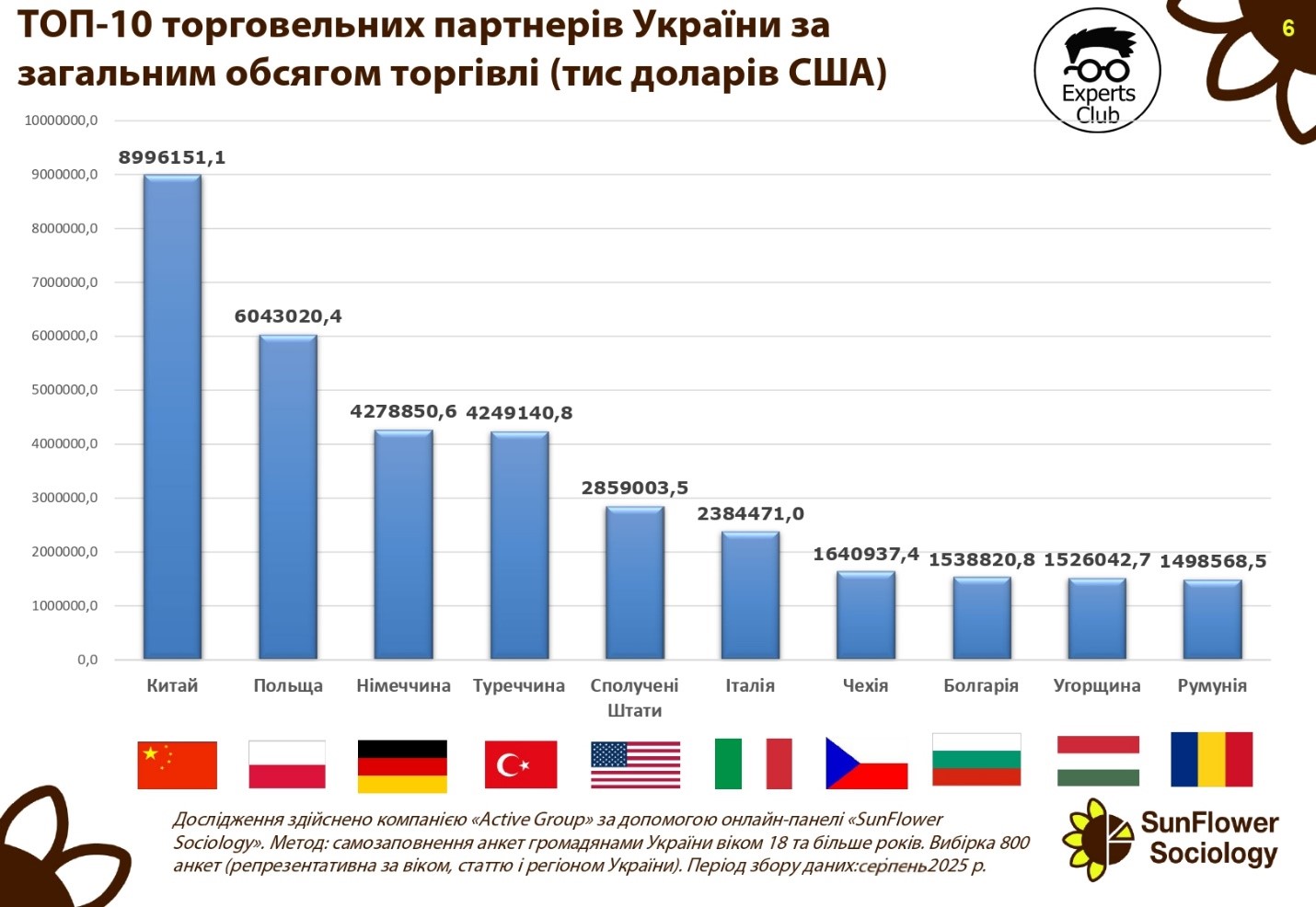

In terms of total trade volume, Ukraine cooperates most closely with China, Poland, and Germany. These countries form the basis of the state’s foreign economic relations, exerting a critical influence on imports and exports.

