The Ukrainian government has made several decisions changing the entry requirements for foreign citizens and stateless persons, the country’s State Border Guard Service said on Saturday. Under the government decree No. 477, approved on June 12, the temporary entry ban for foreigners is no longer effective.

Another decree, No. 480, of June 12, requires foreigners to have a relevant insurance policy and those arriving from countries with high number of coronavirus infections to undergo observation.

For the duration of the quarantine, foreigners and stateless persons (except permanent residents, refugees, or persons seeking additional protection) will be banned from entry if they do not have an insurance policy (certificate) to cover the costs relating to COVID-19 treatment and observation, the decree said.

Arriving from, or being a citizen of, a country with a high number of COVID-19 cases shall be ground for observation, the government said.

“To ensure the transportation of persons from state border checkpoints to observation facilities, the government has compelled regional and Kyiv city state administrations,” the agency said.

At the same time, a citizen (subject) of a country with a high number of COVID-19 infections, who has not been in that country in the previous 14 days, foreign diplomats and consular officials, representatives from accredited international missions and organizations and their family members, drivers and crew members of cargo transport vehicles, air, sea and river crews, members of train and locomotive brigades, participants in an external independent audit (with one accompanying person each), will not be required to undergo observation, unless there is a reason to believe that they have been in contact with a COVID-19 patient.

Also exempt from observation will be those who agree to self-isolate using an act-at-home electronic service.

A country is considered to have a high number of COVID-19 cases if it had at least 40 active cases per 100,000 population.

A list of such countries will be updated and submitted by the State Border Guard Service to the Foreign Ministry every three days.

Therefore, foreign citizens and stateless persons may cross the Ukrainian border from the effective date of the Decrees No. 477 and No. 480, providing they have legal grounds for entry, as stipulated in the Ukrainian border control law, and observe sanitary epidemiological rules.

The Ukrainian President has established the Council of Experts on Energy Security, the press service of the National Security and Defense Council (NSDC) has reported.

“[NSDC Secretary Oleksiy] Danilov informed the audience that in order to ensure an effective response of the state to threats to energy security and identify strategic directions for the development of the state’s fuel and energy complex, taking into account the latest world trends, the President of Ukraine established the Council of Experts on Energy Security, which will be the highest advisory body for the Head of State and the National Security Council of Ukraine on energy issues,” the press service said.

Danilov said that to prepare recommendations for the Council of Experts and ensure its work, a working group on the development of the hydrogen economy has been set up at the Staff of the National Security and Defense Council of Ukraine.

“During the meeting, a number of measures were agreed to organize the effective work of the group in order to submit to the country’s leadership proposals for innovative approaches to the development of non-traditional energy sources,” the press service said.

The working group on hydrogen economy development should prepare and submit to the Council of Experts on Energy Security proposals on developing the hydrogen economy in Ukraine.

The NSDC Secretary stressed the urgency of developing the hydrogen economy: “This issue is extremely important in today’s world. Ukraine has great potential in this area, which we must use it.”

“Today we have specialists, resources, and investors. To get real results, we need to combine the efforts of science, business, and government,” he said.

A bribe to the top officials of anti-corruption bodies was offered for the closure of a criminal proceeding where former ecology minister Mykola Zlochevsky was suspected of embezzlement, which would have allowed him to return to Ukraine, Director of the National Anti-Corruption Bureau of Ukraine (NABU) Artem Sytnyk has said.

“A bribe of $6 million was intended to close the episode when the ex-minister of ecology assisted in embezzling the stabilization loan from the National Bank issued to Real Bank,” Sytnyk said at a briefing in Kyiv on Saturday morning.

He said that a number of persons were suspected in this episode, including Zlochevsky.

“Why people who offered illegal benefit were in a rush? Because tomorrow Mr. Zlochevsky had a birthday and had a plan to achieve the maximum result, namely to close the criminal proceedings and ensure the return of Mr. Zlochevsky to Ukraine,” the director of NABU said.

Sytnyk also said that three people have been detained to date: the first deputy head of the main department of the State Fiscal Service in Kyiv, the second person is related to Burisma, he is an authorized representative of Zlochevsky and the third person is a former employee of the State Fiscal Service, who is also an authorized representative of Zlochevsky.

“At first, during the conversation, there was a proposal of $1 million for simply transferring the case to other investigating authorities… After refusing to receive these funds and continuing negotiations, they offered $5 million to close the criminal proceeding and it was important to do this before June 14, 2020,” Sytnyk said.

According to him, the funds were seized, and the amount of $1 million, which was in the car of the first deputy chief of the State Fiscal Service of Kyiv, was also seized.

“At present, the first deputy head of the State Fiscal Service’s department has been declared suspected of committing a crime… for offering a bribe. As for the other two detainees, as the director of NABU said, draft notices of suspicion have already been prepared for them.

Head of the Specialized Anti-Corruption Prosecutor’s Office (SAPO) Nazar Kholodnytsky recalled that the criminal proceedings in which Zlochevsky appears were suspended.

“The sum (of the proposed bribe) amounted to $6 million, of which $5 million were intended for a person who should have made the procedural decision to close the case, and $1 million was supposed for consulting services of an intermediary,” the head of the SAPO said.

On June 12, a former official, with the assistance of an official of the State Fiscal Service in Kyiv and others, tried to transfer $6 million of illegal benefit to Kholodnytsky and NABU top officials.

The Institute of Molecular Biology and Genetics (IMBG) is developing multi-test systems for the diagnosis of COVID-19 against seasonal flu-like illnesses, said Viktor Liashko, the Deputy Minister of Health and Chief Sanitary Doctor of Ukraine.

“Influenza-like diseases span about 200 viruses. We actively cooperate with our academic institutes. IMBG has developed test systems [for diagnosing COVID-19 by PCR method]. Today it is developing a multi-test system that will allow us to conduct certain tests and will show percentage content of those viruses that circulate during this period of increased viral diseases,” he said on the NV Radio on Thursday.

Commenting on the likelihood of a second wave of the COVID-19 epidemic, Liashko noted that it will be more likely during the seasonal growth of influenza and flu-like illnesses.

“It is this second wave that we fear. Then there may be serious growth of incidences. In such cases, the combination of infections is possible, and it will be difficult to diagnose which pathogen caused the disease: flu or coronavirus,” he said.

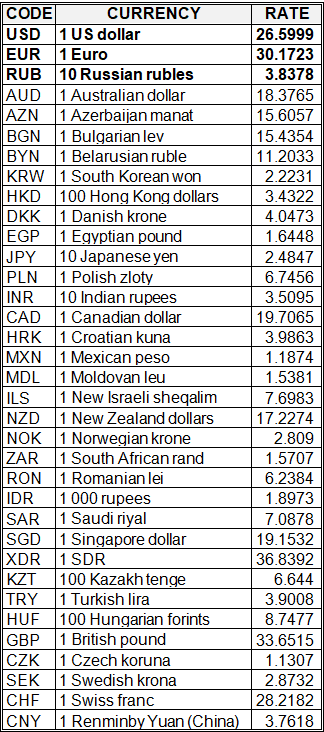

National bank of Ukraine’s official rates as of 12/06/20

Source: National Bank of Ukraine