National bank of Ukraine’s official rates as of 31/12/20

Source: National Bank of Ukraine

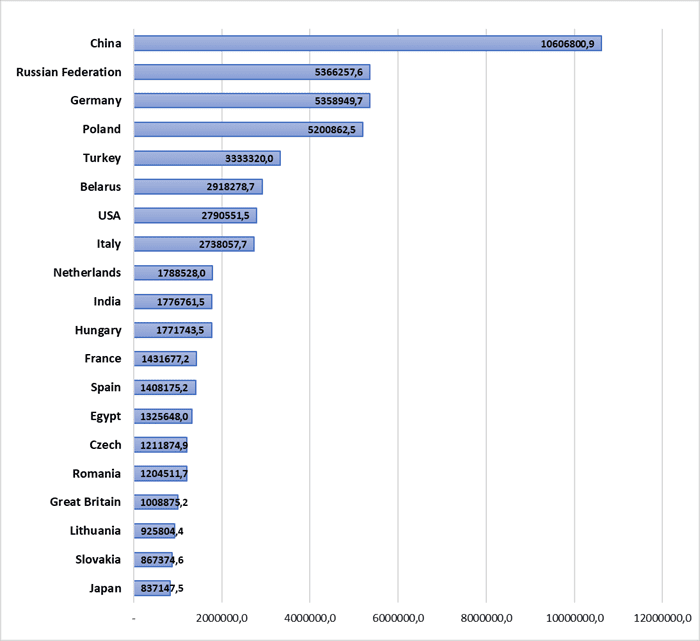

Top 20 countries of Ukraine’s foreign trade partners in Jan-Sept of 2020 (thousand USD).

RibasHotels Group LLC (Odesa), the managing company of the national network of tourist hotel and restaurant complexes of 3-4-star categories, opened a four-star RibasKarpaty hotel in Bukovel (162a Vyshni Street, Polianytsia village, Ivano-Frankivsk region), which became the first facility of the company outside the Black Sea coast.

“In this project, we also acted as a developer who realized the purchase of the site, design and construction of the facility. And in the future we will manage the hotel under the Ribas brand … The site was acquired in early 2019, construction began in May of the same year and it was completed on December 12,” said founder of Ribas Hotels Group Artur Lupashko during an online briefing on Tuesday.

The hotel originally bore the working title of Ribas Bukovel, but Bukovel Group of Companies officially requested not to use the resort brand in the hotel name.

The total area of the Ribas Karpaty hotel is 3,200 square meters, hotel room capacity is 47 rooms. The hotel infrastructure includes the LIS restaurant with access to the terrace, coworking space with panoramic mountain views, swimming pool, Finnish and Roman saunas, jacuzzi, massage rooms, SPA area, and a children’s room.

The total investment in the project was about UAH 100 million, the estimated payback period is 9-11 years.

As reported, in 2020, the management company Ribas Hotels Group (Odesa) became an investor in the Mandra glamping network and plans to expand it to 20-25 franchising facilities.

Ribas Hotels Group LLC was established in 2017. According to the unified public register, Lupashko is the head and owner of a 100% stake in the charter capital of the company.

JSC Ukrzaliznytsia in January-November 2020 updated 11,903 freight cars, most of all high-sided cars were repaired – 5,953 units.

According to the press service of the company, 773 platforms, 479 covered wagons, 563 tanks, 1,066 grain carriers, 411 cement carriers, 468 hopper dispensers were also repaired during this period.

As reported, Ukrzaliznytsia in 2021 plans to allocate 3 times more funds compared to 2020 for renovation, overhaul, modernization of rolling stock and infrastructure construction.

Kyiv will allocate about UAH 6.2 billion for healthcare in 2021, the press service of Kyiv City State Administration said with reference to acting first deputy head of Kyiv City State Administration Valentyn Mondrievsky.

“We will continue to support medical workers and, on the initiative of the mayor, we will increase the allowances for them. Starting from January next year, doctors will receive a salary increase of UAH 5,000, nursing staff will receive UAH 4,000, junior medical staff will receive UAH 2,000,” Mondrievsky said.

He said the city will continue to invest in renovation, repair of medical facilities and the purchase of new equipment.