The cryptocurrency market is showing steady growth: the total market capitalization exceeded $4.1 trillion, with a daily increase of about 2–2.6%.

Bitcoin is currently trading at around $122,000–123,000, close to its all-time high reached in July 2025. Ethereum has strengthened to $4,300, its highest level since the end of 2021.

The growth of the cryptocurrency market is driven by:

Against this backdrop, the crypto market is experiencing a “crypto summer” — a wave of IPOs and public listings of companies in the industry, including brands such as Galaxy Digital, Coinbase, and Kraken.

The market has reached new heights: capitalization consistently exceeds $4 trillion, and Bitcoin and Ethereum are strengthening, supported by institutional inflows and favorable regulation. Regulatory initiatives are stimulating investor interest and confidence: the creation of cryptocurrency ETFs, the permission to include digital assets in pension funds, and the promotion of stablecoin laws (the Genius Act in the US). The industry is becoming increasingly institutionalized: companies are actively launching IPOs, and large funds are entering the market and accumulating assets.

The overall trend is positive: active growth continues, but volatility risks remain, especially in the event of a deterioration in the macroeconomic situation or a change in the policies of key regulators.

The Council of the European Union has approved the fourth tranche of the Ukraine Facility program in the amount of more than EUR3.2bn, while its size was previously determined at around EUR3.05bn.

“The objective is to support Ukraine’s macro-financial stability as well as its recovery, reconstruction and modernization,” the EU Council said in a statement.

As reported, the size of the tranche was reduced from the planned EUR4.5bn due to delays in the implementation of 3 out of 16 indicators that Kiev had to fulfill according to the Ukraine Facility’s Ukraine Plan: the laws on the territorial organization of executive power (the so-called “decentralization reform”) and on the ARMA reform, as well as the selection of 25 judges for the Supreme Anti-Corruption Court in a competition in which only 2 candidates reached the finish line.

At the same time, the head of the Economy Ministry, Oleksiy Sobolev, noted that Ukraine will fulfill two of the three indicators (laws) before September, which will make it possible to receive EUR1.1bn tentatively in early November

As the Ministry of Finance of Ukraine reminded, in general, the state budget has already received EUR19.6bn within the framework of the Ukraine Facility program, the total amount of which is EUR50bn. In 2025 alone, about EUR12.5bn of financial support for Ukraine is envisaged, of which EUR3.5bn has already been attracted.

The European Union remains the largest donor of budget support for Ukraine – EUR53.5bn over more than three years, the Finance Ministry also noted.

