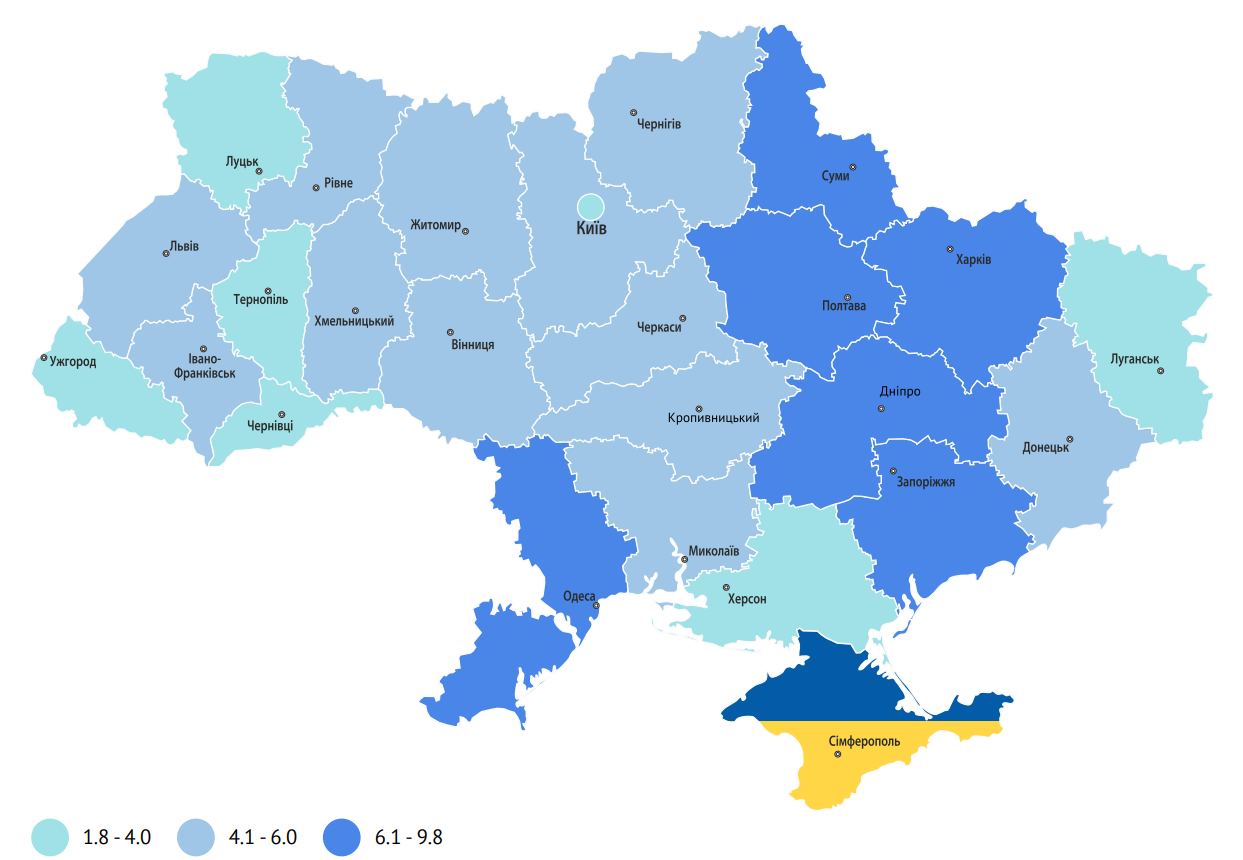

Number of unemployed people registered in public employment service as of 30.04.2024 (in thousands)

Open4Business.com.ua

The number of Green Card contracts concluded in January-August 2024 decreased by 8.7% to just over a million, according to the website of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU).

According to the report, the total accrued insurance premiums under such contracts for eight months increased by 6.22% compared to the same period in 2023 – up to UAH 3.751 billion.

At the same time, the amount of claims paid increased by 16.2% to EUR 32.5 million, while the number of claims paid increased by 9.81% to 10.117 thousand.

MTIBU is the only association of insurers providing compulsory motor third party liability insurance for owners of land vehicles.

“Green Card is a system of insurance coverage for victims of road traffic accidents, regardless of their country of residence or country of vehicle registration. It covers 45 countries in Europe, Asia and Africa.

According to the decision taken by the General Assembly of the Council of the Bureau of the International System of Motor Insurance “Green Card” in Luxembourg in May 2004, Ukraine became a full member of the system on January 1, 2005.

TAS Agro intends to allocate 22 thou hectares for winter wheat, the company’s press service reported on its Facebook page.

“Thanks to the updated modern agricultural machinery, it is possible to ensure an efficient sowing process, combining it with the simultaneous application of granular fertilizers,” the agricultural holding said.

TAS Agro noted that in 2024 it completely abandoned traditional plowing and started using Mini-till technology. This allows to preserve the soil structure, reduce erosion and increase its fertility, which will eventually have a positive impact on yields, the agricultural holding explained.

