As of August 22, farmers harvested 27.25 million tons of early grain and leguminous crops from 6.7 million hectares, which is 60% of the area sown with these crops, according to the Ministry of Economy, Environment, and Agriculture.

Last year, as of August 23, 32.02 million tons of grain were harvested from 8.0403 million hectares, meaning that this year’s figures are 14.9% and 16.7% lower, respectively.

According to the Ministry of Economy, 21.01 million tons of wheat were harvested from 4 million 873.1 thousand hectares (last year – 21.74 million tons from 4 million 858.9 thousand hectares), barley – 4.97 million tons from 1 million 304.6 thousand hectares (5.5 million tons from 1 million 399.2 thousand hectares).

The average yield of these crops this year is 4.31 tons/ha and 3.81 tons/ha, respectively, which is 3.5% and 3.3% less than last year’s figures.

At the same time, this year’s pea harvest is already higher than last year’s – 0.58 million tons from 258,600 hectares compared to 0.468 million tons from 207,600 hectares, and the yield is 12.8% higher at 2.5 tons/hectare.

Other grains and legumes were threshed on an area of 260.6 thousand hectares, with a yield of 685.3 million tons (0.83 million tons).

It is noted that among the leaders are, in particular, the Odessa region, which harvested 3.44 million tons from an area of 1 million 083.4 thousand hectares, Kirovohrad region harvested 2.20 million tons from an area of 533.4 thousand hectares, and Vinnytsia region harvested 2.385 million tons from an area of 423.7 thousand hectares.

According to the ministry, as of August 22, the rapeseed harvest amounted to 3.163 million tons from an area of 1 million 283 thousand hectares, while last year on August 23, it amounted to 3.36 million tons from 1 million 227.7 thousand hectares, and the average yield is 7% lower than last year’s on this date and amounts to 2.5 tons/ha.

Sunflower harvesting has begun in the Dnipropetrovsk and Odesa regions, and soybean harvesting has begun in the Kharkiv region.

As reported, in its Inflation Report published at the end of July, the National Bank of Ukraine lowered its forecast for this year’s grain harvest from 61.7 million tons to 57.9 million tons, and for oilseeds from 22 million tons to 21 million tons.

The NBU recalled that last year, the grain harvest in Ukraine fell to 56.2 million tons from 59.8 million tons in 2023, while oilseeds fell from 21.7 million tons to 20 million tons.

According to forecasts by Deputy Minister of Economy Taras Vysotsky, this year’s grain harvest will be around 56 million tons, the same as last year.

Last week, trading in August 2025, September 2025 and subsequent months continued. In total, 4 companies formed positions for the purchase and sale of natural gas: LTC Electrum, GTS Operator of Ukraine, D.Trading, and Ukrzaliznytsia.

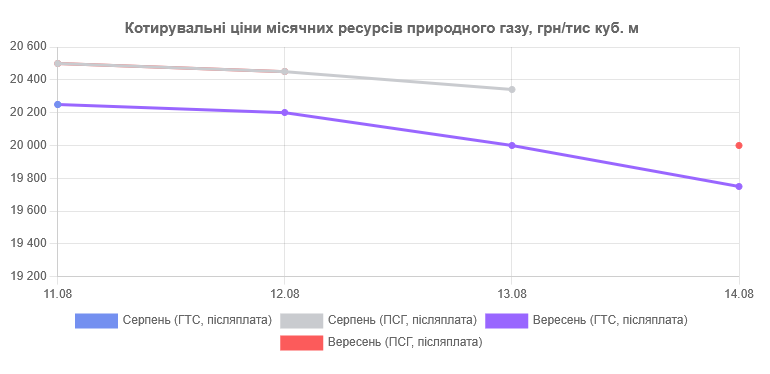

The starting prices of resources in the mid- and long-term market section varied widely. As a result, as of Friday, the average starting price of September resources in the GTS was 3.33% higher than on Monday. Last week, only buy positions were sold. In total, 20,700.00 thousand cubic meters of natural gas were sold, 17700 of which were purchased by the GTS Operator of Ukraine. Last week’s bidders formed the following quotation prices:

In the sections “Cross-border, customs warehouse” and “Imported natural gas”, the initiators formed starting positions, but no selling prices were formed in these sections last week.

