The supervisory board of the Ukrainian Startup Fund (USF), based on the results of 28 Pitch Day, has identified 10 more startups that will receive grants totaling $250,000, the fund’s press service said last week.

In total, teams of 13 projects participated in the pitching. Following the meeting of the Fund’s supervisory board, it was decided to finance seven of them at the pre-seed stage (they will receive a grant of $25,000): Agrotop UA (Kyiv) – a comprehensive expert and analytical information system for agribusiness management; Clasee (Kyiv) – a knowledge sharing platform for personalized learning; MySat UA (Kyiv) – a STEM building set and model of a real satellite, which can be built without special knowledge; Sugarrr (Kyiv) – a mobile application for analyzing the body of a person suffering from diabetes; LuLL world (Kyiv) – mobile, orthopedic and resonance therapeutic hammocks; Deputy (Kyiv) is a digital platform for automating the work of deputies, the tool for collecting, analyzing and understanding the problems of residents; Zeely (Kyiv) – a platform for free website creation and business promotion directly from your smartphone using artificial intelligence; Smart ION (Kyiv) – an ecosystem of smart modules for light control; SolidERP (Kharkiv) – a ERP system for modern service companies; Insolar-T (Kharkiv) – a SaaS platform for improving energy efficiency, the remote-EEaaS-based AI product.

The press service said that the projects are evaluated according to a number of criteria, namely: team, market, appropriateness of financing, idea and development strategy.

The Ukrainian Startup Fund is a government-financed fund created at the initiative of the Cabinet of Ministers. Its purpose is to provide financing to technology companies in the early stages of development (pre-seed and seed).

Transit of natural gas through the gas transmission system (GTS) of Ukraine in January-July 2021 amounted to 25.616 billion cubic meters, which is 14.1% less than in the same period in 2020 (29.82 billion cubic meters), according to the data of Gas Transmission System Operator of Ukraine (GTSOU).

In particular, in January, transit amounted to 3.863 billion cubic meters (124.6 million cubic meters per day), in February – 2.907 billion cubic meters (103.8 million cubic meters per day), in March – 3.694 billion cubic meters (119.2 million cubic meters per day), in April – 3.718 billion cubic meters (123.9 million cubic meters per day), in May – 3.86 billion cubic meters (124.5 million cubic meters per day), in June – 3.723 billion cubic meters (124.1 million cubic meters per day), in July – 3.851 billion cubic meters (124.2 million cubic meters per day).

According to the press service of the company, in particular, 23.3 billion cubic meters of gas were transported by transit in the western directions (Slovakia – 15.8 billion cubic meters, Hungary – 5.3 billion cubic meters, Poland – 2.2 billion cubic meters), in the south – 2.3 billion cubic meters (Moldova – 1.9 billion cubic meters, Romania – 400 million cubic meters).

GTSOU notes that in July Gazprom used all previously booked capacities, but showed no interest in additional transit capacities, despite the record growth in prices in European gas markets, as well as low volumes in European storage facilities and the planned stop of Yamal-Europe routes and Nord Stream 1.

According to GTSOU Director General Serhiy Makogon, Gazprom is emptying its UGS facilities in Europe in order to compensate Europeans for the lost gas volumes, and at the same time not to increase additional transit through Ukraine.

German Chancellor Angela Merkel will visit Ukraine on August 22, spokesperson of the Ukrainian President Serhiy Nykyforov has said.

“The Federal Chancellor of Germany, Mrs. Angela Merkel, intends to visit Ukraine on August 22. The topics of the talks: security, bilateral relations and other topical issues,” Nykyforov said on Facebook.

Ukrainian referee Pavlo Vasylynchuk was named the best referee of the boxing tournament at the Olympic Games in Tokyo 2020, according to the Boxing Federation of Ukraine.

“Referee of the international category AIBA (3 stars) Pavlo Vasylynchuk from Ukraine was recognized as the best referee of the 2020 Tokyo Olympic Games according to the Olympic Boxing Task Force,” the federation said on its website, with reference to the Olympic Organising Committee.

According to the information, Vasylynchuk was the only representative of Ukraine out of 36 referees in the international referee corps of Tokyo 2020.

“In total, our compatriot had ten fights as a referee in the ring and 32 fights as a member of the refereeing brigade,” the Boxing Federation of Ukraine said.