At the same time, TAS-Agro continues harvesting soybeans on 16 thousand hectares.

“Harvesting started in the best possible time. Teams of specialists are using modern methods and equipment to ensure high harvesting efficiency and minimize losses,” the agricultural holding added.

TAS Group was founded in 1998. Its business interests include the financial sector (banking and insurance segments) and pharmacy, as well as industry, real estate, and venture capital projects.

Before the war, TAS Agro Group cultivated 83 thousand hectares in Vinnytsia, Kyiv, Kirovohrad, Chernihiv, Mykolaiv, Sumy, Kherson, and Dnipro regions, where it grows soybeans, sunflower, rapeseed, wheat, barley, and corn. In addition, the agricultural holding is engaged in dairy farming (up to 5.5 thousand heads of cattle) and owns six elevators with a one-time storage capacity of 250 thousand tons.

The founder of TAS is Sergey Tigipko.

The Ukrainian government on Friday approved the draft state budget for 2025 with revenues (excluding official transfers and grants) of the general fund at UAH 2 trillion 7.4 billion and expenditures of the general fund at UAH 3 trillion 643.6 billion, the Finance Ministry said on its website.

“The forecast of state budget financing for 2025 provides for a reduction of the state budget deficit to 19.4% of GDP (in the current law on the state budget for 2024 – 20.6%), which corresponds to the indicators agreed with international partners,” the press release said.

According to it, with a projected deficit of UAH 1 trillion 640.6 billion, state borrowings of the general fund are planned in the amount of UAH 2 trillion 237.6 billion, including internal – UAH 579.2 billion and external – UAH 1 trillion 658.4 billion. “Not the entire volume of external borrowings has yet been confirmed by international partners – which requires further painstaking and perseverance,” the Finance Ministry pointed out.

The ministry specified that external financing is envisaged in the amount of $38.4 billion, privatization – UAH 3.2 billion, debt service of UAH 480.8 billion.

In the draft amendments to the state budget-2024 on the growth of general fund expenditures by UAH 434.6 billion, which the Verkhovna Rada adopted in early September, general fund revenues are envisaged in the amount of UAH 1 trillion 811.1 billion, expenditures – UAH 3 trillion 546.7 billion, deficit – UAH 1 trillion 846.1 billion, state borrowing – UAH 2 trillion 348.0 billion, including internal – UAH 742.0 billion, and total external financing – $41.3 billion.

Businessman Igor Pronin intends to purchase 170 million shares, or 100% of the shares, of Odesa Champagne Wine Factory PJSC, he reported in the NSSMC’s information disclosure system.

According to the report, as of September 13, 2024, Pronin and his affiliates were not among the company’s shareholders.

As reported, the right to privatize the integral property complex (IPC) of the Odesa Champagne Plant at an auction held by the State Property Fund (SPF) on the Prozorro.Sale platform on February 1, 2022, was won by Elitbud Group LLC (Odesa), owned by Askold Koval.

Odesa Champagne Plant’s fixed assets consist of 975 items of fixed assets, including 35 real estate objects, 803 items of machinery and equipment, seven vehicles, 65 items of tools, appliances, and inventory.

The company is located in Odesa on a land plot with a total area of 3.61 hectares.

The SPF clarified that the plant’s production facilities were used by the tenant, Odesa Champagne Wine Factory PJSC, for the production and bottling of champagne and sparkling wines. Since January 2018, production activities at the plant have been suspended.

According to the Opendatabot resource, in 2022-2023, the company did not conduct any production activities and did not have any income.

The authorized capital of the company is UAH 47.6 million.

Currently, the plant has eight employees, while in 2022 there were 14.

Pronin is listed among the authorized persons of Agrotekhpromnafta LLC, which specializes in the trade of fuel, pharmaceuticals, and sugar, and is also one of the founders and head of the All-Ukrainian Human Rights Association Berkut. Both companies are registered in Odesa.

On September 10, the Supervisory Board of Ukrainian Security and Insurance Company (UOSK, Kyiv) decided to terminate the powers of CEO Valeriy Gorkovets and appointed Viktor Reznichenko to this position, according to the information disclosure system of the National Securities and Stock Market Commission.

As reported, on February 2, 2024, the National Bank of Ukraine revoked all the insurer’s licenses to conduct insurance activities and excluded it from the State Register of Financial Institutions on the basis of its application.

As reported, UOSK’s shareholders at a meeting on November 17, 2023, decided to revoke the insurer’s insurance licenses and exclude information about the insurer from the State Register of Financial Institutions.

According to the NSSMC, as of the second quarter of 2023, the company’s shareholders were the security police departments of Zaporizhzhia, Kherson, Dnipro, Poltava, and Odesa regions, which owned from 5.669% to 6.227%, the security police department – 15.758%, and the security police department of Kyiv – 24.742%.

The Ukrainian Security and Insurance Company was registered in 1996 and specializes in risk insurance.