The first container of Serbian goods was shipped to China on Friday as part of the Free Trade Agreement between the two countries, according to the Serbian government website. The container contains products from local companies such as Pionir, Akov, Fruskogorski Vinograd, Vinarija Aleksić, Nutrino, Nash Med, Zarić Rakija, Budimka, and Damar. The transportation was organized by the Milšped company from Krnoševac, near Stara Pazova.

The Minister of Economy Adriana Mesarović noted that this is the result of the hard work of Serbian entrepreneurs, government agencies and Chinese partners, as well as confirmation of the “steel friendship” between China and Serbia. She emphasized that Chinese retailers, importers and distributors have expressed their willingness to accept Serbian products in a market of 1.4 billion consumers.

Chinese Ambassador to Serbia Li Ming said that thanks to the Free Trade Agreement, which entered into force on July 1, 2024, Serbia became China’s first partner in Central and Eastern Europe with such an agreement. He noted that since the agreement came into force, Serbia’s exports to China have increased by 53.7%, and more and more Serbian wines and dairy products are appearing on Chinese tables.

The free trade agreement covers 10,412 Serbian and 8,930 Chinese products. From the first day of application, 60% of the goods were exempted from duties, and over the next five to ten years, another 30% of products will be exempted from customs duties.

Source: https://t.me/relocationrs/633

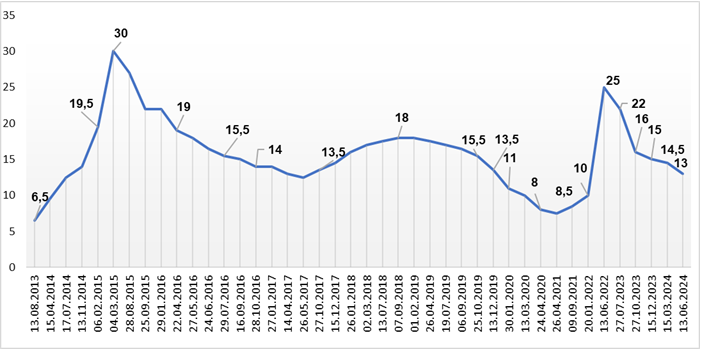

Dynamics of changes in discount rate of NBU – from 2013 to 2024

Source: Open4Business.com.ua

Italy and Spain have made it clear that they are not ready to support the European Union’s proposal to allocate around EUR 40 billion in military aid to Ukraine this year, with each country contributing according to the size of its economy, Reuters reported on Tuesday.

Following a meeting on Monday of foreign ministers from the 27 EU member states in Brussels, Kallas said her proposal had “broad political support” and discussions were now moving to the details.

Diplomats said the proposal has some support from northern and eastern European countries. But some southern European capitals were more reticent, reflecting a division between those geographically closer to Russia, which have given more aid to Ukraine, and those farther away, which have given less, as a percentage of their economies.

According to the Kiel Institute for the World Economy think tank, Estonia, Denmark and Lithuania lead Europe in this area, allocating more than 2 percent of their GDP to aid Kiev between January 2022 and December 2024. At the same time, Italy, Slovenia, Spain, Portugal, Greece and Cyprus are among those who have allocated the least, committing less than 0.5% of their GDP.

Speaking ahead of the meeting, ministers from Italy and Spain – the EU’s third and fourth largest economies – said it was too early to take a final position on the proposal.

Italian Foreign Minister Antonio Tajani said the proposal would need to be discussed in detail in light of upcoming events. “We are waiting for a phone call between Trump and Putin to see if there will be any steps forward to achieve a ceasefire,” he said, adding that Italy must also find money to increase its own defense spending. “There are many expenses that need to be addressed,” he added.

Spanish Foreign Minister Jose Manuel Albares said: “We will see how the debate goes, but there is no decision on this issue yet.”

Albares said Spain had already pledged 1 billion euros in military aid to Ukraine this year. He said Madrid did not have to “wait for the High Representative (Callas – IF-U) to make any proposal” to show that Kiev could count on his support.

