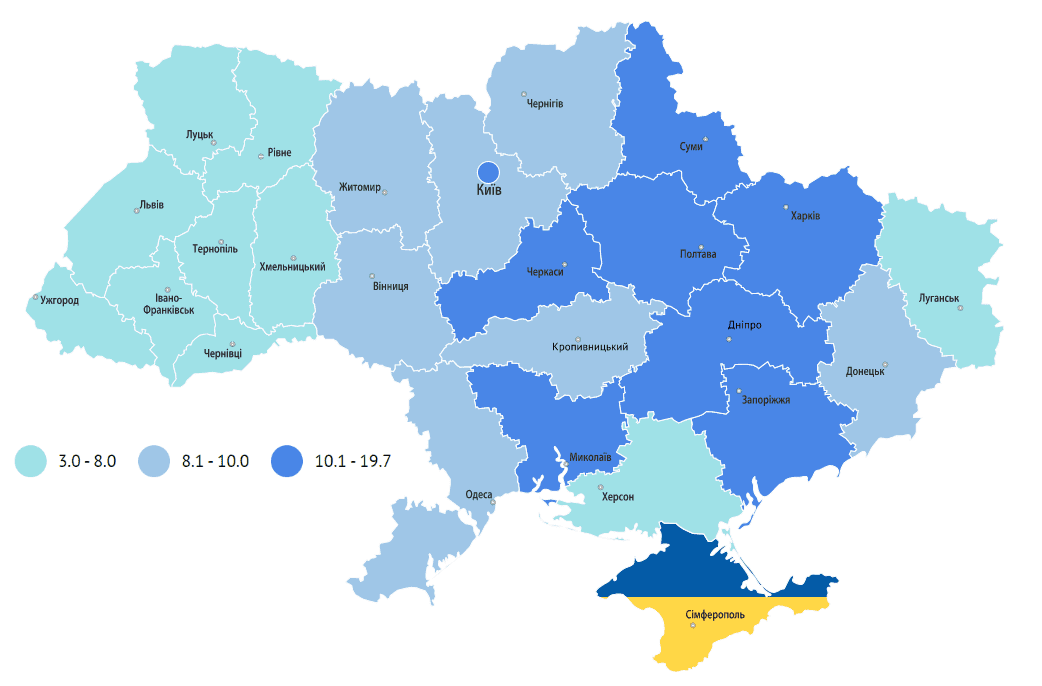

Number of unemployed people registered in public employment service as of 11/01/2022 (thush people)

State employment center

The forecasted gross harvest of grain crops in Ukraine in 2023 could be 34 million tons, which is 37% less than in 2022 and 60% less than in 2021, while the yield of oilseeds is expected to be 19.3 million tons, which is 13% more than in 2022 and 15% less than in 2021.

As reported on the website of the Ukrainian Agribusiness Club Association (UCAB) on Friday, such a reduction in the grain harvest is caused by the reduction of cultivated areas under crops next year by 45%, to 8.7 million hectares.

The reasons for the reduction in the grain harvest next year will be a decrease in the total sown area, a change in the structure of crops in favor of oilseeds and lower yields of grain crops.

UCAB noted that of the 28.4 million hectares under cultivation in 2021, by December 2022 there are 24.6 million hectares of agricultural land (86% of the total area) in the controlled territory of Ukraine, of which 3.8 million hectares are not suitable for agricultural work due to their proximity to the front lines, contamination by mines and shells, etc. In addition, the end of the sowing campaign of winter crops has demonstrated a significant reduction in the sown area – 3.8 million hectares of winter crops have been sown in 2022, which is 43% lower than in 2021.

UCAB stressed that the reason for this trend is the limited ability to export crops, expensive logistics and, as a consequence, a significant difference in prices of crops by region.

“The regions that are geographically close to sea ports and borders with the EU, have a higher price for agricultural products compared to the regions in the north and east of our country. For example, the price of corn with VAT in Transcarpathian region is 6800 UAH per ton, and in Sumy region – 4900 UAH. However, even in western regions the price is unprofitable. Therefore, the proximity of the border with the EU and working ports determines the ability of the relevant areas to continue grain production, “- the association specified in the message.

In turn, next 2023 will see an increase in the area under oilseeds due to their higher margins compared to grain crops and a significant increase in the logistics of grain this year.

“The price of oil-bearing crops is 2 times higher than the price of grain crops on the world market. According to preliminary estimates, the sown areas under grain crops in 2023 will be 8.7 million hectares, which is 22% less than in 2022 and 45% less than in 2021. The projected area sown with oilseeds is 9.7 million hectares, which is 32% more than in 2022 and 9% more than in 2021. For the first time, the area under oilseeds will be larger than that under grains,” the UCAB said in a statement.

In addition, next year’s average yield will decrease by 10-30%, depending on the region and crop, compared to the average yield of previous years due to a 50-60% reduction in fertilizer application, significant amounts of corn left in the fields of the 2022 crop, the lack of agribusiness funding and the need for significant resource savings.

UCAB stressed that taking into account the given gross production volumes and domestic needs of Ukraine the export potential of grains and oilseeds in 2023/24 marketing year (MY, July-June) will be about 35 million tons, or 3 million tons per month. For comparison, in 2021/22 MY export potential was at the level of 85 million tons of grains and oilseeds, or 7 million tons per month.

