Alla Teliga, co-founder of Galya Baluwana and Wesola Pani chains, is launching a new franchise of a family cafe specializing in chebureks, Tsiberek, according to the Ukrainian Council of Shopping Centers.

According to the release, the first restaurant under the brand will be opened in Lutsk (2 Vynnychenka Street), scheduled to open in October. The menu was developed by Alla Teliga, the author of all recipes of the Galya Baluvana chain, and the famous chef Vladyslav Tsymbalyuk. The next step is to launch franchise sales.

Galya Baluvana was founded in 2019 in Lutsk. As of August 2024, Galya Baluwana had more than 950 stores and 172 franchisees. Since 2023, the company has stopped adding new partners to the Galya Baluwana joint network, and only franchisees who were previously included can open new outlets.

According to Opendatabot, Volodymyr Matviychuk and Oleksandr Teliga are the owners of the chain’s developer, Gostuyemo po domashnomu LLC (Lutsk). According to the company’s financial statements for 2022, its net profit for the year increased 3.5 times and amounted to UAH 14.9 million.

As reported, in January 2024, the Ukrainian chain of convenience stores Galya Baluwana opened its first store in Philadelphia (USA) under the MultiCook brand (developed by Volodymyr Matviychuk).

The Wesoła Pani chain of convenience food stores from the Ukrainian company Galya Baluwana (developed by Alla and Oleksiy Telig) is already represented by 140 outlets in three European countries (Poland, Latvia, and the Netherlands). Plans were announced to expand the chain in Poland to 500 stores.

Industrial and technical company Agromat has announced the issue of three-year bonds of the H series for the amount of UAH 100 million for public offering, and has started to redeem the previous issue.

According to the information disclosure system of the National Securities and Stock Market Commission, the H series issue was registered on September 6. The nominal value of the bond is UAH 1 thousand. The interest period is 91 days, the interest rate on the bonds for the first to fourth interest period is 16.5% per annum.

The start date of the public offering is September 30, 2024, and the bonds are scheduled to mature on September 27-29, 2027.

According to the company, 100% of the funds raised will be used to expand Agromat’s retail network.

In addition, on September 25, 2024, Agromat began to redeem UAH 100 million of series G bonds issued in 2021.

“Agromat is engaged in the production and sale of ceramic tiles and sanitary ware, and was registered in 1993. The company has 32 stores in Ukraine.

According to Opendatabot, the company’s co-owners with 28.65% each are Sergiy Voitenko, Oksana Reva, and Anatoliy Taday, 10.05% belongs to Olga Bashota, and 4% to Nadiya Rusheliuk.

According to the company’s financial results for 2023, its revenue increased by 45.5% to UAH 3.12 billion, while net profit increased by 63.7% to UAH 115.3 million.

The net consolidated profit of Naftogaz Group in January-March 2024 increased by 3.7 times (by UAH 17.839 billion) compared to the same period last year, to UAH 24.414 billion.

According to the consolidated financial statements published on Naftogaz’s website, its sales revenue for the first half of the year increased by 28.1% (by UAH 31.456 billion) to UAH 143.373 billion, gross profit by 4.1 times (by UAH 33.479 billion) to UAH 44.377 billion, and operating profit by 2.1 times (by UAH 14.907 billion) to UAH 28.904 billion.

According to the group’s press service, the improvement in financial results was achieved, in particular, due to an increase in revenues from the sale of gas, oil and petroleum products, as well as natural gas distribution services.

The key companies that showed a profit in the first half of 2024 are Naftogaz of Ukraine, Ukrgasvydobuvannya, Ukrtransgaz, Ukrnafta, Gas Supply Company Naftogaz of Ukraine, and Ukrtransnafta.

In addition, in January-June 2024, the group’s companies paid UAH 44 billion in taxes to the state budget, or 7.5% of all payments controlled by the State Tax Service of Ukraine.

As reported, in 2023, the net consolidated profit of Naftogaz Group amounted to UAH 23.1 billion, compared to a loss of UAH 79.1 billion in 2022.

Ukrainian Foreign Minister Andriy Sybiga met with his Chinese counterpart to discuss the development of bilateral relations and trade.

“Together with Andriy Yermak, we met with Chinese Foreign Minister Wang Yi. We thanked China for its support of Ukraine’s sovereignty and territorial integrity,” he wrote on the social network X on Thursday night.

According to Sibiga, the parties focused on the next steps in the development of bilateral relations and trade. They also discussed prospects for further contacts.

Sibiga noted that they briefed on Ukraine’s efforts to implement the Peace Formula and exchanged views on the principles of achieving a comprehensive, just and lasting peace for Ukraine based on the UN Charter.

