Relocation.com.ua has prepared an analysis of the Georgian residential real estate market in the first half of 2025: prices are rising, demand is leveling off, and rents are cooling down.

In June, 3,236 apartment deals were registered in Tbilisi, which is +11% y/y (−2% m/m) — the first noticeable rebound after the sluggish spring months, according to TBC Capital. The average asking price in the city is $1,266/m² (+6% y/y), and the average rental rate is $10.6/m² (−12% y/y).

In Tbilisi, 15,865 deals worth $1.2 billion (+2.6% y/y) were registered in the first five months of 2025, with the average price on the primary market in May at $1,331/m² and rent at $9.3/m².

As for Batumi, 7,129 transactions were registered in Batumi in the first half of 2025 (+4.8% y/y), with a total market volume of $397 million (+16.1% y/y). Weighted average prices: new buildings $1,184/m² (+16.1%), secondary market $1,169/m² (+20%).

According to Galt & Taggart’s assessment, sales growth continued in the second quarter in both the primary and secondary markets; rental rates in June were +1.6% y/y, and yields remain high compared to “pyramids.”

Earlier it was reported that the average gross rental yield in Batumi remains at around 8.8% (end of winter 2025).

Prices across the country: double-digit growth in annual terms

According to the Geostat housing price index, in Q1 2025, housing prices in Georgia were +11.53% y/y (in real terms, adjusted for inflation — +7.78%).

Against the backdrop of the high base of previous years, the issuance of permits in Tbilisi in 5M25 declined moderately (by area −1.1% y/y), and in May, 25 permits were issued for ≈203 thousand m² (−18.3% y/y). This is holding back supply growth and supporting prices in the primary segment.

After peaking in 2022–2023, rents in Tbilisi stabilized and fell to $9.3–10.6/m² in May, depending on the source and observation period. Gross yields in Tbilisi remain around ~8–11%, which is comparable to yields in resort locations.

Foreign buyers: activity continues, with Israelis playing a notable role

Government agencies do not usually publish official monthly breakdowns by nationality. However, a Galt & Taggart survey of systemic developers (covering ≈45% of the primary market in Tbilisi) found that buyers from Israel accounted for 11% of all sales in 5M25. Demand from local and “regional” buyers (Russia, Ukraine, Middle Eastern countries) is also significant, but the shares vary from project to project.

Analysts expect moderate, “healthy” growth while maintaining attractive returns in resort locations (Batumi) and a gradual recovery in demand in the capital as rates and incomes stabilize. External demand will remain selective (investment apartments and lots for short-term rent).

Madrid in the first half of 2025 confirmed its status as one of the key business centers of Southern Europe, remaining an attractive market for investors and tenants. Despite high inflation in the eurozone and ongoing geopolitical risks, the city’s office real estate market shows moderate growth and maintains a high level of activity in the premium segment.

Prices and rental dynamics

The average rental rate for Class A offices in Madrid’s central business district (CBD) in June 2025 was €36-39 per sqm per month, 3-4% higher than in the same period last year. In areas outside the CBD, including the Atocha and Chamartin districts, rates are holding between €22-28 per sqm.

The rental growth is mainly due to the shortage of quality modern space and increased demand from international companies in the IT, consulting and finance sectors.

Sales market

The average purchase price of office properties in Madrid in the first half of 2025 was €4,200-4,800 per sqm in central areas. In suburban areas (Alcobendas, Las Rosas, San Sebastian de los Reyes), prices range from €2,200 to €2,800 per square meter.

Deals with investment funds and REITs remain a key driver: in the first half of the year, several large office building renovation projects entered the market, and the volume of investment in the sector is estimated at €1.6-1.8 billion, 12% more than in the same period in 2024.

Expert opinions

According to CBRE Spain analysts, companies are increasingly abandoning old premises in favor of offices with energy efficiency certification (BREEAM, LEED). The share of such areas in the structure of transactions reached 45%, indicating a growing interest in sustainable development.

Jones Lang LaSalle (JLL) notes that demand for co-working and flexible office solutions in Madrid has increased by 15% year-on-year. Startups and branches of international corporations that are expanding their presence in Spain are particularly active using this format.

Forecast

Office rental rates in Madrid are expected to continue their moderate growth of 2-3% in the second half of 2025, especially in the premium segment. Purchase prices, according to Knight Frank experts, will fluctuate within the current values, but investor interest will continue due to stable demand and limited supply of new space.

