President of Ukraine Volodymyr Zelensky has signed Verkhovna Rada’s bill No. 2285-d on state regulation on organizing and conducting the gambling activity.

The Ukrainian parliament said on its website that the bill was returned with the signature of the head of state on August 11.

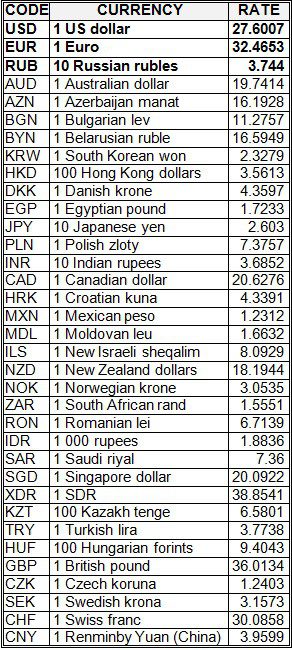

National bank of Ukraine’s official rates as of 11/08/20

Source: National Bank of Ukraine

Raiffeisen Bank Aval (Kyiv) plans to send UAH 4.274 billion (90% of profit) to pay dividends to holders of ordinary shares based on the results of the financial institution’s work in 2019, while in the past year it accrued UAH 3.561 billion, and a year earlier UAH 4.244 billion.

According to the bank’s report in the information disclosure system of the National Securities and Stock Market Commission, the relevant issue was included in the agenda of a general remote meeting of shareholders scheduled for September 11.

It is indicated that out of UAH 4.749 billion of net profit for 2019, the bank plans to send UAH 700,000 (0.01%) to pay dividends to holders of preferred shares and UAH 474.1 million (9.98%) to the reserve fund.

Dividends, if approved, will amount to 6.95 kopecks per share, while at present they are quoted on the Ukrainian Exchange at the following rate: purchase at 35.36 kopecks, sale at 35.5 kopecks.

According to the agenda, the shareholders will also consider the appointment of Lukasz Januszewski as head of the supervisory board of Raiffeisen Bank International (RBI), responsible for investment banking and trade, instead of Martin Grull, and Thomas Matejka as a member of the supervisory board instead of Harald Kroeger.

Former Ecology and Natural Resources Minister of Ukraine Mykola Zlochevsky has been put on wanted list under a criminal case on providing Head of the Specialized Anti-Corruption Prosecutor’s Office (SAPO) Nazar Kholodnytsky and top officials of the National Anti-Corruption Bureau of Ukraine (NABU) with improper advantage. According to the information posted on the website of the Interior Ministry of Ukraine in the Wanted section, Zlochevsky went missing on February 1, 2018 in Odesa and now has the status of a person hiding from the pre-trial investigation agencies. He us charged under Part 4 of Article 369 of the Criminal Code of Ukraine (offering, promising or giving bribe to an official) and no preventive measure was applied to him.

As reported, on June 12, a former official, with the assistance of an official of the State Fiscal Service in Kyiv, a head of the group of companies affiliated to Zlochevsky, and others, tried to transfer $6 million of illegal benefit to SAPO and NABU top officials.

Kyiv-based Biocor Technology LTD, a Ukrainian producer of test systems, has announcement the development of PCR tests for coronavirus (COVID-19).

“At the beginning of July 2020, the diagnostics test kits for SARS-CoV-2 underwent state registration. Laboratories have started using the development. The price of the tests for SARS-CoV-2 is three times lower than the products of western producers,” the company said on a press release.

The tests are made of raw materials produced by Thermo Fisher Scientific.

Biocor Technology LTD will focus on the production and improvement of the product and will sell it through distributors, the company head, Oleksiy Sayutin, said.

The company has been developing PCR tests since 2018. It started to work on the tests for SARS-CoV-2 in February 2020.

Biocor Technology LTD produces various PCR tests. It is certified in line with international standards ISO 9001:2015 and ISO 13485:2016.

According to the state register, the founder and the beneficiary of the company is Maryna Byrsia.