On average, three people a day ask to be declared insolvent

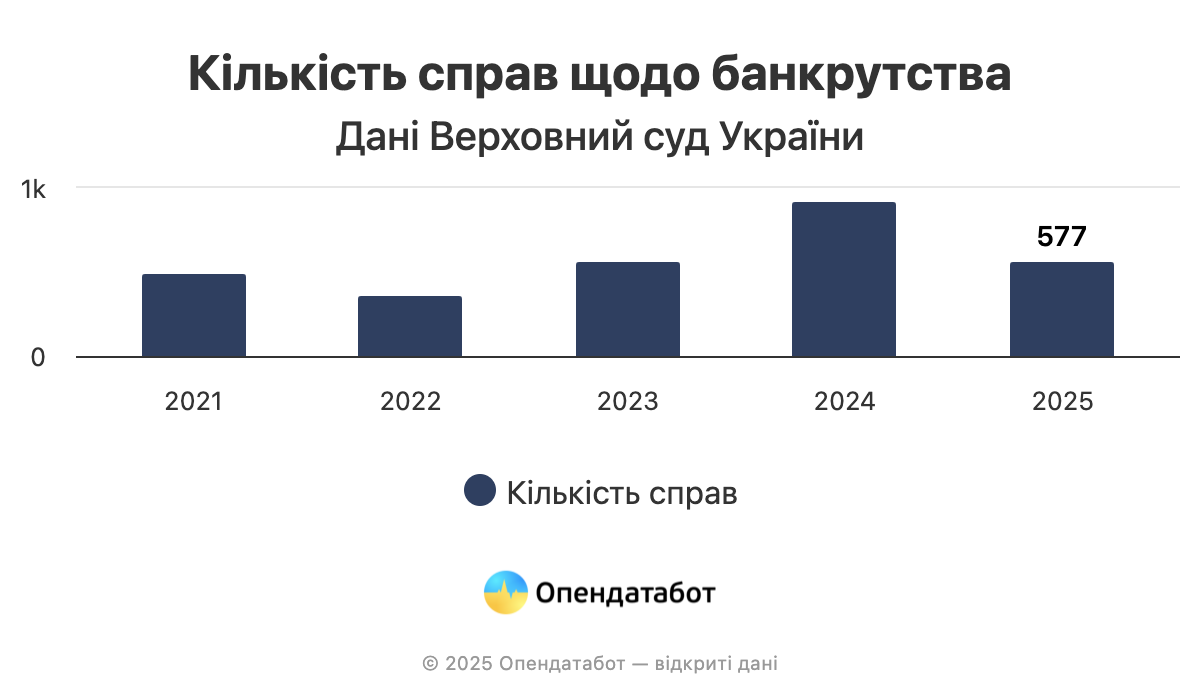

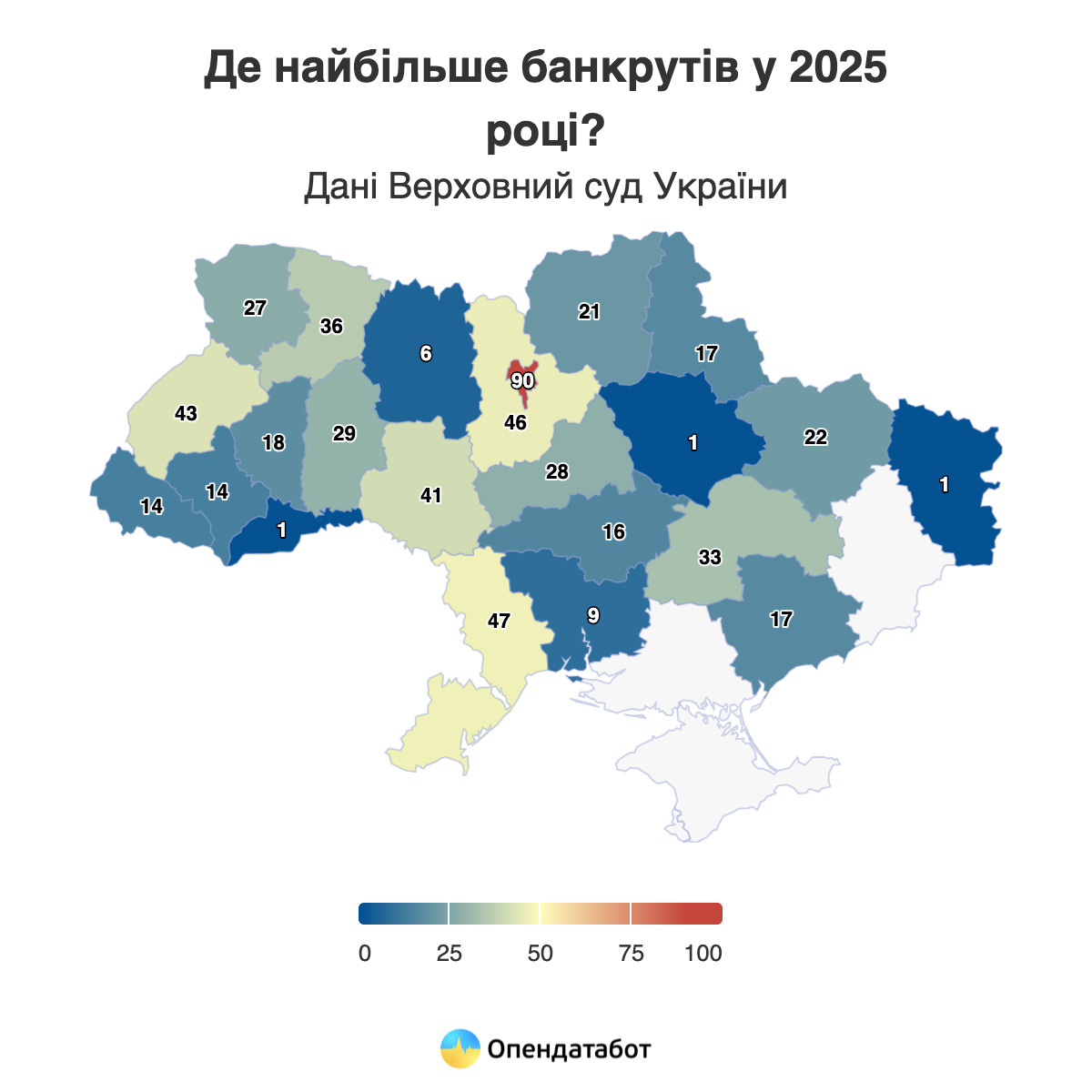

The number of people deciding to declare themselves bankrupt is growing in Ukraine. According to the Supreme Court, more than 2,900 Ukrainians have become bankrupt in the last five years. 577 Ukrainians have already filed for bankruptcy in the first six months of 2025. In 52% of cases, it is men who are asking to be declared insolvent. The highest number of bankruptcies this year is in Kyiv, Kyiv Oblast, and Lviv Oblast.

577 Ukrainians went bankrupt in the first half of 2025 in Ukraine. Such cases increased by 33% compared to the same period in 2024. In general, the largest number of people went bankrupt last year: 926 cases, but this year risks catching up with these figures.

