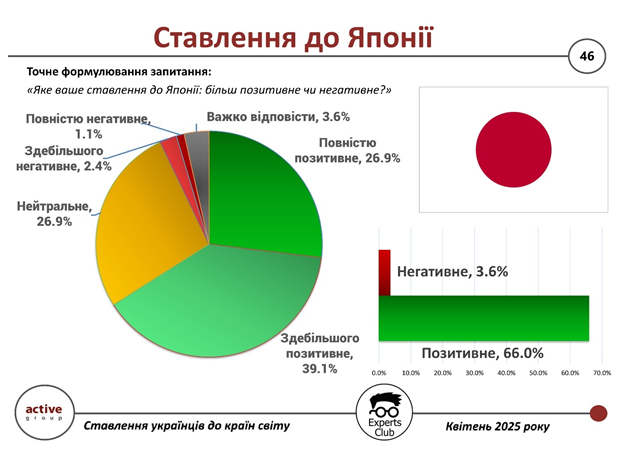

According to a survey conducted by Active Group and the Experts Club analytical center in April 2025, Japan was included in the list of countries with the highest level of positive perception among Ukrainians.

The majority of respondents — 66.0% — expressed a positive attitude toward Japan: 39.1% — mostly positive, and 26.9% — completely positive. Neutral attitudes toward the country were expressed by 26.9% of respondents, another 3.6% were undecided, and only 3.6% expressed negative attitudes (of which 2.4% were mostly negative and 1.1% were completely negative).

“Ukrainians traditionally have great respect for Japan. It is a country of high technology, a stable economy, a culture of discipline and solidarity,” said Maxim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Japan is perceived as a country with a high cultural reputation and technological leadership and is among the leaders in terms of positive attitudes among Ukrainians, while the level of negativity is one of the lowest among all countries.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Yemen remains a little-known country for most Ukrainians, which explains the high level of neutrality. This is evidenced by the results of a survey conducted by Active Group in cooperation with the Experts Club think tank in April 2025.

According to the survey, 64.1% of respondents took a neutral position on Yemen. At the same time, 17.0% of respondents have a negative attitude (12.0% — mostly negative, 5.0% — completely negative), while only 6.9% expressed a positive attitude (4.5% — mostly positive, 2.4% — completely positive). Another 12.0% of respondents were unable to give a clear answer.

According to analysts, this pattern of responses indicates a lack of established associations with the country, except for possible mentions in the context of news about armed conflicts and the Houthi government’s aggressive policy towards shipping in the Gulf of Aden and the Red Sea.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

