC “Lvivskaya confectionery factory “Svitoch”

Nestlé owns a 96.96% stake in the Svitoch confectionery. The Nestle group of companies in Ukraine also unites Nestle Ukraine LLC, Volynholding PrJSC (Torchin TM), Technocom LLC (Mivina TM).

Svitoch received UAH 70.44 million in net profit in 2020, and its revenue amounted to UAH 2.56 billion.