Pharmaceutical company Farmak (Kyiv) will set up a representative office in Vietnam.

As the company said in the information disclosure system of the National Securities and Stock Market Commission, such a decision was made by its supervisory board on August 19 in order to carry out economic activities in Vietnam.

Farmak is the leader of the Ukrainian pharmaceutical market. The company’s product portfolio includes about 200 brands. Among the main directions are endocrinological, gastroenterological, cardiological, neurological, anti-cold and other drugs.

The company annually reinvests up to 90% of its profits in development. In total, more than $310 million have been invested in the modernization of production since 1995. Annual investments in research and development are approximately $15 million.

Over 2020, Farmak increased its net profit by 7.8% compared to 2019, to UAH 1.138 billion, and sales income reached UAH 7.5 billion.

The export share increased to 29.6% in total sales. Export deliveries increased by 40% over the year. The company exports its products to more than 25 countries around the world.

On August, 28 and 29 the «Kyivan Rus Park» invites to the horse-trick show «The Princely druzhina». The guests will see the knightly tournaments, the Princely hunt, horse-trick performances, will take part in the ancient Slavic amusements, rites, fiery round dances and master-classes. Also the guests will be awaited by the walks on horseback, tasty dishes prepared on open fire, master classes and many more from the life of the medieval city.

Ancient Kyiv opens at 10:00. The program starts at 13:30.

The ticket price: a full adult ticket – 200 UAH, for pensioners and students – 150 UAH, for schoolchildren – 80 UAH, for preschool children – for free.

Ancient Kyiv in the «Kyivan Rus Park» is located in Kyiv region, Obukhiv district, the vill. Kopachiv.

Details on the website www.parkkyivrus.com

The Interfax subscribers can save money with the “openbusiness-20” promo code for a 20%-discount for a full price adult ticket to the Principality of Kyivan Rus:

– by previous order by tel.: +38 044 461-99-37, +38 050 385-20-35

– or at the cash desk at the entrance to the «Kyivan Rus Park».

Ukrainian transport companies transported almost 1.5 billion passengers in January-July 2021, which is 4% more than in the same period in 2020, the State Statistics Service reported.

The passenger turnover of transport enterprises in January-July 2021 amounted to 34.8 billion passenger-kilometers, which is 26.8% more than last year.

According to the State Statistics Service, 47.5 million passengers used rail transport (including city commuter train services) in January-July, which is 22% more than in January-July 2020, and 622.8 million passengers used road transport (more by 0.8%).

Air transport increased passenger traffic by 99.6%, to 4.7 million people.

In addition, according to the State Statistics Service, over the seven months of 2021, some 222.6 million passengers used trams (less by 6.4% versus January-July 2020), 261.7 million people used subway (more by 22%), and 340.1 million people were carried by trolleybuses (more by 2.9%).

During the specified period, water transport carried 200,000 passengers (more by 182%).

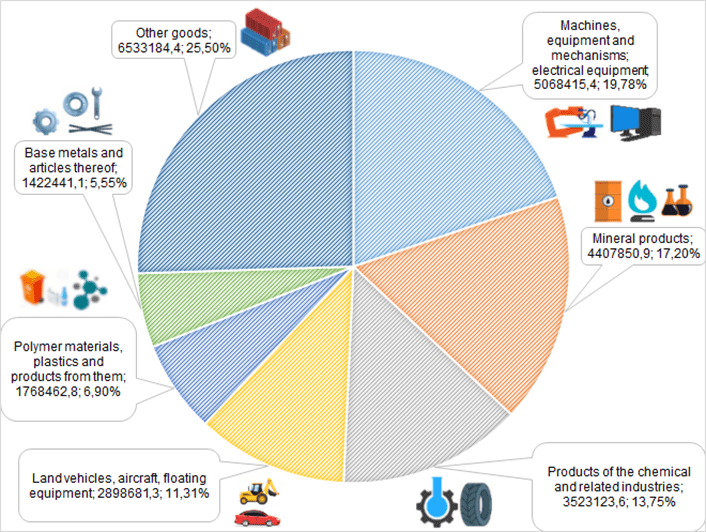

FOREIGN TRADE TURNOVER BY THE MOST IMPORTANT POSITIONS JAN-MAY 2021 (IMPORT)

Ukrainian swimmer Yelyzaveta Mereshko won the gold medal in the 50 meter-freestyle at the Tokyo Paralympics.

“Yelyzaveta Mereshko, Ukraine, won gold in parasailing, women, 50 meter-freestyle, S6 at the Paralympic Games in Tokyo,” the press service of the organizing committee of the Olympic and Paralympic Games in Tokyo said on Twitter.