Net sales of dollars by the National Bank of Ukraine (NBU) jumped to $560.1m this week from $242.9m a week earlier, the highest in eight weeks.

According to the NBU website, from April 17 to April 21, 2023, the purchase of foreign currency was again absent.

On the cash market the dollar went up during the week by 0.35 UAH – to about 38.15 UAH/$1.

Market participants connect the change of tendency to the concerns, caused by temporary ban on import of Ukrainian agro-products to Poland, Hungary and Slovakia, and also unstable operation of grain corridor, which questions its prolongation after May 18.

Since the beginning of the year, the NBU bought $62.3 million at the market, while it sold $8 billion 172.7 million.

As reported, the volume of interventions of the National Bank in March decreased to $1.67 billion from $2.43 billion in February and $3.08 billion and $3.16 billion in January and December.

Due to significant inflows of external financing, international reserves of Ukraine in March increased by 10%, or $3 billion – to $31.88 billion.

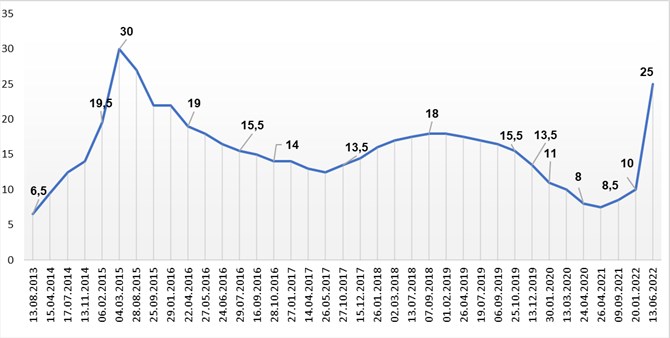

Dynamics of changes in discount rate of NBU

Source: Open4Business.com.ua and experts.news

The number of participants in the non-banking financial market in March 2023 decreased by 37 to 1,347, the website of the National Bank of Ukraine reports.

The number of banks in February decreased by two, to 65, due to the NBU’s decisions to revoke the license and liquidate Forward Bank and Ayboks Bank.

No one was included in the register for March. At the same time, 12 financial companies, five pawnshops, two credit unions and five leasing companies have been voluntarily excluded from the roster, while seven financial companies, five insurers and one leasing company have been compulsory excluded.

According to the regulator, during March one leasing company was denied a license. Simultaneously, 15 financial companies, four pawnshops, two credit unions and five leasing companies had all their licenses revoked voluntarily (on the basis of applications submitted by them), and the other three financial companies were revoked compulsorily (as a measure of influence).

In addition, two financial companies and one insurer had their licenses revoked voluntarily, and two financial companies and four insurers – forcibly. Also, the licenses of one financial company and one lessor were renewed.

As of March 31, the non-banking market had 110 non-life insurers (115 in February) and 12 life insurers (the number has not changed), one insurer with special status, 171 pawnshops (176), 157 credit unions (159), 89 leasing companies (92), 682 financial companies (701), 58 insurance brokers (number has not changed) and 67 collection companies (number has not changed).

Besides, 25 banking groups (the number has not changed) and 22 non-banking financial groups (as in February) are recognized in the market.

In the payment market operate 33 payment systems (37), created by residents, including state, and 16 international payment systems, created by non-residents (the number has not changed). In addition, companies providing financial payment services operate in the market, including three banks issuing electronic money (the number did not change). Other subjects operating in the payment market include 36 commercial agents (41) and 35 technological operators of payment services (the number has not changed).

In March, the National Bank received 414 requests from market participants for registration and licensing actions. The number of inquiries on financial companies, pawnshops and lessors amounted to 256. The number of inquiries on credit institutions (banks and credit unions) was 57, on insurers – 75, on payment institutions – 26.

Ukraine’s largest mobile operator Kyivstar has joined the National Bank of Ukraine’s (NBU) BankID electronic remote identification system for individuals, the bank’s press service said on Friday.

“Another large mobile operator, Kyivstar, has joined the NBU’s BankID system. Now, using BankID NBU system, Kyivstar prepaid subscribers in mobile application “My Kyivstar” will be able to pass identification for switching to a contract form of service,” – explains the report.

Switching to contract form of service or mobile number registration is the most effective protection of subscriber’s SIM-card from fraud, the NBU pointed out.

Now NBU BankID System is used by all three major mobile operators in Ukraine: in April 2021 Lifecell Ukraine and in April 2022 Vodafone Ukraine joined to it.

As reported, BankID NBU provides access to services of more than 40 state and public institutions, allows users to be verified remotely to gain remote access to financial, administrative and commercial services.

As of April 14, 2022 the BankID NBU System had 40 BankIDs, including PrivatBank, Ukrgasbank, Ukrsibbank, Ukreximbank, Alliance Bank, Forward Bank, PUMB, Oschadbank, Alfa-Bank, OTP Bank, Accordbank, Globus Bank, Piraeus Bank, Pravex Bank, Raiffeisen Bank Aval, TAScombank, Kristallbank (all – Kyiv), Motor Bank (Zaporizhia), Vostok, Radabank, Concord Bank, A-Bank (all – Dnipro), Credobank, Idea Bank, Lviv Bank (all – Lviv), Pivdenny Bank (Odessa), MTB Bank (Odessa obl. ), Asvio Bank (Chernihiv), as well as virtual monobank and izibank.

The National Bank of Ukraine (NBU) cancelled licenses of six non-banking institutions and removed four non-banking financial institutions from the State Register of Financial Institutions and one non-banking institution from the Register of Persons who are not financial institutions but are entitled to provide certain financial services.

As reported on the website of the regulator, all existing licenses were revoked and excluded from the State Register on the basis of their own applications: PO “Lombard “Express-Gotivka”, LLC “The World of Financial Solutions and Company”, LLC “Astra.Finance”, CC “Zalogy House”, CC “Crez-Capital” and LLC “Navia Invest” from the Register of persons who are not financial institutions, but have the right to provide certain financial services. Sovremennaya Finansovaya Kompaniya LLC had its licenses revoked on the basis of an application.

The Committee for the Supervision and Regulation of the Non-banking Financial Services Markets adopted these decisions on March 16, 2023.

The National Bank of Ukraine (NBU) has included Credit Agricole Bank into the list of systemically important banks following its annual review, thus increasing the number of banks on the list to 15.

As stated in the NBU`s resolution No.95 “On Determination of Systemically Important Banks” dated March 8, it also includes A-Bank, Credobank, OTP Bank, Oschadbank, Pivdenniy Bank, PrivatBank, PUMB, and Raiffeisen Bank.

Sens Bank, TAScombank, Ukrgasbank, Ukreximbank, Ukrsibbank, and Universal Bank (mono) are also on the list.

As of February 1, 2023, Credit Agricole Bank ranked 11th out of 67 operating banks by total assets (UAH 81.03 billion). At present, the number of operating banks has dropped to 65.