Poninkivska Cardboard and Paper Mill-Ukraine (PKPF-Ukraine, Khmelnytsky region), a major Ukrainian corrugated cardboard producer, increased its corrugated packaging output by 18.7% in January-November 2024 compared to the same period in 2023, to 89.7 million square meters.

As reported, in the first ten months of the year, the increase in corrugated packaging production was also 18.7% compared to the same period in 2023.

According to Ukrpapir Association statistics provided to Interfax-Ukraine, the mill continues to be one of the top three producers of corrugated packaging after Kyiv Cardboard and Paper Mill and Trypillia Packaging Mill.

Over 11 months, the company also increased its production of containerboard (including corrugated paper) by 3.5% to 73.2 thousand tons, and paper by 28% to 0.92 thousand tons.

In monetary terms, in January-November, PCPF-Ukraine produced products worth UAH 2 billion 487.3 million (+17.9%).

As reported with reference to the data collected by the association from the main enterprises of the industry, in January-November, the production of paper and cardboard in Ukraine increased by 2.6% compared to the same period in 2023 – up to 549.7 thousand tons, cardboard boxes – by 13.4%, to 539.7 million square meters.

Poninkivska Paper Mill (formerly Poninkiv Cardboard and Paper Mill), once the largest producer of school notebooks, now has one main production facility – paper and cardboard, producing mainly corrugated cardboard and corrugated packaging, as well as wrapping and waste paper.

The plant is part of the United Cardboard Company-Ukraine (UCC, Lutsk) owned by businessman Mykola Lobov, whose production assets include, among others, Lutsk KPF-Ukraine (Volyn region), which produced 58.3 thousand tons of various cardboard (down 3.7%) and 44.65 million square meters of corrugated boxes in 11 months (according to Ukrpapir), compared to 13.5 million square meters a year earlier.

As reported, in 2023, PCPF-Ukraine produced products worth almost UAH 2 billion 450 million, up 3% year-on-year. Net profit increased 2.7 times to UAH 27 million.

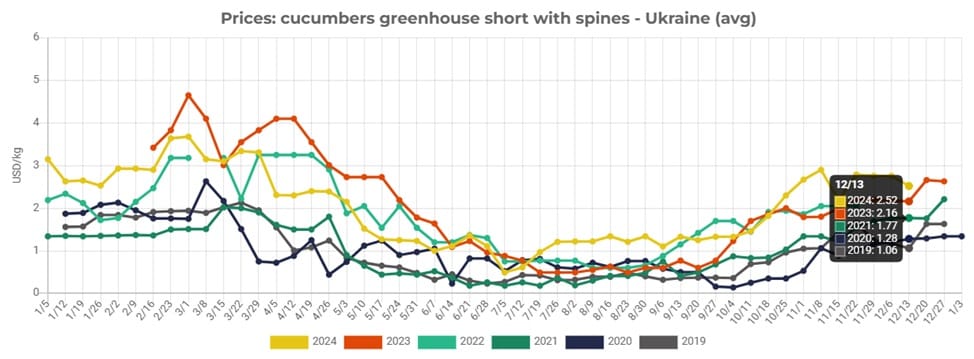

This week, wholesale prices for cucumbers in Ukraine have started to decline again, according to analysts from the EastFruit project. Sellers describe this step as a necessary measure due to the unusually low demand for greenhouse cucumbers in mid-December.

Currently, greenhouse cucumbers are being sold at 80-110 UAH/kg ($1.92-2.64/kg), which is on average 11% cheaper than the previous week. Market operators attribute this price drop to wholesale companies and retail chains increasingly refusing to purchase large batches of greenhouse cucumbers, citing low retail sales. As a result, significant volumes of unsold products have accumulated in warehouses, with their quality deteriorating.

However, it is worth noting that greenhouse cucumbers in Ukraine are still, on average, 21% more expensive than during the same period last year. Most market operators consider this situation temporary and do not rule out the possibility that prices in this segment may start to rise again as early as next week.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

In January-November 2024, Kokhavynsk Paper Mill (KPM, Lviv region), which produces sanitary paper products, increased its production by 81.9% compared to the same period in 2023, to UAH 1 billion 922 million, according to statistics from UkrPapir Association.

As reported, in the first 10 months of the year, the factory’s production growth was 78.3% compared to the same period in 2023, and in the first nine months it was 75.1%.

According to the association’s statistics provided to Interfax-Ukraine, in physical terms, the production of the base paper for sanitary products at the mill increased by 41% to 53.65 thousand tons during this period.

The production of toilet paper in rolls amounted to 125 million units, slightly (by 1.4%) decreasing in January-November 2023. KPF confidently ranks second in terms of its output after Kyiv CPP.

As reported, in October last year, Kokhava Pulp and Paper Mill put into operation a paper machine for the production of cellulose base paper (previously, it produced products only on a waste paper basis). To organize such production in 2021, the mill attracted a EUR 13.8 million loan from the EBRD.

Kokhava Pulp and Paper Mill, which has been operating since 1939, produces base paper for sanitary and hygiene products, as well as toilet paper and paper towels. Before the new machine was put into operation, the mill had two paper machines with a total capacity of 40 thousand tons of base paper per year.

In 2023, the plant increased its production by 18% compared to 2022 to UAH 1 billion 151.2 million, while net profit increased 2.7 times to UAH 137 million.

This week, Ukraine’s potato market has experienced a notable uptick in trading activity, according to analysts from the EastFruit project. Industry experts highlight that, in response to rising demand, farmers are continuing to increase their selling prices in this segment.

Currently, potato prices are being declared in the range of 22-30 UAH/kg ($0.53-0.72/kg), which represents an average increase of 22% compared to the previous week.

Market operators attribute this heightened trading activity to the growing interest from wholesale companies and retail chains, which have already begun stocking up for the New Year holidays. While further price increases in this segment are not ruled out, a sharp rise in prices is considered unlikely.

It is noteworthy that, as of today, potatoes in Ukraine are being sold at an average of 85% higher than during the same period last year. This significant price hike is primarily due to a reduction in potato production in Ukraine this year, largely caused by the drought that affected almost all major potato-growing regions during the summer.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

Beer production in Ukraine in January-November 2024 reached 129.8 million dal, up 4.9% compared to the same period in 2023, according to the website of the industry organization of brewers Ukrpyvo.

“The expert estimate of beer production in Ukraine (except for non-alcoholic beer with an alcohol content of up to 0.5 vol%) for 11 months of the year is 129.8 million dal, which is 104.9% compared to the same period in 2023. At the same time, this figure is only 82.5% of the production volumes for 11 months of 2021,” the statement said.

As reported, beer production in Ukraine in 2023 increased by 7.8% compared to 2022. At the same time, in 2022, it fell by 27.9% compared to 2021 – to 122.8 million dal.

Norway will allocate 2.7 billion kroner ($242.38 million) to strengthen the Ukrainian navy and help deter Russian naval forces in the Black Sea, Prime Minister Jonas Gahr Støre said, Reuters reports.

“It is necessary to protect the population and infrastructure of Ukraine from attacks by the Russian Black Sea Fleet,” Reuters quoted the Norwegian prime minister as saying on Monday.

“It is also important to protect the export of grain and other products by sea, which bring Ukraine its most important revenues,” he added.