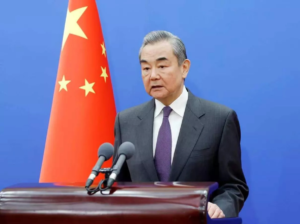

Chinese Foreign Minister Wang Yi, speaking on the sidelines of the Munich Security Conference, said that “the door to dialogue in Ukraine is open, and all parties should strive to reach a comprehensive and lasting peace agreement and eliminate the root causes of the conflict,” and called on Europe to be more active in peace efforts, according to a correspondent for Interfax-Ukraine.

“The doors to dialogue have finally opened on the ‘Ukrainian crisis’ (Russia’s full-scale war against Ukraine – IF-U). All interested parties should seize the opportunity to achieve a comprehensive, durable, and binding peace agreement, eliminate the root causes of the conflict, and ensure lasting peace and stability in Europe,” he said.

According to the Chinese foreign minister, Europe should not stand by and watch.

“Since the conflict broke out here in Europe, Europe has every right to participate in the negotiations at the appropriate time. Europe should not be on the menu, but at the negotiating table,” he said.

“Now we see that Europe has found the courage to negotiate with Russia. This is good, and we support it,” Wang Yi emphasized.

At the same time, in his opinion, dialogue should not be conducted for the sake of dialogue itself, and Europe should offer new ideas and new plans to resolve this issue.

” And in this process, we need to promote the creation of a more balanced, effective, and sustainable security architecture for Europe. Consequently, by doing so, we are addressing the root causes of the crisis and can prevent its recurrence. And to achieve sustainable and lasting peace, China, for its part, will fully support the peace process,” the foreign minister concluded.

He also clarified that China is not a party directly involved in the conflict, has no right to make a final decision, and is only facilitating peace talks.

Regarding relations between China and the EU, Wang Yi expressed his conviction that they should be partners, not systemic rivals or strategic competitors.

“But there are differences and disagreements between our two sides, for example, our social systems, our values, and our development models, but that is because we have different histories and cultures, and based on that, our peoples have different choices regarding the path of development. But that does not mean that we should become rivals or competitors,” the minister said.

He declared that it is more important for China and the EU to practice multilateralism, defend the authority of the UN, say “no” to unilateral practices, uphold free trade, and oppose bloc confrontation.

Information that China’s Foreign Minister Wang Yi said Ukraine is viewed as a “friend and partner” is confirmed by China’s official statements. The remark was made on February 15, 2025, during Wang Yi’s meeting with Ukraine’s Foreign Minister Andrii Sybiha on the sidelines of the Munich Security Conference, Xinhua reported.

According to Xinhua’s publication, Wang Yi noted that China and Ukraine maintain a “traditional friendship,” and that bilateral relations are based on the strategic partnership established in 2011. He also said Beijing is ready to work with Kyiv to advance bilateral relations and practical cooperation despite “unfavorable factors.”

In 2026, the topic of China–Ukraine contacts was again brought to the fore at this year’s Munich conference. Ukraine’s Foreign Minister Andrii Sybiha said on February 13, 2026, that he invited Wang Yi to visit Ukraine and stated that China could help achieve an end to the war.

The volume of tractor imports to Ukraine in January 2026 amounted to $33.3 million, which is 24.2% less than in the same month of 2025 ($43.9 million), according to statistics from the State Customs Service.

According to the published statistics, tractor imports decreased by 2.5 times compared to December last year.

Last month, tractors were imported mainly from China (31.2% of total imports of this equipment, or $10.4 million), the United States (13.3%, or $4.4 million), and Germany (11.8%, or $3.9 million), while last year China was also the leader ($9.34 million), Germany was second ($5.5 million), and the United States was third ($3.7 million).

According to statistics from the State Customs Service, last month $0.4 million worth of tractors were exported, mainly to Belgium (31.8%), while last year exports amounted to $0.56 million, with most supplies going to Zambia (41.4%).

As reported, the volume of tractor imports to Ukraine in 2025 reached $845.7 million, exceeding the 2024 figure by 7.9%. The main suppliers were the United States ($179.7 million), Germany ($145 million), and China ($142.8 million). Exports amounted to $6.6 million, compared to $5.4 million in 2024, and were mainly to Romania, Belgium, and Germany.

Chinese smartphone manufacturers have notified their partners of an increase in purchase prices, which could result in retail prices for devices rising by 15-30%, with smartphones bearing the new price tags going on sale in March-April 2026.

The most significant price increases are expected in the mid-range and high-end segments, as well as for models with increased built-in memory and storage capacity. Market participants cite the rising cost of components responsible for device memory, primarily RAM and ROM modules, as one of the reasons for the price increases.

The backdrop for the price increase is being formed on the global memory market: due to rapid growth in demand from AI infrastructure, DRAM and NAND manufacturers are reallocating capacity in favor of more marginal solutions for data centers, which is squeezing supply for consumer electronics and supporting the growth of memory prices.

Imports of electric batteries and separators to Ukraine in 2025 increased by 55% compared to 2024, to $1.476 billion, according to data from the State Customs Service.

According to statistics, China remained the main supplier of batteries in 2025, accounting for $1.12 billion, or 76% of imports. Next came Vietnam ($97 million, 6.6%) and Taiwan ($54.6 million, 3.7%). In 2024, China’s share of imports was 84.3%, followed by the Czech Republic (2.6%) and Bulgaria (2.5%).

In December 2025, imports of these products increased by 74% compared to December 2024, to $243.5 million, which is also 37% more than in November 2025.

Exports of batteries from Ukraine in 2025 amounted to $52.7 million, compared to $41.6 million a year earlier. The main destinations for exports were Poland (34.1%), Germany (12.5%), and France (11%). In 2024, Ukraine exported batteries mainly to Poland (30.5%), France (almost 15%), and Germany (11.2%).

As reported, at the end of July 2024, Ukraine exempted the import of power generator equipment and batteries from customs duties and VAT. According to the State Customs Service, in 2024, battery imports more than doubled compared to 2023, amounting to $950.6 million.

China’s population in 2025 decreased by 3.39 million people to 1 billion 404.89 million, according to a report by the National Bureau of Statistics (NBS). The population has declined for the fourth consecutive year.

This included 716.85 million men and 688.04 million women. These figures do not include the populations of Hong Kong, Macao, and Taiwan, as well as foreigners living in China.

Last year, 7.92 million children were born in the country, compared to 9.54 million a year earlier. This is the lowest level in the history of calculations (since 1949). The birth rate was 5.63 per 1,000 people, compared to 6.77 in 2024.

The sharp decline may be partly due to the increase in 2024, most of which occurred during the Year of the Dragon, which is considered auspicious for marriage and childbirth in Chinese culture, experts note.

The number of deaths in China in 2025 increased to 11.31 million from 10.93 million a year earlier, according to the NBS. The mortality rate rose to 8.04 per 1,000 people from 7.76.

People aged 16 to 59 accounted for 60.6% of the total population, while those aged 60 and older accounted for 23%.

Cities were home to 953.8 million people, which is 10.3 million more than at the end of 2024. The number of permanent residents in rural areas decreased by 13.69 million to 451.09 million people. As a result, the share of the urban population increased by 89 basis points to 67.89%.

The average number of years of schooling among the population aged 16 to 59 reached 11.3 years, which is 0.1 years more than in 2024.

At the end of 2025, China’s GDP increased by 5% to 140.2 trillion yuan. The growth rate coincided with the government’s target and the pace of economic growth in 2024.