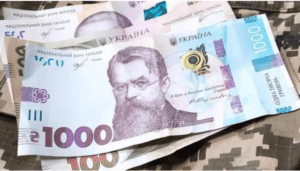

The Ministry of Finance of Ukraine at primary auctions on Tuesday, April 19, for the first time will offer buyers the full range of military bonds – both hryvnia and currency in dollars and euros.

According to the announcement of the Ministry of Finance, in particular, hryvnia military bonds with maturity in 6 months will be put up for auction. and 14 months, as well as 12 months. dollar bonds and 7-month. euro bonds.

Rates on these hryvnia bonds at the last auctions were respectively 10% and 11% per annum, on dollar bonds – 3.7%, and on euro bonds – 2.5% per annum.

As reported, the Ministry of Finance last week, at the seventh auctions for the placement of military bonds, was able to attract UAH 6.17 billion compared to UAH 0.96 billion a week earlier and UAH 3.33-4.88 billion in the previous three weeks. Currency notes were not offered last Tuesday.

The total volume of issuance of military bonds is up to UAH 400 billion. They can be bought by the National Bank, which has already purchased these securities under a separate procedure for UAH 40 billion.

At market auctions since March 1, their sales amounted to UAH 34.9 billion, $11.9 million and EUR143.4 million.

The hryvnia exchange rate on the interbank FX currency market weakened to UAH 28.005/$1 on Friday from UAH 27.860/$1 on the previous business day, dealers of commercial banks has told Interfax-Ukraine.

According to them, the quotes of the national currency at the close of trading amounted to UAH 27.995-UAH 28.015/$1.

According to the data of the National Bank of Ukraine, the hryvnia reference rate on the interbank FX market weakened to UAH 27.94/$1 on Friday from UAH 27.70/$1 on Thursday.

At the same time, the regulator weakened the exchange rate of the national currency for January 17 to UAH 27.9514/$1 from UAH 27.7372/$1 the day before.

Vodafone Ukraine (PrJSC VF Ukraine) at the end of 2020 cut its net profit by 52.4% compared to 2019, to UAH 1.2 billion.

Vodafone Ukraine CEO Olha Ustynova said that the drop in net profit was due to the exchange rate difference.

“The only and main factor why this happened is the exchange rate difference on our loan. The U.S. dollar exchange rate has changed, the $500 million loan, which is more than [UAH] 1 billion of loss as a result to our net profit,” she said during the presentation last year’s results on Tuesday.

According to her, the company’s revenue last year increased 14% and amounted to UAH 18 billion, and the OIBDA (operating income before depreciation of fixed assets and intangible assets) grew by 18% year-over-year, reaching UAH 9.8 billion.

The number of Vodafone Ukraine customers in the country at the end of the year amounted to 19 million. The operator’s 4G network covers 81% of the country’s territory, which is 12% higher than the previous indicator for 2019.

At the end of 2020, the number of Vodafone Ukraine data users was 12.2 million, and the number of 4G users was 7.3 million.

Over the past year, the use of data traffic grew by 26%.

Vodafone Ukraine is the second largest mobile network operator in Ukraine.

The total government debt of Ukraine in March 2020 decreased by 3.62% in dollar terms, to $80.38 billion, and in the hryvnia it increased by 10.15% and amounted to UAH 2.255 trillion, the Ministry of Finance has reported. According to the Ministry of Finance, direct public debt in March this year in dollar terms decreased by 3.71%, to $70.87 billion, while in hryvnias it grew by 9.98%, to UAH 1.988 trillion. In particular, external direct debt in March decreased by 0.4%, to $40.34 billion.

State-guaranteed debt last month increased by 11.33%, to UAH 266.7 billion, in dollars decreased by 2.96%, to $9.51 billion. In particular, external debt fell by 11.23%, to UAH 255.83 billion, in dollars it external guaranteed debt decreased by 2.98%, to $9.12 billion.

Since the beginning of the year, the total public debt decreased by almost 4% in dollar terms and increased by 8.4% in hryvnias, according to the ministry.

As reported, the total and state debt of Ukraine in February decreased due to the weakening of the hryvnia by 1.46% in hryvnias and by 0.02% in dollar terms.