China’s BYD Co. plans to choose a country to build a third European plant within seven to eight months, the company’s special adviser for Europe said Tuesday.

“We are not ruling out any options and are now considering any country,” Alfredo Altavilla said, speaking at an auto show in Milan.

“The site selection process for the third plant has already started and we expect to finalize it within seven to eight months,” he added.

BYD is set to start production at an assembly plant in Hungary in October, while the company’s plant in Turkey is due to start operations in March 2026. The combined production capacity of these two plants will be up to 500,000 cars per year.

Earlier, there were media reports that BYD was considering Germany for a new assembly facility, in part because the country spoke out against the imposition of duties on Chinese car imports last year.

Altavilla denied these speculations, calling them devoid of logic. At the same time, he emphasized that a decision has not yet been made.

He noted that the company is guided by several criteria, including the competitiveness of conditions for battery and car production. At the same time, Altavilla added that it is hard to imagine BYD building a plant in a country that treats Chinese cars poorly.

Prices for new buildings will continue to grow in 2025, in the comfort class they can grow by more than 15% by the end of the year, said the press service of the developer Alliance Novobud.

“In business class prices will remain at about the same level, plus 5-10% due to the rise in the cost of building materials. At the same time, in the comfort class prices may increase by more than 15% by the end of the year”, – says Irina Mikhaleva, the company’s SMO.

According to her, the main factors that affect the cost per square meter are a significant increase in the cost of almost all types of building materials, works, as well as the shortage and, accordingly, the growth of labor costs.

She noted that the cost of building materials, prices of transportation services, electricity are constantly growing, and during construction, electricity, in particular, is used a lot. And it becomes even more expensive when generators are used or imported e/e is purchased at a higher price.

“There is a catastrophic shortage of people who can work on construction sites, this is a consequence of mobilization processes, the shortage of personnel is increasing,” Mikhailova listed the factors that have significantly affected the market.

As a consequence, developers are forced to adjust prices. In particular, according to the results of last year, the cost per square meter of housing in the comfort class increased by about 20%.

“This year we are again likely to see the rise in the price of construction materials, our suppliers are already sending new prices, therefore, for the year the cost of new housing in comfort class will again increase by at least 10-15%, and for some objects by 20%”, – she said.

Less growth is expected in business class, one of the factors of more restrained market reaction here is dumping on the part of the secondary market. For example, last summer a large number of “secondary” objects were put up for sale at prices many times less than pre-war prices.

According to Mikhaleva’s forecasts, in 2025 the construction of suburban housing will develop more actively: cottages, townhouses, etc.

“We are also considering the option of such construction, thinking about the possibility of cottage or townhouse project,” she said.

According to the data of the portal of new buildings LUN, Alliance Novobud was founded in 2006, since 2010 the company has commissioned 32 houses, in the process of realization of 9 houses and a country house project.

In January-February this year, Ukraine reduced exports of carbon steel semi-finished products in physical terms by 44.9% year-on-year to 200,696 thousand tons.

According to statistics released by the State Customs Service (SCS) on Tuesday, exports of carbon steel semi-finished products fell by 47% to $92.752 million in monetary terms.

The main exports were made to Bulgaria (40.00% of supplies in monetary terms), Turkey (25.10%) and Egypt (10.78%).

In the period under review, Ukraine imported 2.544 thousand tons of semi-finished products worth $2.043 million from the Czech Republic (94.42%) and Italy (5.58%), with all deliveries occurring in February.

As reported, in 2024, Ukraine increased exports of semi-finished carbon steel products in physical terms by 56.7% compared to 2023 – up to 1 million 886.090 thousand tons, while revenue in monetary terms increased by 52.4% to $927.554 million. The main exports were made to Bulgaria (32.06% of supplies in monetary terms), Egypt (18.50%) and Turkey (11.14%).

In 2024, Ukraine imported 306 tons of semi-finished products worth $278 thousand from the Czech Republic (88.13%), Romania (7.19%), and Poland (2.88%), while in 2023 it imported 96 tons worth $172 thousand.