Vitaliy Koval, Head of the State Property Fund of Ukraine

Small-scale privatization has been systematically gaining momentum over the past 5 years (from 2019 to 2023) with some interruptions, in particular due to a full-scale invasion. Last year’s performance largely surpassed all previous results and demonstrated the effectiveness and timeliness of privatization in general.

Budget revenues

As a result of small-scale privatization in 2019, which was carried out by the State Property Fund of Ukraine, the budget received approximately UAH 561 million. The following year, this amount increased almost 5 times and exceeded UAH 2.69 billion. In 2021, the budget received UAH 3.5 billion. In 2022, when there was a break in privatization until September, the Fund transferred assets worth UAH 1.74 billion to private investors in less than six months.

Last year, proceeds from the privatization of state property amounted to UAH 2.84 billion. The state has fully resumed this process and is helping to support the state budget with funds that ensure our protection and defense against the aggressor. In total, over the past 5 years, privatization revenues, excluding large-scale privatization objects, amounted to UAH 11.34 billion.

As for the price of the assets sold by the Fund, the final value of the property increased the most compared to the starting price in 2020.

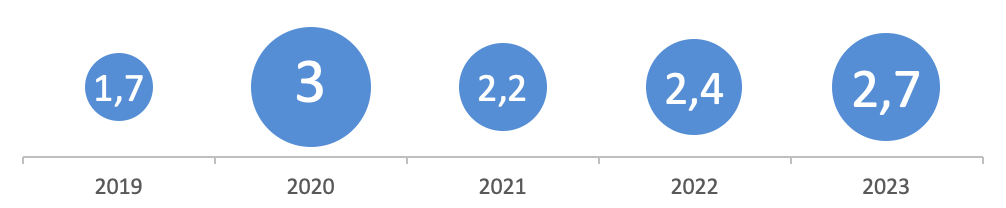

Increase in the sale price of assets relative to their initial value

After the fall of this indicator in 2021, it has been growing over the past two years. Thus, in 2023, the sale price was 2.7 times higher than the initial price.

Competition in auctions

The increase in budget revenues and the growth of the final price indicate an important thing. Participants in the auctions held by the SPFU through the Prozorro.Sale system are interested in state assets and are ready to fight for them. The indicators of competitiveness in 2023 leave no doubt about this.