On average, three new bankruptcy cases are opened every day this year.

A total of 2,948 bankruptcy cases involving citizens have been opened in the last five years. Although the bankruptcy procedure was officially introduced in 2019, Ukrainians only began to actively use it in 2021.

Fifty-two percent of cases since 2021 involve men, and 48% involve women. The gender gap is not critical and remains almost the same every year. For example, in 2021, men dominated (57.9%), while in 2022 and 2025, women slightly outnumbered men.

The largest number of bankruptcy cases in 2025 were opened in Kyiv — 128. Kyiv region is in second place with 83 cases, followed by Lviv, where 73 applications were filed.

You can check whether a person is bankrupt in OpenDataBot — just enter their TIN and you will receive complete information in a matter of seconds.

“The current increase in the number of bankruptcy cases is part of a steady trend that has been going on for several years. The procedure is gradually becoming more predictable: judicial practice is being developed, participants in the process are gaining experience, and the mechanism itself is working more smoothly. At the same time, creditors — banks and financial institutions — are becoming more demanding in terms of debt write-off or restructuring conditions. It is important to understand that bankruptcy is not a panacea for easy and painless “debt write-offs.” The consequences of insolvency will affect a person for at least several years,” comments Denys Pavlovych Lykhopok, lawyer, arbitration manager, member of the Qualification Commission of Arbitration Managers, and bankruptcy specialist.

According to him, there are still gaps in the procedure that need to be addressed. In particular, these relate to the tax consequences of restructuring and debt write-offs, as well as interaction with enforcement proceedings and other related court cases, which often remain outside the scope of insolvency cases.

https://opendatabot.ua/analytics/bankrupts-2025-6

Prices for construction and installation work in Ukraine in April-June 2025 increased by 5.5% compared to the same period in 2024, the State Statistics Service (Gosstat) reported. According to the State Statistics Service, in the second quarter of 2025 compared to the second quarter of 2024, prices increased in all segments of construction: in residential construction growth amounted to 6.6%, in non-residential – 5.6%, in engineering – 5%. Compared to the previous quarter, prices increased by 1.9%, 1% and 0.7% respectively.

In June-2025 to June-2024, prices of construction work increased by 5.1%, particularly in the residential sector by 5.9%, non-residential by 5.1%, and engineering by 4.7%. Compared to the previous month, prices increased by 0.4%, 0.5% and 0.3% respectively.

According to the results of six months, prices increased by 6.1%: 6.9% in residential construction, 6.3% in non-residential construction, 5.7% in engineering construction.

As reported, in 2024, prices for construction works increased by 7.9% year-on-year, and in 2023 – increased by 15.8% to 2022.

The State Statistics Committee pointed out that the figures are given without taking into account the temporarily occupied territories and part of the territories where hostilities are (were) conducted.

Rozetka opened 33 new stores in January-June 2025 and plans to launch 10 more by the end of the year, according to its press service.

“Despite constant threats, Rozetka opened 33 new stores in the first six months of 2025: 22 of its own and 11 franchises. This is almost half of last year’s figure, when the company added 74 new stores and entered 35 new cities,” the company said in a statement.

It is noted that the new stores will also include relocated facilities.

In addition, Rozetka continues to develop its network of parcel terminals and partner delivery points.

“At the beginning of 2024, there were only four parcel terminals, but now there are already 104,” the company’s press service reported.

Rozetka, an online store for electronics and household appliances, was founded in 2005 in Kyiv by Vladislav and Irina Chechotkin, and later the fund managed by Horizon Capital became a co-owner of the company. Today, the company has transformed into a multi-category online marketplace, but is also developing a network of its own stores. As of August 1, 2025, the network has 549 stores in 166 cities.

Azerbaijani President Ilham Aliyev has signed a decree allocating funds equivalent to $2 million to the Ministry of Energy of the Republic of Azerbaijan for the purchase of Azerbaijani-made energy equipment, which will be transferred to Ukraine as humanitarian aid.

“To allocate funds in manats equivalent to 2.0 (two) million US dollars from the reserve fund of the President of the Republic of Azerbaijan, provided for in the state budget of the Republic of Azerbaijan for 2025, to the Ministry of Energy of the Republic of Azerbaijan for the purchase and shipment of electrical equipment manufactured in the Republic of Azerbaijan for the purpose of providing humanitarian aid to Ukraine,” reads the text of the decree dated August 11, published on the website of the President of Azerbaijan.

As reported, on July 28, 2025, Naftogaz of Ukraine signed an agreement with SOCAR Energy Ukraine on the purchase of Azerbaijani natural gas. Under the agreement, test supplies will be carried out via the Trans-Balkan route through the Bulgaria-Romania-Ukraine corridor.