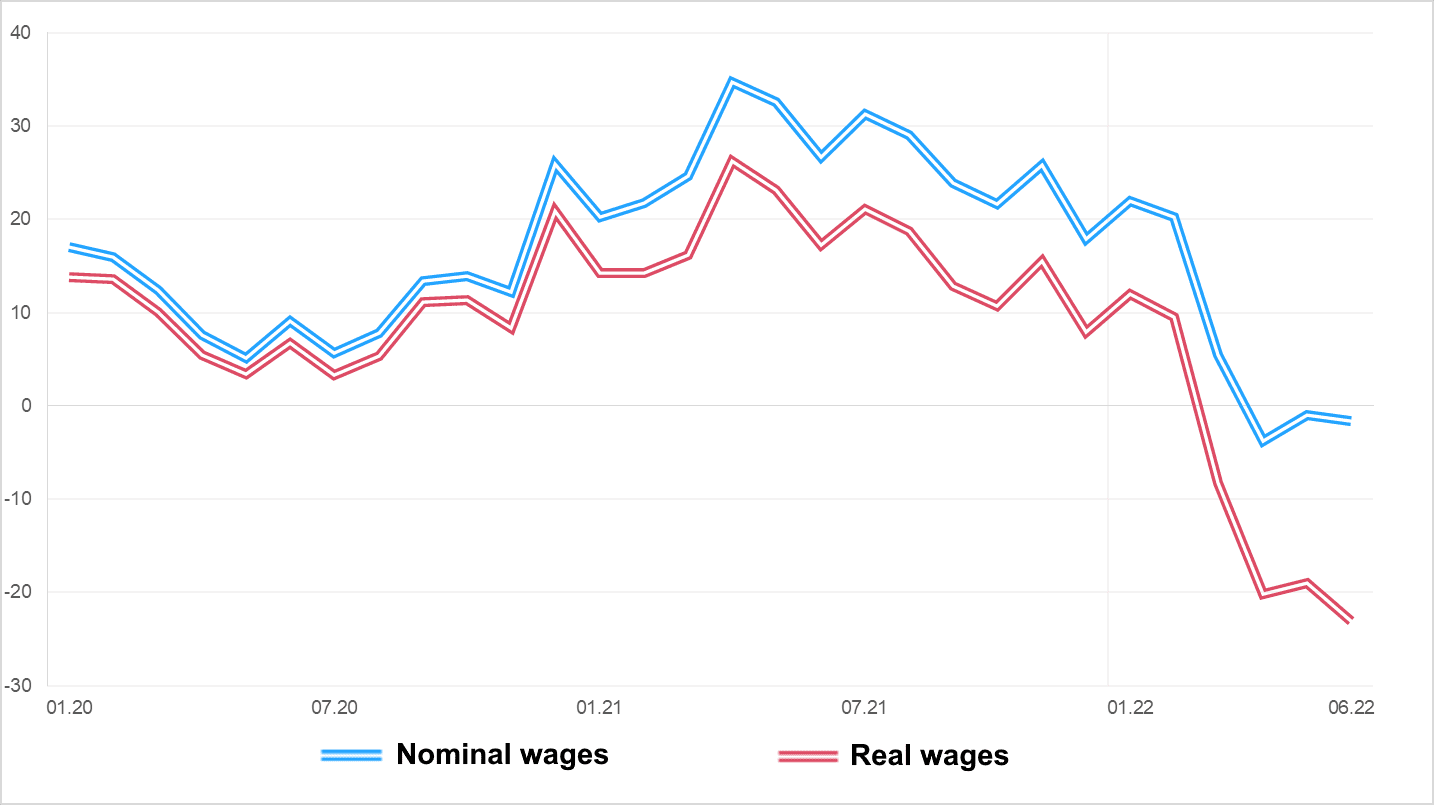

Dynamics of changes in level of wages in Ukraine for 2020-2022 (%)

Source: open4business.com.ua and experts.news

The US dollar is getting stronger against the euro, the yen and the pound sterling during trading on Tuesday.

Traders are awaiting the publication of the Federal Reserve System (Fed) meeting minutes from January 31 to February 1. The Federal Reserve Board decided to raise the rate by 25 basis points (bps) – to 4.5-4.75% a year.

Experts expect that the protocol may confirm the Fed’s intention to continue raising the rate longer than it was planned before, Trading Economics said.

The latest statistical data on the U.S. economy has “called into question” arguments that the Fed may soon halt its rate hike cycle or move to lower rates altogether, notes Chuck Camello, president and chief executive officer of Essex Financial Services.

“I think the market is finally coming to the realization that U.S. rates will be higher than expected, and longer than expected,” Bloomberg quoted the expert as saying.

Calculated by ICE index showing dollar dynamics against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) added 0.13% during Tuesday’s trading, broader WSJ Dollar Index added 0.15%.

The euro/dollar pair is trading at $1.0672 as of 8:10 a.m., up from $1.0687 at Monday’s market close.

The pound fell to $1.2026 from $1.2041 the day before.

The value of the American currency against the yen rose to 134.39 yen against 134.26 yen in previous trading.

The price of Brent crude oil was falling on Tuesday after a rise the day before, while WTI, which was not traded on Monday, was stable.

The oil market has remained in a narrow price range of around $11/bbl since early 2023. On the one hand, it is supported by expectations of increased demand in China after the lifting of quarantine restrictions and fears of supply reduction on the market due to the reduction of production by Russia. On the other hand – the market fears the weakening of the U.S. economy amid tighter monetary policy by the Federal Reserve (Fed), said Bloomberg.