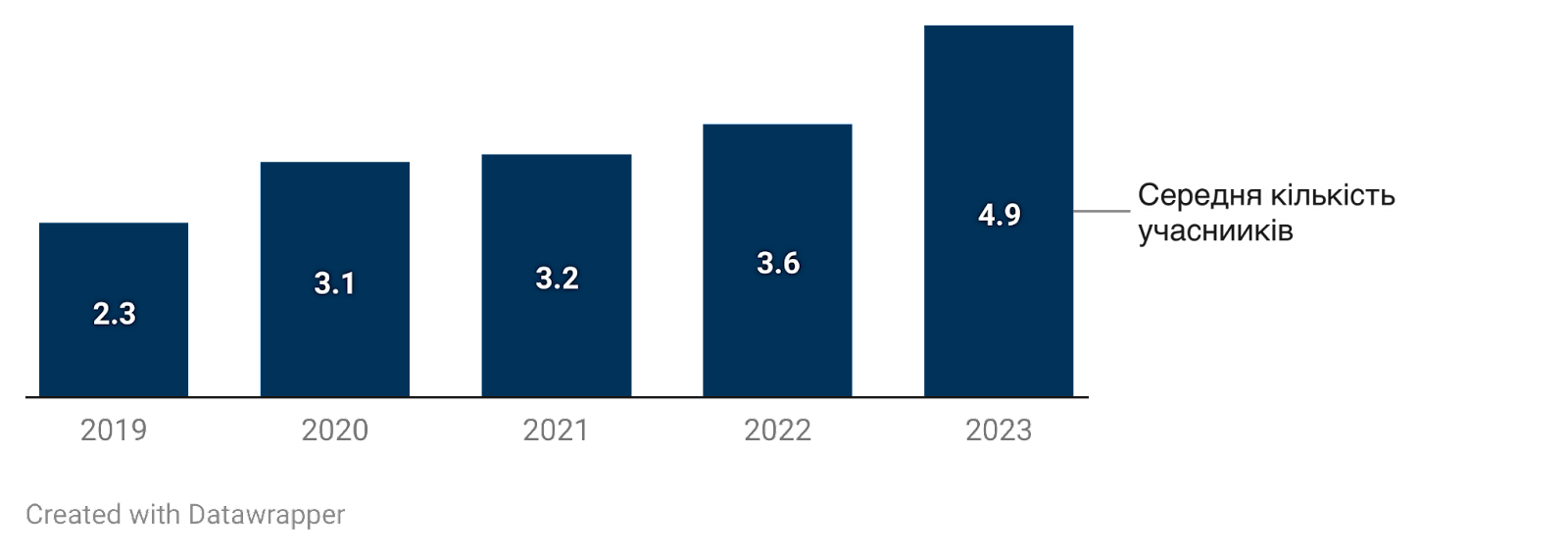

Average competition in privatization auctions

Over the past 5 years, competition in successful auctions has been growing steadily. But while from 2020 to 2022 its level was in the range of 3.1-3.6 bidders per auction, in 2023 almost 5 bidders competed for each lot on average.

This year, there is every chance of exceeding even such strong results: in the first quarter of 2024, more than 5 bidders took part in each successful auction on average.

Business interest in state assets

Business activity in privatization auctions is driven by many factors. Some companies need to relocate to regions far from the front line. Some entrepreneurs want to build a business on a ready-made material base, with the infrastructure, equipment and communications offered by the state when it sells, for example, single property complexes. Others need real estate, warehouses, workshops, garages, etc. to expand their current capacities.

So entrepreneurship in Ukraine is developing even in the face of war and other difficulties. And the government is striving to provide business with resources that will help it do so.

There are lots in which the market sees such great prospects and value that dozens of participants compete for them at once. The record was set in 2020, when 48 bidders competed for an unfinished garage for 50 cars in Kyiv. The second lot was non-residential premises in Uzhhorod. This auction, which had 47 bidders, took place in 2023.

As a result of this demand, the price of the first property in Kyiv increased almost 35 times (from just over UAH 1 million to UAH 36 million). And the cost of the second lot in Uzhhorod increased 818 times (from UAH 12.2 thousand to UAH 10 million).

Businesses are interested in assets of different sizes, but the vast majority of lots sold through privatization cost up to UAH 1 million.

