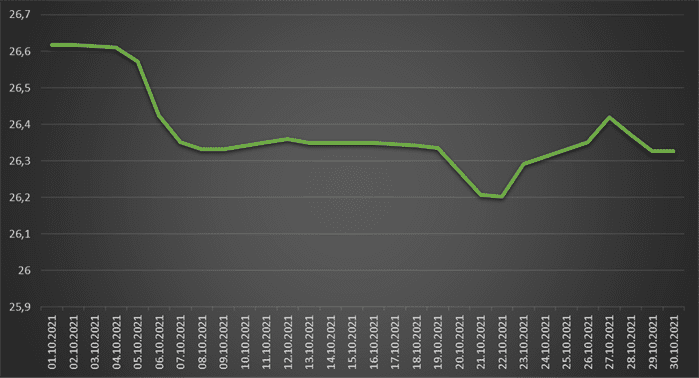

Quotes of interbank currency market of Ukraine (UAH for $1, in 01.10.2021-39.10.2021)

The number of citizens’ complaints to the National Bank of Ukraine (NBU) in July-September 2021 amounted to 29,000, which is 13.7% more than in the previous quarter (25,500), according to a report on work with complaints from consumers of financial services, published on the regulator’s website on Wednesday. At the same time, number of written complaints in the third quarter increased by 18%, to 11,340, and the number of calls to the call center – by 10%, to 17,400.Most of the complaints from consumers relate to the work of nonbank financial institutions: 8,720 written complaints and 5,750 calls to the call center.One of the main reasons for the growth in the number of applications is Law No. 1349-IX on the regulation of collection activities, which came into full force on July 14, 2021.“It clearly outlined the rights of consumers of financial services and bans on the work of debt collectors. That is why citizens began to complain more often to the National Bank about the violation by debt collectors and lenders when settling overdue debts,” the central bank said.According to the report, debt management and unethical behavior of debt collectors and credit institutions is the most common topic of both written complaints (47% of the total) and calls to the call center (19%).In addition, in their written requests, consumers asked questions about loans from nonbank financial institutions (23%), relations on compulsory types of insurance (8%), bank loans (7%).At the same time, the topical topics of calls to the call center were loans from nonbank financial institutions (14%), issues of banknotes and coins (11%), relations under bank loan agreements (7%).According to the NBU, 45% of written requests had signs of violation of the rights of consumers of financial services.Among the problematic issues in the work of nonbank financial institutions is the accrual of interest over the loan period, fraud using lost consumer documents, problematic issues with insurance companies, tough methods of collecting bad debts.Among the problematic issues identified in the work of banks are also cases of fraud with customer accounts, the imposition of additional services, tough actions to collect bad debts.

State-owned Ukreximbank (Kyiv) has expanded the list of securities for investment, and offers its clients corporate eurobonds placed on international stock markets and admitted to circulation on Ukrainian stock exchanges.According to the financial institution, in addition to sovereign eurobonds at the request of clients, Ukreximbank carries out operations with eurobonds of Ukrainian companies Naftogaz Ukrainy, Metinvest, Kernel Holding, MHP SE, and DTEK Renewables.In addition, clients can purchase eurobonds of Ukrainian Railway (Ukrzaliznytsia), Vodafone Ukraine, Ukravtodor, Oschadbank, Ukreximbank. In the future, the bank plans to expand the list of investment services and provide access to trading in shares of foreign companies, the press release says.“Among the first transactions, a significant one is the acquisition by our client […] of corporate eurobonds of Ukreximbank. We value the trust of our clients and are glad that now, among the instruments for placing funds, we can offer, among other things, investments in debt instruments of international capital markets,” member of the bank’s board Mykhailo Medko said.Ukreximbank was founded in 1992, its sole owner is the state. According to the National Bank of Ukraine, as of September 1, 2021, Ukreximbank ranked third in terms of total assets (UAH 241.973 billion) among 72 banks operating in the country.

The single counterparty exposure limit (H7, should be no more than 25%) as of February 1 was violated by Prominvestbank (65.76%), Industrialbank (50.9%) and Sberbank (52.37%), according to the website of the National Bank of Ukraine (NBU).

According to the regulator, the related party transactions exposure limit (H9, should not exceed 25%) was violated by Megabank (28.43%), First Investment Bank (51.46%) and Unex Bank (28.71%).

The limit on bank total long open FX position (L13-1, should be no more than 10%) was violated by Prominvestbank (93.24%), Oschadbank (127.7%), PrivatBank (103.67%) and Industrialbank (10.6%).

The limit on bank total short open FX position (L13-2, should be no more than 10%) was violated by Prominvestbank (93.28%).