China remains the leader with a total trade volume of $8.99 billion. Poland ranks second with $6.04 billion, while Germany and Turkey are almost equal with $4.28 billion and $4.25 billion, respectively. The United States ranks fifth with $2.86 billion.

The top 10 also includes Italy ($2.38 billion), the Czech Republic ($1.64 billion), Bulgaria ($1.54 billion), Hungary ($1.53 billion), and Romania ($1.50 billion).

“The top ten partners form the basis of Ukraine’s foreign trade balance. China and the EU countries account for the largest volumes of trade, but it is important to take into account the significant negative balance in relations with these countries,” said Maksim Urakin, founder of Experts Club and economist.

He added that although the large volume of trade indicates Ukraine’s integration into global supply chains, dependence on imports from China and Europe creates strategic risks.

“Poland and Germany are key hubs for Ukrainian exports, but at the same time they are significant sources of imports. Therefore, it is critically important to balance trade flows, preserving positive sectors such as agriculture and metallurgy, and reducing dependence on critical imports,” Urakin noted.

BULGARIA, CHINA, CZECH REPUBLIC, ECONOMY, EXPERTS CLUB, FOREIGN TRADE, GERMANY, HUNGARY, ITALY, POLAND, ROMANIA, TURKEY, UKRAINE, USA, МАКСИМ УРАКИН