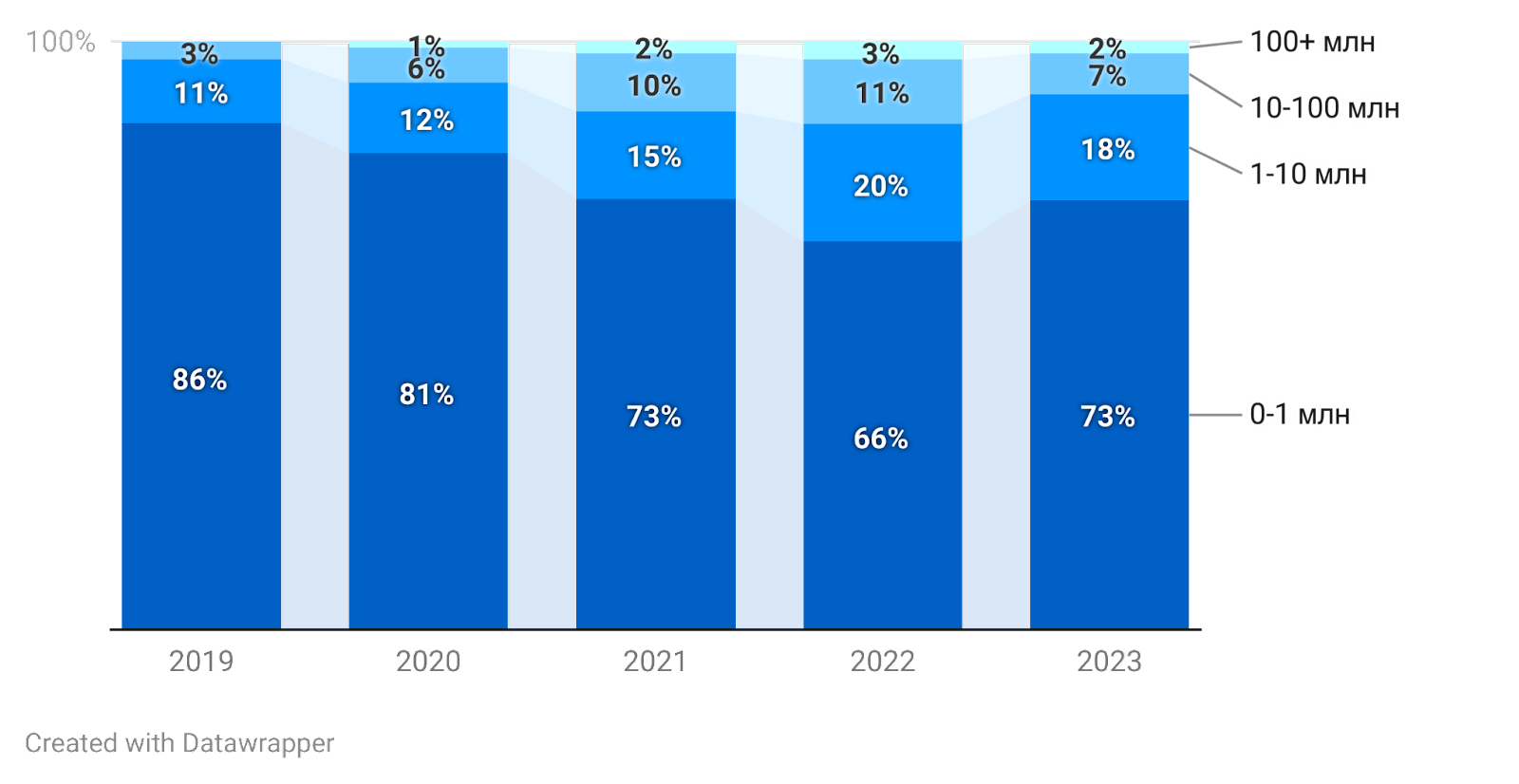

Distribution of successful auctions by the final value of the privatized object

In 2020, the share of auctions where the sale price of an asset was up to UAH 1 million reached a maximum of 86%. At the same time, in 2022, the share of auctions with the final value of the object from UAH 1 to UAH 10 million and even in the range of UAH 10-100 million increased significantly. Last year, the trend went in the opposite direction again: the number of assets sold for up to UAH 1 million began to grow.

It is also important to understand the overall economic context in Ukraine. A sharp drop in the hryvnia exchange rate, the crisis in many markets, the occupation of territories, and many other things have affected the ability of businesses to operate. This has hit small businesses particularly hard, as their already scarce material resources have been significantly depreciated and other problems have been added.

The return of demand for inexpensive, small state assets suggests that small and medium-sized businesses are resuming activity and continuing to grow after the first shocks of the full-scale invasion.