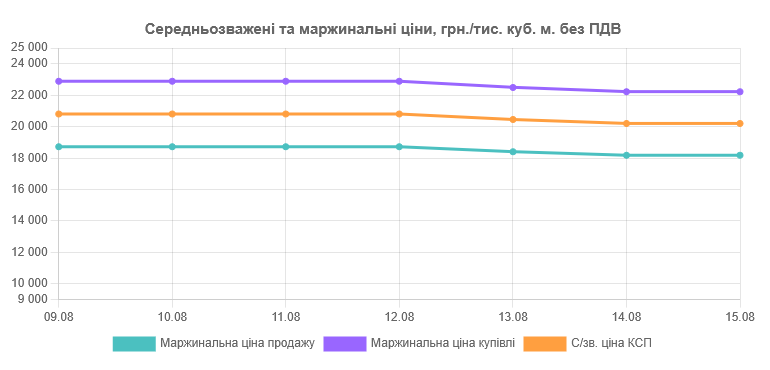

On the short-term natural gas market of the UEEX , participants placed bids on the intraday market. The deals were concluded for delivery to the Ukrainian gas transmission system. The weighted average price of the DAM on Friday, August 15, amounted to UAH 20200 excluding VAT.

European market

Gas prices declined last week. TTF futures dropped to around 32 euros/MWh. Gas stocks continue to grow, and geopolitical risks did not create a new shock in the short term. Steady gas supplies from Norway and high LNG imports offset some of the problems.

At the same time, the energy landscape was shaken by several strategic moves: Centrica and ECP (Energy Capital Partners) bought the Isle of Grain LNG terminal, Europe’s largest, for about €1.5 billion, sending a clear signal to the market about long-term dependence on imported gas, even as demand for its use in the power sector fell. In addition, Centrica has signed an agreement with the US-based Devon Energy to supply the equivalent of five LNG cargoes annually for a decade, another foundation that lays the groundwork for Europe’s energy security.

Month-ahead contracts at all analyzed hubs showed a different trend relative to spot prices, with an average increase of 1.64%. Quarter-ahead prices were higher than spot prices by an average of 4.68%. The season-ahead prices with an average value of 35.50 EUR/MWh tended to increase compared to the spot prices by an average of 5.77%.

September futures for LNG in Asia, the JKM Platts Future index, settled on August 14 at $426.38 per thousand cubic meters. US dollars per thousand cubic meters. The futures for LNG delivered to Northwest Europe (LNG North West Europe Marker) closed at $393.80 per mcm. US $/thousand cubic meters.

European LNG terminals operated on August 13 with an average capacity of 79.81%.

LNG stocks in the EU as of August 13, 2025 amounted to 4.336 million cubic meters, according to the Aggregated LNG Storage Inventors.

The storage level of the largest LNG exporter, the United States, according to the latest EIA data as of August 8, 2025, was 3.186 billion cubic feet, which is 6.6% higher than the average for the last five years.

This week, oil prices have declined – for example, Brent is trading in the range of $66-67 per barrel. OPEC+ has announced a significant increase in production (over 500 thousand barrels per day since September), and the imbalance between supply and demand is beginning to be smoothed out as the peak supply season gradually ends.

The meeting between Trump and Putin in Alaska is putting the market on edge. If sanctions against Russia are eased, prices could move downward, even to below $60 per barrel. On the other hand, if the opposite is true, the confrontation will escalate, and prices could jump up, approaching or even surpassing $80-90 per barrel.

Gas balance in Ukraine

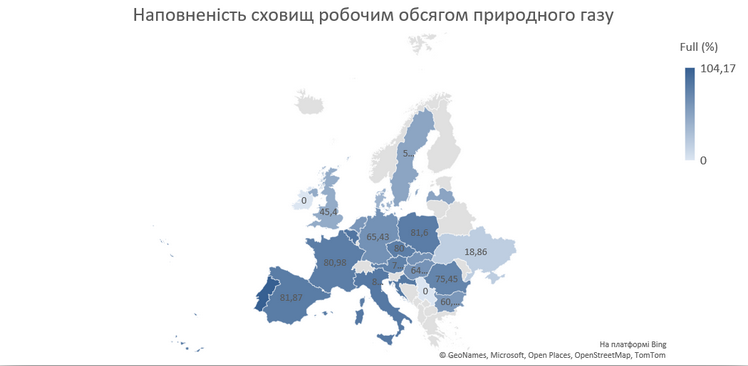

During the week, natural gas imports from Europe averaged 21 million cubic meters per day (1 million cubic meters higher than the previous week), from Hungary, Poland, Moldova, and Slovakia. The Hungarian direction was mainly used, although the share of other directions remained high. Ukraine’s storage facilities held about 10.4 bcm. There was virtually no withdrawal. Injection amounted to about 51 million cubic meters per day.