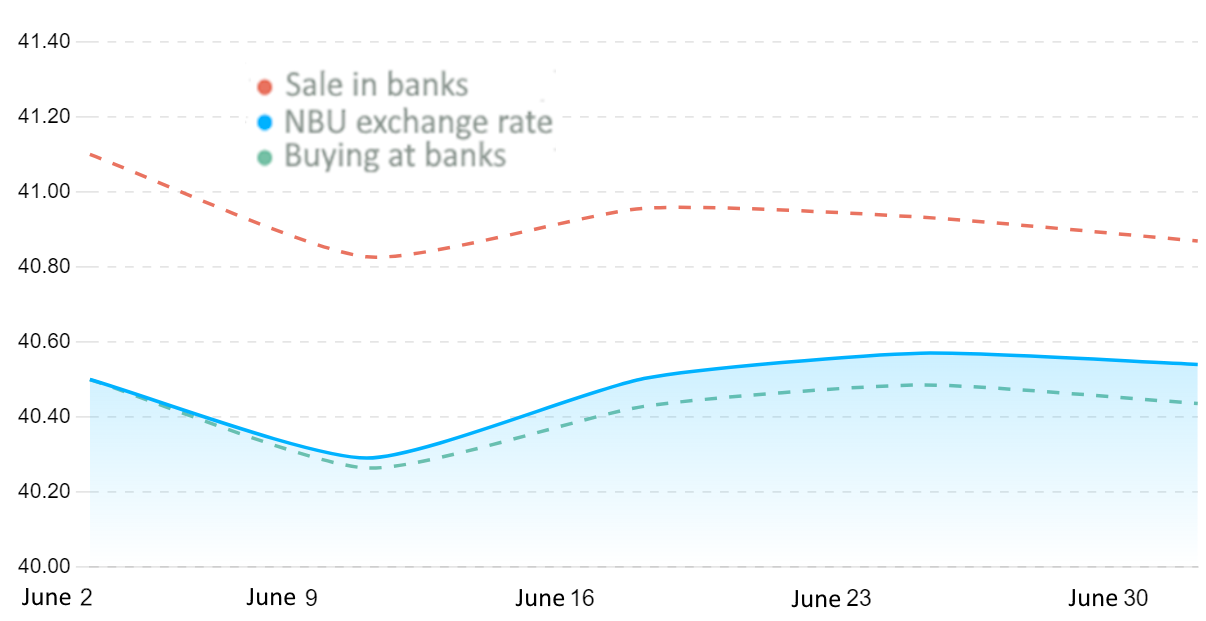

Quotes of interbank currency market of Ukraine (UAH for $1, in 01.06.2024-30.06.2024)

Open4Business.com.ua

September 24, 2024, Kyiv – As part of the Access2Finance conference, after the panel discussion “Sources of Financing for Small and Medium-Sized Businesses (SMEs)”, an important event took place – the signing of a memorandum of cooperation between the Ukrainian Association of Fintech and Innovation Companies (UAFIC) and the Entrepreneurship Development Fund.

The memorandum was signed by Rostyslav Dyuk, Chairman of the Board of UAFIC, and Viktor Katrenych, Deputy Chairman of the Board of the Entrepreneurship Development Fund. The purpose of the agreement is to strengthen cooperation between the organizations to support regional economic development and strengthen the position of small and medium-sized enterprises (SMEs) in Ukraine.

The memorandum pays special attention to supporting veteran and women-owned businesses, which is one of the key aspects of social responsibility. The parties also intend to promote the implementation of the principles of sustainable development and ESG (environmental, social and governance criteria), which are important for ensuring sustainable economic growth and increasing the competitiveness of Ukrainian entrepreneurs.

The parties agreed on joint initiatives aimed at increasing SMEs’ access to finance, promoting regional economic activity, and introducing the latest technological solutions for business development.

“The signing of this memorandum is an important step for UAFIC towards expanding opportunities for small and medium-sized enterprises in Ukraine. It is important that as part of our cooperation we will focus on supporting veteran and women-owned businesses, which are the basis for creating a more inclusive and sustainable economy. In addition, the implementation of ESG principles will be a key aspect for increasing the competitiveness of Ukrainian enterprises,” said Rostyslav Dyuk, Chairman of the UAFIC Board.

“For the Fund, the top priority is to support Ukrainian business, especially in such difficult times. In addition, this is exactly the period when it is necessary to involve businesses in the implementation of ESG standards and further develop in this direction for the successful implementation of economic activities. That is why we are pleased to sign a memorandum with UAFIC to jointly support entrepreneurs in our country,” said Viktor Katrenych, Deputy Chairman of the Board of Ford Entrepreneurship Development.

The signing of this memorandum is an important step in strengthening Ukraine’s economy, improving the business climate and supporting entrepreneurship that meets the principles of sustainable development.

The memorandum was signed at the Access2Finance conference, which was supported by the USAID Project Investing for Business Sustainability.

COOPERATION, Entrepreneurship Development Fund, FINTECH, MEMORANDUM