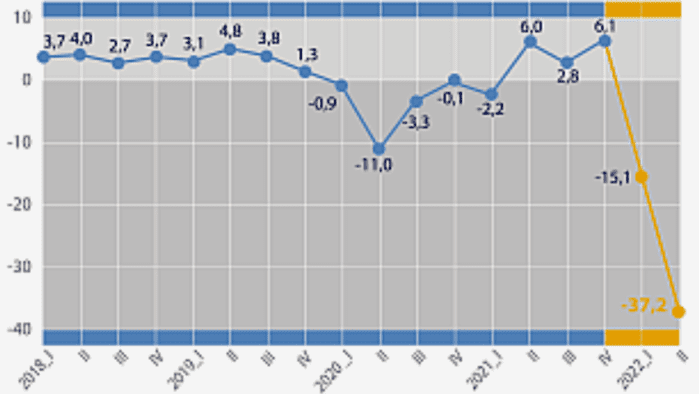

Ukraine’s real gross domestic product (GDP) fell by 30.8% in the third quarter of 2022 compared with the third quarter of 2021 after falling by 37.2% in the second quarter and 15.1% in the first this year, the State Statistics Service released this operational estimate on Friday.

According to the released data, GDP grew by 9.0% compared to the previous quarter (seasonally adjusted).

According to the State Statistics Service, Ukraine’s GDP grew by 3.4% in 2021 after a decline of 3.8% in 2020, its nominal volume was about $200 billion.

The Ministry of Economy previously noted that the Russian attacks on the energy infrastructure, which began on October 10, increased the rate of decline of the Ukrainian economy to approximately 39% in October and 41% in November, resulting in the forecast for the year as a whole worsened from 32% to 33.2%.

NBU leaders also said at a briefing on December 8 that the Russian energy terror worsened their estimate of this year’s GDP decline by 31.5%, but did not specify by how much.

IMF expects Ukrainian economy to fall by 33% this year

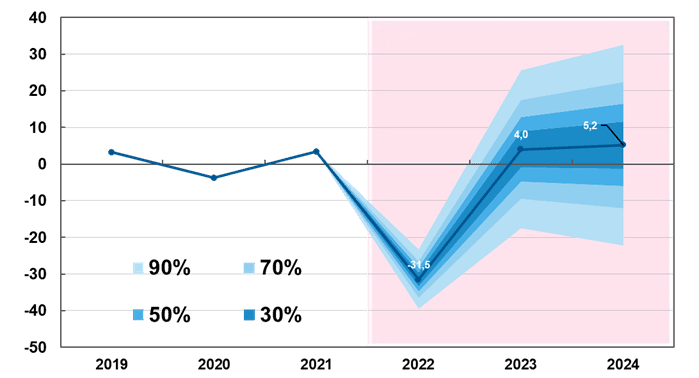

Forecast of dynamics of changes in GDP in % for 2022-2024 in relation to previous period

NBU

Real GDP percentage changes over previous period in 2018-2022

SSC of Ukraine

The decline in real gross domestic product (GDP) of Ukraine in the fourth quarter of 2022 compared to the same period last year will be 35.6% compared to 34.4% in the third quarter and 37.2% in the second quarter, such is the forecast of the National Bank of Ukraine published in the inflation report on his website on Friday night.

According to him, in the first quarter of 2023, the economy will also contract – by another 17.5%, given the higher base of the first quarter of this year, when the decline was 15.1%, and recovery will begin from the second quarter of next year.

In particular, in the second quarter it will be 13.9%, in the third – 9.2% and in the fourth – 11.3%, the NBU assumes.

The estimates of GDP dynamics updated by the National Bank for the fourth quarter of this year and the first quarter of the next are slightly better than in July, when it expected a 37.5% decline in the economy in the last quarter of this year and 19% in the first quarter of next year.

At the same time, the NBU worsened the forecast for economic recovery in the remaining three quarters of 2023.