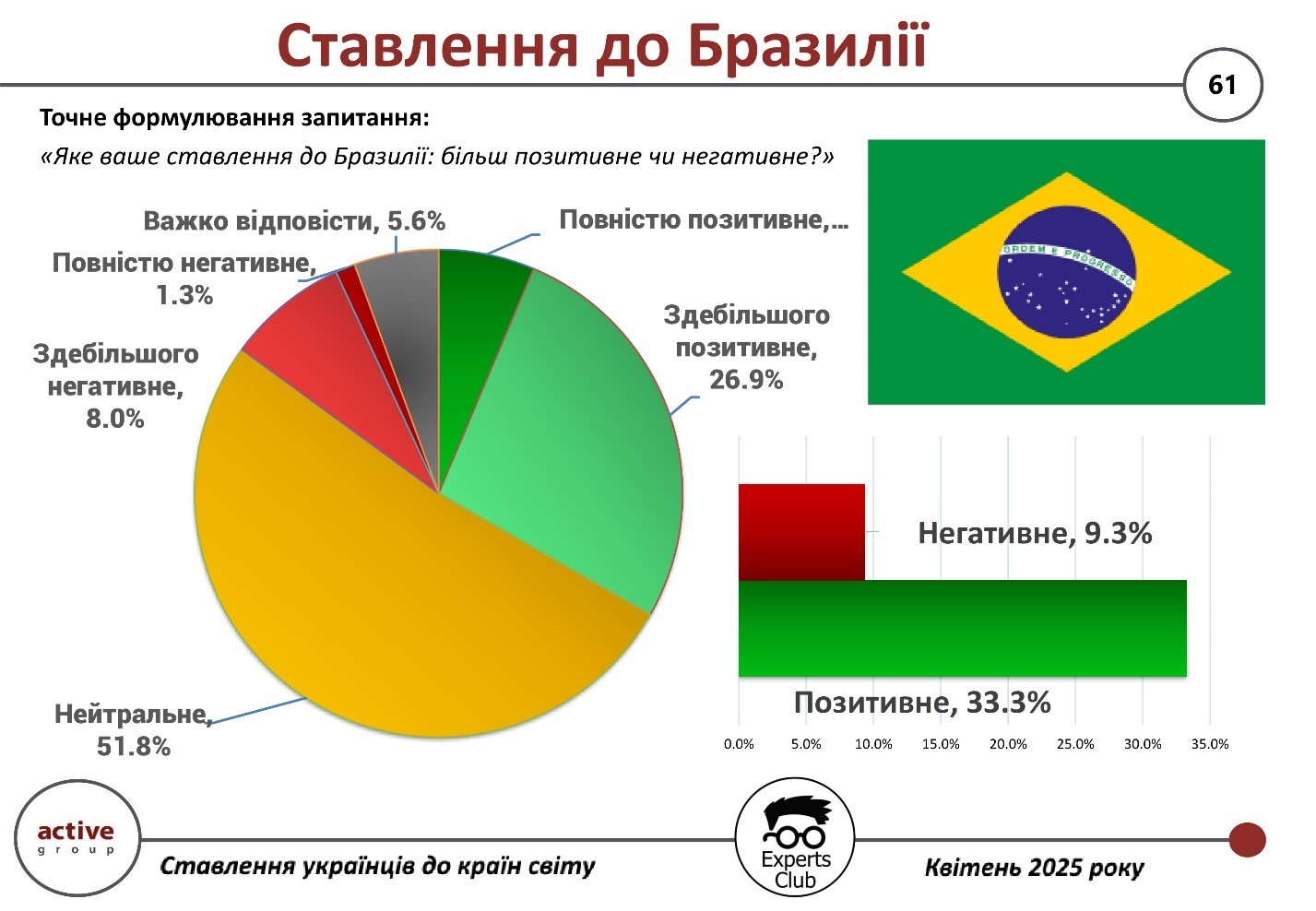

According to a survey conducted by Active Group in cooperation with the Experts Club think tank, Ukrainians’ attitude toward Brazil is mostly positive or neutral.

51.8% of respondents chose a neutral position, while 33.3% expressed a positive attitude (of which 26.9% said “mostly positive” and 6.4% said “completely positive”). A negative attitude was recorded in 9.3% of respondents, of which 8.0% were “mostly negative” and 1.3% were “completely negative.”

“Brazil is associated with vibrant cultural events, football, and natural wonders, which creates a generally positive image. However, geographical distance and weak interaction at the intergovernmental level lead to a significant proportion of neutral perceptions,” comments Maksim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Ukrainians mostly maintain a neutral or positive attitude toward Brazil. At the same time, a significant proportion of respondents were unable to give an assessment, which indicates the potential for forming a stable image of the country in the mass consciousness.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

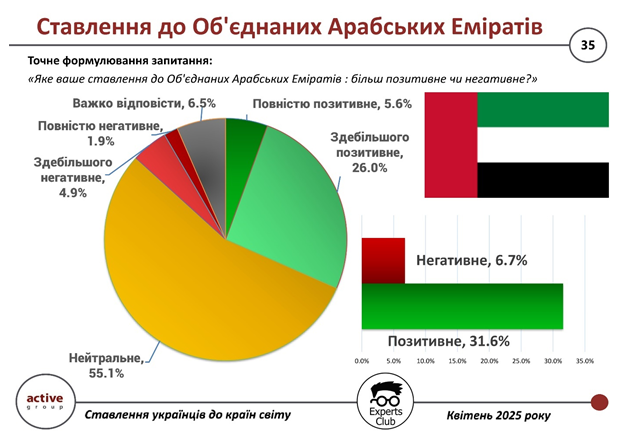

The United Arab Emirates has a positive image among Ukrainians, but more than half of the population remains neutral. These are the results of a sociological survey conducted by Active Group in cooperation with the Experts Club think tank in April 2025.