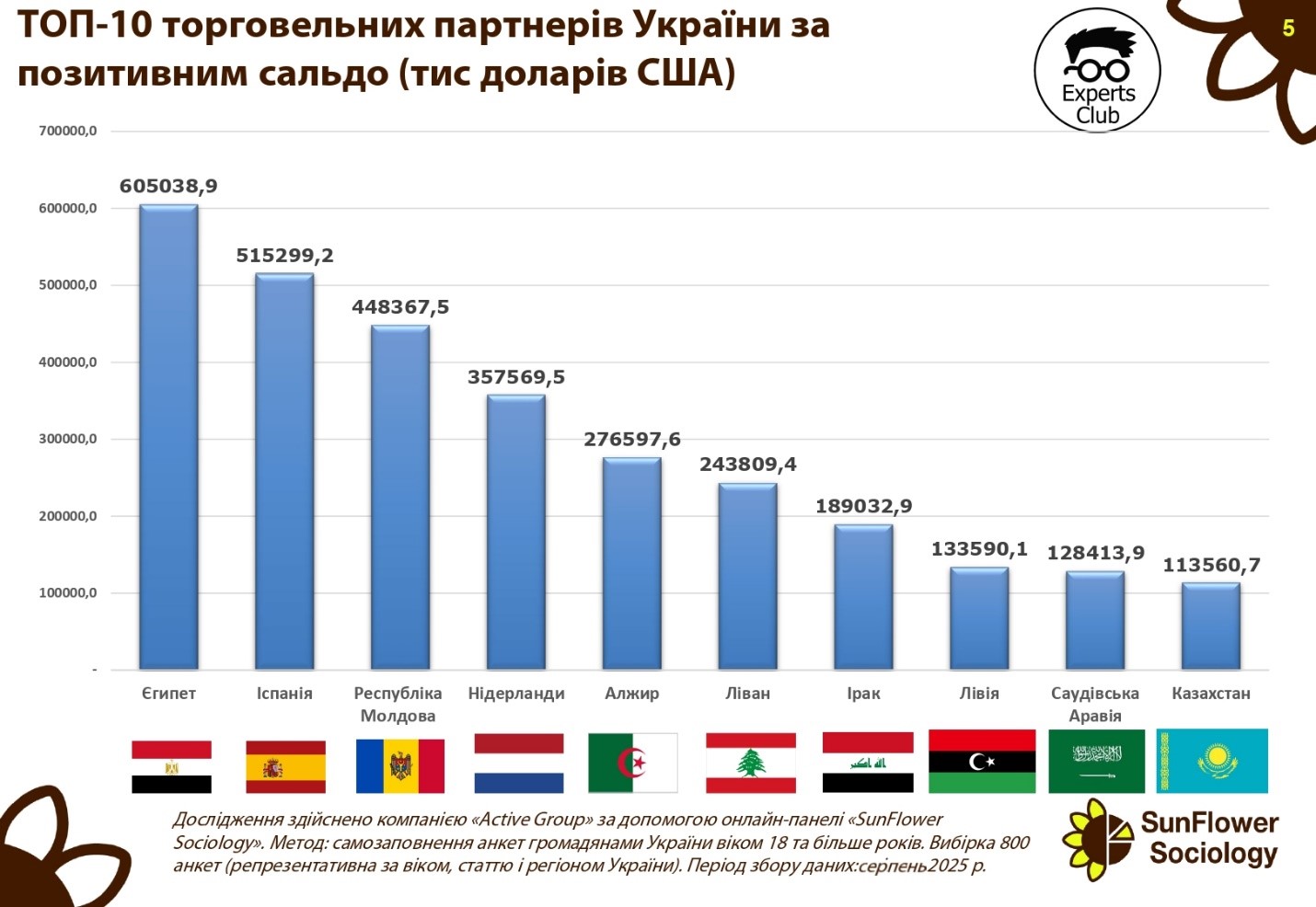

Ukraine maintains a significant positive trade balance with a number of key partners, which partially offsets the deficit in relations with China and EU countries.

The largest surplus in the first half of 2025 was recorded in trade with Egypt — $605.0 million. Spain ranks second with a balance of $515.3 million, followed by the Republic of Moldova — $448.4 million. Positive dynamics are also observed in relations with the Netherlands ($357.6 million), Algeria ($276.6 million), and Lebanon ($243.8 million).

Ukraine also has a high trade surplus with Iraq ($189.0 million), Libya ($133.6 million), Saudi Arabia ($128.4 million), and Kazakhstan ($113.6 million).

“The positive trade balance indicates that Ukraine is capable of competing effectively in international markets, especially in the agricultural sector and metallurgy. At the same time, it should be borne in mind that these markets are vulnerable to changes in the global economic situation, price fluctuations, and political factors,” emphasized Maksim Urakin, founder of Experts Club and economist.

According to him, maintaining a positive balance in relations with the countries of the Middle East and North Africa is a key element of Ukraine’s foreign trade strategy.

“Egypt, Spain, and the countries of the Arab world are stable importers of Ukrainian agricultural products. This is a strategic direction that needs to be developed further, as it creates a safety cushion for the economy against the backdrop of significant import costs,” Urakyn emphasized.

Analysts note that consolidating positions in the African and Middle Eastern markets could become a long-term factor in strengthening Ukraine’s foreign economic balance.

Agricultural exports, ALGERIA, ECONOMY, EGYPT, EXPERTS CLUB, FOREIGN TRADE, IRAQ, KAZAKHSTAN, LEBANON, LIBYA, MOLDOVA, NETHERLANDS, positive balance, SAUDI ARABIA, SPAIN, UKRAINE, МАКСИМ УРАКИН

