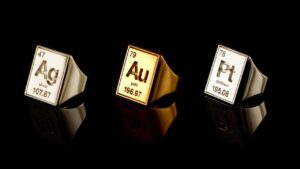

The rapid growth in the price of gold continues on global markets: December futures prices on the Comex exchange rose to $3,965 per troy ounce on Monday

Against the backdrop of rising gold prices, other precious metals are also becoming more expensive.

Platinum added about 0.8%, rising to $1,085 per ounce, on expectations of reduced supply from South Africa.

Silver strengthened by 1.2%, reaching $32.7 per ounce, following the general increase in interest in precious metals.

According to experts, if political uncertainty in the US and the EU persists, gold could consolidate above the $4,000 mark, with silver and platinum continuing to rise moderately in its wake.

Earlier, the Experts Club analytical center presented an analysis of the world’s leading gold-producing countries in its video on YouTube channel – https://youtube.com/shorts/DWbzJ1e2tJc?si=9YBue5CS6dz-tA6_

The price of gold continues to rise rapidly on global markets: December futures on the Comex exchange rose to $3,965 per troy ounce on Monday, a new historic high. Since the beginning of the year, gold has risen in price by almost one and a half times.

The main drivers of growth were increased demand for safe-haven assets and political instability in the US and Europe.

In Washington, federal agencies have been shut down for six days now, as Congress has been unable to approve a temporary budget. Against this backdrop, investors are pulling their money out of stocks and bonds and putting it into gold, which they see as a safer bet in times of crisis.

Adding to the nervousness is the political crisis in France: Prime Minister Sébastien Lecornu resigned after criticism of the composition of the new cabinet, causing another surge of volatility in European markets.

“We see both fundamental and situational factors for a further rally in gold. If current conditions persist, the price could reach $4,200 per ounce by the end of the year,” UBS analysts predict.

According to experts, if political uncertainty in the US and the EU persists, gold could consolidate above the $4,000 mark.

Earlier, the Experts Club analytical center presented an analysis of the world’s leading gold-producing countries in its video on YouTube — https://youtube.com/shorts/DWbzJ1e2tJc?si=9YBue5CS6dz-tA6_

The Ministry of Education and Science of Ukraine has completed the state certification of higher education institutions and scientific institutions in the fields of agricultural, veterinary, and social sciences using a new method of assessing scientific effectiveness, according to Vladimir Khaustov, an expert at the Experts Club information and analytical center and scientific secretary of the Institute of Economics and Forecasting of the National Academy of Sciences of Ukraine, in a blog posted on the Interfax-Ukraine news agency website.

According to him, for the first time, not only institutions as a whole were evaluated, but also individual scientific departments — a step that should “truly support the strongest teams and stimulate real competition in Ukrainian science.”

“Without funding for science, there is no future. We are rich not because we have money, but because we fund science,” Khaustov recalled, quoting Ronald Reagan.

He noted that the new certification methodology “is not perfect, but necessary.” Among the positive changes, the expert mentioned the division by scientific fields and the attempt to introduce quantitative indicators. However, according to him, the consolidation of scientific groups (for example, combining all social sciences — economics, history, sociology — into one category) creates methodological distortions.

“The formula should take into account the specifics of the disciplines, and the weighting coefficients should be differentiated. Now, much of it has been reduced to arithmetic, which does not reflect the real contribution of scientists,” the expert emphasized.

Among the problems, Khaustov highlighted excessive bureaucracy in filling out reports and the lack of data automation:

“All indicators are entered manually, although publications and patents are already in the DNTB and UkrNOIVI databases. We proposed creating an automated system called ”Science of Ukraine,“ which would collect data itself, but so far everything is done manually.”

He also drew attention to the imbalance between the evaluation of domestic and foreign publications, as well as the underestimation of national grants and scientific achievements.

“Three hryvnia of Ukrainian funding is equivalent to one hryvnia of foreign funding. And seven out of eleven indicators relate to publications abroad. This distorts the real picture and devalues national achievements,” he said.

According to the expert, the methodology needs to be refined to take into account the specifics of the industry and the real working conditions of Ukrainian researchers.

“Science is not a formula or a table. It is people, ideas, and the future of the country,” concluded Volodymyr Khaustov.

The full version of the expert’s video is available on the Experts Club channel:

Experts Club is an independent platform for analytical videos and research. The center regularly publishes expert reviews on economics, science, and business, bringing together the opinions of leading analysts, scientists, and business representatives.