According to the survey, 31.6% of respondents have a positive opinion of the UAE (26.0% mostly positive, 5.6% completely positive), while 6.7% have a negative opinion (4.9% mostly negative, 1.9% completely negative). At the same time, 55.1% of respondents took a neutral position, and 6.5% were unable to decide on an answer.

“Ukrainians generally have a favorable perception of the UAE, associating the country with humanitarian initiatives during the war, in particular prisoner exchanges, as well as technological development and tourism opportunities. However, a significant percentage of neutral responses indicates a lack of awareness,” commented Maxim Urakin, PhD in Economics and founder of the Experts Club information and analytical center, on the results of the study.

These results create fertile ground for the development of economic and cultural relations between Ukraine and the Emirates.

The study can be found at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

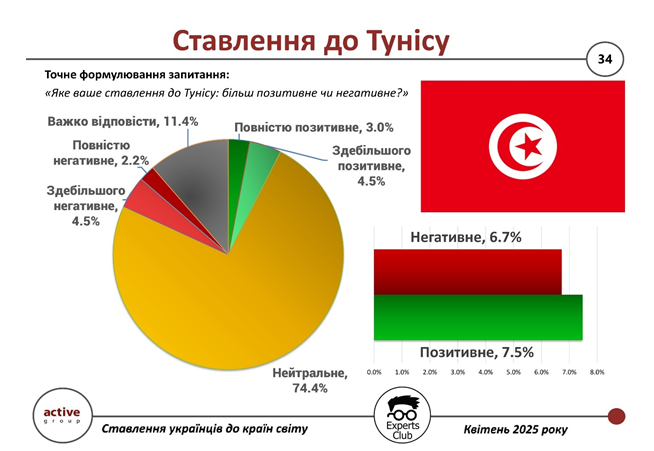

Tunisia is perceived by Ukrainians as mostly neutral, with a slight predominance of positive assessments over negative ones. This is evidenced by the results of a sociological survey conducted by Active Group in collaboration with the Experts Club think tank in April 2025.

According to the data, 7.5% of Ukrainians have a positive attitude toward Tunisia (4.5% — mostly positive, 3.0% — completely positive), while 6.7% express a negative attitude (4.5% — mostly negative, 2.2% — completely negative). 74.4% of respondents took a neutral position, and 11.4% were undecided.

“The high level of neutrality and slight predominance of positive assessments indicate the absence of clear stereotypes or conflicting associations regarding Tunisia among Ukrainians,” said Alexander Pozniy, co-founder of Active Group.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