Interesting things for the week

For the first time, a €500 million loan for gas imports to Ukraine is provided under the EU’s UIF Hi-Bar program , which does not require a Ukrainian state guarantee, Gas United reports. The UIF – Ukraine Investment Framework – is the investment component of the Ukraine Facility program for the rehabilitation of energy infrastructure. The financing was launched at the URC-2024 in Berlin. The EBRD provided the funds for gas imports under the Hi-Bar facility, which aims to remove barriers to mobilizing the financing needed to accelerate the transition of the energy sector to net-zero, which involves the maximum possible reduction in greenhouse gas emissions.

The historic Qutub Minar tower in New Delhi was illuminated in blue and yellow on the evening of August 23–24 in honor of National Flag Day (August 23) and Ukraine’s Independence Day (August 24). The event became a symbol of solidarity with the Ukrainian people; photos and videos of the illumination were posted on the embassy’s social media pages and website. Indian media also reported on the event: Ukrainian Ambassador to India Alexander Polischuk thanked the organizers, noting that the illumination was “another sign of support” for Ukraine;

The event took place despite the rain.

Previously, similar Qutub Minar lighting events were held on international dates and anniversaries, making the monument one of the venues for public diplomacy in the Indian capital.

In July 2025, Ukrainian metallurgical enterprises produced 581,000 tons of steel (down 18.1% year-on-year and down 6.4% month-on-month), ranking 23rd in the Worldsteel rating of 70 countries. In January–July, production amounted to 4.263 million tons (–7% y/y), with Ukraine ranking 22nd for this period.

According to Worldsteel, India, the US, Turkey, and Iran showed growth in July compared to last year, while the other countries in the top 10 recorded a decline.

The World Steel Association is an international association of the steel industry, bringing together steel producers, national and regional industry associations, and research institutes; its members account for about 85% of global steel production. Its headquarters are in Brussels, and it has an office in Beijing. The organization was founded in 1967 as the International Iron and Steel Institute and was renamed in 2008. Worldsteel regularly publishes monthly production statistics and an annual reference book, World Steel in Figures.

In July 2025, global steel production amounted to 150.126 million tons, which is 1.3% less than in July 2024.

According to the World Steel Association (Worldsteel), the top ten countries are as follows:

China — 79.660 million tons (-4% y/y)

India — 14.000 million tons (+14%)

United States — 7.142 million tons (+4.8%)

Japan — 6.918 million tons (-2.5%)

Russia — 5.700 million tons (-2.4%)

South Korea — 5.256 million tons (-4.7%)

Turkey — 3.182 million tons (+4.2%)

Brazil — 2.930 million tons (-5.5%)

Germany — 2.719 million tons (-13.7%)

Iran — 2.235 million tons (+29.7%)

Romania is the most accessible country in Europe for digital nomads, according to a study by Omio. The index looked at the cost of living, rent, visa requirements, and internet access, with interest in remote work across borders growing fast.

Romania ranked first among European countries in terms of accessibility for digital nomads. Its assets include the lowest cost of living (index 37) and favorable rental conditions (index 7), which are significantly lower than in the US (72).

However, to obtain a digital visa in Romania, you need to prove that you have a monthly income of at least £3,700 (~$5,000), which is a high threshold for many freelancers.

In second place is Albania, which has the same low cost of living and rent but a more lenient income threshold (€1,000), although it lags behind Romania in terms of safety and internet speed.

Georgia is one of the leaders in terms of low living and rental costs, but its mandatory income requirement for a visa — around £2,000 — is higher than in Albania.

Hungary also ranks highly in the regional rankings thanks to its fast internet speeds and moderate income requirements for a visa.

Omio’s research confirms Eastern Europe’s status as the most accessible region for digital nomads. Romania leads the way thanks to its favorable combination of cost of living and infrastructure quality. However, visa requirements — particularly the relatively high level of provable income — remain a barrier for effective freelancers with unstable incomes.