The Experts Club Information and Analytical Center has presented a video analysis of global copper production from 1970 to 2024. Chile continues to confidently maintain its leadership in the global copper market, smelting 5.3 million tons of metal in 2024. This is evidenced by data from the US Geological Survey (USGS) published in the Experts Club analytical video.

The Democratic Republic of Congo ranks second with 3.3 million tons, followed by Peru (2.6 million tons), China (1.8 million tons), and Indonesia (1.1 million tons).

The top ten copper producers also include the United States (1.1 million tons), Russia (930,000 tons), Australia (800,000 tons), Kazakhstan (740,000 tons), and Mexico (700,000 tons).

The list of the world’s 20 leading producers also includes countries such as Zambia, Canada, Poland, Brazil, Panama, Mongolia, Iran, Armenia, Serbia, and Bolivia.

Experts note that the distribution of copper production by country has become more diversified in recent decades. In addition to the traditional leaders in Latin America, African and Asian countries are playing an increasingly important role.

Copper remains one of the most important industrial metals in the world, used in construction, power generation, telecommunications, and especially in the production of “green technologies” — electric vehicles, solar and wind power plants.

The Experts Club video analysis is available at link

The Experts Club information and analytical center, with the assistance of the Ukrainian Cement Manufacturers Association (Ukrcement), has conducted an analysis of the Ukrainian cement industry.

Over the past five years, the Ukrainian cement industry has experienced a peak in production in 2021, a sharp decline in 2022, a gradual recovery in 2023, and stabilization in 2024. However, the current level is still far from pre-war indicators.

According to trade union and industry reviews, output was about 11 million tons in 2021, fell to 5.4 million tons in 2022, recovered to 7.43 million tons in 2023, and reached 7.93 million tons in 2024. In 2025, manufacturers are talking about an actual “ceiling” — approximately 8 million tons under current risks and logistics, which is likely to be the maximum figure.

The dynamics of domestic cement consumption show a similar trend of “decline and normalization.” In 2021, before the full-scale invasion, consumption was around ~10.6 million tons. In 2022, the cement market fell sharply to approximately 4.5 million tons, rose to 6.2 million tons in 2023, and stabilized at around 6.3 million tons in 2024. Thus, the country approached a stable level of “war” demand, which is almost half of the pre-war level, within the range of 6–6.5 million tons.

The structure of demand has changed: the share of traditional residential and commercial construction has given way to infrastructure and defense projects. The key short-term drivers are fortification works, shelters, emergency repairs of roads and bridges, as well as targeted housing programs such as “єОселя,” which supported demand in 2023–2024, although they did not return it to the 2021 level. The market expects demand to remain stable in 2025, sensitive to the volume of budgetary and international financing.

Amid declining domestic demand, a natural step to support production capacity utilization was the gradual reorientation of part of the cement output to foreign markets. In 2021, cement exports amounted to about 971,000 tons (9% of production), and in 2024, about 1.7 million tons (21.3% of production). The main destinations remain neighboring countries—Poland, Romania, Hungary, and Moldova—as confirmed by both statistical data and industry estimates. The industry has repeatedly emphasized that as soon as domestic consumption begins to grow, the export share will decline in favor of Ukrainian construction sites.

Imports, on the contrary, have declined. After approximately 1 million tons in pre-crisis 2020, deliveries in 2024 decreased to ~40 thousand tons (including niche items such as white cement). This was also influenced by anti-dumping duties: against Turkey — 33–51% (in effect until September 2026), and against Russia/Belarus/Moldova, measures have been extended until 2030. Under the current conditions, when production capacities and logistics are adapted to the “military” level of consumption, demand is fully covered by domestic resources.

The market structure in 2024–2025 is highly concentrated. The key producers are PJSC Ivano-Frankivskcement, the CRH group (after the AMCU approved the deal to acquire CRH’s Dyckerhoff/Buzzi assets — PJSC VIPCEM, Podolsky Cement JSC, Mykolaivcement PJSC, Cement LLC) and Kryvyi Rih Cement PJSC. Despite market discussions, legal disputes, and attention from antitrust authorities—which is to be expected for transactions of this scale—the CRH deal creates potential for integration into global production and logistics chains, attracting new investments, modernizing production, and raising the standards of the competitive environment. In the context of the country’s future large-scale recovery, the agreement opens up opportunities to strengthen supply stability, improve product quality, and develop a competitive environment.

Who is currently driving domestic consumption? In peacetime, the main stabilizers of demand were mass housing construction and infrastructure. In 2023–2025, basic demand will be driven by roads and engineering structures (including fortifications and shelters), municipal and energy facilities, selective reconstruction projects, as well as the private sector — repairs and local construction.

