NASA has confirmed the readiness of the Blue Ghost moon lander of the American company – the developer of rocket and space technology Firefly Aerospace Inc., owned by Ukrainian businessman Max Polyakov, in accordance with the schedule of the Artemis lunar mission – by September 2023. Polyakov’s press service said Firefly Aerospace has reached a milestone in the project by successfully completing the Critical Design Review (CDR) phase of the Blue Ghost moon lander. Completing the CDR paves the way for building the Blue Ghost lander.

According to the Artemis lunar mission schedule, the moon lander is to land in the Mare Crisium lunar basin in September 2023. The module will deliver ten NASA payloads to the lunar surface, as well as several commercial cargoes.

This mission is a harbinger of what we see in the future: the growing number of repetitive lunar maintenance and payload delivery missions that will lay the foundation of the lunar economy. We are honored to demonstrate our ability to provide such services to NASA and our commercial customers, Firefly CEO Thomas Markusic said.

It is noted that the Blue Ghost will monitor the safe delivery of the payload during transit to the Moon and in its orbit, as well as on the surface of the Moon. The vehicles delivered to the surface will investigate the properties of regolith, the geophysical characteristics of the surface, and the interaction of the solar wind and the Earth’s magnetic field. In addition, several demonstrations of key technologies related to navigation and sampling will be conducted during the mission.

The Blue Ghost mission opens up new opportunities for Firefly Aerospace to cooperate with NASA and other partners. We are proud of the high appraisal of our partners from NASA and are glad that we can join such an ambitious international program as Artemis, Max Polyakov said.

In his opinion, the Moon is extremely important for the more distant missions of mankind – it should become a kind of base, a fort, where the necessary resources will be produced in the future.

In such exploration of the Moon we see one of the strategic goals of the company, he added.

The Kazakh fintech company Kaspi.kz has signed a sale and purchase agreement for 100% of BTA Bank Ukraine shares, the transaction is scheduled to be completed in the first half of 2022.

“We have entered into a sale and purchase agreement for 100% of BTA Bank Ukraine. It is purchased exclusively to obtain a banking license in Ukraine. This will allow us to launch fintech products, open mobile wallets, accounts, etc.,” the official website Kaspi.kz says.

As noted in the document, BTA Bank Ukraine conducts limited operational activities, it does not have branches and a loan portfolio. According to the holding, the deal will not have a significant financial impact on Kaspi.kz.

“With the banking license and payment licenses of Portmone Group, we will take a strong position and will be able to repeat the Super App strategy in Ukraine,” the report says.

The cost of the deal was not disclosed.

As reported, in October Kaspi.kz completed the acquisition of Portmone Group, an online payment platform in Ukraine, which was controlled by Europe Virgin Fund (EVF).

Qatar Airways, the national airline of Qatar, will launch flights from Doha to Odessa on December 9, which has become the second in Ukraine after Boryspil, where Qatari airlines will start operating.

According to the Odessa international airport’s Facebook page, the flights will be operated three times a week, namely on Tuesdays, Thursdays and Saturdays.

Departure from Doha to Odessa is scheduled for 08.30, arrival will be at 12.45. Departure from Odessa will be at 16.45, arrival in Doha at 22.50.

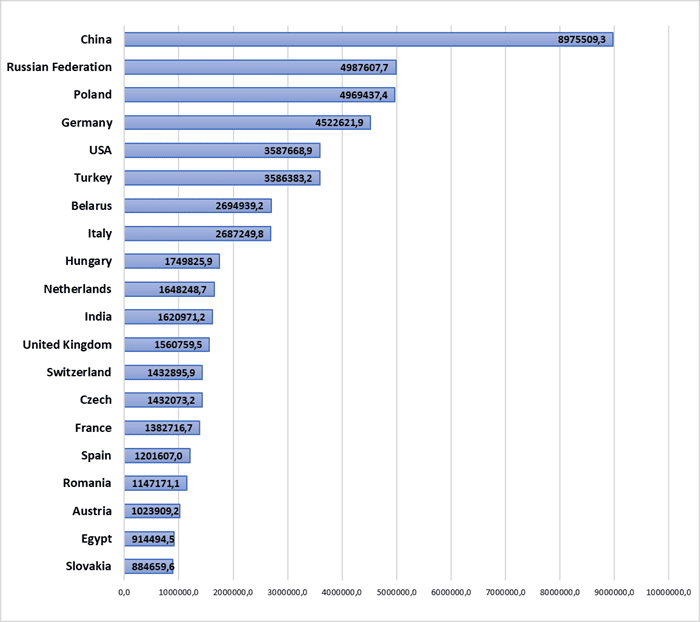

TOP 20 COUNTRIES OF UKRAINE’S FOREIGN TRADE PARTNERS JAN-JUNE 2021 (THOUSAND USD)

Ukraine is not considering the supply of Johnson & Johnson’s anti-COVID vaccine, negotiations with the company are not underway, Deputy Minister of Health, Chief Sanitary Doctor Ihor Kuzin said.

“Johnson & Johnson’s vaccine supply is not currently being considered and supply negotiations are currently not held,” he told reporters on Monday.

Kuzin said that the vaccine manufacturer “is not proactively communicating.”

“The communication mechanisms that we have used have so far been ineffective,” he said.

As reported, in July 2021, Ukraine registered a vector vaccine against COVID-19 Janssen manufactured by Johnson & Johnson. One dose of Janssen vaccine is sufficient for a complete immunization. It requires a storage temperature of +2 to +8 degrees Celsius.

Earlier, 500 doses of Janssen vaccine were delivered to Ukraine in compliance with the procedure for importing unregistered medicines for vaccination of employees of a private company, which paid its cost, organized delivery and ensured compliance with the temperature regime. Employees of this company work in Alaska in the fishing industry and had to be vaccinated with a U.S.-certified vaccine in order to be allowed into this country.

Almost 88.2% of Ukrainian teachers have already received one dose of the vaccine against the COVID-19 coronavirus infection, the Ministry of Education and Science of Ukraine said.

“As of today, October 25, 2021, at least one dose of COVID-19 vaccination was received by 88.2% of employees of general secondary education institutions, almost 400,000 teachers across the country were vaccinated with two doses,” the Ministry of Education said.

It is reported, that the highest level of vaccination is demonstrated by: Mykolaiv region – 98%, Kyiv region – 95.5%, Kharkiv region – 94.6%, Donetsk region – 92.7%, Khmelnytsky region – 91.6% (full and incomplete vaccination cycle). At the same time, the vaccination threshold of 80% of school workers has not been reached only in Rivne region.

The ministry reports that 8,000 schools are on vacation since October 25. In the regions caught in “red” zones of epidemic danger, there are schools on vacation or distance learning that have not reached the vaccination rate of 100%. In Odesa region there are 149 schools, in Donetsk region – 93, in Zaporizhia region – 47.