The volume of commercial output of Kyiv Cardboard and Paper Mill (Kyiv KPK, Obukhiv, Kyiv region), Ukraine’s industry leader in this indicator, amounted to almost UAH 7 billion 984 million in 2024, up 5.5% from 2023, according to statistics from Ukrpapir Association.

According to the statistics provided toInterfax-Ukraine, in physical terms, the plant’s production of corrugated boxes is almost the same as last year’s figure of 228.27 million square meters, which is consistently the best in the industry.

Cardboard production decreased by 5.4% to 156 thousand tons, including production of containerboard by 6.3% to 126.5 thousand tons and boxboard by 1.4% to 29.6 thousand tons.

The production of base paper for sanitary and hygiene products increased by 5.8% to 48.4 thousand tons, and the output of toilet paper in rolls increased by 4.7% to 271.8 million units.

The plant is a stable leader in the production of toilet paper in Ukraine: in 2024, the industry’s main enterprises produced a total of 640.4 million rolls, which is 4.5% more than in 2023.

According to the Association’s data obtained from the main industry enterprises, last year in Ukraine the production of cardboard boxes increased by 12.3% to 590.1 million square meters, paper and cardboard by 3.1% to 601 thousand tons by 2023 (in particular, cardboard production decreased by 0.7% to 463.5 thousand tons, paper production increased by 18.2% to 137.5 thousand tons).

At the same time, the association states that compared to pre-war 2021, the production of corrugated boxes decreased by 21.8%, cardboard – by 37%, and paper – by 14.8%.

Kyiv PDA is the parent company of the eponymous group of companies, one of the largest cardboard and paper products producers in Europe with a staff of more than 2,500 people.

It has, among other things, a 240,000-tonne-per-year cardboard production facility and a 355 million-square-meter corrugated packaging plant, as well as a production facility for the production of base paper and finished products with an annual capacity of 70,000 tons of base paper.

According to the company, last year it paid UAH 1.5 billion in taxes to the budgets, including UAH 1.3 billion to the state budget and UAH 0.205 billion to the local budget.

The Group of companies also includes five procurement enterprises (waste paper and recyclables collection), Palm Mill Print LLC in Kyiv (production of cardboard, flexible, flexo packaging and printing of periodicals) and the transport company Avtospetstrans-KPK.

As reported, in 2023, the plant produced products worth UAH 7 billion 568 million, up 1.8% year-on-year.

Relocation has analyzed the latest data on migration in Italy and identified a number of trends and features. As of the beginning of 2025, 5.2 million migrants officially reside in Italy, which is about 9% of the country’s total population of 58.5 million people. In our study, we rely on official data from the country. It should be borne in mind that, according to various estimates, about 4 million more migrants may reside in Italy illegally. Italy remains an important destination for migrants due to its geographical location, economic opportunities, and EU membership.

Migrants play a significant role in the country’s economy, taking jobs in sectors where there is a shortage of local labor.

Detailed analysis of the main groups of migrants

Employment of migrants by sector

Agriculture:

More than 30% of workers are migrants, mostly from North Africa and Eastern Europe.

The seasonal nature of the work makes this sector particularly dependent on migrants.

Construction:

About 20% of workers are migrants, especially from Albania, Ukraine and North Africa.

Services and domestic staff:

Migrants hold up to 60% of jobs, including cleaning, childcare, and elderly care.

Restaurant and hotel business:

A significant part of the staff (up to 40%) is made up of migrants from Asia and Eastern Europe.

Industry and manufacturing:

Asian migrants (especially Chinese) play a key role in the textile industry.

The system of assistance to migrants in Italy

Migrant reception centers:

In the south of the country, especially in Sicily and Lampedusa, there are centers for temporary accommodation of migrants. Social assistance is provided – financial support for refugees and asylum seekers, as well as integration programs: language courses, professional retraining. Children of migrants are entitled to free education in public schools. Free access to primary health care for all migrants, regardless of their status.

