US President Donald Trump has ordered a halt to all military aid to Ukraine, days after he and Ukrainian President Volodymyr Zelenskyy clashed during a meeting at the White House, Bloomberg reports.

According to a senior Defense Department official, the United States will suspend all current military assistance to Ukraine until Trump decides that the country’s leaders have demonstrated a good faith commitment to peace.

The official said that all U.S. military equipment not currently in Ukraine would be suspended, including weapons in transit on airplanes and ships or waiting in transit zones in Poland.

According to the source, Trump ordered Pentagon Chief Pete Hegseth to pause.

Bloomberg notes that the US president is pushing for a quick deal to end the war that has been going on for three years. But when Zelenskiy demanded security guarantees in the Oval Office last week that Russia not violate the agreement, Trump angrily told him to come back when he was ready for peace.

This, in turn, has forced European allies to rush to develop plans to supply Ukraine with weapons as well as peacekeepers as part of the deal. However, Europe lacks many other weapons and capabilities that the United States currently provides. Allied officials have said that the arms supplies are likely to last only until the summer.

The newspaper writes that it is not yet clear to what extent Trump’s order will affect the amount of aid. He took office with $3.85 billion of money left over from the previous administration in the form of the so-called Presidential Authorization for the Reduction of

US Stockpiles. It is unclear whether the Trump administration will actually use this money for Ukraine, especially given that the US stockpile of weapons is running low and needs to be replenished.

Also, Monday’s decision goes beyond simply cutting off funding, but jeopardizes aid that is already being delivered or in progress. This includes the delivery of critical munitions, hundreds of guided missile systems and anti-tank weapons, and other capabilities.

Termination of existing contracts with industry may also require the US to pay some form of break fee to companies that have begun fulfilling orders.

The US and Ukraine were supposed to sign a deal that would have allowed the US to get a significant share of future revenues from Ukraine’s natural resources, but after Friday’s meeting, the deal appears to have fallen apart, according to Bloomberg.

Meanwhile, the White House confirms the cancellation of military aid to Ukraine, CNN reports.

“The president has made it clear that he is focused on peace. We need our partners to be committed to that goal as well. We’re suspending and reviewing our assistance to make sure it’s contributing to a solution,” the White House official said.

Another official said the pause would apply to all military equipment not already in Ukraine.

The pause is a direct response to what Trump sees as Zelenskiy’s bad behavior last week, the official said. They noted that the pause could be lifted if Zelenskiy demonstrates a renewed commitment to negotiations to end the war in Ukraine.

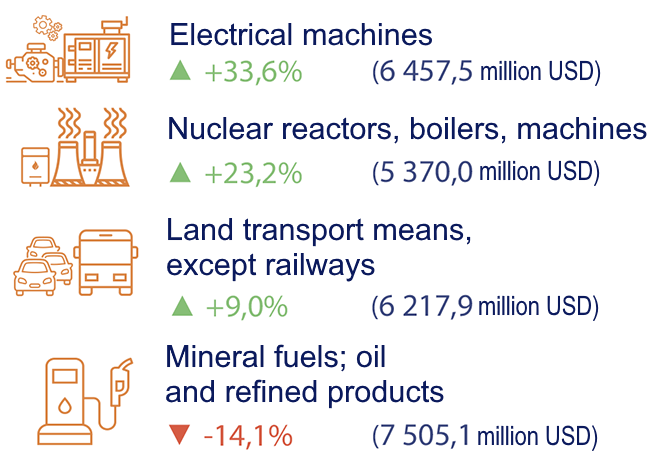

Dynamics of import of goods in January-October 2024 by the most important items in relation to the same period of 2023, %

Source: Open4Business.com.ua

The desire of Ukrainians who fled the war to stay in Germany even after the end of hostilities is linked to their increasing integration into German society, according to an analysis by the Institute for Research on the Labor Market and Professions (IAB). “The high level of education and strong desire to integrate among Ukrainian refugees create opportunities for both sides, especially given the demographic changes and the lack of qualified personnel in Germany,” said IAB expert Yulia Kosyakova.

However, for mutually beneficial relations to develop, Germany should be more active in helping Ukrainians find jobs, learn the language and recognize professional qualifications, Kosyakova said.

