In Ukraine this week prices for imported tomatoes produced in Turkey have started to decrease, analysts of the EastFruit project report. The reason for this was a rather weak interest of wholesale companies and retail chains in the purchase of these products.

Today Ukrainian importers offer Turkish tomatoes for sale at 75-90 UAH/kg ($1.79-2.15/kg), depending on the quality and volume of batches, which is on average 14% cheaper than at the end of last week. At the same time, the supply of imported products is quite voluminous, while the demand for them is quite restrained. As a result, significant volumes of unsold products are accumulated in the warehouses of companies, due to which sellers are ready to concede in price.

Thus, during the week the supply of tomatoes from Turkey continued to increase, as a result of which the supply on the market remained excessive. Due to low sales rates, most wholesalers and retailers reduced the volume of tomato purchases and purchased new batches as the existing stocks were realized.

At the same time, it should be noted that prices for imported tomatoes in Ukraine are currently still 10% higher than in the same period last year. According to key market players, if the sales rates in the tomato segment do not accelerate in the near future, the decline in prices for these products may last until the end of February this year.

You can get more detailed information about market development of tomatoes and other horticultural products in Ukraine by subscribing to the operative analytical weekly – EastFruit Ukraine Weekly Pro. Detailed information about the product can be found here.

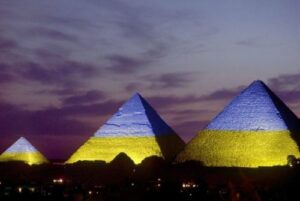

Ukraine and Egypt may sign a free trade agreement that will expand the range of products traded between the two countries, according to Vitaliy Koval, Minister of Agrarian Policy and Food.

The Minister noted that the trade turnover of agricultural products between Ukraine and Egypt increased in 2024. In particular, the export of Ukrainian agricultural products increased by 32% compared to 2023 and amounted to $1.4 billion. It is based on corn, wheat, soybeans, and oil. Egypt supplies Ukraine with citrus fruits, potatoes, nuts, and more.

According to the minister, Egypt is interested in expanding cooperation, particularly in the field of livestock and exports of Ukrainian meat. At the same time, there are factors that hinder the development of trade, including veterinary and phytosanitary restrictions.

The parties discussed issues of processing and storage of agricultural products, the use of modern technologies to reduce food losses and increase production efficiency. The Ukrainian side is represented by Taras Kachka, Deputy Minister of Economy and Trade Representative of Ukraine, and Serhiy Tkachuk, Head of the State Service of Ukraine for Food Safety and Consumer Protection.

The Ukrainian delegation has already held talks with the Minister of Agriculture and Land Reclamation Alaa El-Din Farouk and the Minister of Supply and Internal Trade of Egypt Sharif Farouk. The parties discussed prospects for bilateral partnership in agriculture and food security.

Today, Donald Trump will officially begin his term as the 47th President of the United States of America. His possible actions and strategies in the international arena were the main topic of discussion at a meeting of experts organized by the Atlantic Council and Experts Club. Brian Mefford, Senior Fellow at the Atlantic Council’s Eurasia Center, and Maksym Urakin, founder of the Experts Club, discussed key issues that will affect the geopolitical situation in the world, including Ukraine.

Brian Mefford noted that Trump’s first months in office will be focused on resolving domestic issues, such as the confirmation of his cabinet members in the Senate. However, the expert emphasized that Ukraine will remain an important issue in US foreign policy.

“Ukraine already has a special envoy, General Kellogg. Although his visit to Kyiv was postponed, it shows that Ukraine remains a priority. Its security is crucial for stability in the region,” Mr. Mefford said.

One of the key topics of discussion was Ukraine’s membership in NATO, which was first promised at the Bucharest Summit in 2008. According to Brian Mefford, this decision could have prevented many of the current problems.

“It was a serious mistake at the time. Russia used this uncertainty: first in Georgia and then in Ukraine. Now, because of the war on its own territory, the NATO issue for Ukraine is being postponed indefinitely. At the same time, there is a need for long-term security guarantees. Ukraine needs modern weapons, so the United States and European partners must remain reliable allies of Ukraine,” he explained.

At the same time, according to the expert, the issue of NATO funding became one of the most discussed during Trump’s first presidency, when he called on European countries to increase their defense spending.

“The United States spends more on defense than the next nine countries combined. Trump was right to insist that European countries spend at least 2% of GDP on defense. And now these requirements are being met. Increasing defense spending in Europe is in everyone’s interest. The alliance remains a powerful tool for ensuring stability,” Mr. Mefford emphasized.

