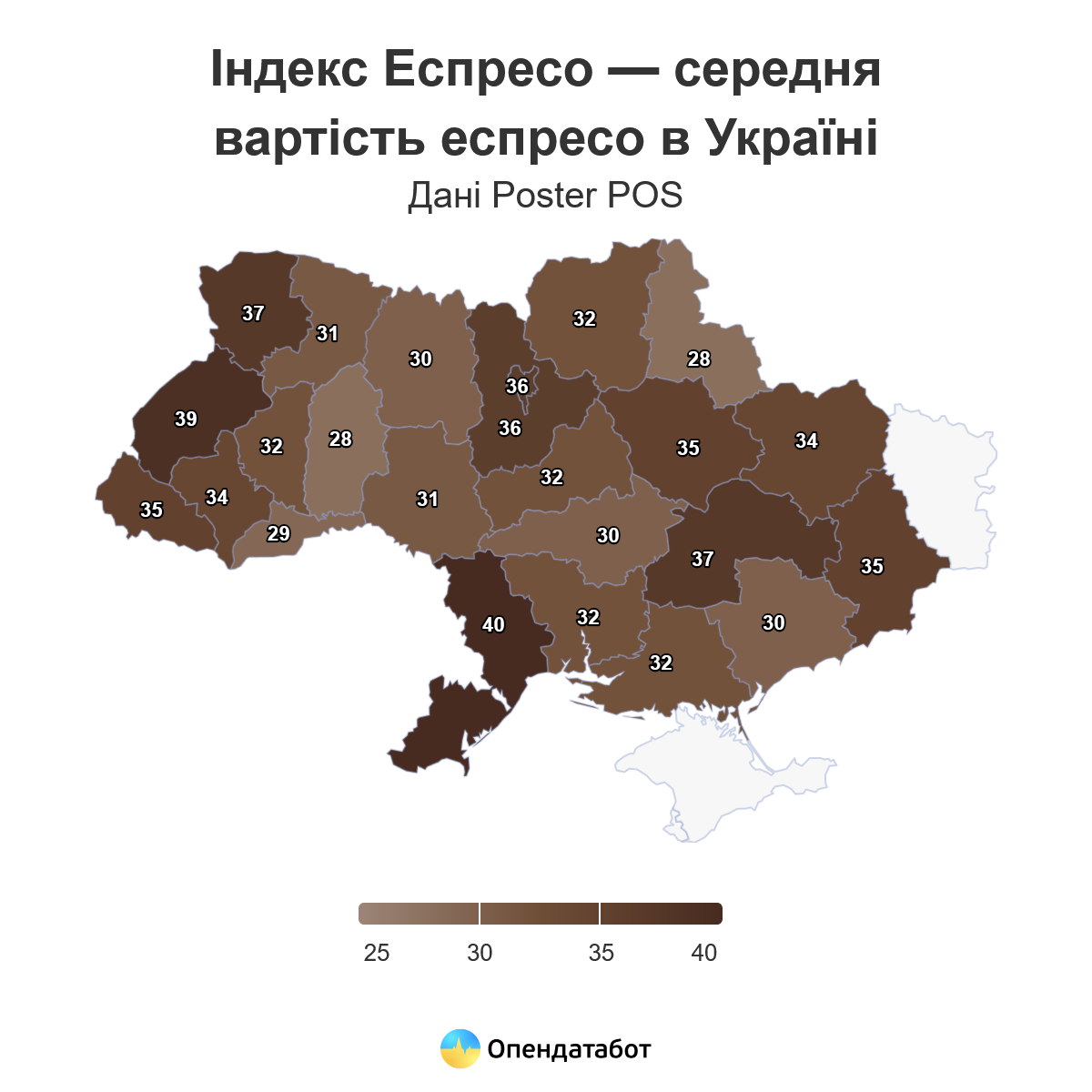

Espresso in Ukraine has risen in price again: In 2024, the average price for a cup of coffee was 31 UAH, which is 11% more expensive than a year earlier, according to the Espresso Index study by Poster POS, conducted for the Opendatabot service.