Migrants play an important role in the Italian economy, occupying key positions in agriculture, construction and services. However, the successful integration of these groups requires a comprehensive approach that includes social support, educational initiatives and legal protection. Efforts to improve conditions for migrants will help Italy not only maintain stability in the labor market, but also improve the overall economic climate.

Source: http://relocation.com.ua/analiz-migratsii-v-italii-ot-relocation/

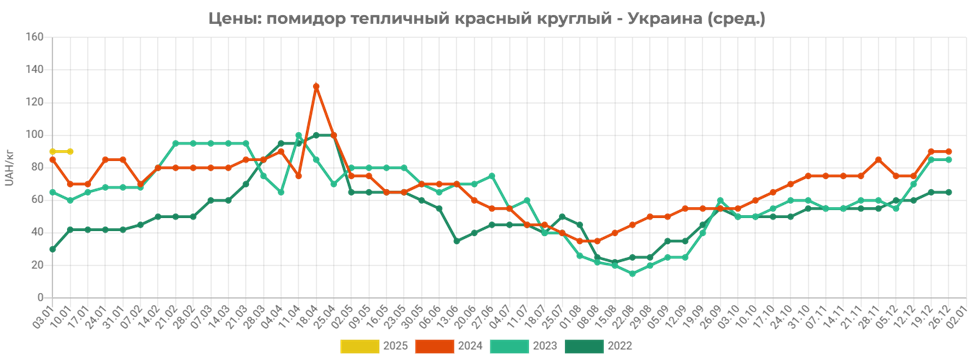

A noticeable decrease in the supply of greenhouse tomatoes on the Ukrainian market this week allowed sellers to slightly increase selling prices in this segment, according to analysts of the EastFruit project. Turkey has traditionally been the main supplier of products at this time of year, but over the past few weeks, Turkey has experienced unfavorable weather conditions, which has led to a significant decrease in the supply of greenhouse vegetables to foreign markets.

According to the daily monitoring of the project, today tomatoes on the Ukrainian market are offered for sale in bulk at 85-105 UAH/kg ($2.01-2.48/kg), which is on average 10% more expensive than at the end of the last working week. At the same time, however, experts note that sellers do not risk raising prices more significantly, given the very weak demand from both wholesale companies and retail chains.

It is worth noting that greenhouse tomatoes in Ukraine are currently being sold on average 36% more expensive than in mid-January 2024. However, many market participants agree that this price situation in this segment is a temporary phenomenon. They do not rule out that tomatoes will start to fall in price again next week, after the supply of Turkish vegetables to the Ukrainian market is normalized.

For more information on the development of the market of greenhouse vegetables and other fruit and vegetable products in Ukraine, please subscribe to the operational analytical weekly – EastFruit Ukraine Weekly Pro. Detailed information about the product is available here.

Source: https://east-fruit.com/novosti/ocherednoj-rost-czen-na-pomidory-v-ukraine/

The National Bank of Ukraine has strengthened the official hryvnia-dollar exchange rate by 1 kopeck after the official hryvnia-dollar exchange rate was raised by 9 kopecks on Wednesday, according to the regulator’s website. – to 42.1729 UAH/$1, according to data on the regulator’s website.

The NBU set the reference rate at 12:00 Thursday at 42.1971 UAH/$1 against 42.2650 UAH/$1 a day earlier.

On the cash market, the dollar exchange rate fell by 21 copecks when buying – to UAH 42.61/$1, and when selling – by 17 copecks. – to UAH 42.70/$1.

In turn, analysts of the currency exchange market operator “KIT Group” for the near future predict the hryvnia exchange rate to remain in the corridor of 42-43 UAH/$1, looking at the stabilization process after a seasonal surge in demand for currency at the end of 2024.

“Low economic and business activity in January will contribute to the stability of the exchange rate on a short horizon. Evidence of this is the spread between the rates of buying and selling of the dollar: it remains relatively stable, which indicates the balance of supply and demand in the foreign exchange market of Ukraine”, – analysts note in the January review-forecast of the situation in the foreign exchange market.

