Ferrexpo plc, a mining company with its main assets in Ukraine, produced 2,169,631 tons of pellets in January-June this year, which is 34.2% less than in January-June last year (3,297,441 tons).

According to the company’s press release on Monday, total production of commercial products (pellets and iron ore concentrate) in the first half of 2025 decreased by 9% compared to the first half of 2024, to 3 million 393,135 thousand tons. In particular, the output of marketable concentrate amounted to 1 million 223.504 thousand tons against 429.865 thousand tons, respectively. The company also produced 81,787 thousand tons of DR pellets (in the first half of 2024 – 162,645 thousand tons) and 2 million 87,844 thousand tons of premium pellets (a decrease of 33.4%).

The press release notes that from January to April 2025, the amount of VAT refunds denied amounted to $31 million. Due to the current suspension of VAT refunds and the associated decline in financial liquidity, the group was forced to reduce production from two to one pelletizing line and also to reduce the production of high-quality concentrate. As a result, total commercial production for the second quarter amounted to 1.3 million tons, down 40% from 2.1 million tons in the first quarter.

However, the group demonstrated flexibility and agility by continuing to benefit from strong demand for its concentrate from customers in China, which accounted for more than a third of its product mix in the first two quarters of 2025, the statement said.

Among other things, it has made efforts to reduce its costs in order to remain financially viable. This includes reducing working hours for employees, cutting purchases of goods and services, and suspending all non-essential capital expenditures, overhead costs, and corporate social responsibility expenses.

Commenting on the group’s performance, interim CEO Lucio Genovese noted that the strong momentum at the beginning of the year, which reflects, in particular, increased quarterly production since the full-scale invasion in February 2022, was significantly limited in the second quarter as the company began to feel the impact of tax authorities’ decisions to suspend VAT refunds. As a result, production fell to 1.3 million tons in Q2 2025.

“Despite the weaker iron ore pellet market, we were able to significantly change our production portfolio and take advantage of strong demand in China for our high-quality low-alumina iron ore concentrates. During the first six months of 2025, concentrate sales accounted for 36% of our production portfolio, three times more than in the same period a year ago. In a challenging operating and market environment for iron ore, it is encouraging that we have been able to be so flexible and take advantage of the demand for high-quality concentrates,” said the top manager.

At the same time, he pointed out that lower iron ore prices and reduced production had a negative impact on profitability. The situation was exacerbated by higher prices for raw materials such as gas and electricity. During the second quarter, the group worked hard to reduce its costs in order to remain financially viable.

“This includes reducing working hours or leave for approximately 37% of employees, reducing purchases of goods and services, and suspending all non-essential capital expenditures, CSR, and humanitarian expenditures. At the same time, every effort is being made and measures are being taken with the relevant authorities and government agencies in Ukraine and internationally to try to resolve the issue of the suspension of VAT refunds,” Genovese added.

As reported, Ferrexpo produced 1 million 347,749 thousand tons of pellets in Q1-2025, which is 26% lower than in January-March last year (1 million 813,973 thousand tons). At the same time, total production of commercial products (pellets and iron ore concentrate) in Q1 2025 increased by 3% compared to Q1 2024, to 2 million 125.467 thousand tons. In particular, the output of marketable concentrate amounted to 777,718 thousand tons, compared to 240,516 thousand tons in Q1-2024. The company also produced 81,879 thousand tons of DR pellets (not produced in Q1-2024), 1 million 105.049 thousand tons of premium-grade pellets (a decrease of 36%) and 160.913 thousand tons of other pellets (an increase of 95%).

In 2024, Ferrexpo increased its production of pellets by 58% compared to 2023, to 6 million 70.541 thousand tons from 3 million 845.325 thousand tons. In the fourth quarter of 2024, it produced 1 million 503.373 thousand tons of pellets, which is 18% higher than in the previous quarter (1 million 269.727 thousand tons).

At the same time, total production of marketable products (pellets and iron ore concentrate) in 2024 increased by 66% compared to 2023, to 6 million 889.879 thousand tons from 4 million 152.028 thousand tons. In particular, the output of marketable concentrate reached 819,338 thousand tons compared to 306,703 thousand tons in 2023. The company also produced 489,720 thousand tons of DR pellets, 4 million 984,990 thousand tons of premium pellets, and 595,831 thousand tons of other pellets.