According to the study, overall, espresso in Ukraine has risen in price 1.7 times since the start of the full-scale war – from UAH 19 in 2021 to UAH 33 at the end of 2024.

As of the end of December, the most expensive coffee in Ukraine, as in 2023, is drunk in Odesa region – 40 UAH per cup. In just one year, the price in the region has increased by 20%. Next comes Lviv region, where a cup of espresso costs UAH 39. The third place was taken by Volyn region, where a cup of espresso costs 37 UAH.

The cheapest coffee for the second year in a row is recorded in Khmelnytsky and Sumy regions: 28 UAH per cup.

The researchers noted that in 2024, the price of espresso rose the most – by 29% – in Vinnytsia region: up to UAH 31 per cup. Only in Kharkiv region did the cost of a cup of espresso remain unchanged at UAH 34.

“Espresso is the main component of every coffee drink, so its cost directly affects the price of any drink in a cafe,” Opendatabot explained.

The Espresso Index is an economic indicator used to measure the cost of a standard portion of espresso in different cities around the world. It can be useful for comparing the price level and cost of living in different places. Such an indicator helps to assess how big the difference in prices for the same goods and services in different countries is, reflects purchasing power and inflation, according to Poster POS.

Ukrainian restaurant automation company Poster POS is a Ukrainian restaurant automation company that is a developer of a HoReCa accounting program that is installed on tablets. More than 50 thousand establishments use the developer’s services.

Last year, Kyiv region received more than UAH 1.155 billion from the state budget to purchase 497 apartments for veterans and their families, Kyiv Regional State Administration reported in a telegram on Saturday.

Thanks to the support of Andriy Zasukha’s charitable foundation and Kolos Kovalivka football club, the first inclusive town with 59 modern houses for veterans was built in the region.

There are nine veteran hubs in the region. These include three classic hubs in Boryspil, Brovary and Irpin, as well as six veteran spaces. Another hub in Bila Tserkva is planned to open soon.

Since the beginning of 2024, 753 combatants have applied to the Kyiv Regional Employment Service. Thanks to the support of the service, 208 people have already found jobs.

There are already 98 veteran-owned businesses in the region, enabling former military personnel to realize their entrepreneurial initiatives.

Over the course of the war, the United States has allocated $177 billion to Ukraine, but we have not received half of these funds, President Volodymyr Zelenskyy said.

“If we take, for example, the money of the United States of America, during this entire time of this war, about 177 billion dollars have been voted or decided. Let’s be honest. We haven’t received half of this money,” Zelensky said in an interview with Lex Friedman published on Sunday on the YouTube channel of the Office of the President of Ukraine.

