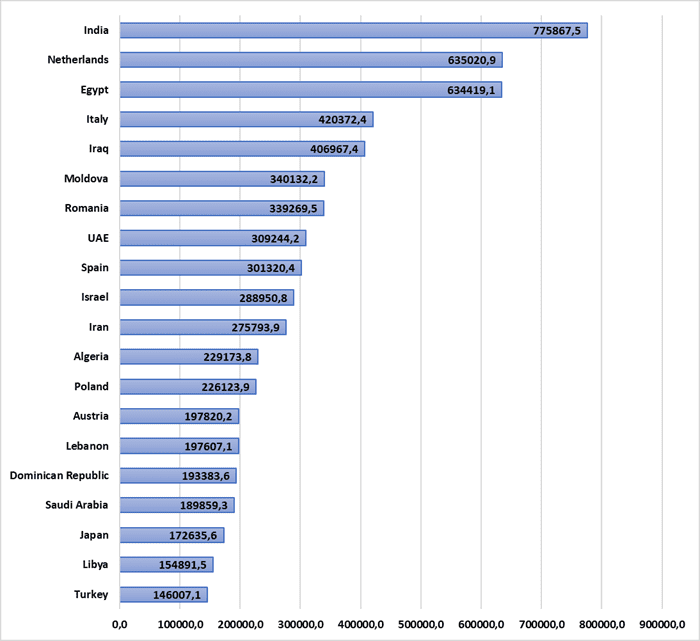

TOP 20 COUNTRIES UKRAINE HAS POSTED THE HIGHEST SURPLUS OF TRADE IN JAN-JUNE 2021 (THSD USD)

The Ukrcement Association has asked Ukrzaliznytsia to take into account the specifics of the cement industry when distributing wagons at auctions, as well as to reduce the use of specialized cement wagons for the transportation of other goods in high season, Chairman of the association, Pavlo Kachur said in an exclusive interview with Interfax-Ukraine.

According to him, among the urgent problems with the distribution of wagons, in particular, the lack of cement cars for transporting cement due to their use for the transportation of crushed stone and other bulk materials, and inappropriate offers at auctions in terms of the number of wagons.

“Cement producers lose to grain producers, power companies, crushed stone producers in routing. They are profitable clients for Ukrzaliznytsia. They load 40 wagons in one place, bring them to the port, a power plant or an open area, unload and this is the end of the work. And they tell us: bargain, there are wagons. But cement consumers have their own specifics, which we ask to also take into account. We have only a few consumers for 20-30 wagons. Basically three or five wagons are ordered, but such offers at auctions are not enough,” Kachur said.

In addition, until September 2021, Ukrzaliznytsia put up 170 cement carriages for sale per day exclusively for the shipment of cement, but in September-October this restriction was canceled and 80 cars were put up for the transport of bulk cargo.

“On October 21, 2021, Ukrzaliznytsia also canceled this division of cement cars by type of cargo, which caused a speculative jump in the railway tariff due to increased demand from shippers of bulk materials, while leaving cement producers without wagons for transporting cement. After all, cement, in contrast to other bulk materials can only be transported by cement wagons,” the chairman of Ukrcement said.

The sale of agricultural products and residues of its production for the operation of biogas plants can become a guarantor of the state’s energy security, the agricultural sector can significantly strengthen NJSC Naftogaz Ukrainy from the point of view of energy independence. As reported on the website of the Ministry of Agrarian Policy and Food on Tuesday with reference to Minister Roman Leshchenko, the adoption at the final reading bill No. 5464 on amendments to the law of Ukraine on alternative fuels regarding the development of biomethane production by the Verkhovna Rada last week gives Ukraine every chance to become a center for the production and supply of biomethane, as well as a source of energy security for Europe.

“In the conditions of very expensive energy resources – gas and electricity, not only food security, but also energy security is impossible without the agricultural sector,” Leshchenko said.

He said that the development of the biomethane market will allow Ukrainian farmers to obtain an alternative source of energy from waste and residues of their own production, and as a result, use biomethane instead of natural gas for the production of heat and electricity, as well as fuel for transport and raw materials for the chemical industry.

The majority of cement producers in Ukraine are forced to work with minimum margins due to the rise in coal prices by more than two times, the Ukrcement association has reported.

“The price swing for coal this year did not pass us by. The supply contracts were signed last year at an average price of $60 per tonne, and in August, suppliers agreed to ship coal at a price of at least $175 per tonne. This creates significant pressure on the pricing policy. It is impossible to make cheap goods out of expensive components,” Chairman of the Ukrcement association Pavlo Kachur said in an interview with Interfax-Ukraine.

According to him, the cost of energy is 52-55% of the cost of clinker required for cement production. At the same time, all Ukrainian cement plants have previously been modernized and switched to coal due to the high price of gas.

The situation with the rise in prices for cement in Ukraine due to the rise in prices for coal is not unique and is observed in the markets of other countries, Kachur said.

“For example, Turkish cement producers sharply raised cement prices in July due to the rise in the cost of coal. We proceeded from the fact that we must take into account the needs of consumers. Therefore, some companies significantly minimized margins in order to go through this difficult period with minimal costs for cement plants and the construction market as a whole,” he said.

Employment of people with disabilities in Ukraine can be based on two models, advisor and presidential envoy on disability issues Tetiana Lomakina said in an exclusive interview with Interfax-Ukraine.

According to her, currently 2 million 2,700 people with disabilities live in Ukraine, of which only 26% are employed.

She also noted that if all employers actually fulfill the 4% quota for hiring people with disabilities provided by law, they will all be employed, but theory and practice are different.

“We talked with companies, with entrepreneurs and found two models. The first is social entrepreneurs – those who, when creating a business, put and continue putting the ideals of society higher than earnings at its foundation. You probably know such examples. For example, Kyiv’s bakery Good Bread from Good People or restaurant in Kharkiv Snow on the Head, where people with mental disabilities work. That is, people initially wanted to do good and after that they formalized it into social entrepreneurship,” Lomakina said.

The second model, as the adviser- presidential envoy on issues of disability said, is the use of international business practices by Ukrainian campaigns.

“The most important thing in such campaigns: the principles of policy, corporate standards, daily routine, the rules are the same for all employees, regardless of whether they have physical or mental disabilities. And if these rules are not respected, the same approaches are applied to all … Such a policy of equality stipulates that a person with a disability may have more needs and the company is ready to meet them, but there are rules, indicators are indicators, the result is a result. And it is in such a situation that all these fears that Ukrainian entrepreneurs talk about (about the difficulties of changing the approach to a worker with a disability, if he does something wrong or he has insufficient qualifications), are simply leveled out by the correct setting of the process of organizing work,” she said.

In addition, according to Lomakina, international campaigns pay great attention to staff training and exploring the capabilities of their employees.

“Their corporate training programs are aimed at closing weaknesses and developing strengths. I am sure that all this is possible in Ukrainian conditions, if we put a person and his qualifications in the center of attention,” she added.

According to her, practice shows that it is this approach that makes it possible to fulfill not even a 4%, but a 6% quota for the employment of people with disabilities.