In general, the National Bank, as previously announced, predicts a decline in GDP this year by 31.5% and its growth by 4% in 2023 and 5.2% in 2024, while in July it expected a decline this year by 33.4% and growth in 2023-2024 by 5.5% and 4.9%, respectively.

Nominal GDP, according to the document, this year may be reduced to UAH 4.75 trillion from UAH 5.46 trillion last year. However, due to high inflation (30% this year, 20.8% next year and 9.4% in 2024), nominal GDP will reach UAH 6.175 trillion in 2023, and UAH 7.35 trillion in 2024 , expects the National Bank.

“The baseline scenario is based on assumptions about the launch of a new program with the IMF, the implementation of a coordinated monetary and fiscal policy, the gradual leveling of quasi-fiscal imbalances, in particular in the energy sector. The baseline scenario also assumes a tangible reduction in security risks from the middle of next year, which will contribute to the full unblocking of sea ports, reducing the sovereign risk premium and returning forced migrants to Ukraine,” the report says.

The NBU clarifies that this scenario assumes the full opening of seaports from the second half of the year, an increase in gas and heating tariffs to 50% of parity, and the return of 0.4 million refugees out of 8 million who left in 2022.

The central bank adds that this baseline moderately optimistic forecast also assumes continued active international financial support for Ukraine of $28 billion in 2023 and $20 billion in 2024, compared with $31.1 billion this year (about $24.1 billion received so far). ).

The National Bank names the prolongation of the war and its escalation as the strongest risk for this scenario, estimating its probability from 25% to 50%. With the same probability, the National Bank assumes such risks as increased emigration and energy risks of the passage of winter, as well as the termination of gas transit. However, the degree of influence of the first two is moderate, and the termination of transit, which is expected to be 20 billion cubic meters. m per year – weak.

The NBU also names the unbalancing of public finances (low government bonds rates, freezing tariffs for housing and communal services, reduction of international aid, longer issue) among the strong risks of the base scenario, but its probability is lower – 15-25%.

The cessation of the grain corridor and the non-signing of the program with the IMF are classified as moderate risks in terms of their impact on the basic macro-forecast, however, the National Bank estimates their probability at 15-25% and less than 15%, respectively.

There is also a mention in the report of such a factor as the “Marshall Plan”, which can greatly affect and improve the macro forecast, but the Central Bank estimates its probability below 15%.

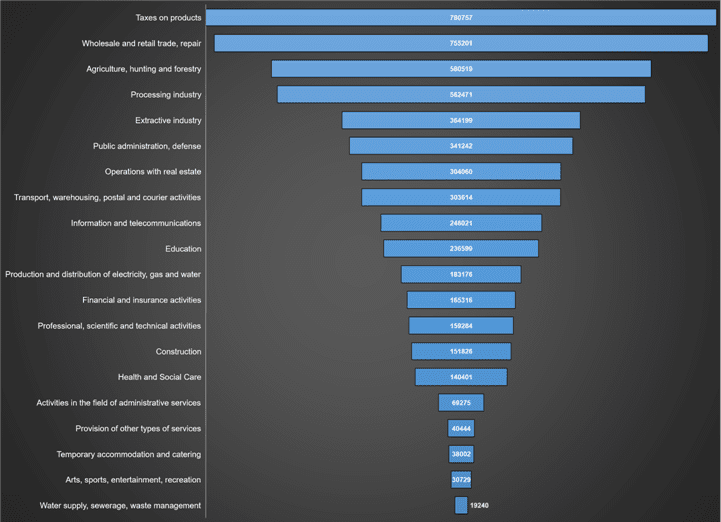

Structure of Ukraine’s GDP in 2021 (production method, graphically)

SSC of Ukraine , graphics of the Club of Experts

Real GDP percentage changes over previous period in 2018-2022

SSC of Ukraine , graphics of the Club of Experts