As reported, Ukraine in 2021 harvested a record crop of cereals, legumes and oilseeds at 106 million tons: 84 million tons of cereals and legumes, and 22.6 million tons of oilseeds.

A total of 32.4 million tons of wheat, 40 million tons of corn, 10 million tons of barley, 581.5 thousand tons of peas, 191 thousand tons of millet and 110 tons of buckwheat were harvested last year. Sunflower harvest amounted to 16.3 million tons, soybeans – 3.4 million tons and rapeseed – 2.9 million tons.

Due to the enemy-induced de-energizing of the contact network, 17 trains of Ukrzaliznytsia are already running with delays of more than 30 minutes.

As emphasized in the communication in the telegram channel UZ, at the same time:

– not a single long-distance train has been cancelled;

– if a passenger misses his trip due to alarm – he will be delivered to the next one with the same ticket;

– reserve diesel locomotives are put out to work and back up the de-energized sections;

– train stations are working on boarding and disembarking through underpasses; people are in shelters.

Trains are delayed by more than an hour:

– No. 45/46 Uzhgorod – Kharkiv (+1:46);

– №111/112 Kiev – Izyum (+1:40);

– No.149/150 Chernivtsi – Poltava-South (+1:20);

– #31/32 Peremyshl – Zaporizhzhia (+1:18);

– #21/22 Truskavets – Kharkiv (+1:17);

– No. 707/708 Kyiv – Chernihiv (+1:17);

– #15/16 Rakhiv – Kharkiv (1:15);

– #93/94 Chelm – Kharkiv (+1:15);

– №131/132 Dnipro – Lviv (+1:13);

– #119/120 Lviv – Zaporizhzhya-1 (+1:11);

– #721/722 Kyiv – Kharkiv (+1:10);

– No. 731/732 Kyiv – Dnipro (+1:07);

– No. 725/726 Kharkiv – Kiev (+1:07);

– #715/716 Peremyshl – Kiev (+1:01).

On the Odesa, Prydniprovska, and Yuzhnaya Railways, commuter trains, which are already on their way, will continue to run under diesel locomotives with a delay of up to 2 hours.

The Kiev ring train continues with delays due to power outages in several sections of the capital, but traffic across both bridges continues.

The International Financial Corporation (IFC) has announced a new $2 billion bailout package to help boost the vitality of the Ukrainian private sector and support the well-being of Ukrainians in response to Russia’s invasion of the country.

“The $2 billion response package includes $1 billion from IFC’s own account, as well as additional funding that depends on guarantees from donor governments,” the IFC said on Friday.

IFC notes that the contribution of the private sector to Ukraine’s GDP was almost 70%, according to NBU estimates for September 2022, 11% of enterprises completely stopped working, and more than half did not work at full capacity, and the Ministry of Economy indicated that at least 5 million workers were lost places.

“During the war and initial reconstruction stage, the Program will focus on ensuring access to critical goods and services with emergency liquidity support for agribusiness and trade finance, including for fuel imports,” the IFC said in the press release said.

Other priority areas of the Program at this stage include the maintenance of economic activity; critical economic infrastructure such as agricultural trade routes and logistics; and providing for the needs of displaced persons and war-affected municipalities.

It is indicated that IFC financing will be provided directly to current and new clients in the real sector, as well as through financial intermediaries for further lending to micro, small and medium-sized enterprises and agribusiness, as well as through trade finance guarantees.

IFC said it has refocused its advisory program to support clients as they adapt to war and prepare for reconstruction.

“The Ukrainian private sector has shown unprecedented resilience in the face of this war. Our top priority is to maintain this resilience and continue to develop the potential of the private sector,” IFC Managing Director Makhtar Diop said.

A dry cargo ship with more than 71,000 tons of wheat left a Ukrainian port on Thursday, the Joint Coordination Center (JCC) reported.

“On December 15, the vessel Star Emerald left the port of Pivdenniy, it is carrying a total of 71,400 tons of wheat to Indonesia as part of the Black Sea Grain Initiative,” the report said.

Two dry-cargo ships Sea Bridle and Tuo Fu 8, which passed through the sea humanitarian corridor on December 15, are heading to Ukrainian ports.

69 vessels capable of exporting about 2.5 million tons of food are awaiting permission to enter Ukrainian ports, while 21 loaded vessels are preparing to be inspected to proceed further to their destinations.

“As of December 15, the total tonnage of grain and other agricultural products exported from the three Ukrainian ports is 13,990,897 tons. A total of 1,106 vessels have been allowed to move so far: 551 to arrive at Ukrainian ports and 555 to leave them,” the JCC summarized.

The ninth package of European Union sanctions on Russia for the war it is waging against Ukraine will be approved in writing on Friday.

The Czech Presidency announced this on its Twitter page.

“Ambassadors agreed in principle on a sanctions package against Russia as part of the EU’s ongoing support for Ukraine. The third Russia sanctions package negotiated under the Czech Presidency of the Council of the European Union should be confirmed via written procedure tomorrow,” it said.

In accordance with the practice of the EU, initially the decisions that must be further approved by the leaders of the EU are agreed upon at the level of ambassadors of the EU member states. So in this case, before the leaders approved the ninth package of sanctions for Russia, they were agreed upon by the ambassadors, whose Committee meetings were held almost simultaneously with the meeting of the European Council.