In 2023, Ferrexpo produced 3.845 million tons of pellets, which is 36.5% less than in 2022.

Ferrexpo owns 100% of Yeristovsky GOK LLC, 99.9% of Bilanivsky GOK LLC, and 100% of Poltavsky GOK PJSC.

Value added tax (VAT) refunds for January-May 2025 reached UAH 70.9 billion, which is 23.8%, or UAH 13.3 billion, more than in the same period of 2024, and 15% (UAH 9.3 billion) more than in 2023, the State Tax Service of Ukraine (STS) reported on Wednesday.

According to a statement on the agency’s Telegram channel, taxpayers were reimbursed UAH 15.5 billion in May 2025.

“This is 22.3% (+2.8 billion UAH) more than in May 2024. Compared to May 2023, the figure increased by 55.9% (+5.6 billion UAH),” the service emphasized.

As reported, on May 27, Kravchenko denied the growth of VAT refund arrears, as as of May 1, the figure reached UAH 30.4 billion. He explained that these funds are “in progress” as audits are being conducted.

The National Bank of Ukraine (NBU) has authorized the purchase and transfer of foreign currency by resident legal entities that are e-commerce entities abroad to pay value added tax (VAT) on the purchase of goods from domestic producers by consumers from EU countries.

“The condition for these transactions is that the e-commerce entity must be registered as a taxpayer in the EU. This mitigation will primarily support small and medium-sized businesses that will be able to promote their own goods on the EU market through trading platforms,” the central bank said in a press release on Monday.

The regulator assumes that this will not have a negative impact on international reserves, as the inflow of foreign currency to Ukraine for the goods sold will far exceed the additional demand for currency to pay VAT in the EU.

In addition, the NBU announced a number of other currency easing measures. In particular, the central bank allowed state-owned companies to buy and transfer foreign currency abroad to cover carbon dioxide emissions.

“State-owned enterprises will be able to buy foreign currency and transfer it to non-residents to purchase quotas to cover or compensate for carbon dioxide (CO₂) emissions associated with aviation activities,” the National Bank explains.

According to the regulator, this step contributes to the continuity of defense procurement under state contracts, will allow for further air transportation abroad, and will support military-technical cooperation with the EU.

Other transactions that the NBU has authorized since September 10 include payments for operations under reinsurance agreements concluded with foreign nuclear insurance pools.

“In particular, to pay a break-even bonus, which is a mandatory condition stipulated by the reinsurance agreement. This mitigation will have a minor impact on international reserves and at the same time will allow the Nuclear Insurance Pool to fulfill its obligations to partners, which is important for the smooth operation of the industry,” the NBU said in a release.

As reported, the regulator also allowed Ukrainian businesses to reimburse coupon payments on Eurobonds paid from February 24, 2022, to July 9, 2024, at the expense of their own foreign currency accumulated in Ukraine.

At the same time, starting from September 10, the NBU introduced a limit of UAH 100 thousand per month for payments for watches, jewelry, precious stones and coins from currency cards of Ukrainian banks abroad and up to UAH 500 thousand per month for transactions with real estate agents.

All of the above innovations are introduced by Resolution No. 108 of September 6, 2024, which was officially promulgated on Monday, September 9.

The Cabinet of Ministers of Ukraine for the period of martial law has exempted from VAT operations on the supply of components for vehicles (including special and specialized), as well as fuel and lubricants for security and defense forces, said the Cabinet’s representative in the Verkhovna Rada Taras Melnychuk following a government meeting on Thursday.

The government’s decision is enshrined through amendments to the government resolution from March 2, 2022 N178 “Some issues of imposition of value added tax at a zero rate during martial law”.

“It is established that until the termination or abolition of martial law, operations on the supply of goods (spare parts, batteries, car tires, coolants, components, additional equipment, etc.) for vehicles (including special, specialized vehicles), as well as fuel and lubricants … are subject to value added tax at a zero rate,” Melnychuk wrote in Telegram.

The Ministry of Finance of Ukraine has supported the proposal of the Association “Insurance Business” (ASB) and the League of Insurance Organizations of Ukraine (LIOU) on the inadmissibility of VAT taxation of commission remuneration of insurance agents, according to the press release of the ASB.