The IAB study shows that on average, only 22% of Ukrainian refugees aged 18 to 64 are employed. 57% of Ukrainian women and 50% of men work in Germany in positions that do not correspond to their qualifications. Most often, Ukrainians find work in the cleaning industry, catering, and social services, including care for people with disabilities. The average monthly gross income of Ukrainians working full-time is EUR 2,600, which is significantly lower than the average in Germany (EUR 4,479).

At the same time, according to the study, 97% of adult refugees have a school education, 75% have vocational or higher education, and 90% have work experience in their home country. Only 20% were able to officially confirm their diplomas and qualifications in Germany.

Source: http://relocation.com.ua/bilshe-polovyny-ukrainskykh-bizhentsi/

Ukraine is a strategic partner of the EU and the world. While a significant part of the world’s land is becoming unsuitable for agriculture due to climate change and soil degradation, in Ukraine, with a total area of 60.35 million hectares, 42.73 million hectares or 70.8% of the territory is already used in agricultural production, according to SEEDS.

Dmytro Ustavytskyi, co-founder of the logistics company NIDERA AGRO, an expert in international logistics and innovative solutions, and industry leader of the NGO Svit.UA, writes about this in a blog on the Svit.UA website.

“Despite the realities of the war, grain exports from Ukraine are crucial for the food security of the world. This month, the EU is presenting the updated Common Agricultural Policy of the European Union, which will be adopted in 2028. Currently, it is being discussed that trade preferences introduced in 2022 due to the war should be extended until 2027, as the war continues.

According to the Ministry of Agriculture, in 2024, exports of agricultural products brought in $24.6 billion, which is 59% of the country’s total exports. Ukrainian farmers managed to increase exports by 12.5% compared to 2023. Sales of grains (+1.1 billion USD) and oilseeds (+0.5 billion USD) increased the most,” says Dmytro Ustavytskyi.

In his opinion, logistics in the agricultural sector of Ukraine plays a crucial role in ensuring food security both domestically and in foreign markets.

“Logistics covers the entire supply chain – from the delivery of seeds, fertilizers and machinery to producers to the transportation of crops to storage, processing, domestic markets and export terminals. Efficient logistics helps to minimize crop losses, preserve its quality and ensure competitive prices,” adds the expert on international logistics and innovative solutions.

Challenges of war: infrastructure losses and risks

Russia’s full-scale invasion has shown the critical importance of stable logistics. The destruction of transport infrastructure, blocking of sea routes, destruction of elevators and mining of agricultural land have complicated agricultural processes. However, Ukraine was able to adapt by expanding export routes through the Danube ports and alternative land corridors to the EU.

Export potential: opportunities and constraints

The European Union remains Ukraine’s main trading partner. Ukrainian grain helps to reduce food inflation in the EU.

“However, neighboring countries view the Ukrainian agricultural sector not only as a partner but also as a competitor, which makes it difficult to enter new European markets. Therefore, the issue of extending trade benefits for exporters and solving the problems of blocking borders is a priority.

Ukraine has significant export potential because of its high quality products. For example, the President of the Ukrainian Grain Association (UGA) conducted an audit in the EU and received positive feedback on the quality of Ukrainian grain, which is recognized as one of the best in Europe,” recalls Dmytro Ustavytskyi.

How medium-sized farmers can enter EU markets

“Ukrainian farmers now have the opportunity to sell grain to the EU without customs barriers. For example, a farmer with 500 hectares of land can supply products directly to processors in Italy. And now Ukrainian grain can reach San Martino in Italy in just 2 weeks!

Currently, 90% of Ukrainian grain (wheat and corn) is supplied to Italy, gradually displacing Russian products from the local market. This demonstrates the effectiveness of Ukrainian logistics, which is gradually integrating into the European infrastructure,” emphasizes the co-founder of the logistics company NIDERA AGRO.

Development of logistics infrastructure: the key to competitiveness

According to the expert, his team has now built a complete logistics chain for farmers:

“Today, farmers have a choice – to sell grain on the domestic market or to export on more favorable terms. Transparency of prices on trading platforms allows us to plan sales more efficiently, which reduces logistics costs,” adds Dmytro Ustavytskyi.

