On November 12-13, 2019, Kyiv will host the 11th international conference, Petroleum Ukraine 2019. This was announced by the organizer of the event, A-95 Consulting Group.

Petroleum Ukraine is a central meeting point for the elite of the Ukrainian fuel market, owners and top managers of Ukrainian and foreign companies. More than 200 delegates visit the forum every year, including the largest players: Belarusian Oil Company, PKN Orlen, Ukrtatnafta, Proton Energy Group, OKKO, WOG, AMIC, Wexler Group, Vitol, Trafigura, Coral Energy, Alliance Energo Trade, and many others.

This year, the central topics of the event will be: the transformation of sources of fuel supply in Ukraine, the reform of the fuel trade control system, and alternative energy.

“The fuel market is experiencing an extremely difficult and eventful stage in its history. At the same time, there is a search for alternative sources of supply, a transition to a tougher fiscal control system and fierce competition between both legal players and the shadow market. Simultaneously, the new reality is shaping up with an understanding for the need for clean energy,” says Serhiy Kuyun, director of A-95 Consulting Group and moderator of Petroleum Ukraine.

Panel discussion will include reports by representatives of relevant ministries and departments (Ministry of Energy, the State Fiscal Service, and Ministry of Defense), state-owned companies (Ukrzaliznytsia, NJSC Naftogaz of Ukraine), leading producers and suppliers of petroleum products, analysts from international energy agencies, owners and top managers of leading gas filling stations.

The first Petroleum Ukraine forum was held in 2009. A-95 Consulting Group is also the organizer of the largest conferences for participants in the liquefied petroleum gas market (LPG Ukraine) and suppliers engaged in transportation by sea (Black Sea Petroleum Trading).

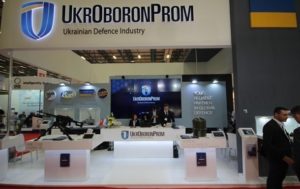

The enterprises of Ukroboronprom state concern reduced export volumes to $451 million a year compared to $900 million in 2013, director general of the state concern Aivaras Abromavicius has said at a meeting with Ukrainian President Volodymyr Zelensky in Kharkiv. “The most important reform we have already launched is the reform of exporters … We are reducing the number of exporters from six to two at the initial stage,” he said.

He specified that in order to rectify the situation, “movement veteran” Mykhailo Morozov was appointed to this direction. He has led ISTIL Group for more than ten years and has significant experience in managing special exporters, in particular, Progress state enterprise.

The director general of Ukroboronprom noted that 1,500 people are engaged in exports in the state concern, while in a Turkish company with export of $300 million per year some 80 people.

“People are sitting in the center of Kyiv, it is not clear what they are doing. We’ll motivate those people who will stay with us to work, because every time you go abroad, you have to blush,” Abromavicius described the current situation and plans.

As an example, he cited his recent trip to Peru and retold criticism from colleagues from South American countries.

“Guys, it’s hard to pronounce your names: Ukroboronprom, Spetstechnoexport, Ukrspecexport … You all run around, each with two agents, lower prices for your manufacturers,” they said.

The Ukroboronprom director emphasized that such a lack of culture and coordination within the concern should cease.

The group of the seller in a transaction to acquire Preludium B.V. (the Netherlands), through which MTS Group owns the second largest mobile communications operator in Ukraine, PrJSC VF Ukraine (Vodafone Ukraine), by Azerbaijan’s Bakcell telecom operator will terminate control over Preludium B.V.

According to the decision of the Antimonopoly Committee of Ukraine (AMCU) of October 24, 2019, published on the agency’s website on Tuesday, the parties to the transaction have already agreed on the obligations of the Luxembourg subsidiary of MTS Allegretto Holding Sarl to refrain from competing with Vodafone Ukraine for three years territory of Ukraine.

In addition, PJSC Mobile TeleSystems undertakes not to lure employees (unless otherwise agreed between the parties) and Vodafone Ukraine suppliers.

According to the document, at present Bakcell LLC does not carry out economic activities in Ukraine. He is controlled by an individual a citizen of Azerbaijan and business entities non-residents of Ukraine, forming the Bakcell group.

Bakcell, founded in 1994, is the mobile communications operator and a leading provider of mobile Internet in Azerbaijan. It operates in GSM, UMTS and LTE standards.

Bakcell network consists of more than 7,500 towers, covers 93% of the territory (excluding occupied territories) and 99% of the population of Azerbaijan. The company has more than 3 million subscribers.

According to the results of 2018, Vodafone Ukraine reduced its net profit by 18.1% compared to 2017, to UAH 1.8 billion. The company explained this figure as an increase in costs due to the active deployment of 4G and 3G networks.

Vodafone Ukraine is fully owned by Preludium B.V. It is part of the international MTS Group, which shares are listed on the New York Stock Exchange.

President of Ukraine Volodymyr Zelensky has instructed to eradicate total corruption in the field of state architectural and construction control and urban planning by the end of 2019, a president’s press service reported. Zelensky set the appropriate task to Minister of Development of Communities and Territories Olena Babak during a meeting with the leadership of the Verkhovna Rada and the Cabinet of Ministers in the President’s Office.

The head of state noted the need to switch rendering of the administrative services in construction to an electronic format and introduce automatic registration in the register of approval documents.

As the President’s Office reported, Zelensky commissioned Minister of Justice of Ukraine Denys Maliuska to change the software of real estate and business registers to stop unauthorized access. Besides, by the end of June 2020, Maliuska must ensure the formation of the legislative framework for the operation of an electronic notarial system.

The Cabinet of Ministers of Ukraine has amended the charter of the Energy Efficiency Fund, increasing its charter capital by UAH 1.119 billion, MP Oleksiy Honcharenko has said. “The Cabinet of Ministers has increased the charter capital of the Energy Efficiency Fund by UAH 1.119 billion,” he said on Telegram.

The decision will allow implementing 2,041 thermal modernization projects for multi-apartment buildings, the press service of the Ministry for Community and Territory Development said.

As reported, the national budget of Ukraine for 2019 foresees UAH 1.6 billion for the charter capital of the Energy Efficiency Fund.

The Energy Efficiency Fund intends within five years to finance more than 16,000 projects under the energy modernization program for the associations of co-owners of multi-apartment buildings.