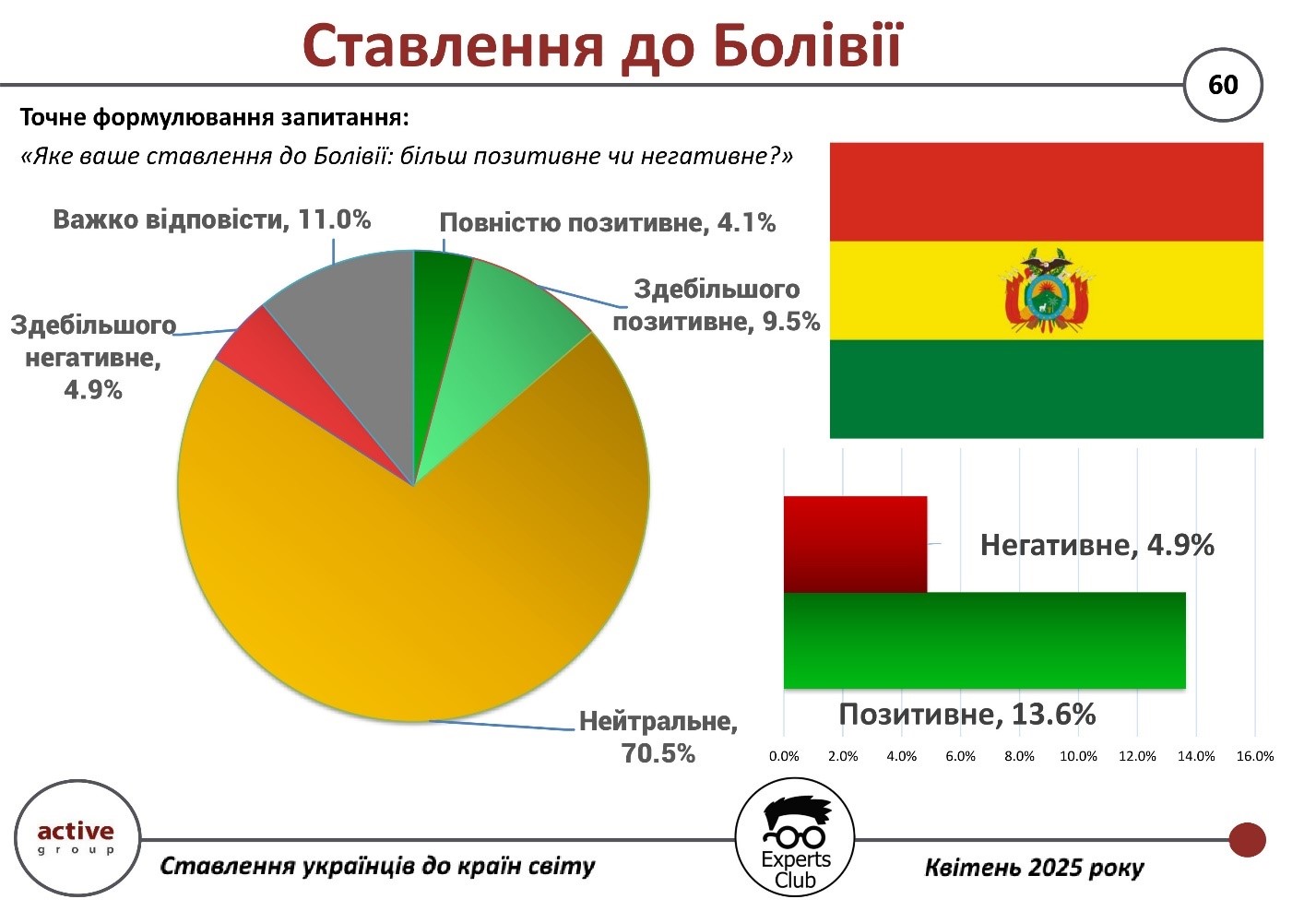

According to the results of a sociological survey conducted by Active Group in cooperation with the Experts Club think tank, Ukrainians are mostly neutral towards Bolivia.

70.5% of respondents chose a neutral position, while 13.6% expressed a positive attitude (of which 9.5% said “mostly positive” and 4.1% said “completely positive”). Bolivia is viewed negatively by 4.9% of respondents, while 11.0% were undecided.

“These results indicate that Bolivia remains a ‘blank spot’ on the world map for Ukrainians. The lack of vivid associations or regular presence in international news shapes a predominantly neutral or indifferent attitude,” said Oleksandr Pozniy, co-founder of Active Group.

Ukrainians’ neutral attitude toward Bolivia dominates, indicating limited awareness of the country among the general public. A positive attitude was recorded in more than 13% of respondents, while a negative attitude was minimal.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN