Due to Russia’s full-scale invasion and its desire to use food as a weapon, transporting grain and oilseeds from Ukraine to other countries has become extremely difficult. Since 2022, logistics issues have had to be significantly revised in order to find safer shipping routes and options. Despite the dire circumstances created by the Russian Federation, Ukrainians are ensuring food security for many countries, particularly in Europe.

In March 2025, Kyiv exported a total of 4.7 million tons of grain and oilseeds and their processed products. This is 7% more than in the previous month.

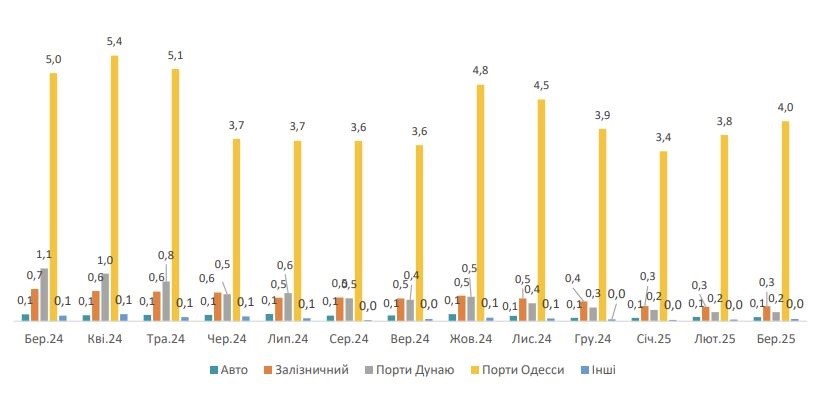

“How does Ukraine transport grain and oilseeds, as well as products made from them? The lion’s share goes to the seaports of the Odesa region. This figure is 4 million tons. By rail – 300,000 tons, through the river ports of the Danube – 200,000 tons. It is also exported by road. The volume reaches 100,000 tons,” said grain market analyst Oleksandr Korenitsyn.

Exports of grain crops, oilseeds, and processed products, million tons

Let’s look at the prices of the main agricultural crops that Ukraine exports to world markets. In April 2025, the price of wheat (France, FOB) was 244 USD/ton. Note that this is 3 USD more than in March of this year and 29 USD more than in the same period of 2024. The price of wheat (Ukraine, 2nd class, CPT) in April 2025 was USD 211/t (central regions), which is USD 4 more than in March 2025 and USD 75 more expensive than a year ago. In ports, the price was 229 USD/t, which is 7 USD higher than in the previous month and 65 USD more expensive than in April 2024, according to the International Grains Council.

As for corn (USA, FOB), the price as of April 2025 was USD 211/t. This amount is USD 4 higher than in the previous month and USD 19 higher than in April 2024. The price of corn (Ukraine, CPT) in the central regions is 206 USD/t, thus increasing by 11 USD over the month and by 89 USD over the year; ports – 222 USD, which is 12 USD more than in March 2025 and 78 USD higher than in April 2024.

As noted by Oleksandr Korenitsyn, the price of barley (France, FOB) was 229 USD in April 2025, which is 1 USD less than in March of this year and 26 USD more than in the same period last year. The price of barley (Ukraine, CPT) was USD 195 in the central regions, which is USD 8 more than in March 2025 and USD 102 higher than in April 2024; in ports, it was USD 215 (the price rose by USD 5 per month and USD 85 over the year).

“Another important crop for Ukraine and the world that should be mentioned is sunflower. The price of its seeds in the EU (Rotterdam, FOB) in April this year was 730 USD/t. There has been an increase in price over the last month – by 7 dollars, as well as an increase over the year – by 273 dollars. Meanwhile, the cost of sunflower seeds (Ukraine, CPT) for the central regions was 537 USD/t. The price rose by 10 USD per month and 221 USD per year. For ports, the cost is $512 per ton, which is $6 more than last month and $194 more than last year,” said expert Oleksandr Korenitsyn.

We would like to add that the cost of sunflower oil (Ukraine, FOB) in April was $1,140 per ton. It should be noted that among the key factors that could destabilize further pricing on the world market and affect food security in Europe and the world are Russia’s military actions on the territory of Ukraine.