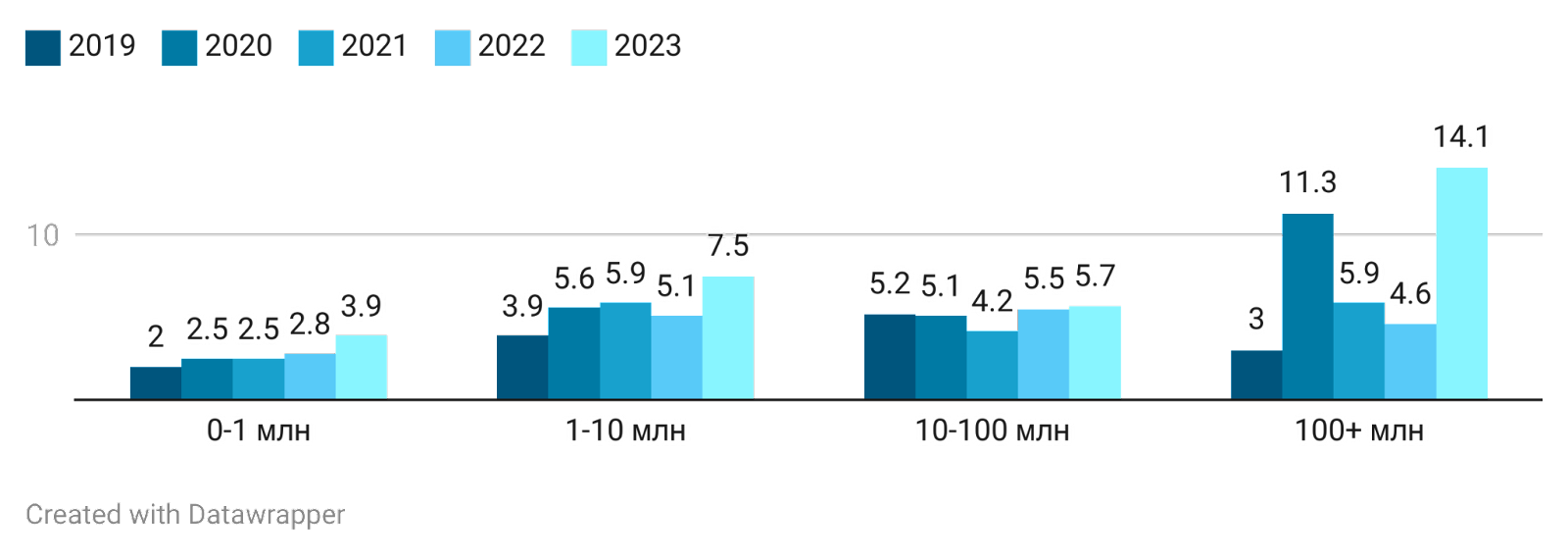

The average number of bidders in privatization auctions, relative to the final value of assets

At the same time, large market players are also interested in large state-owned assets when they come up for sale. Thus, in 2023, an average of 14.1 bidders participated in auctions with a sale price of more than UAH 100 million. At the same time, the average competition in auctions up to UAH 1 million last year amounted to 3.9 participants.

Efficiency of privatization processes

Overall, privatization auctions attracted thousands of players from different markets. The highest number of bidders, namely 2035, was in 2023. This is 3.3 times more than in 2022 and almost twice as many as in 2021. In 2020, this figure exceeded 1340 bidders. And in 2019, when privatization had just intensified, there were about 800 of them.

Legislative changes, business activity, competitive bidding, and their transparency and openness have helped to increase the efficiency of privatization processes. At the same time, the State Property Fund has also changed its approach in recent years and improved the process of preparing objects for sale. Information about the availability of state assets for privatization was disseminated through various communication channels to draw attention to these lots. In general, all information about the current lots, how to participate in the auction, and the results of privatization is collected on a separate special resource.

The Fund has developed a mechanism for sorting (triage) state assets, depending on their condition and market needs. The property that has no value or exists only on paper will be liquidated or bankrupt. Those objects that can work for the benefit of the economy in private hands will be privatized.

Effective steps taken by the SPFU and the interest of private investors have yielded results: in 2023, the share of successful auctions increased many times over compared to previous years.