Financial opportunities for exporters

According to the expert in international logistics and innovative solutions, farmers have already learned how to work with foreign exchange contracts, which simplifies export operations. Banks have simplified the mechanism for servicing foreign currency accounts, which helps to avoid exchange rate risks.

“However, exports require certification and professional support. We help small producers to go through this process without risks by providing solutions for exporting consignments of 1,800 tons or more. Quality assurance is a key factor in successful exports,” says Dmytro Ustavytskyi.

Trade strategies and training for farmers

One of the common mistakes, the expert believes, is selling grain immediately after harvest, when prices are lowest. In his opinion, it is more profitable to store products and analyze the market to sell at the most favorable time.

In addition, further improvement of agro-logistics is impossible without investment in:

“At NGO Svit.UA, we are raising these issues and will be organizing meetings with the Ministry of Agrarian Policy to discuss the possibilities of state support for small and medium-sized farmers in entering international markets.

In times of war, export support for small and medium-sized farmers is becoming a strategically important area for food security and economic development.

Ukrainian producers remain important partners for the EU, so there must be a certain trade culture, because the main requirement of European buyers is honesty in terms of quality and quantity of products,” adds Dmytro Ustavytskyi.

In his opinion, Ukraine has unique opportunities to integrate into the European market even despite the challenges of war. Investments in logistics, digital solutions and international cooperation will help make this process efficient and profitable for Ukrainian farmers.

Chinese short video-sharing service operator TikTok plans to invest $8.8 billion in building data centers in Thailand over five years, TikTok’s Vice President of Public Policy Helena Lersch said during an event in Bangkok on Friday.

In January, Thailand’s Board of Investment announced TikTok’s plans to invest $3.8 billion in the country. It is unclear whether this amount is included in the total amount of investments announced by Lersh. The number of TikTok users in Thailand is over 50 million.

Assets of non-state pension funds (NPFs) under the management of ICU Investment Group grew by 20.4% to UAH 1.07 billion in 2024, while the total increase in assets of the entire non-state pension system of the country amounted to 17.3% to UAH 5.72 billion, the group said in a press release on Friday.

“Despite the wartime challenges, the stable operation of NPFs and the growing need for long-term motivational tools for employees have attracted the attention of employers to corporate pension programs,” it quotes Grigory Ovcharenko, director of asset management at ICU Group in Ukraine, as saying.

It is noted that excluding the NPF of the National Bank of Ukraine, the share of assets of the investment group in the context of the entire non-state pension system amounted to 32.1% at the end of this year.

The company reminded that ICU manages the assets of six NPFs: NCPF “Ukreximbank” (NAV as of February – UAH 413.5 million), VNPF “Emerit-Ukraine”, NPF “Dynasty”, NPF “Priчастность”, NPF “Mutual Aid”, NPF “Turbota”.

According to the release, NPF “Turbota” at the end of 2024 increased the amount of contributions by 84.8% (net asset value, NAV as of February was UAH 2.55 million), NPF “Dynasty” – by 42.8% (NAV of UAH 292.4 million) and NPF “Mutual Aid” – by 33% (NAV of UAH 10.6 million).

The leaders of ICU NPFs in terms of net profitability according to the results of 2024 were: NPF “Dynasty” (+19.8%), NPF “Mutual Aid” and ONPF “Emerit-Ukraine” (+18.3%, NAV 328.8 million UAH), which took the fourth, fifth and sixth positions among all NPFs in the country.

“All these funds outperformed inflation, devaluation and yields on hryvnia-denominated government bonds and deposits,” the company notes in the release.

According to ICU information, the number of clients in funds managed by the group increased by 4.4% over the year – to more than 124 thousand people.

ICU Group is an independent financial group providing brokerage, asset management and private equity services. The company is also engaged in venture capital and fintech investments. ICU’s geographic focus is on emerging markets around the world. It has more than $500 million in assets under management and a client investment portfolio of UAH 23.8 billion.

The group, according to its data, has been the largest broker of government bonds in Ukraine for more than 15 years.

The co-owners of ICU are Makar Pasenyuk and Konstantin Stetsenko.