In the medium term, the Madrid market will remain a benchmark for investors in Southern Europe: the combination of high quality of life, developed infrastructure and a growing number of international companies makes it one of the most stable office markets in the region.

http://relocation.com.ua/office-real-estate-market-in-madrid-results-first-half-2025/

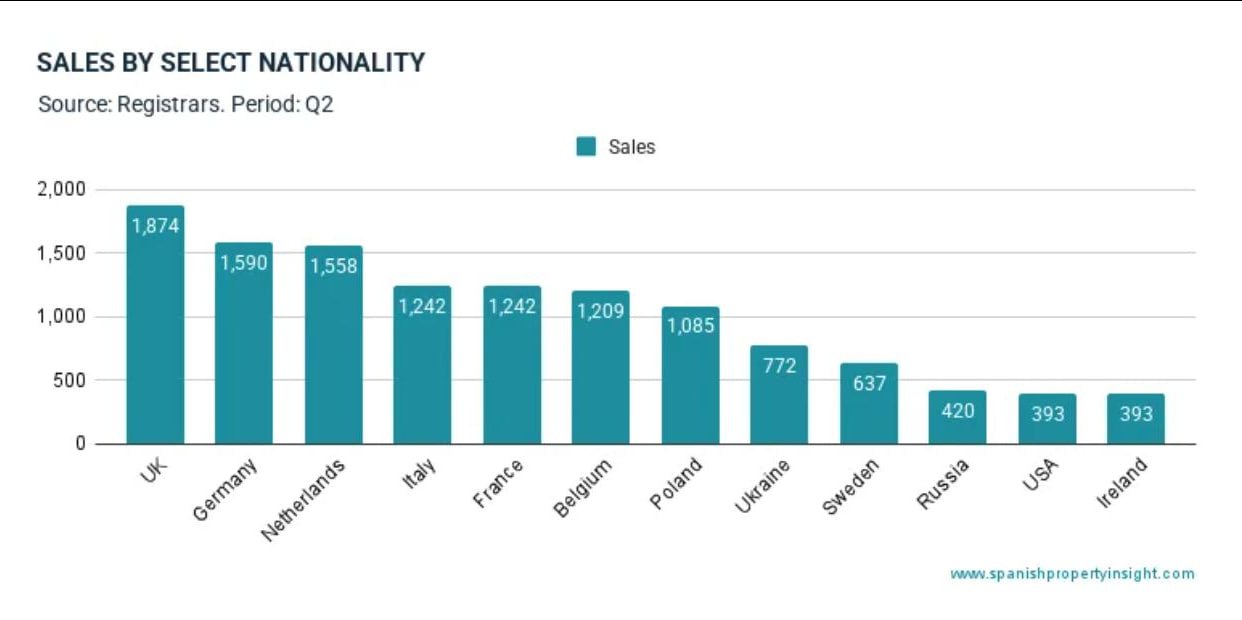

The second quarter of 2025 showed sustained interest from foreigners in the Spanish real estate market. According to data from the Spanish registration authority, British citizens led the way in terms of the number of properties purchased, with 1,874 transactions.

Germany came in second (1,590 transactions), followed by the Netherlands (1,558 transactions). Italy and France shared fourth place, each with 1,242 transactions.

The top ten also included:

Belgium — 1,209 transactions

Poland — 1,085 transactions

Ukraine — 772 transactions

Sweden — 637 transactions

Russia — 420 transactions

The list of top countries is rounded out by buyers from the US and Ireland, with 393 transactions each.

Experts note that the UK’s high ranking is traditionally linked to British buyers’ interest in the Costa Blanca and Costa del Sol, while the growth in activity in the Netherlands and Poland is due to the favorable economic situation and a desire to diversify investments.

Ukrainians remain interested in the Spanish market, ranking eighth in terms of the number of transactions in the second quarter of this year. Ukrainian citizens are consistently among the top 10 buyers of apartments and houses in Spain.

According to official data from the Spanish Ministry of Inclusion, Social Protection, and Migration, since the start of the war, temporary protection status has been granted to 236,570 people with Ukrainian passports.

This makes Spain the fourth country in the EU in terms of the number of temporary permits issued, accounting for about 5% of all such statuses in the EU.

The Athens residential real estate market continued to show steady growth in the first half of 2025 amid a recovery in tourism, investment, and economic stability in Greece, according to a market review.The National Bank of Greece recorded a 6.8% year-on-year increase in residential property prices in urban areas in the first quarter of 2025. The price index in nominal terms rose by 8.0% for new apartments and 6.0% for properties over five years old. Growth was 5.5% in Athens, 10% in Thessaloniki, and around 7.3% in other cities.

According to Spitogatos, average asking prices in Athens reached €2,317/m² in the center, €3,222/m² in the north, and €4,000/m² in the south of the city, corresponding to an increase of 7-9% compared to the first quarter of 2024.

Key market drivers:

• Domestic and foreign demand, including thanks to the Golden Visa program

• Infrastructure transformations, including the Ellinikon project on the Athens coast

• Limited supply of quality properties and a shortage of premium housing

Investment in residential and commercial real estate in Greece exceeded €5.9 billion in 2024, of which more than €3 billion was in the residential segment. In the first quarter of 2025, FDI inflows into the real estate sector amounted to approximately €520 million (43% of total investment inflows into the country).

Experts predict that during 2025, price increases will slow to around 4-6%, especially in Athens, and the market will move to more moderate price growth rates after the turbulent dynamics of 2022-2023.