EUROPE, full-scale Russian invasion, grain exports, Korenitsyn, LOGISTICS, Odessa ports, OILSEEDS, PRICES, UKRAINE, VOLUME

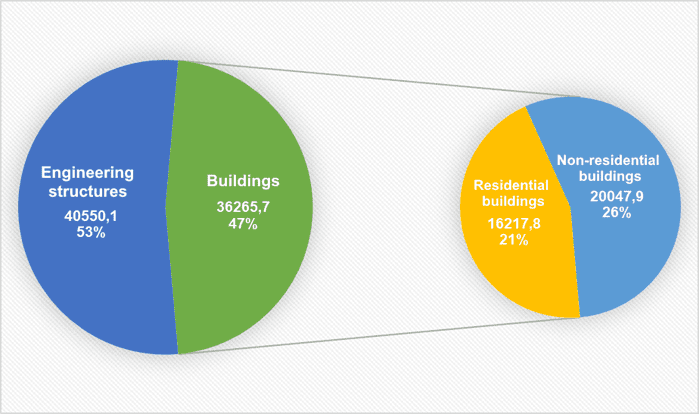

VOLUME OF CONSTRUCTION PRODUCTS PRODUCED BY TYPE IN JAN-JUNE OF 2021 (MLN UAH)

The mortgage program, which is being implemented by the government at the initiative of the president of Ukraine through the Entrepreneurship Development Fund, did not affect housing sales, Viktoria Volkovska, the director general of the Finance and Investment Management Association (FIMA), has told Interfax-Ukraine.

According to FIMA research, 53.8% of surveyed managers of construction financing funds did not notice the impact of “mortgage at 7%” on sales and do not expect it in the future. At the same time, 38.5% still hope that it will have an impact on the volume of construction and sales. Only 7.7% are optimistic about the program and consider it as the beginning of active growth in the industry.

“Some 38.5% of respondents see the reason for the not very successful start of the “mortgage at 7%” as the conditions of the program do not suit the borrowers,” Volkovska said.

At the same time, 30.8% of respondents indicated that the terms of the program do not suit lenders and developers, and 7.7% simply believe that the program does not work.

“The fact that borrowers cannot pass financial scoring at the bank because of their salaries in envelopes is not considered a problem,” the expert emphasized.

The FIMA study is based on an online survey of construction finance fund managers, conducted following the results of the first half of 2021.

The Finance and Investment Management Association (FIMA) was established in May 2020. It unites 41 financial companies-managers of construction financing funds in Kyiv, Lviv, Odesa, Dnipropetrovsk, Khmelnytsky and Kharkiv.

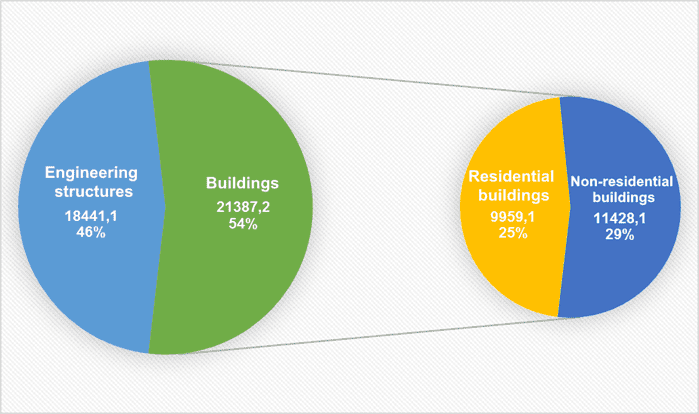

VOLUME OF CONSTRUCTION PRODUCTS PRODUCED BY TYPE IN JAN-APRIL OF 2021 (MLN UAH)

The volume of construction work performed in Ukraine in January-May 2021 decreased by 6.1% compared to the same period in 2020.

According to the State Statistics Service, in January-May, the volume of construction work completed amounted to UAH 54.4 billion.

According to the statistics department, in May 2021 the seasonally adjusted index of construction products amounted to 93.1% compared to the previous month, adjusted for the effect of calendar days compared to May 2020 – 91.6%.

The State Statistics Service reported that in May 2021 from May a year earlier, an increase in the volume of construction work was observed only in residential construction – by 30.9%, while in the segment of non-residential construction it decreased by 4.8%, engineering – by 19.7%.

The share of new construction in the total volume of completed construction work was 40.6%, repairs – 31.6%, reconstruction and technical re-equipment – 27.8%.

An increase in the volume of construction work in January-May 2021 compared to January-May 2020 was recorded in Khmelnytsky (by 20.1%, to UAH 1.4 billion), Ternopil (by 50.6%, to UAH 1.1 billion), Rivne (by 20.6%, to UAH 949.5 million), Volyn (by 10.6%, to UAH 713.7 million), Kharkiv (by 10.6%, to UAH 5.9 billion), Donetsk (by 5.9%, to UAH 2.1 billion) and Ivano-Frankivsk (by 9.8%, to UAH 1.1 billion) regions.

In other regions, there was a decrease in construction volumes. The most significant drop was shown by Chernivtsi (by 48%), Kherson (by 32.7%) and Vinnytsia (by 37%) regions.

As reported, the volume of construction work performed in Ukraine in 2020 increased by 4% compared to 2019.