Road construction is an important factor in economic and social development. The introduction of the latest technologies, the use of high-quality materials, and compliance with environmental requirements are key aspects of the successful development of this industry.

The development of the construction and repair of cement concrete roads based on cement mixtures can play a key role in stimulating stable cement consumption in conditions of war and reconstruction. This infrastructure direction makes it possible to maintain the production capacity of enterprises, jobs, and economic activity, despite a significant reduction in residential and commercial construction. Thanks to their durability and endurance, cement concrete pavements are the optimal solution for both military and civilian logistics. The implementation of such projects not only ensures constant demand in the industry, but also the development of related sectors, creating a multiplier effect for the economy even in crisis conditions. This issue will be the focus of a specialised seminar organised by NIRI and the Ukrcement Association on 15-16 October 2025, where the advantages and role of cement concrete solutions in the reconstruction of Ukraine will be discussed (details at ukrcement.com.ua).

In terms of sales channels, the market remains predominantly B2B: most of the cement is purchased by contractors, road and infrastructure companies, large developers, reinforced concrete manufacturers, and concrete plants. The B2C channel (retail chains of building materials, small contractors) continues to play a significant role in repairs and low-rise construction, but in terms of total volume, it is inferior to the project segment. Industry reviews of construction projects and reports on fortification works in 2024–2025 provide further confirmation of the “infrastructure” shift.

The geography of foreign sales shows a stable “corridor” and proximity to the EU. According to trade statistics for 2023, Romania accounted for the largest value of supplies, followed by Poland and Hungary; in 2024, Romania, Poland, and Hungary remained in the lead.

This reflects shortages in the EU border markets and the competitiveness of Ukrainian prices with close logistics.

What limits growth. Military risks and energy infrastructure (in particular, the availability of electricity), regional logistics, as well as regulatory and competitive issues. A large-scale jump in consumption (approximately 12–13 million tons) requires a steady inflow of investment resources for reconstruction of around $35 billion per year — the association considers such a scenario to be technically and operationally realistic. Predictable competition rules and price monitoring are important in the equation so that the “reconstruction” multiplier is not absorbed by costs.

Conclusion by Experts Club. The industry has found a “military balance”: production of about 8 million tons, domestic consumption of ~6.3 million tons, and exports as insurance at the level of 1.5–1.7 million tons. With the scaling up of energy restoration and strengthening programs, a shift from exports to the domestic market is logical. The key to acceleration is stable financing of infrastructure and housing, affordable energy, and maintaining fair competition between major players. In such a scenario, cement remains one of the first materials that quickly transforms the budget into employment and GDP — through concrete, reinforced concrete structures, roads, and fortifications.

Sources: Global Cement (production and consumption; import duties), Interfax-Ukraine/Ukrcement (exports in 2024; estimates of reconstruction needs), OEC (export destinations in 2023), CEMBUREAU (imports, exports, and consumption, in particular the benchmark for 2024), industry and business media regarding the CRH/Dyckerhoff deal and the competitive situation.

Source: https://expertsclub.eu/rynok-czementu-ukrayiny-doslidzhennya-experts-club/

Sunflower processing in Argentina in August 2025 increased to 488 thousand tons compared to 330 thousand tons in the same month of 2024, according to the APK-Inform agency, citing data from Oil World. At the same time, the figure was only slightly lower than in July of this year (491,000 tons).

According to experts, processing in September and October will continue to significantly exceed last year’s figures, as Argentine processors are taking advantage of the decline in sunflower harvests in Ukraine, Russia, Turkey, and Bulgaria.

Argentine sunflower oil is currently the most competitive on the world market and is sold at significant discounts compared to products from the Black Sea region. Thus, exports in August amounted to 172,000 tons, compared to 116,000 tons a year earlier. The main destinations are India (90,000 tons compared to 21,000 tons a year earlier) and Iraq (14,000 tons compared to 31,000 tons).

According to data from the Argentine Ministry of Agriculture, the sunflower harvest in 2025 exceeded forecasts and amounted to 5.3 million tons, compared to 3.9 million tons in 2024. The country’s authorities expect to maintain high production levels in 2026 by increasing the area under cultivation by 10% annually.

Analysts at the Experts Club note that the growth in processing and exports from Argentina is putting pressure on the global sunflower oil market, lowering prices and increasing competition.

For Ukraine, one of the world’s largest producers and exporters of oil, this could mean a reduction in export revenues and the need to actively seek new markets, as well as to focus on deeper processing and improving product quality.