The price of April Brent crude futures on London’s CE Futures exchange is $83.08 a barrel by 7:10 a.m. Tuesday, down $0.99 (1.18%) from the previous session’s closing price. Those contracts rose $1.07 (1.3%) to $84.07 a barrel on Monday.

The price of WTI futures for April oil grew by $0.03 (0.04%) to $76.58 per barrel at electronic trades of New York Mercantile Exchange (NYMEX) by that time. There were no major trades on the NYMEX on Monday due to a holiday in the U.S. (Presidents’ Day).

March contracts, which expire at the close of Tuesday’s session, are stable at $76.34 a barrel.

The big event this week is the release of the minutes of the latest Fed meeting, in which the benchmark interest rate was raised by 25 basis points.

“Any hawkish signals in the Fed meeting minutes will be a catalyst for lower oil prices,” notes IG Asia Pte Ltd. analyst Yep June Rong. The market, according to him, is trying to go up amid improving prospects for supply due to the economic recovery in China.

In addition, experts see signals of increased demand in India: refinery workload in the country in January rose to its maximum level for five years, notes Bloomberg.

Ukrzaliznytsia JSC (UZ) is negotiating with the Romanian side to implement a project that will extend the connection from the recently opened Valia-Visheului station to major cities in Romania, and continues to develop the connection between Ukrainian regional centers and international destinations, UZ board member Alexander Pertsovsky told Interfax-Ukraine Agency.

“We continue to develop international connections. We have already made the first steps to connect western Ukraine with Romania. So far it is one small station Valya-Visheului, but we are working with the Romanian side to extend messages to major cities on the Romanian side,” – said Pertsovsky.

According to him, there is a wide track (1520 mm) in this direction, on which ordinary Ukrainian cars will be able to pass.

As previously reported, last year UZ repaired sections Rakhiv – Dilove – Valya Visheului (19.2 km of track, 12 bridges), and also held repairs of the station in Rakhiv. This allowed to bring back to life a section of the railroad, which has not functioned since 2011, and to run trains number 755/756 and number 753/754 Rakhiv-Valya-Visheului-Rakhiv. Also, the section at the border with Romania, Teresva – border, which had not functioned since 2007, was repaired. There are also two international crossings between Ukraine and Romania, through which only freight traffic is carried out: Vadul-Siret-Dornesti and Dyakovo-Halmeu.

In general, due to active launching of new international communications, the number of passengers traveling in international directions from Ukraine has increased by 9 times, said Pertsovskyi, without specifying absolute numbers.

He pointed out that the most popular destination is Poland. Every day, UZ receives up to 2 thousand or more requests to buy tickets for the train Kyiv-Warsaw. As reported, to provide more seats, on February 19, UZ launched a service that allows people from Kharkiv to go to Kyiv and Kyiv-Warsaw train to Helm, where passengers can arrive in Warsaw at the same time as the passengers of direct train Kyiv-Warsaw with an interchange. Now there are 8 cars with the occupancy of 95%. In the future there may be up to 10 of them. Also on February 19 UZ started one more train Kharkiv-Peremyshl.

According to Pertsovsky, UZ will continue to develop the direction of communication of the regions in the direction of international destinations.

“We will continue to work with the Polish direction. We see that the routes connecting the same Kharkiv work effectively. We will see to what extent Dnipro, Odessa… Because since the beginning of the war we have got communication with Europe not only the capital, but also Dnipro, Zaporozhye, Odessa, Vinnitsa. And we look at the demand in these directions to assess plans for further development”, – said a member of the board of UZ.

After a long break, the construction of the subway to Vynohradar has been resumed in Kiev.

As the head of the Kyiv subway Viktor Brahinsky said on the air of TSN, the contractor has resumed the construction of a new subway station in Kyiv – Vinohradar: first the consolidation of already built tunnels will be completed, and then will begin construction of the second tunnel from Mostitskaya station to Syrets station.

According to Brahinsky, there is no clear timeline for the completion of the work yet, because the pace of construction is affected by the current situation in the country.

“Of course, the pace of construction is affected by the current situation, because construction crews and everyone involved in the construction during the air alert must be safe. In addition, the unstable power supply slows down the work process. But despite the difficulties arising from the war, the Kiev city authorities and the subway are making every effort to ensure that this project will continue,” – said the head of the subway.

Previously, the capital authorities had promised the citizens to open the first station at the end of 2021, but it did not meet the deadline, and then the war began. According to the previously published project, the Kyiv subway is going to build four new stations from “Syrets” terminus: “Mostitskaya”, “Prospekt Pravda”, “Vinogradar” and “Marshala Grechko Street”.

French Economy Minister Bruno Le Maire on Monday called on the IMF to provide EUR 15 billion in aid to Ukraine and tighten economic sanctions against Russia ahead of the G20 financial meeting this week in India, French Le Figaro writes.

“In addition to the support that Europe provides, in addition to the support that the G7 countries provide, it is important that the IMF mobilizes for Ukraine,” Bruno Le Maire said, marking the “sad anniversary” of the war in Ukraine.

“We are working on the IMF Program for Ukraine, which could amount to about EUR 15 billion over four years,” the French minister said.

According to the publication, citing a source in the IMF, Ukraine will be able to demand financial support, since the Fund believes that the Ukrainian authorities have shown “solid” work within the “Monitoring Program.”

According to the French minister, “economic sanctions are effective” because “they made it possible to almost halve Russia’s oil revenues, they made it possible to completely disrupt Russian production chains, especially in such strategic industries as aviation or automobiles.”

On Friday, February 24, a meeting of finance ministers and heads of central banks of the G20 countries will be held in Bangalore (India).