Retail trade turnover in Ukraine in January 2021 at comparable prices increased by 3.5% compared to January 2020, the State Statistics Service has reported.

According to its data, in January 2021 retail trade turnover decreased by 27.9% compared to December 2020.

The largest growth in the turnover of retail trade of enterprises (legal entities and individual entrepreneurs) in January 2021 compared to January 2020 was recorded in Kyiv (by 13.9%), Chernihiv (by 10.7%), Zaporizhia (by 6.9%), Odesa (by 6.4%), Dnipropetrovsk (by 6.2%), Vinnytsia (by 6%), Poltava (by 5.6%), Sumy (by 4.2%) and Luhansk (by 4.1%) regions.

According to the statistics department, the leaders in absolute indicators of the volume of retail trade in January 2021 were Kyiv city (UAH 19.099 billion), Dnipropetrovsk (UAH 9.382 billion), Kyiv (UAH 8.458 billion), Kharkiv (UAH 7.065 billion), Odesa (UAH 7.213 billion UAH) and Lviv (UAH 5.736 billion) regions.

The State Statistics Service clarifies that the turnover of retail trade enterprises (legal entities) in January 2021 compared to January 2020 increased by 4.9%, from December 2020 decreased by 27.1%, amounting to UAH 71.915 billion.

The wholesale trade turnover of enterprises (legal entities) in January 2021 compared to the same month in 2020 decreased by 0.6% and amounted to UAH 196.453 billion.

As reported, the retail trade turnover of Ukraine in 2020 increased by 8.4% and amounted to UAH 1.211 trillion.

The State Statistics Service reminds that the data are given without taking into account the temporarily occupied territory of the Autonomous Republic of Crimea, Sevastopol and the zone of the JFO.

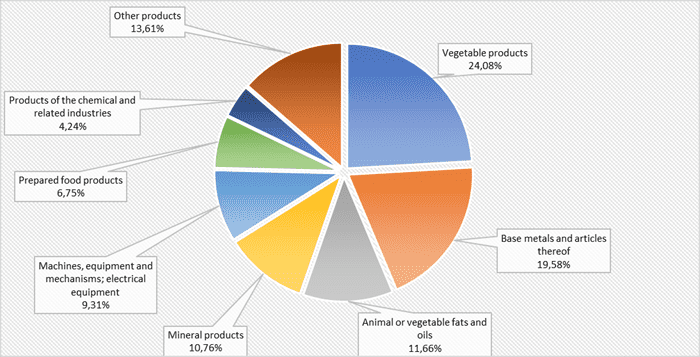

Foreign trade turnover by the most important positions in Jan-Oct 2020 (export).

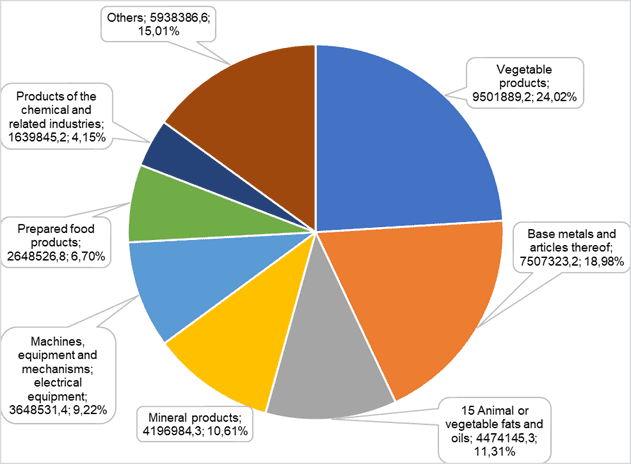

Foreign trade turnover by the most important positions in Jan-Sept 2020 (export).

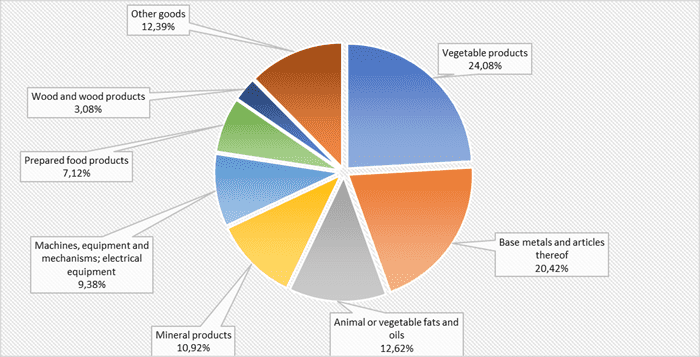

Foreign trade turnover by the most important positions in Jan-Aug 2020 (export).