It is specified that the norm on VAT taxation was contained in the draft law of Ukraine “On Amendments to the Tax Code of Ukraine to improve the taxation of insurance activities in Ukraine”.

As reported, both associations jointly appealed to the Ministry of Finance, the Ministry of Economy, the State Regulatory Service, the National Bank with a request not to worsen the tax conditions of insurance business and not to violate the requirements of the EU Directive.

“Ukraine is moving to the EU, so we must check all tax innovations both with common economic sense and with the principles and norms in force in the European Union,” says Vyacheslav Chernyakhovsky, general director of the Insurance Business Association.

At the same time, the press release specifies that the imposition of VAT on commissions of insurance agents directly contradicts the EU Council Directive No. 2006/112/EC of November 28, 2006 “On the Common System of Value Added Tax”. Article 135 “Exemption from taxation of other activities”, which expressly stipulate that “Member States shall exempt from taxation … insurance and reinsurance operations, including related services provided by insurance brokers and insurance agents.

The report also notes that to substantiate their position, insurance associations have analyzed the performance of insurers of Ukraine for the first nine months of 2023 and conducted a representative survey of market participants. According to the results of which it became clear that the state would not receive economic effect from this innovation, and on the contrary, there would be unpredictable additional costs for administration, control and monitoring of VAT operations in insurance activities.

“According to our estimates, our proposals, supported by the Ministry of Finance, saved each insurance company at least 40-50 thousand UAH monthly,” – said Chernyakhovsky.

insurance agents, MINISTRY OF FINANCE, TAXATION, VAT, АСБ, ЛСОУ

Amounts to be refunded decreased by almost one and a half times

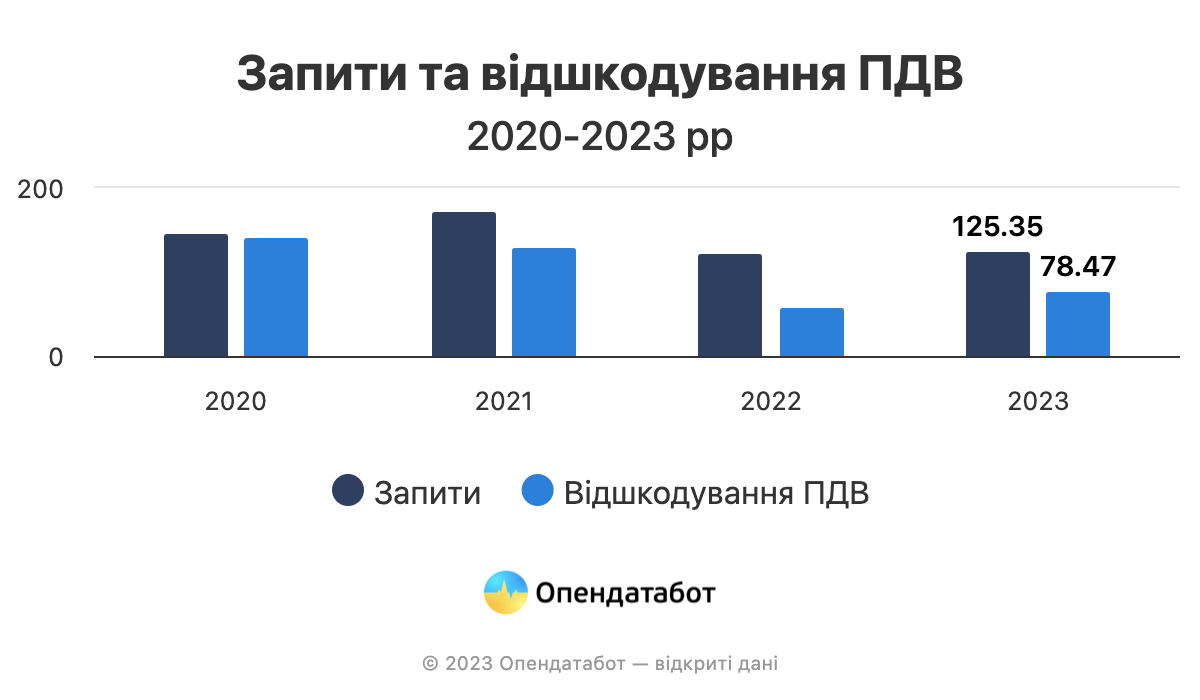

Value added tax (VAT) accounted for one fifth of all state budget revenues in 2023. All VAT payers are entitled to a VAT refund. However, only 63% of the requested VAT refunds were paid by the State Tax Service (STS) in 2023.