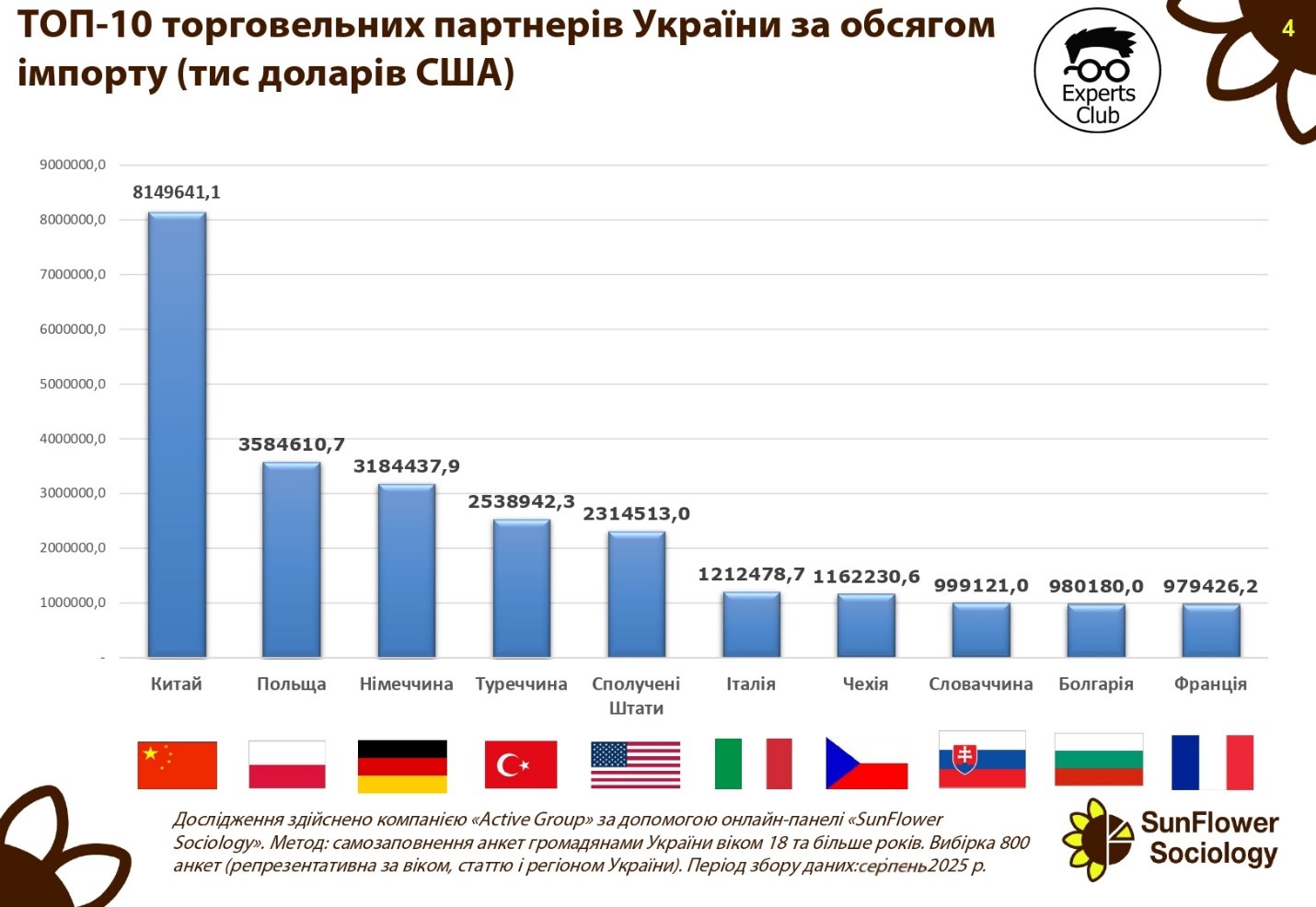

China remains the undisputed leader among Ukraine’s trading partners in terms of import volume. In the first six months of 2025, Ukraine imported Chinese goods worth US$8.15 billion. This is more than twice the figures for Poland ($3.58 billion) and Germany ($3.18 billion), which ranked second and third, respectively.

High import volumes were also recorded from Turkey ($2.53 billion) and the United States ($2.31 billion). Italy, the Czech Republic, Slovakia, Bulgaria, and France round out the top ten key suppliers with volumes ranging from $1.2 billion to $979 million.

