According to Serbian Economist, Serbian Prime Minister Džuro Mačut stated at a meeting with the new Ukrainian ambassador to Belgrade, Alexander Litvinenko, that Serbia will continue to provide humanitarian aid to vulnerable groups in Ukraine within the limits of its capabilities.

According to a statement on the Serbian government’s website, this assistance will take the form of financial support and supplies of medical and electrical equipment. Matuz also noted that Belgrade is closely monitoring developments in Ukraine, especially the impact on the civilian population and the humanitarian situation.

The ambassador, in turn, expressed his gratitude for the assistance that Serbia has already provided to Ukraine.

Litvinenko is the new head of the Ukrainian diplomatic mission in Serbia and presented his credentials on February 3, 2026.

The State Border Service has announced that traffic will be restricted from 5:00 a.m. on February 18 at border crossing points located on the border with Moldova due to difficult weather conditions.

“Attention international carriers! Traffic through border crossing points located on the border with Moldova will be restricted,” the State Border Service said in a statement on its Telegram channel on Tuesday.

It is reported that the temporary restriction will be imposed on the M-15 Odessa-Reni (to Bucharest) public highway, km 11+920 – km 308+000, from 5:00 a.m. on February 18, 2026. The restriction applies to trucks and passenger vehicles (buses, minibuses).

The reason for the traffic restrictions is difficult weather conditions, which create an increased danger for all road users, as well as to ensure the timely elimination of the consequences of bad weather and prevent accidents.

In this regard, traffic to and from the checkpoints “Palanka-Mayaki-Udobnoe,” “Starokozachye,” “Serpnevoe,” “Maloyaroslavets,” “Lesnoye,” “Reni,” “Dolinskoe,” “Orlovka,” “Vinogradovka,” “Tabaki,” “Novye Trojany” for the specified category of vehicles will be suspended. This has been communicated to our Moldovan colleagues.

EU enlargement is a geopolitical decision, and changes need to be made to the process of accepting new members, but EU member states are not yet ready to name a specific date for Ukraine’s accession, as Ukrainian President Volodymyr Zelensky insists, said EU High Representative for Foreign Affairs and Security Policy Kaja Kallas.

“We really need to work on this. But I think I have the feeling that the member states are not ready to name a specific date,” she said in response to questions at the Munich Security Conference on Sunday, according to a correspondent from the Interfax-Ukraine agency.

Kallas recalled that, in addition to Ukraine, Montenegro and Albania have also been on the list of candidates for accession for a long time.

“I think that the priority, the urgent need to move forward and show that Ukraine is part of Europe, exists,” the head of European diplomacy noted.

Latvian President Edgars Rinkēvičs also agreed with the EU’s unwillingness to set a date for Ukraine’s accession today.

“When I spoke with many heads of state and government of the European Union, I got the impression that at this stage, as we speak here in Munich in February, there is no readiness to set a date,” he said.

In his opinion, there is a desire to see Ukraine become part of the EU as soon as possible.

“The EU has always been very creative when it was really necessary. And we can find a formula that will probably suit us,” the Latvian president believes.

According to him, two other issues need to be resolved as part of this decision: the admission of candidate countries from the Western Balkans, which have long been promised this, and Moldova.

“When talking about Ukraine, don’t forget about Moldova. If Ukraine joins, we cannot exclude Moldova from this. So it’s not just about Ukraine anymore. We are talking about perhaps the largest unifying expansion, but probably under different rules,” Rinkēvičs explained.

In his opinion, it will then be necessary to return to a very serious discussion of what the entire structure of European Union decision-making will look like.

The Latvian president also stressed that the date of Ukraine’s possible accession to the EU, whether we like it or not, is now very much linked to a peace agreement with Russia — will there be a peace agreement or not?

“To be honest, I don’t see Russia being ready for an agreement. And if Russia doesn’t move, we won’t have an agreement,” he explained.

According to Rinkevics, Zelensky’s appeal to set a date for accession should be heard at a meeting of the European Council.

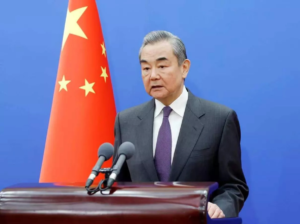

Chinese Foreign Minister Wang Yi, speaking on the sidelines of the Munich Security Conference, said that “the door to dialogue in Ukraine is open, and all parties should strive to reach a comprehensive and lasting peace agreement and eliminate the root causes of the conflict,” and called on Europe to be more active in peace efforts, according to a correspondent for Interfax-Ukraine.

“The doors to dialogue have finally opened on the ‘Ukrainian crisis’ (Russia’s full-scale war against Ukraine – IF-U). All interested parties should seize the opportunity to achieve a comprehensive, durable, and binding peace agreement, eliminate the root causes of the conflict, and ensure lasting peace and stability in Europe,” he said.

According to the Chinese foreign minister, Europe should not stand by and watch.

“Since the conflict broke out here in Europe, Europe has every right to participate in the negotiations at the appropriate time. Europe should not be on the menu, but at the negotiating table,” he said.

“Now we see that Europe has found the courage to negotiate with Russia. This is good, and we support it,” Wang Yi emphasized.

At the same time, in his opinion, dialogue should not be conducted for the sake of dialogue itself, and Europe should offer new ideas and new plans to resolve this issue.

” And in this process, we need to promote the creation of a more balanced, effective, and sustainable security architecture for Europe. Consequently, by doing so, we are addressing the root causes of the crisis and can prevent its recurrence. And to achieve sustainable and lasting peace, China, for its part, will fully support the peace process,” the foreign minister concluded.

He also clarified that China is not a party directly involved in the conflict, has no right to make a final decision, and is only facilitating peace talks.

Regarding relations between China and the EU, Wang Yi expressed his conviction that they should be partners, not systemic rivals or strategic competitors.

“But there are differences and disagreements between our two sides, for example, our social systems, our values, and our development models, but that is because we have different histories and cultures, and based on that, our peoples have different choices regarding the path of development. But that does not mean that we should become rivals or competitors,” the minister said.

He declared that it is more important for China and the EU to practice multilateralism, defend the authority of the UN, say “no” to unilateral practices, uphold free trade, and oppose bloc confrontation.

Information that China’s Foreign Minister Wang Yi said Ukraine is viewed as a “friend and partner” is confirmed by China’s official statements. The remark was made on February 15, 2025, during Wang Yi’s meeting with Ukraine’s Foreign Minister Andrii Sybiha on the sidelines of the Munich Security Conference, Xinhua reported.

According to Xinhua’s publication, Wang Yi noted that China and Ukraine maintain a “traditional friendship,” and that bilateral relations are based on the strategic partnership established in 2011. He also said Beijing is ready to work with Kyiv to advance bilateral relations and practical cooperation despite “unfavorable factors.”

In 2026, the topic of China–Ukraine contacts was again brought to the fore at this year’s Munich conference. Ukraine’s Foreign Minister Andrii Sybiha said on February 13, 2026, that he invited Wang Yi to visit Ukraine and stated that China could help achieve an end to the war.