According to their expectations, during the first half of the current 2025 hryvnia is very likely to weaken to 44 UAH/1$, which is fully consistent with the government’s budget forecast for this year.

“Avoidance of exchange rate extremes during the first half of the year will allow the National Bank and the economic block of the government to keep the exchange rate reserve to keep within the projected parameters of the average annual rate of UAH 45/$ according to the results of the current year”, – emphasize the experts of ‘KIT Group’.

At the same time, in their opinion, controlled devaluation may become one of the tools to fill the budget at the expense of duties and other fixed charges in foreign currency, including some excises.

The European Bank for Reconstruction and Development (EBRD) provided almost EUR2.4 billion to Ukraine last year, up from EUR2.1 billion in 2023, a record high in the history of cooperation with the country, the bank said in a press release on Thursday.

“The Bank is the largest institutional investor in Ukraine, which has significantly increased its investments since the start of the full-scale Russian invasion in February 2022. The total amount of financing provided by the EBRD in Ukraine during the war is almost EUR 6.2 billion,” the statement said.

It is noted that the priority areas of the EBRD’s activities in Ukraine remain support for energy security, vital infrastructure, food security, as well as trade and the private sector. The press service clarifies that trade finance is taken into account in the total volume along with investments.

The EBRD plans to maintain its investments in Ukraine at around EUR 1.5 billion per year, with a potential increase during the recovery phase, following an agreement reached in 2023 to increase the bank’s capital by EUR 4 billion to EUR 34 billion.

“Our shareholders have shown tremendous confidence in us by approving a significant capital increase to support our operations in Ukraine and other war-affected countries. Most of all, I would like to see 2025 become a year of recovery. This is where the EBRD is able to make the most of itself – we use our financial expertise to help rebuild better than before,” EBRD President Audrey Renaud-Basso said.

It is specified that the total amount of financing provided by the EBRD in 2024 reached EUR 16.6 billion, which is 26% more than the previous record of EUR 13.1 billion in 2023.

The EBRD was founded in 1991. According to the latest data, the financial institution has invested more than EUR 21.29 billion in Ukraine since then. The current portfolio consists of 614 projects worth EUR5.58 billion.

Knauf Gypsum Rock LLC has won the auction for a 20-year special permit for gypsum mining at the Skoviatynske deposit in Ternopil region, according to the results of the bidding on Prozorro.Sale.

Two companies participated in the auction held on Thursday, January 16, by the State Service of Geology and Subsoil of Ukraine, with a starting price of UAH 119 million 608 thousand 594.06 excluding VAT. The winner, Knauf Gypsum Skala LLC, offered UAH 121.05 million excluding VAT for the license, while the second bidder, Kamianets-Podilskyi Gipsovik JSC, offered UAH 120.55 million.

The 115-hectare Skoviatynske deposit is located 1-2 km from the village of Shyshkivtsi in Chortkiv (formerly Borshchiv) district and is the largest in Ternopil region with gypsum reserves of 43.9 million tons. Knauf has been developing the Shyshkovets deposit adjacent to Skoviatynske since 2006. As of 2021, the Shyshkovetsky deposit covered an area of 41 hectares and had reserves of over 11.4 million tons of gypsum.

Knauf is a leading global manufacturer of gypsum and building materials.

Currently, Knauf has an operating plant in Kyiv, which produces about 25 million square meters of gypsum board and 200 thousand tons of dry mixes. Previously, Knauf also owned a plant in Soledar (Donetsk region), which was destroyed by the occupiers. The company took its employees out and employed them at the Kyiv plant, which employs 425 people in total.

As reported, the German company Knauf will build a plant for the production of drywall and dry building mixtures in Borshchiv (Ternopil region), with investments in the project amounting to EUR 150 million, with a design capacity of 30 million square meters of drywall and 320 thousand tons of dry mixtures.

According to Opendatabot, at the end of 2023, the Knauf plant in Kyiv (Knauf Gypsum Kyiv LLC) increased its net income by 65% to UAH 3.53 billion, and net profit by 2.6 times to UAH 1 billion.