Forecast for August-September 2025

Analysts expect prices to continue rising in central Athens despite seasonality and a possible slowdown in demand, as favorable factors remain in place: the tourist season, foreign investor activity, a construction shortage, and the Golden Visa program.

In August, demand remains strong, especially for apartments ranging from 60 to 80 square meters. In September, there may be moderate stagnation or a slight correction amid expectations of ECB decisions and a seasonal slowdown in activity, but overall the market will remain stable, with potential for growth by the end of the year.

Source: http://relocation.com.ua/athens-residential-real-estate-market-analysis-by-relocation/

An overview of the property tax system in Poland for foreign citizens and expats

Interest in Polish real estate among foreigners, including Ukrainian expats, continues to grow. At the same time, it is important to consider the tax burden associated with both the purchase and ownership and sale of a home. In this article, we will look at the key taxes related to real estate in Poland, as well as the current rates and features for individuals.

– Tax on the purchase of real estate: tax on civil law transactions (PCC)

When purchasing secondary real estate (from a private individual), the buyer is required to pay PCC at a rate of 2% of the property value.

Example: an apartment for €100,000 — the tax will be €2,000.

If the property is purchased on the primary market (from a developer), PCC is not payable, but VAT is charged (usually 8% or 23% depending on the type of housing and area).

Up to 150 m² for an apartment or 300 m² for a house — 8% VAT

Above these limits — 23% VAT on the excess

The purchase is accompanied by notary fees: drawing up the agreement, entry in the land register, registration fees. The average amount of additional costs is about 2–4% of the purchase price.

– Property tax (Podatek od nieruchomości)

This is an annual local tax paid by every property owner. It is determined at the commune (municipality) level and depends on the size of the property.

Maximum rates in 2025 (set annually by the Polish Ministry of Finance):

Apartments and houses: up to PLN 1.15 per m² (≈ €0.27)

Land plots for residential purposes: up to PLN 0.70 per m² (≈ €0.16)

Example: a 60 m² apartment in Warsaw → tax ~ €16 per year.

Important: the rate is lower in small towns and closer to the maximum in the capital.

– Tax on rental income

If the property is rented out, the income is taxable. Individuals can choose one of the following schemes:

Market rate (general PIT scale): 12% up to PLN 120,000 of income per year and 32% on the excess (2025)

Flat rate (ryczałt): 8.5% on income up to PLN 100,000 and 12% on the excess

The ryczałt regime is popular among small landlords, especially for short-term rentals.

– Capital gains tax (on sale)

When selling real estate earlier than 5 years after its acquisition, there is an obligation to pay 19% capital gains tax on the profit.

Exceptions:

The tax is not payable if the seller has owned the property for 5 years or more.

Exemption is also available if the entire amount is used to purchase a new home or for construction within 3 years.

– Other costs and fees

Property maintenance: utility bills, repair and management fees (especially in residential complexes)

Garbage collection fee: set by the municipality, depends on the number of residents

Management company fees: from PLN 2 to PLN 4/m² per month (€0.5–1/m²)

The Polish real estate taxation system is moderate and relatively transparent. Particular attention should be paid to the PCC tax when purchasing and the obligation to pay capital gains tax when selling. For foreign investors and relocators, it is important to take into account the total tax burden in advance when planning a purchase or lease.

relocation.com.ua recommends consulting a Polish tax advisor or lawyer before entering into a transaction to avoid unexpected costs and optimize the tax consequences.

In June 2025, Ukrainian citizens ranked second among foreign nationals in terms of the number of properties purchased in Turkey. This is evidenced by recent data from the Turkish Statistical Institute (TÜİK). According to the published information, Ukrainians purchased 111 properties, second only to Russians, who traditionally remain the main foreign investors in the Turkish housing market, with 326 transactions per month.

Iranian citizens came in third place (109), followed by Iraq (97), Germany (95), Azerbaijan (71), Kazakhstan (66), China (54), the United States (41), and Palestine (40).

Experts attribute the growing interest in Turkish real estate to the following factors:

Visa-free travel and well-developed air links between Ukraine and Turkey;

Relatively low entry threshold: housing prices in Antalya, Alanya, and Mersin remain attractive compared to the European market;

The possibility of using housing as a means of preserving capital and as an evacuation address in the context of the ongoing war.

In addition, in June, Turkey saw an influx of buyers from Ukraine due to the active tourist season and investors seeking rental income in foreign currency.

Despite an overall decline in real estate purchases by Russians compared to the peak values of 2022–2023, Russians once again became the largest foreign buyers in Turkey in June 2025. This confirms the continuing trend of relocation, including permanent or temporary residence, against the backdrop of Russia’s international isolation.

Given the current geopolitical conditions and the attractiveness of the Turkish market, Ukraine may maintain its high position in the ranking of foreign buyers of real estate in Turkey in the coming months. At the same time, interest from Central Asian and Middle Eastern countries is also expected to pick up.

Overall, Turkey remains one of the leading destinations for real estate investment among citizens of the post-Soviet space.