According to him, the US withdrawal from NATO is currently an unlikely scenario.

Mefford suggested that the Trump administration will continue its tough economic policy towards China, including trade wars.

“China does not follow fair rules in international trade. Support for Taiwan will remain unchanged, as the United States has strategic interests in the region. Although China often demonstrates strength, its economy is on the verge of recession and its military power is exaggerated,” he explained.

The expert also touched upon the issue of sanctions against Russia, which remain an effective tool of international pressure.

“Trump imposed more sanctions against Russia during his previous term than Obama did. Their mitigation is possible only if the war ends. This is a long-term mechanism that cannot be ignored,” emphasized Mefford.

Maksym Urakin, founder of the Experts Club think tank, in turn, emphasized the importance of Donald Trump’s election for Ukraine and the world and reminded of other important elections for Ukraine and the region in 2025:

“For Ukraine, partnership with the United States is crucial. However, we need to be prepared for different scenarios and strengthen our economic resilience and diversify our foreign policy, given the very important elections this year in Germany, Poland, Romania, Moldova, and Canada. The world is becoming very dynamic in the future,” said Maxim Urakin.

The experts’ analysis showed that Trump’s policy toward Ukraine will be shaped by both internal and external factors. At the same time, Ukraine’s role in global security will only grow, and international support will remain critical for security on the European continent.

The full version of the video is available here:

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

Atlantic Council, EXPERTS CLUB, NATO, SECURITY, TRUMP, UKRAINE, URAKIN, USA, Меффорд

Ukraine in 2024 imported 7 million 562,556 thousand tons of petroleum products (under HS code 2710: gasoline, diesel fuel, fuel oil, jet fuel, etc.), which is 1.1% less than in 2023 (7 million 646,537 thousand tons).

According to the State Customs Service, petroleum products were imported for $6 billion 820.605 million, 12.9% less than in 2023 ($7 billion 831.477 million).

From Greece imported fuel for $1 billion 393.372 million (share – 20.43%), Poland – $917.31 million (13.45%), Lithuania – $681.88 million (10%), other countries – $3 billion 828.042 million (56.12%).

As reported, Ukraine imported 7 million 300.073 thousand tons of petroleum products in 2022, which is 17% less than in 2021 (8 million 790.515 thousand tons). Petroleum products in 2022 imported $8 billion 787.171 million, 56.5% more than in 2021 ($5 billion 614.787 million).

To increase humanitarian aid amid Russia’s war of aggression this winter, the European Union will provide €140 million to Ukraine and a further €8 million to Moldova.

The European Union has announced a new humanitarian aid package

for Ukraine and Moldova. Of this amount, 140 million euros are earmarked for vital emergency aid in Ukraine, including food, shelter, clean water and health care.

This is to be provided in particular to vulnerable groups in the war-torn regions of eastern and southern Ukraine. A further 8 million euros will be allocated to projects in Moldova to support Ukrainian refugees and local communities. The aid is intended to help people survive the “hard winter” in the Russian war of aggression, as Commission President Ursula von der Leyen wrote on X.

Hadja Lahbib, European Commissioner for Resilience, Humanitarian Aid and Crisis Management, and Gender Equality, visited Ukraine to discuss the distribution of EU aid and to step up efforts. “With €148 million in new humanitarian aid for Ukraine, we are providing life-saving support for people and helping to rebuild communities,” Lahbib wrote on X. ”In its hour of need, the EU stands resolutely by the side of the people of Ukraine.”

Ukrainian President Volodymyr Zelensky held a telephone conversation with Argentine President Javier Miley, during which the parties discussed the development of economic cooperation, in particular, the relaunch of the Intergovernmental Commission on Trade and Economic Cooperation and the start of intergovernmental consultations.

“Javier Miley assured that Ukraine can continue to count on Argentina’s full support,” the Ukrainian head of state’s website reported on Friday.

Zelensky thanked Argentina for participating in the inaugural Peace Summit and joining the Coalition for the Return of Ukrainian Children, the international Crimea Platform and the Ramstein format. He stressed that Ukraine needs the preservation of the Contact Group on Defense, as well as joint steps by Argentina, the U.S. and all allies to weaken the Russian dictator and end the war with a just and lasting peace.

In a Friday evening video message, the Ukrainian president noted his Argentine counterpart’s results in economic reforms and called from “the right example of economic growth.”

“We will increase our cooperation with Argentina – both economic, political and security,” the Ukrainian head of state said.

Zelensky invited Milay to come to Ukraine on a visit.