Corum Group (DTEK) has signed the first contract with Turkey’s leading coal mining company Imbat Madencilik for a pilot supply of KD90T 17.5/28 support sections, Corum said in a press release on Friday.

According to the statement, entering new markets is one of the key directions of the company, approved as part of the adopted development strategy until 2030, among which the goals are to arrange the supply of mining equipment to the markets of Turkey and India.

“Due to the mining and geological features, coal mining in Turkey is associated with other dangerous and complex challenges compared to Ukraine. Therefore, in the foreground are occupational safety and modern technological solutions, which is the focus of Corum Group equipment,” the press service said, citing Director of Corum Trading Oleh Nesterenko.

The supports are optimized for the client’s conditions, they will be manufactured by Corum Druzhkivka Machine Plant (Donetsk region), and the shipment is scheduled for this summer.

“Corum experts paid a lot of attention to the issues that arise with our current fleet of powered roof supports from Poland and China, and suggested solutions to the problems. Therefore, we decided to try and test Corum products,” General Manager of Imbat Madencilik Yavuz Burbut said.

The cost of the deal was not disclosed.

Corum Group is a leading manufacturer of mining equipment in Ukraine, unites machine-building assets of DTEK Energy.

Two warships belonging to the countries of the North Atlantic Alliance, on Friday, June 18, entered Odessa seaport.

According to Odessa-based Dumskaya online publication with reference to its own correspondent, British destroyer HMS Defender D36 and Dutch HNMLS Eversten F805 entered the port. The ships were escorted by the port tugboats Bulat and Patriot.

“This is not the first time that British Type 45 destroyers have been to Odessa – a few years ago HMS Duncan [2017 and 2019] and HMS Dragon [2020] visited us, but the Defender is in the Black Sea for the first time. The Defender joined the Royal Navy in March 2013. The total displacement is 8,500 tonnes, length is 152 meters, width is 21, draught is over 7 meters, and speed is over 30 knots,” the journalists said.

They add that the Defender is equipped with such naval gun systems as a 114-mm Mark 8 Mod, a pair of 20-mm Mark 15 Phalanx and two 30-mm Oerlikon.

“Missile armament is 2×4 launchers for Harpoon anti-ship missiles and 48 launchers for Aster-15 or Aster-30 missiles. There are two Lynx helicopters or one Merlin in the hangar,” the message said.

It notes that the Eversten entered the Black Sea region in 2019, but visited Trabzon, Poti and Constanta. The ship joined the Netherlands Navy in June 2005. Its length is 144 meters, width is 19, and draught is 5 meters. Total displacement is over 6,000 tonnes, its crew consists of over 200 people, and speed is over 28 knots.

The artillery armament of the Dutch vessel consists of one 127-mm main-caliber gun, a seven-barreled 30-mm gun Goalkeeper, a pair of Oerlikon, and Browning machine guns.

“Missile armament consists of eight Harpoon anti-ship missiles and 40 vertical launch launchers MK41 for the Standard SM2 missile defense system SM2 Block IIIA [32 missiles ammunition], Sea Sparrow RIM-7R [four cells, 32 missiles ammunition]. Torpedo armament consists of two twin-tube 324-mm torpedo tubes MK32 [for torpedoes MK46]. There is an NH-90 helicopter in the hangar,” the journalists said.

It is noted that the ships are part of the escort of the newest British aircraft carrier Queen Elizabeth, which recently launched a round-the-world voyage, and shortly before entering Odesa, they both conducted joint maneuvers with American destroyer USS Laboon DDG58.

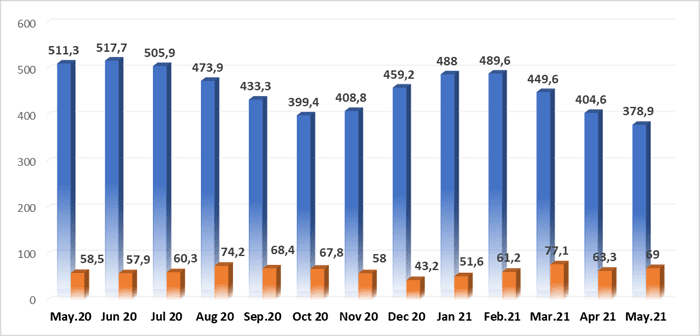

number of unemployed in ukraine and job opportunities, Feb 20 – may 21

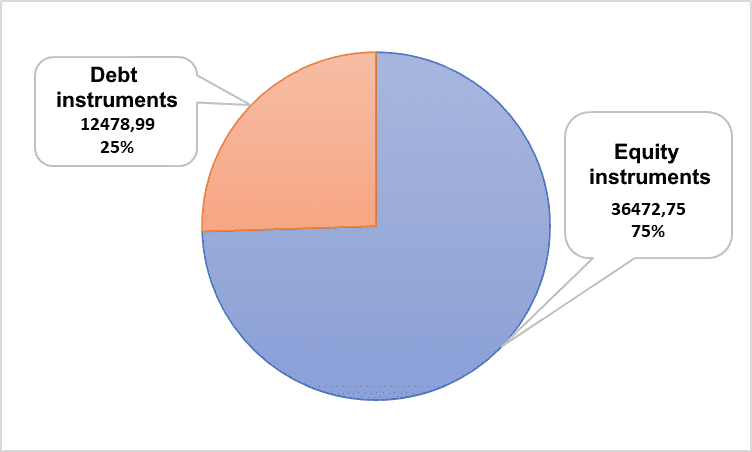

FOREIGN DIRECT INVESTMENT IN THE ECONOMY OF UKRAINE AS OF 09/30/2020 (BALANCE, $ MILLION)

Prime Minister of Ukraine Denys Shmyhal has met with Minister of Trade and Integration of the Republic of Kazakhstan Bakhyt Sultanov following the results of the 14th meeting of the joint Interstate Ukrainian-Kazakh Commission on Economic Cooperation. “Sultanov noted that Ukraine is one of the leaders in the field of agro-industrial complex and IT, therefore Kazakhstan is interested in developing cooperation in these areas,” the press service of the government said.

Shmyhal stressed that Ukraine is interested in developing cooperation with Kazakhstan and considers it an important partner in Central Asia.

“Our countries have a good potential to increase trade. I am convinced that close cooperation between our governments will contribute to further growth in the economic performance of the two countries,” he said.

Ukrainian Foreign Minister Dmytro Kuleba, at a meeting with his Iraqi counterpart Fuad Hussein, assured Baghdad that Kyiv will remain a reliable guarantor of Iraqi food security.

According to the MFA press service, during the meeting, which took place on the sidelines of the Antalya Diplomatic Forum, the ministers discussed the development of trade, in particular the increase in the volume of Ukrainian agricultural exports to Iraq.

On Kuleba’s initiative, a delegation of Ukrainian entrepreneurs will visit Iraq to look for new trade opportunities between the countries. Kuleba said that Ukraine will remain a reliable guarantor of food security for Iraq, an important trading partner in the Middle East region.

The head of Ukrainian diplomacy expressed support for Iraq’s efforts in the fight against terrorism. The sides paid special attention to the issue of protecting the rights of Ukrainian citizens on the territory of Iraq.

Kuleba also expressed his readiness to work together to increase the number of Iraqi students in Ukrainian educational institutions.