3-4 September, Kyiv, UNIT.City, Dorogozhytska Str., 3

The largest innovation park in Ukraine and Eastern Europe, UNIT.City will host a large-scale international event U Tomorrow Summit on the 3rd and 4th of September. The annual innovation summit will bring together startups, entrepreneurs, top executives of leading companies, creators, and venture investors to unleash the intellectual capacity of the Eastern European region.

Hundreds of genuine successful cases, unique startups, business trends, and insights for an active business community that seeks to implement modern solutions to scale their business will be highlighted during the U Tomorrow Summit (UTS). Due to this, the summit participants will be able to share experiences and discuss the main challenges and prospects for implementing innovative solutions in contemporary business models with people holding the same views.

The organizers of UTS are the UNIT.City team and the Kyiv International Economic Forum, which have extensive experience in working with foreign partners and attracting investment to Ukraine. The first innovation park of Ukraine seeks to scale its experience and become the entry for investment in the Ukrainian economy through the platform of the annual technology summit UTS. Given that Eastern Europe is a heartland of promising companies and startups that the world needs to know about.

“The world is constantly being under the pressure because of new challenges. Innovation and technology can help tackle this. We are sure that talented people and entrepreneurs, startups, and technologies from Eastern Europe can produce effective solutions. The U Tomorrow Summit brings together more than 1,000 participants from Ukraine, Poland, Germany, France, the United States of America, Georgia, Bulgaria, Lithuania, Latvia, Estonia, Kazakhstan, and other countries at UNIT.City. We will seize, identify, study and evaluate these solutions. And we will build a better future together! ”- states Dominique Piotet, CEO of UNIT.City, the World Class manager.

Participants include the best experts from global companies, the country’s leaders in transforming Ukraine, private investors and international funds, startups, and developers. This is an opportunity for the press to learn about the latest technological developments in Ukraine, meet and communicate with young and talented startups, as well as foremost experts on the global technological map.

UTS will be beneficial for entrepreneurs and top managers, providing an opportunity to find new business partners, clients and get valuable advice for business in the post-pandemic period. Startups and young entrepreneurs with ideas will be able to meet potential investors here. The Summit will be noteworthy for representatives of creative industries due to the ability to discuss trends of 2022. Moreover, it is a crucial opportunity for media representatives to find the cover hero for the next editorial material.

More than 1 000 participants will have an opportunity to visit 20+ discussion panels and absorb knowledge from 100+ top speakers, including:

Oleg Gorokhovsky, co-founder of Fintech Band and the monobank project

Vasyl Khmelnytsky, founder of the UFuture holding company

Dominic Piote, CEO, UNIT.City

Yaroslav Azhnyuk, co-founder and CEO of Petcube

Yanika Merilo, digital and IT innovator, venture investor

Rick Rasmussen, Research Fellow, University of California, Berkeley

Ilya Laurs, a leading ideologue, lecturer, founder of the venture fund Nextury Ventures

To summarize, the U Tomorrow Summit is an opportunity for high-quality and mutually beneficial networking, connecting like-minded people around a common idea – to find solutions for modern challenges in an innovative, efficient, and socially responsible way.

UNIT.City is the first innovation park in Ukraine. Place where ecosystem and infrastructure for business development in technology and creative industries are created. UNIT.City unites more than 200 companies and organizes more than 400 events a year.

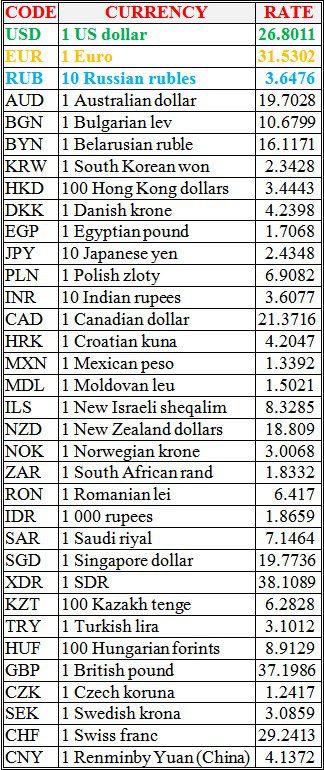

National bank of Ukraine’s official rates as of 10/08/21

Source: National Bank of Ukraine