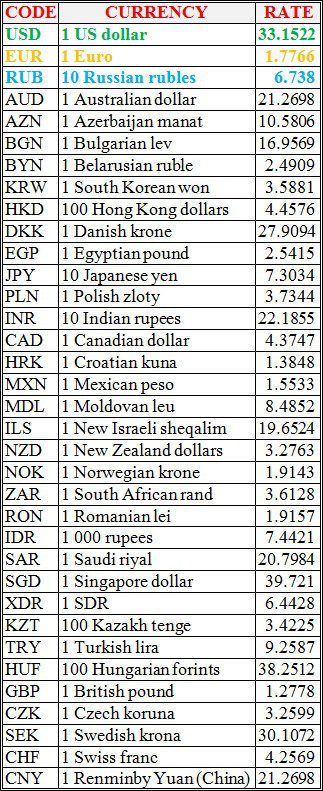

National bank of Ukraine’s official rates as of 12/04/21

Source: National Bank of Ukraine

Ukrainian vehicle manufacturers produced 1,829 vehicles in January-March of this year, which is 34% more than in the same period in 2020, according to a posting on the website of the Ukrautoprom association.

As reported, in January-February 2021, vehicle production exceeded the figure for the same period last year by 3%.

According to the preliminary data of the association, in the first quarter the production of passenger cars increased by 43%, to 1,690 units, production of buses decreased by 24%, to 133 units, and only six commercial vehicles were produced versus 12 a year earlier.

In March alone, car production increased 2.5 times compared with March 2020, to 722 units, including cars produced 2.7 times more – 665 units, which is also 48% more than the February indicator of the current year.

At the same time, the association recalled that in March last year, statistics in this segment were formed only by one plant – Eurocar, and the Zaporizhia Automobile Plant (ZAZ) resumed production of passenger cars only in September.

In the March statistics on commercial vehicles, as in the previous year, only two vehicles assembled at the Cherkasy Bus plant are announced, and AvtoKrAZ still does not disclose information on its production figures (since August 2016).

The production of buses in March grew by 37.5%, to 55 units.

The specialized departments of the State Customs Service have begun testing the updated automated risk management system (ASUR 2.0), developed as part of the EU4PFM program support, the authority said on its website.

As indicated by the State Customs Service, the updated system will allow transferring a significant part of data from paper format to digital, and processes will go online.

“In particular, ASUR 2.0 should allow maintaining an electronic register of profiles (replacing the hard-to-use paper one), digitizing the history of the profile (including the history of all actions that occur with this profile),” the service said.

In addition, the updated system contains tools for monitoring and analyzing the effectiveness of risks, as well as analyzing declarations to work on new risks.

ASUR 2.0 has already passed four types of preliminary tests, including stress testing and testing for vulnerabilities. It is equipped with all the required papers, internal regulatory documents have been drawn up, the customs service said.

The Cabinet of Ministers has removed two cannabinoid preparations from the list of illegal drugs, psychotropic substances and precursors.

According to government resolution No. 324 dated April 7, 2021, public control measures are not applied to the substance cannabidiol isolate, the circulation of psychotropic substances Dronabinol, Nabilon and Nabiximols is allowed only in the form of medicines or in the form of substances intended for the production and manufacture of such medicines.

The changes will make it possible to create mechanisms for the use of drugs containing cannabinoids in medical practice, ensuring their prescription and use in accordance with the legislation of Ukraine with measures to control their circulation.

Ukraine since the beginning of the 2020/2021 agricultural year (July-June) as of April 7, 2021 exported 36.07 million tonnes of cereals and legumes, which is 22.8% less than on the same date of the previous agri-year.

According to the information and analytical portal of the agro-industrial complex of Ukraine, to date, 14.46 million tonnes of wheat, 16.90 million tonnes of corn, and 4.11 million tonnes of barley have been exported.

As of the indicated date, 97,400 tonnes of flour were also exported.

According to the Ministry of Agrarian Policy and Food, Ukraine exported 56.72 million tonnes of grain and leguminous crops in 2019/2020 agri-year.