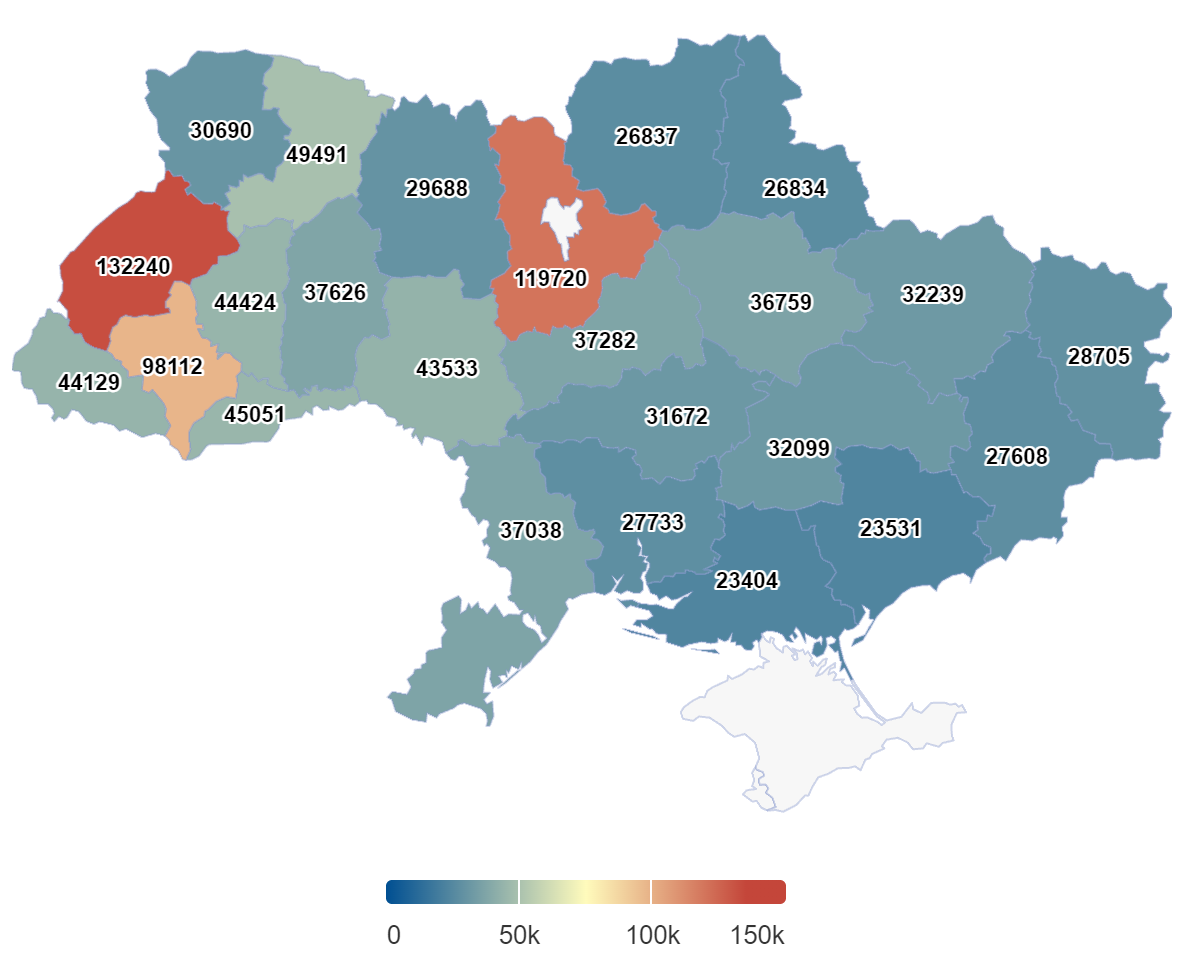

Average price per hectare of land in 2023, UAH

Open4Business.com.ua

A little wet snow and rain is expected on Monday night, January 6, in western regions, and in the afternoon throughout Ukraine, according to Ukrhydrometzetr.

On the roads of the country, except for the south, in some places icy. The wind is southern, 7-12 m/s, in the west, in the afternoon and southern regions in some places gusts of 15-20 m/s.

Temperatures at night 3-8° frost; during the day from 1° frost to 4° warm, in the Carpathian region, in the Crimea and most of the southern regions 4-9° warm.

In Kiev on January 6, there will be no precipitation at night and light wet snow and rain during the day. The wind is southerly, 7-12 m/s. The temperature at night 4-6° frost, during the day 0-2° warm.

According to the Central Geophysical Observatory named after Borys Sreznevsky, in Kiev for all the time of meteorological observations, the highest temperature on January 6 was recorded in 1988 at 9.8° of heat, the lowest in 1935 at 30.8° of frost.

Tuesday, January 7, in Ukraine without precipitation, only in the eastern and northeastern regions at night a little wet snow. On the roads of the country, except for the south, in some places icy. Wind south, southwest, 7-12 m/s.

Temperatures at night from 4° warm to 1° frost; in the daytime 4-9° warm, in southern regions and in the Carpathian region 7-12°. In the Carpathians without precipitation, daytime temperature 0-5° warm.

In Kiev on January 7, no precipitation. The roads are icy in places. The wind is south, southwest, 7-12 m/s. The temperature at night 0-2° of heat, during the day 6-8°.