Smart Energy plans to invest $ 400 million in hydrocarbon production by 2031, CEO of the group of companies Serhiy Hlazunov has told reporters, presenting the results of ten years of activity in the market.

According to him, the total volume of Smart Energy investments in production for 2011-2020 amounted to UAH 3.5 billion, in particular, in 2019 – UAH 687 million, in 2020 – UAH 541 million.

The total amount of taxes paid for this period exceeded UAH 7.6 billion, in particular, in 2019 – UAH 1.291 billion, in 2020 – UAH 947 million.

Hlazunov said that in the next ten years, the group plans to drill over 30 new wells, while in the previous ten years, 13 wells were drilled. The existing Smart Energy park currently consists of 29 wells.

As reported, Smart Energy in 2020 increased natural gas production by 8.6% (by 31.8 million cubic meters) compared to 2019, to 400.6 million cubic meters, gas condensate – by 4.8% (by 1,600 tonnes), to 34,700 tonnes, and production of liquefied propane-butane – by 9.5% (by 800 tonnes), to 9,200 tonnes.

Smart Energy is a management company, part of Vadim Novinsky’s Smart-Holding Group, which implements projects in the field of hydrocarbon production and alternative energy. The group’s oil and gas business is represented in Poltava and Kharkiv regions by PrJSC Ukrgazvydobutok, the British public company Enwell Energy with assets in Poltava region, Prom-Energo Product LLC and Arkona Gas-Energy LLC.

Investments in the construction of a bakery of the international bakery holding company Grupo Bimbo in Kyiv region will amount to nearly $30 million, General Manager of Bimbo QSR Ukraine Ihor Mariash has said.

“Now, our enterprise is located in Dnipro, but we feel that Ukraine is developing and we do not have enough capacity. Therefore, our management has an initiative to build a new bakery in Kyiv region. This will create an opportunity to create 200-300 jobs. Total investment about $30 million is planned,” Mariash said during a roundtable entitled “Investment Law: Projects for First Billion” held on Friday.

According to him, it is planned to build lines for the production of buns, as well as tortilla and toast bread, which are currently not produced in Ukraine.

As Head of the International Relations and Communications Department of UkraineInvest Investment Promotion Office Olena Gitlianska said earlier, the investment company is helping a Mexican investor in finding a site for the construction of a plant in Fastiv.

According to the data of the unified public register of legal entities and private entrepreneurs, Bimbo QSR Ukraine was registered in 2000 by Dutch Bimbo QSR B. V in Dnipro with a charter capital of UAH 297 thousand.

According to the Grupo Bimbo website, it is represented in 33 countries, has 196 factories and a network of 3 million points of sale worldwide. The bakery holding produces about 13,000 names of products under more than 100 brands.

The pharmaceutical company Farmak increased capital investments by 78% in 2020 compared to 2019, to UAH 1.3 billion.

According to the company’s press release, the main investment projects last year are the launch of a new workshop for the production of sterile drugs and the start of construction of an R&D center, which will develop modern complex component drugs.

Farmak’s research and development expenditures in 2020 amounted to UAH 448 million.

In addition, the company’s funds were used to modernize and equip existing sites, bring production facilities in line with FDA (U.S. Food and Drug Administration) requirements, energy saving projects, develop a laboratory complex, and implement IT projects to automate business processes.

The company also said that in 2020 Farmak paid UAH 712.1 million in taxes, and the number of employees for the specified reporting period increased to 2,761 people.

Farmak is the leader of the Ukrainian pharmaceutical market, produces medicines in all 14 therapeutic groups. Annually, the company introduces to the market about 20 new complex component modern drugs. Currently, there are about 100 drugs in development. The company exports products to more than 25 countries around the world.

Over the past five years, Farmak’s investments in the scientific and technical complex, production equipment, and research activities amounted to UAH 3.4 billion.

JSC Farmak is a member of the Association of Manufacturers of Medications of Ukraine (AMMU).

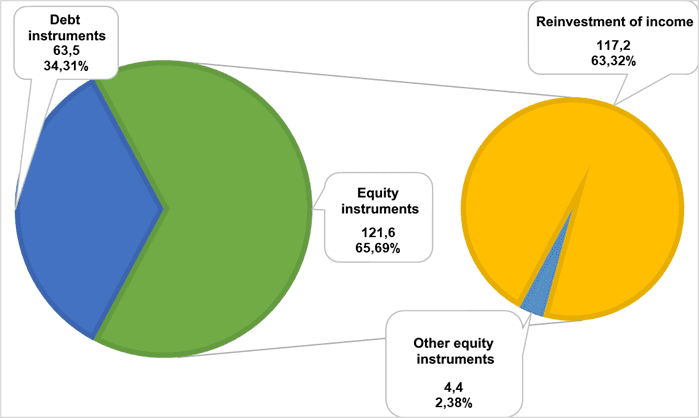

FOREIGN DIRECT INVESTMENTS IN THE ECONOMY OF UKRAINE FOR THE III QUARTER OF 2020 (OPERATIONS, $ MILLION)

The pharmaceutical company Farmak increased capital investments by 78% in 2020 compared to 2019, to UAH 1.3 billion.

According to the company’s press release, the main investment projects last year are the launch of a new workshop for the production of sterile drugs and the start of construction of an R&D center, which will develop modern complex component drugs.

Farmak’s research and development expenditures in 2020 amounted to UAH 448 million.

In addition, the company’s funds were used to modernize and equip existing sites, bring production facilities in line with FDA (U.S. Food and Drug Administration) requirements, energy saving projects, develop a laboratory complex, and implement IT projects to automate business processes.

The company also said that in 2020 Farmak paid UAH 712.1 million in taxes, and the number of employees for the specified reporting period increased to 2,761 people.

Farmak is the leader of the Ukrainian pharmaceutical market, produces medicines in all 14 therapeutic groups. Annually, the company introduces to the market about 20 new complex component modern drugs. Currently, there are about 100 drugs in development. The company exports products to more than 25 countries around the world.

Over the past five years, Farmak’s investments in the scientific and technical complex, production equipment, and research activities amounted to UAH 3.4 billion.

JSC Farmak is a member of the Association of Manufacturers of Medications of Ukraine (AMMU).

Ukrainian IT companies received $571 million in investments by the end of 2020, which is $27 million more than in 2019.

The relevant data was published in the annual study of investments in the Ukrainian IT sector DealBook of Ukraine: 2021 from the investment fund AVentures Capital.

Some 62% of the total amount was attracted by four global companies with Ukrainian roots – GitLab, Creatio, Restream and airSlate.

GitLab became the first multi-billion dollar company established in Ukraine. It was estimated at $6 billion.

According to the study, 2020 was a record year for financing at an early stage – in seed and A-rounds, it was possible to attract $161 million, most of which from international investors, and this is 3.5 times more than in 2019.

The fastest growing startup in 2020 is Reface.ai application, which lets one swap faces in videos. Since its launch in January, the application has been downloaded 70 million times.

The rating of companies with the highest international income includes Jooble, Genesis, Grammarly, airSlate, Creatio and others.