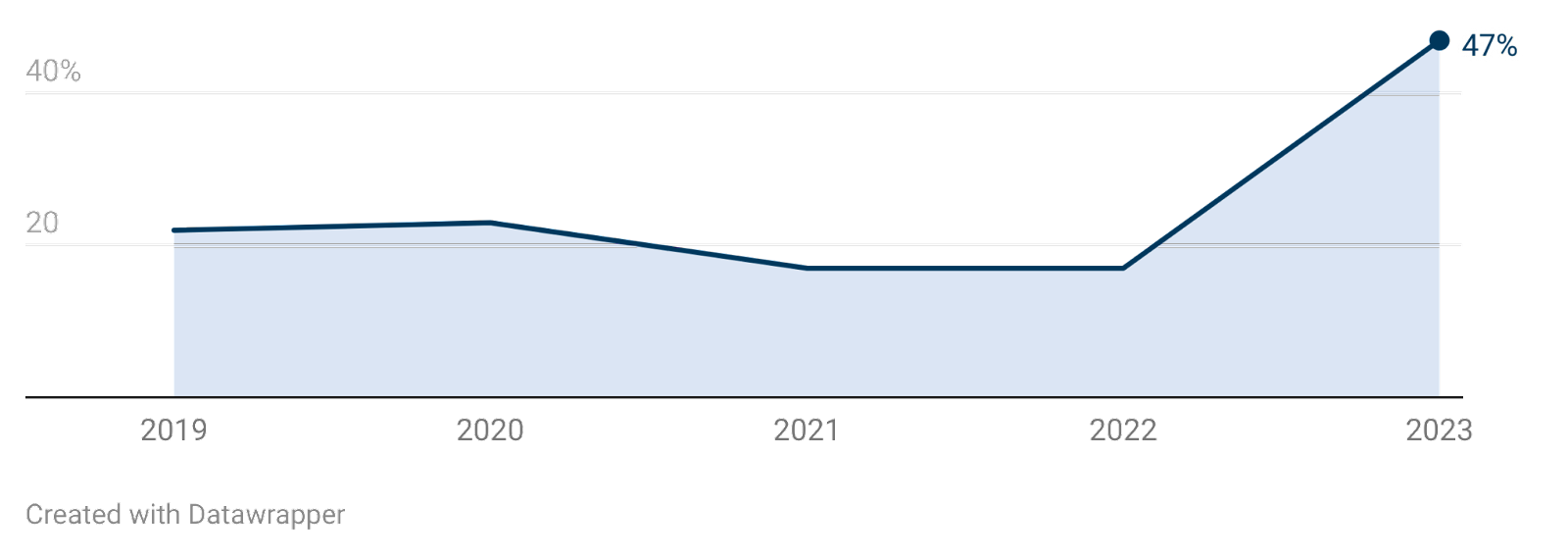

Increase in the share of successful SPFU auctions

The lowest rate of successful auctions was recorded in 2021-2022: it was 17% of all announced auctions. Therefore, the peak result of almost 47% last year is a difference of 2.8 times.

Over the past 5 years, privatization has become more efficient, increased revenue, and attracted the attention of more and more entrepreneurs. This proves the success of Ukraine’s privatization strategy, when the state, instead of subsidizing unprofitable assets, gives them a new life and helps generate funds for the state budget at a time when the survival of our country depends on these revenues.

The Cabinet of Ministers of Ukraine has allocated another UAH 5.6 billion for the construction of fortifications in Donetsk, Zaporizhzhia, Sumy, Mykolaiv and Kherson regions, Prime Minister of Ukraine Denys Shmyhal said.

“This year, the government has already allocated UAH 20 billion for the construction of reliable fortifications. Today we are adding another UAH 5.6 billion,” Shmyhal wrote on his Telegram channel following a government meeting on Tuesday.

In particular, UAH 1.1 billion has been allocated for the construction of fortifications in Donetsk region, more than UAH 1 billion for Zaporizhzhia region, UAH 1.5 billion for Sumy region, as well as UAH 300 million and UAH 400 million for Mykolaiv and Kherson regions, respectively.

The Ministry of Finance of Ukraine has supported the proposal of the Association “Insurance Business” (ASB) and the League of Insurance Organizations of Ukraine (LIOU) on the inadmissibility of VAT taxation of commission remuneration of insurance agents, according to the press release of the ASB.

It is specified that the norm on VAT taxation was contained in the draft law of Ukraine “On Amendments to the Tax Code of Ukraine to improve the taxation of insurance activities in Ukraine”.

As reported, both associations jointly appealed to the Ministry of Finance, the Ministry of Economy, the State Regulatory Service, the National Bank with a request not to worsen the tax conditions of insurance business and not to violate the requirements of the EU Directive.

“Ukraine is moving to the EU, so we must check all tax innovations both with common economic sense and with the principles and norms in force in the European Union,” says Vyacheslav Chernyakhovsky, general director of the Insurance Business Association.