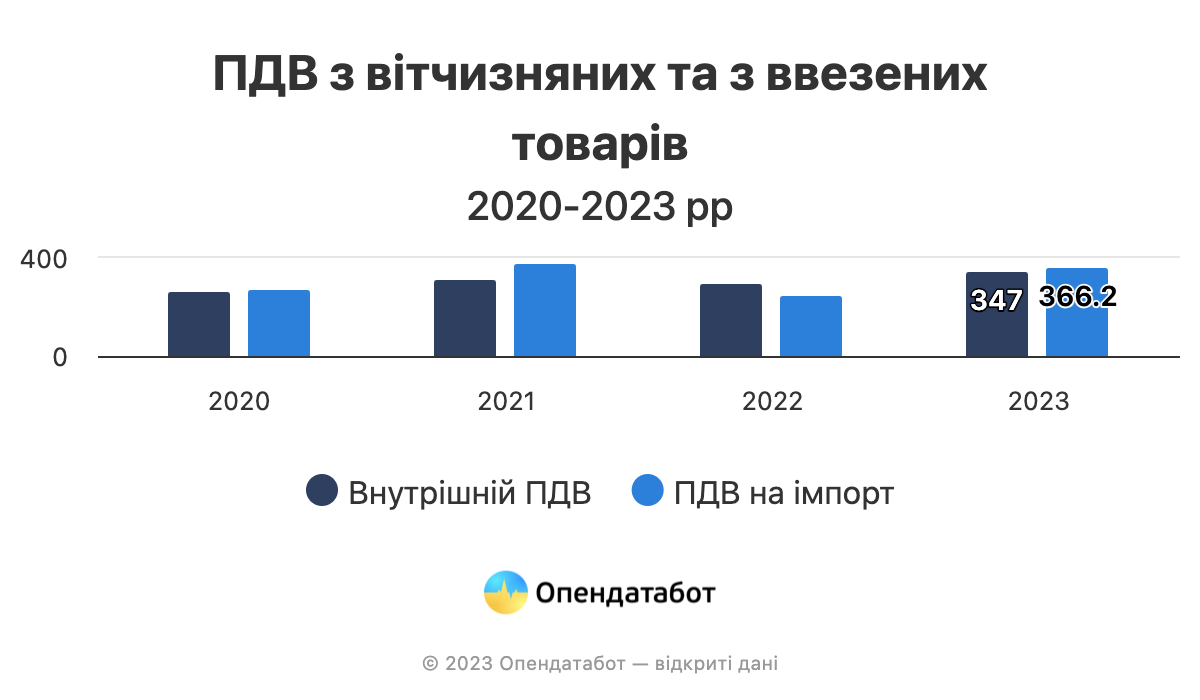

Last year, VAT on imported goods amounted to UAH 366.2 billion, a 1.4-fold increase compared to the first year of the full-scale war. This is almost the same as in 2021 – UAH 380.7 billion.

At the same time, domestic VAT – that is, the tax on goods produced in the country – increased by 10% by 2021.

The situation with VAT refunds in 2023 improved slightly, but still did not reach pre-war levels. Last year, the Tax Service refunded 63% of the amounts claimed for refund, almost UAH 78.5 billion. This is 1.6 times less than in 2021. It is worth noting that the amounts to be refunded decreased by 1.4 times compared to the same pre-war year.

In general, the worst VAT refund rates over the past 4 years were recorded in 2022 – only 48% of the requested amounts, and the best – in the covid 2020: 97% of the requested amount.

Last year, VAT on domestic goods, including refunds, amounted to 8.6% of the budget, and VAT on imported goods – 11.5%. VAT will account for 20% of all state budget revenues in 2023. For comparison, in 2022, VAT brought 25% of the state treasury.