“The formation of such an import structure indicates Ukraine’s excessive dependence on Chinese goods, especially in the electronics, technology, and industrial products segments. Such an imbalance poses risks to economic stability, as any political or logistical restrictions will immediately affect the domestic market,” emphasized Maksim Urakin, founder of Experts Club and economist.

At the same time, experts point to the diversification of supplies from European Union countries. Poland, Germany, Italy, and France together account for more than $8.5 billion in imports, forming a significant segment of the domestic consumer and industrial market.

Economists predict that, provided the hryvnia exchange rate remains stable and import flows continue at current levels, the trade deficit with China will continue to grow. This will require an adjustment of state trade policy towards stimulating domestic production and searching for alternative markets.

ACTIVE GROUP, CHINA, ECONOMY, EU, EXPERTS CLUB, GERMANY, IMPORTS, POLAND, SunFlower Sociology, TRADE BALANCE, TURKEY, UKRAINE, USA, МАКСИМ УРАКИН

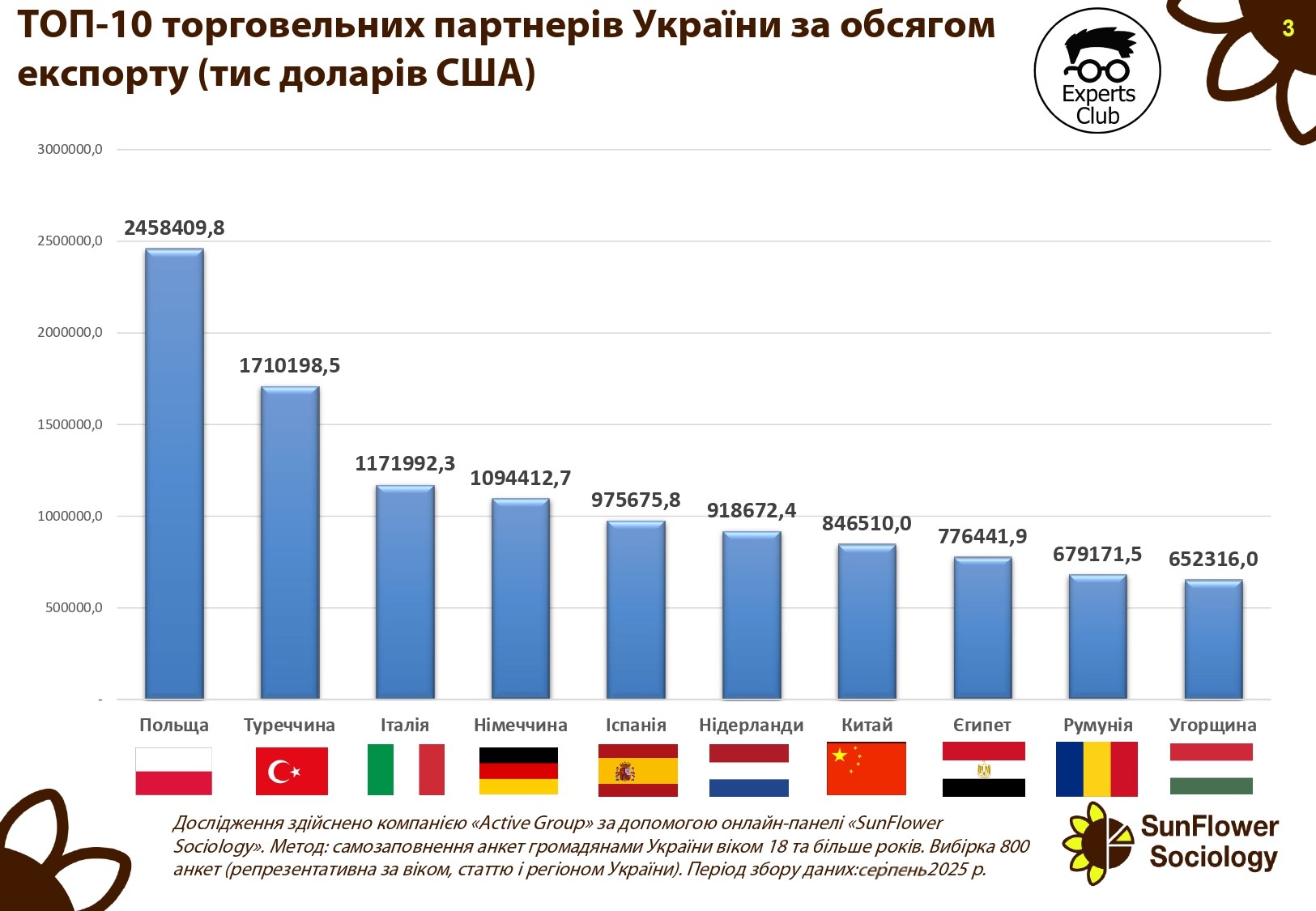

According to the results of the first half of 2025, Poland remains Ukraine’s main trading partner in terms of export volumes. According to research by Active Group and Experts Club, exports to Poland amounted to US$2.45 billion.

Turkey ranks second with USD 1.71 billion, and Italy ranks third with USD 1.17 billion. Other major partners include: Germany ($1.09 billion), Spain ($976 million), the Netherlands ($919 million), China ($847 million), Egypt ($776 million), Romania ($679 million), and Hungary ($652 million).

“The structure of Ukraine’s exports shows a clear focus on European Union countries. Poland, Italy, Germany, Spain, and the Netherlands together account for more than half of total exports. This indicates Ukraine’s strategic integration into the European economic space,” emphasized Maksim Urakin, founder of Experts Club and economist.

He also noted that Turkey remains a critically important partner for Ukrainian agricultural and metallurgical exports, while China and Egypt are key markets for agricultural products, particularly grains.

“The presence of trading partners such as Egypt and China diversifies Ukrainian exports,” Urakin added.