At the same time, the press release specifies that the imposition of VAT on commissions of insurance agents directly contradicts the EU Council Directive No. 2006/112/EC of November 28, 2006 “On the Common System of Value Added Tax”. Article 135 “Exemption from taxation of other activities”, which expressly stipulate that “Member States shall exempt from taxation … insurance and reinsurance operations, including related services provided by insurance brokers and insurance agents.

The report also notes that to substantiate their position, insurance associations have analyzed the performance of insurers of Ukraine for the first nine months of 2023 and conducted a representative survey of market participants. According to the results of which it became clear that the state would not receive economic effect from this innovation, and on the contrary, there would be unpredictable additional costs for administration, control and monitoring of VAT operations in insurance activities.

“According to our estimates, our proposals, supported by the Ministry of Finance, saved each insurance company at least 40-50 thousand UAH monthly,” – said Chernyakhovsky.

insurance agents, MINISTRY OF FINANCE, TAXATION, VAT, АСБ, ЛСОУ

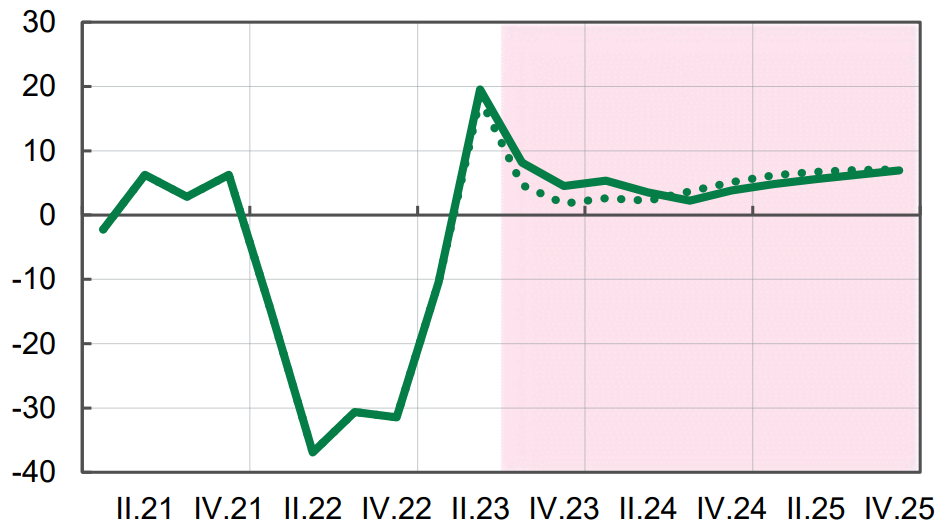

Real GDP in 2021-2025 (forecast)

Source: Open4Business.com.ua and experts.news

In 2023, the distribution system operators of DTEK Grids recycled 3.5 thousand tons of various types of waste.

“DTEK Grids operates an efficient waste management system. It is built on the principles of the circular economy and last year alone helped to transfer more than 3.5 thousand tons of various types of waste for recycling,” the energy holding said in a press release on Tuesday.

According to the document, last year, DTEK Grids’ companies in Dnipro, Odesa, Donetsk and Kyiv regions and Kyiv sent about 25% of the total amount of waste for recycling. These include construction materials, used tires, waste paper, glass, office equipment, and oil products.

“Despite the war, our companies continue to implement the principles of the circular economy, in particular, in terms of waste management. They collect waste separately, store it in special conditions and send it for recycling and reuse. Thanks to this, over the past three years, about 20 thousand tons of industrial waste from DTEK Grids’ iron ore production facilities have been given a second life,” said Olena Potapenko, Head of Environmental Safety at DTEK Grids, quoted in the press release.

According to her, for example, more than 15 thousand tons of reinforced concrete pillars were used in construction and for the production of secondary crushed stone.

For separate waste collection, the company’s waste management facilities use more than 2 thousand labeled containers.

“Everything is organized in such a way as to prevent negative impact on the environment and to direct waste for recycling and reuse as much as possible,” the energy holding added.

“DTEK Grids develops the electricity distribution and power grid operation business in Kyiv, Kyiv, Dnipro, Donetsk and Odesa regions. The energy holding’s DSOs serve 5.4 million households and 150,000 enterprises.