CHINA, ECONOMY, EGYPT, EXPERTS CLUB, EXPORTS, GERMANY, HUNGARY, ITALY, POLAND, ROMANIA, TRADE, TURKEY, UKRAINE, МАКСИМ УРАКИН

According to Serbian Economist, the Serbian Economists’ Association (SEA) will host the 11th World Congress of Economists, which will take place in Belgrade from June 22 to 26, 2026, the SEA announced.

More than 1,000 leading global economists from prestigious universities are expected to attend. A delegation from the International Economic Association (IEA) was in Belgrade during this time, with SES representatives, led by Chairman Aleksandar Vlahovic, agreeing on the organizational and program details of the forum.

“We had very productive meetings, discussed key issues, and proved that we are ready to organize such a prestigious event at the highest level,” Vlahovic said.

According to him, the importance of the congress is underscored by the fact that the program committee is headed by Harvard University professor and Nobel Prize winner in economics Eric Maskin. Other Nobel laureates and experts who have held key positions in the economic policy of the world’s leading countries are also expected to arrive in Belgrade.

The congress is being held in Southeast Europe for the first time and is returning to Europe after 20 years. The SES believes that this forum will be an opportunity for universities and research institutes in Serbia and the region to establish strong ties with the global academic community, and for businesses and authorities to receive direct recommendations from leading economists.

The World Congress is organized by the International Economic Association (IEA) every three years. The forum brings together hundreds of scientists and experts to discuss global economic trends and new scientific approaches. In 2023, the congress was held in Medellin, Colombia, and brought together representatives of the academic and business worlds from all continents.

The main role of the congress is to bring together academic science and practice, develop dialogue between economists and politicians, and shape innovative solutions for the global economy.

https://t.me/relocationrs/1463

GDP and economic growth

GDP

Inflation

Unemployment

Additional macro indicators